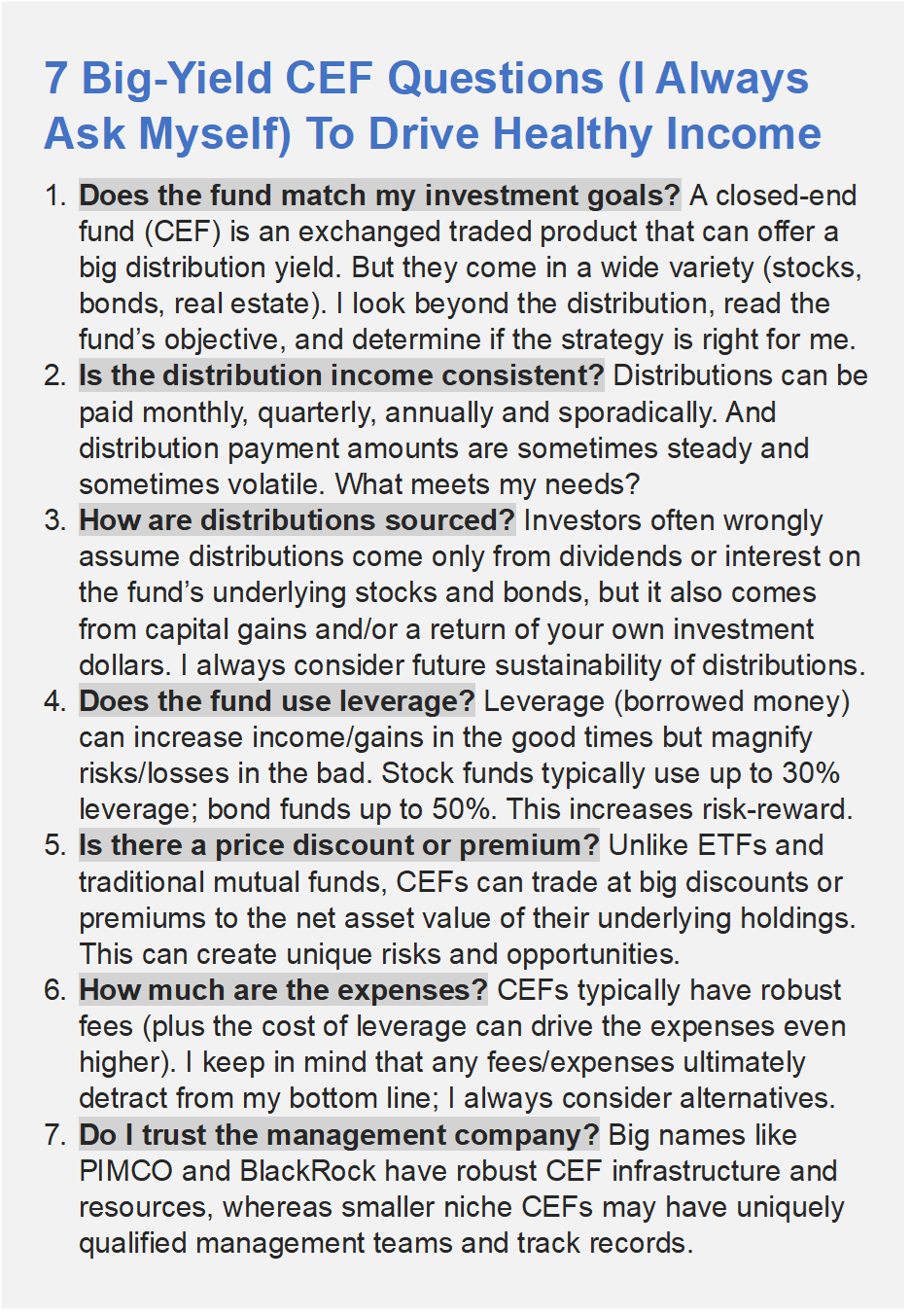

1. Does the fund match my investment goals?

A closed-end fund (CEF) is an exchanged traded product that can offer a big distribution yield. But they come in a wide variety (stocks, bonds, real estate). I look beyond the distribution, read the fund’s objective, and determine if the strategy is right for me.

2. Is the distribution income consistent?

Distributions can be paid monthly, quarterly, annually and sporadically. And distribution payment amounts are sometimes steady and sometimes volatile. What meets my needs?

3. How are distributions sourced?

Investors often wrongly assume distributions come only from dividends or interest on the fund’s underlying stocks and bonds, but it also comes from capital gains and/or a return of your own investment dollars. I always consider future sustainability of distributions.

4. Does the fund use leverage?

Leverage (borrowed money) can increase income/gains in the good times but magnify risks/losses in the bad. Stock funds typically use up to 30% leverage; bond funds up to 50%. This increases risk-reward.

5. Is there a price discount or premium?

Unlike ETFs and traditional mutual funds, CEFs can trade at big discounts or premiums to the net asset value of their underlying holdings. This can create unique risks and opportunities.

6. How much are the expenses?

CEFs typically have robust fees (plus the cost of leverage can drive the expenses even higher). I keep in mind that any fees/expenses ultimately detract from my bottom line; I always consider alternatives.

7. Do I trust the management company?

Big names like PIMCO and BlackRock have robust CEF infrastructure and resources, whereas smaller niche CEFs may have uniquely qualified management teams and track records.