In this report, we share data on 30 top big-dividend REITs. And when comparing them, it is important to note that they come in a wide variety of types (for example sub-industries) and require very different forms of analysis. The 30 in this report are widely followed, and investors have passionately different viewpoints. We share ours in this report, including information on the ones we currently own, the ones we are avoiding, and the REITs that are high on our watchlist (and that we may purchase soon).

30 Top Big-Dividend REITs

The following table includes data on 30 big-dividend REITs from across REIT industries. We have strong opinions on investing in each of these industries (which we will review throughout this report) and strong opinions about investing in specific REITs from each category (including the ones we own, and the ones we are avoiding).

(data as of Thursday, July 27th, market close)

You likely recognize many of the REITs in the table above. They are sorted by industry and then market cap, and include recent performance information, dividend metrics, valuation multiples, short interest and more.

Interest Rate Discussion:

Typically, REIT values tend to rise with interest rates because rising interest rates typically mean rising economic growth. However, the macroenvironment has been a bit unusual over the last two years and REITs have NOT kept pace with the overall market (as you can see in the table above by comparing year-to-date and 2-year total returns for REITs versus the S&P 500). In particular, rates have been rising to fight inflation even though economic growth was slowing (this is an aftereffect of pandemic stimulus and artificially low interest rates).

Fortunately, the ugly recession that economists have been predicting may not come to fruition. And with interest rate hikes (and inflation) now slowing, select REITs are increasingly attractive going forward. Before getting into the more attractive REIT industries (in our opinion), let’s first start with a group of REITs that has been particularly challenged—Retail REITs.

Retail REITs:

There was a time in America when department stores and shopping malls were the place to be. However, with rapid growth of the Internet, things changed dramatically. For example, over the last decade, we’ve seen the demise of a huge swath of once-lucrative retail real estate (and the REITs that owned the properties). And since the covid lockdowns, the growth of online shopping has driven the nail deeper into the coffin of many retail REITs.

You can see in our table above that popular retail REITs Simon Property Group (SPG) and Tanger Factory Outlet Centers (SKT) have very weak 10-year total returns (as the pressure on traditional retail real estate has taken a toll). And keep in mind, these are two popular REITs that have survived (while others have gone bankrupt or been taken over at fire-sale prices).

Realty Income (O), Yield: 4.9%

One retail REIT that we continue to like (and own) is Realty Income. In particular, we like Realty Income because many of its properties are “Internet Proof.” For example, Realty Income owns the properties behind many CVS Pharmacies, Home Depots and grocery stores—properties that in our view, will continue to exist going forward because people still demand them.

Realty Income is also special because it pays dividends monthly (see our early table) and it has increased its dividend every year for 28 years straight. And while past performance is no guarantee of future performance, we like the strong combination of Realty Income’s business strategy and management’s track record of success.

From a valuation standpoint, Realty Income is also attractive. It trades at only 15.4x funds from operations and has relatively low (and safe) debt, especially considering the strength of its business. If you are going to invest in retail REITs, we believe Realty Income is particularly attractive now (we own shares).

Mortgage REITs:

Mortgage REITs are extremely tempting to many income-focused investors because of their outsized dividend yields (often paid monthly). However, mortgage REITs are dramatically different than other types of REITs. For one, mortgage REITs often invest heavily in real estate securities (such as mortgage-backed loans). Also, mortgage REITs frequently apply a dramatically higher level of leverage (borrowed money). Investing in mortgage-related securities can often be accomplished much easier than physical real estate, but the high degree of leverage can also make things a lot riskier.

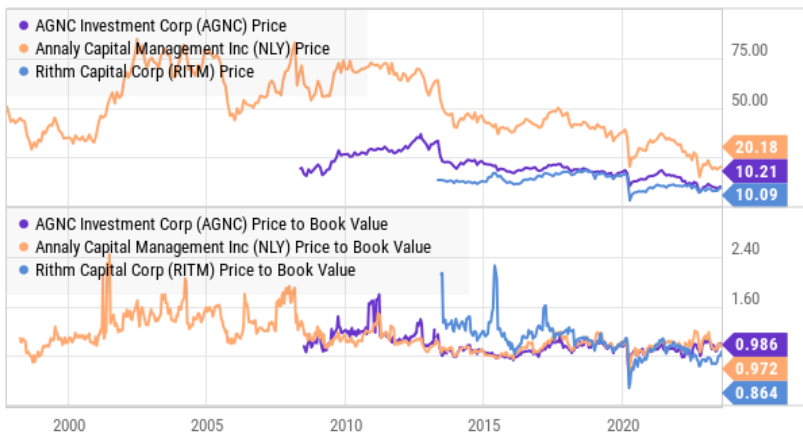

We have owned mortgage REITs in the past, but quite honestly view them more as an asset that provides short and mid-term trading opportunities (if you are into that—we’re not—we like long-term investing). For example, you can see in the chart below, the dramatic price declines (and then recoveries) for mortgage REITs during periods of market turmoil (such as the great financial crisis of ‘08-09 and when the pandemic first hit in 2020).

Price-to-book value is a common mortgage REIT valuation metric (they’re considered to be trading at a discount when p/b is below one, and a premium when above one). However, investing in the industry requires skill and close attention because they tend to take a big hit to book value and dividend payments about once every market cycle. For example, you’ll notice in our earlier table that they’ve all decreased their dividends over the last 5 years (see the “dividend 5 year average column”).

Worth mentioning mortgage REIT prices update each day the market is open, but book values are updated only quarterly (in the companies’ quarterly earnings releases). Annaly and AGNC Investment Corp just recently released quarterly earnings and both trade at market prices very near their book values.

Again, mortgage REITs can present attractive opportunities from time-to-time throughout the market cycle, but we currently do not own any mortgage REITs.

Industrial REITs:

Industrial REITs continue to be one of our favorite long-term REIT industries because they are supported by strong secular tailwinds. Specifically, industrial REITs have not been put out of business by the internet (for example, goods purchased online still pass through industrial REIT distribution centers on their way to their final destinations). And as the economy continues to grow, so too do industrial REITs.

Prologis (PLD), Yield: 2.8%

One of the biggest and best industrial REITs is Prologis. We like (and are considering purchasing shares of) Prologis, even though a lot of investors avoid it because they think the dividend is not high enough. Just be aware of total returns (price appreciation plus dividends reinvested) because Prologis has been one of the best over the last 10 years (and we expect it will continue going forward due to economies of scale, strong balance sheet, top management, ongoing growth for the industry and its current valuation (it trades at 22.6x FFO, which is relatively low and attractive for a high quality REIT like PLD)).

Also know that Prologis’ dividend has increased at a faster pace than most other REITs historically (for example, see the 5 year dividend growth rate in our earlier table), and we expect it to continue to do so going forward. However, the yield will likely stay relatively lower (mathematically speaking) because we expect the price will keep rising too. Prologis shares represent an attractive buying opportunity right now (it’s very high on our watch list for our Income Equity Portfolio).

We also currently own shares of industrial REITs Plymouth (PLYM) and Stag Industrial (STAG)—both offer significantly bigger yields, plus have ongoing attractive price appreciation potential (thanks to the attractiveness of the industrial REIT industry).

Office REITs:

Office REITs appear to be forever changed by the increasing work-from-home initiatives that accelerated during the covid lockdowns. And even though many employees have returned to work, many continue to work from home, apparently permanently. Work-from-home is not good for office REITs because it dramatically reduces the demand for the office real estate that office REITs invest in.

There may be some particularly attractive “buy low” opportunities in the office REIT industry, but we are currently staying on the sidelines and avoiding the group altogether because of the secular decline risks.

Specialty REITs:

Specialty REITs invest in a unique mix of property types. And the group continues to present select attractive opportunities. In the past, we have owned data center REIT Digital Realty (DLR), but we currently do not own shares mainly because technology innovation results in relatively smaller real estate requirements for data centers (even though data is growing extraordinarily fast) and because big tech companies (such as Meta) are increasingly building their own data centers.

Crown Castle (CCI), Yield: 5.7%

Crown Castle is an increasingly attractive contrarian big-dividend specialty REIT opportunity, in our view. Specifically, Crown Castle is the nation's largest provider of communications infrastructure (that includes cell towers, small cells and fiber) that connects people and businesses to data and technology.

(Crown Castle owns, operates and leases shared communications infrastructure that is geographically dispersed throughout the U.S., including more than 40,000 towers and other structures, such as rooftops (collectively, "towers"), and more than 80,000 route miles of fiber primarily supporting small cell networks ("small cells") and fiber solutions).

Crown Castle’s business is supported by 5G growth and the increasing use of data because its small cell towers are increasingly required to support industry growth. Further, it’s built-in rent escalators support continuing steady revenue growth.

Crown Castle recently announced restructuring (whereby they’re slashing 15% of the workforce) which is largely consistent with job cuts by many companies across the economy this year (and may signal a near-bottom to share price declines this year). Trading at 13.7x FFO, CCI looks attractive (it’s now high on our watchlist) and we may purchase shares soon.

Healthcare REITs:

Healthcare REITs come in a wide variety (nursing homes, medical centers, research, and more), and present unique sets of challenges (such as regulatory-driven cost cutting pressures and changing demographics). The group was particularly volatile during the pandemic (and heavily impacted by lockdowns and regulatory/tax funding).

Despite claims of growing “demographic/aging population” demand, we currently own no healthcare REITs, other than a very small position in Medical Properties Trust.

Medical Properties Trust (MPW), Yield: 11.3%

MPW is basically a hospital REIT. It offers a big dividend that has been increased for 10 years straight. However, the share price has been under pressure due to some struggling operators (and because it has become the target of vocal short sellers claiming the hospital assets are overvalued and interest rates are making the cost of debt unbearable).

In our view, MPW is a risky investment, and it is NOT appropriate for the most risk averse investors. However, if you can handle the uncertainty, MPW is worth considering for a spot in a prudently diversified income-focused portfolio. The company will face challenge, but we believe it can continue to work through them (and the current situation is not as dire as the market price (and short interest) suggest). We currently have a very small position in MPW (>1.0%) in our Income Equity and High Income NOW portfolios.

Diversified REITs:

Diversified REITs are another group that continues to present select attractive opportunities for income-focused investors. For example, we have done very well with VICI Properties (VICI) and continue to own the shares.

VICI owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas (three iconic entertainment facilities on the Las Vegas Strip). VICI was a “dumpster fire” during the covid lockdowns, but used the situation to acquire more assets inexpensively, and is now positioned for more attractive growth ahead.

WP Carey (WPC), Yield: 6.0%

WPC is another popular big-dividend REIT (for good reason), yet the shares are down significantly and trade at an attractive 12.1x FFO. The company announced earnings on Friday (whereby it topped revenue and FFO estimates, and affirmed strong 2023 guidance).

WPC is a diversified REIT, but with heavy investments in industrial properties (a REIT industry we like). It also has a strong business, a healthy balance sheet and a well-covered dividend. The shares have gotten caught up in macro concerns, and the share price is down this year, thereby creating an increasingly tempting entry point. We have own WPC in the past (and written about it here), and we’re considering purchasing shares again soon. It’s increased the dividend every year for more than a decade straight, and currently presents an attractive contrarian opportunity.

The Bottom Line:

If you are an income-focused investor, REITs can be a compelling sector to invest in. And the group has underperformed the market over the last two years due (in large part) to challenging fast-paced interest rate hikes (and re-adjusting to the post-pandemic world). In our view, REITs currently present select attractive investment opportunities going forward. Just know that REIT types vary widely, and make sure any REIT investments you are considering are consistent with your own personal investment goals.