This is a quick note to let readers know we have placed a new trade in our Blue Harbinger High Income NOW and Income Equity portfolios. Specifically, we have sold 100% of our position in Owl Rock Capital (ORCC) (recently renamed Blue Owl, (OBDC)) and replaced it with this (see below) highly attractive 11.2% yield BDC instead. We’ll be updating our portfolio tracker sheets shortly, but wanted to share this information with readers right away.

Why The Trade?

The trade comes on the heels of reported drama among the founders of “Blue Owl.” We have no indication that the internal drama will cause any problems for “Blue Owl” (the shares may continue to do perfectly fine going forward). However, where there is smoke, there is often fire. And considering two of the Blue Owl founders have retained attorneys because the third founder refuses to resign, we’re more comfortable just getting out of this one.

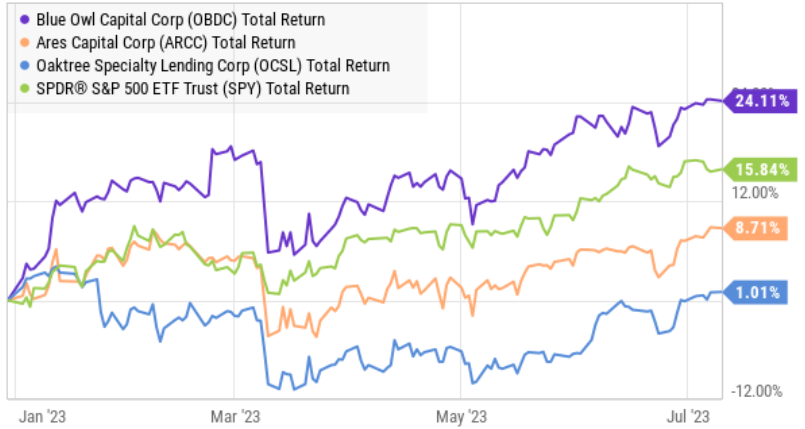

Blue Owl (formerly OwlRock) has been a strong performer for us, and the shares are performing significantly better than other BDCs so far this year (see below).

However, on the suspicion that the management team will be distracted, we’re getting out of the shares altogether.

New Purchase: Oaktree Specialty Lending, Yield: 11.2%

Oaktree Specialty Lending is a BDC that provides financing (mainly first, and sometimes second, lien loans) across a variety of industries. And what is interesting about OCSL is that it completed its own merger in January of this year that has contributed to the shares underperforming this year (as you can see in our chart above.

However, we like OCSL specifically because its big dividend is well covered, the balance sheet is strong and the company is helped by moderately rising interest rates (thanks to floating rate loans). It also trades at a reasonable valuation and has opportunities for growth.

We recently wrote up Oaktree Specialty Lending in detail, and you can access that full report here.