Income-focused investors love big-yield bond CEFs because of their large distributions payments, often paid monthly. But if you’ve been following along, you know most of them (i.e. the popular PIMCO and BlackRock bond CEFs) have been feeling a lot of pain over the last year (because as rates have gone up, bond prices have gone down). Granted some investors don’t care about price as long as the income keeps rolling in, but it really does matter. In this report, we provide an update on three popular Bond CEFs (two from PIMCO and one from BlackRock), and share our views on whether the interest rate environment is signaling an “all clear” sign. We conclude with our strong opinion on investing.

3 Popular Bond CEFs: (PDI) (PTY) (BTZ)

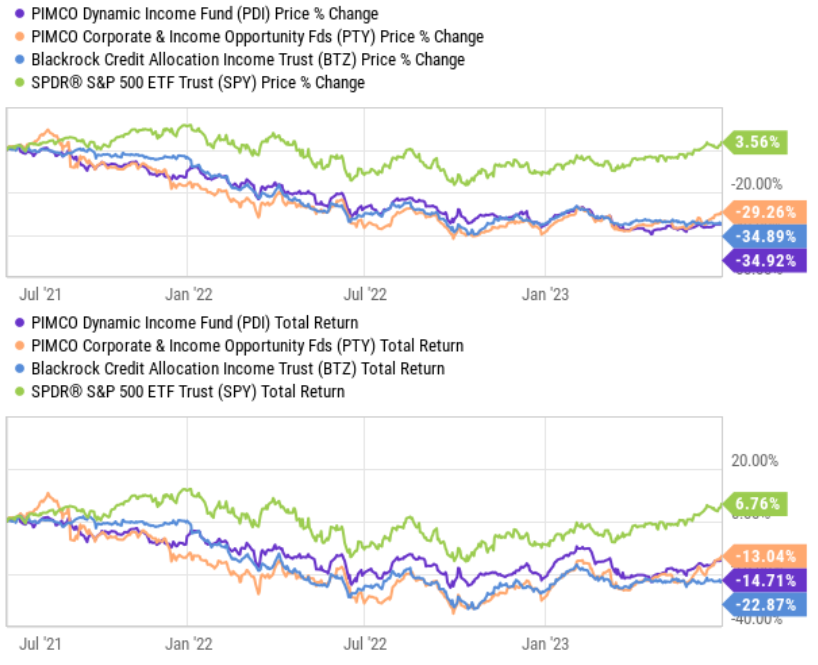

Here is a look at the recent performance of three popular big-yield bond CEFs (two from PIMCO and one from BlackRock) as compared to the S&P 500 (which is a stock index).

As you can see, the price returns have been negative, and the total returns (when you factor in distribution payments as if they were reinvested) have still been negative. And the reason is because the fed has been increasing interest rates at a historically fast rate (to fight inflation), as you can see in the chart below.

And of course, rising rates hurt bond prices.

Monthly Distributions:

Of course many investors claim they don’t actually care about what happens to short-term prices as long as they keep receiving the big steady monthly distributions payments. And as you can see in this next chart, all three of these Bond CEFs have continued to pay big steady monthly distribution payments to investors

And as the bond CEF prices have fallen, the yields have mathematically risen (a good thing for those looking to purchase high income investments, all else equal).

Premiums and Discounts:

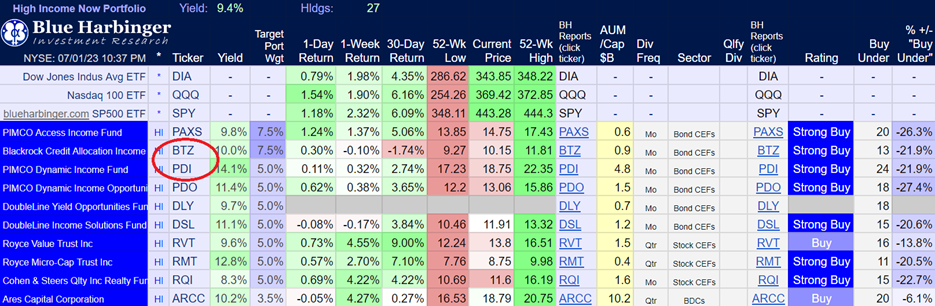

Two important things to note about the yields on these big-yield bond CEFs in the chart above. First, the yields above are based on net asset value of each fund, and because they trade at varying degrees of premiums and discounts, the yields on price (i.e. the yields you actually get if you invest) are actually different.

Specifically, PDI’s yield is actually smaller (only 14.1%) because it trades at an 8.4% premium to NAV; BTZ’s yield is actually bigger (it is 9.9%) because it trades at a 9.4% discount to NAV; and PTY’s yield is smaller because it trades at a premium.

And secondly, as long as these funds don’t reduce their distributions, now may be a particularly attractive time to buy them because the yields have mathematically increased (as prices have fallen), and the interest rate pain may be almost over, as we describe in the next section.

Interest Rate Risk:

As mentioned, when interest rates rise, bond prices fall, and that is exactly why these big-yield Bond CEFs have experienced steep price declines over the last two years. However, there is reason to believe the interest rate hikes may be over (or almost over) and this is a much more attractive time to purchase these bond CEFs.

Specifically, the fed actually did NOT hike interest rates at its last meeting (for the first time in a while—a good thing for bond CEFs). And even though the fed says they expect more rate hikes ahead, the hikes are expected to be less extreme and almost over.And if you listen to the market, it seems to be practically completely over based on the stock market’s recent strong rally (it’s the rate hikes that are intended to slow inflation, but the side effect is rate hikes slow the entire economy and hurt the stock market).

In a nutshell, it seems most (if not all) of the interest rate pain is over, bond CEFs are entering a more normal period, and investors should be able to keep collecting high monthly income without as much risk of price declines (and prices may actually increase now that we’re entering more normal market conditions and these actively managed bond CEFs security selections skills can shine).

Calm Market Conditions

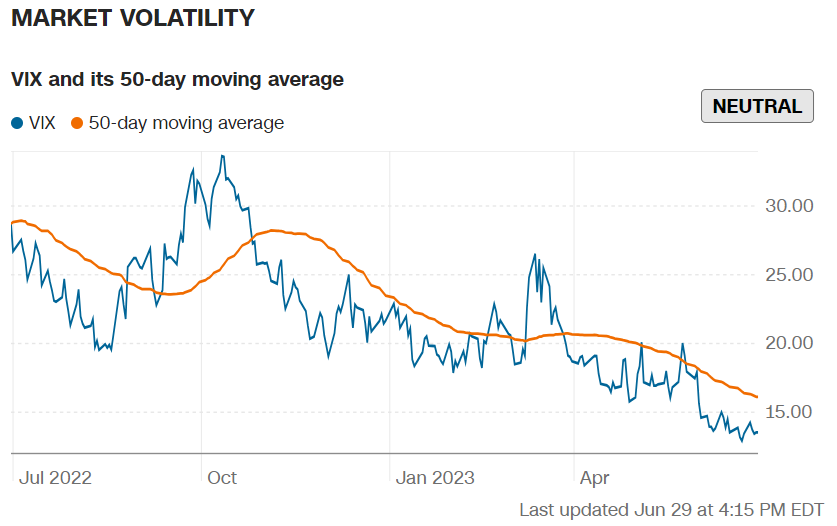

Another positive sign in our view, is that market fear (as measured by the VIX) is low—a good thing.

And credit spreads are also low (as you can see in the next chart). This indicates lower market risk (but also slightly lower underlying income for these funds). However, an overall good sign for bond CEFs (the calmer the conditions, often the easier for the managers to manage the funds).

The Bottom Line:

Bond CEFs are particularly attractive right now as the yields are high and as the interest rate dynamics are slowing down (calm and steady can be better for bond CEFs). In particular, we have “strong buy” ratings on both BTZ and PDI in our High Income NOW portfolio, and a “buy” rating on PTY.

Of course everyone’s personal situation is different, but if you are an income-focused investor, we believe bond CEFs are particularly attractive right now (especially as compared to over the last two years), and the three in this report are absolutely worth considering (we currently own all three in our High Income NOW portfolio).