The company we review in this report is a leading manufacturer of semiconductor-based microinverters, as well as batteries, EV chargers, and other storage solutions. The company is well positioned given the strong investment activity in the clean energy space globally as well as its innovative microinverter technology. The company is actively diversifying its product offerings and expanding into new markets, while also focusing on continuous technological advancements to maintain a strong presence in the industry. In this report, we analyze the company’s business model, its market opportunity, financials, valuations, risks, and finally, conclude with our opinion on whether an investment in the shares offers an attractive balance between risks and rewards.

Enphase Energy (ENPH), Key Takeaways:

Pioneered semiconductor-based microinverter technology for enhanced solar energy and storage.

Attractive growth prospects in the fast-growing solar energy market.

Interconnected innovative offerings increasing revenue per customer.

Robust top-line growth amidst near-term headwinds.

Healthy balance sheet with solid free cash flow generation.

Recent pull back in stock price offers optimal entry point for long-term patient investors

For reference, you can access a pdf version of this report here.

Enphase Overview:

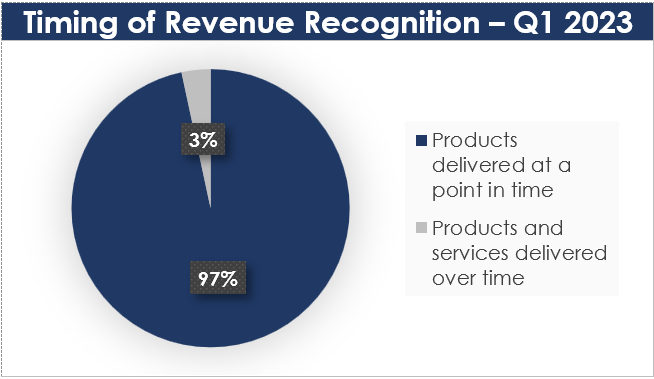

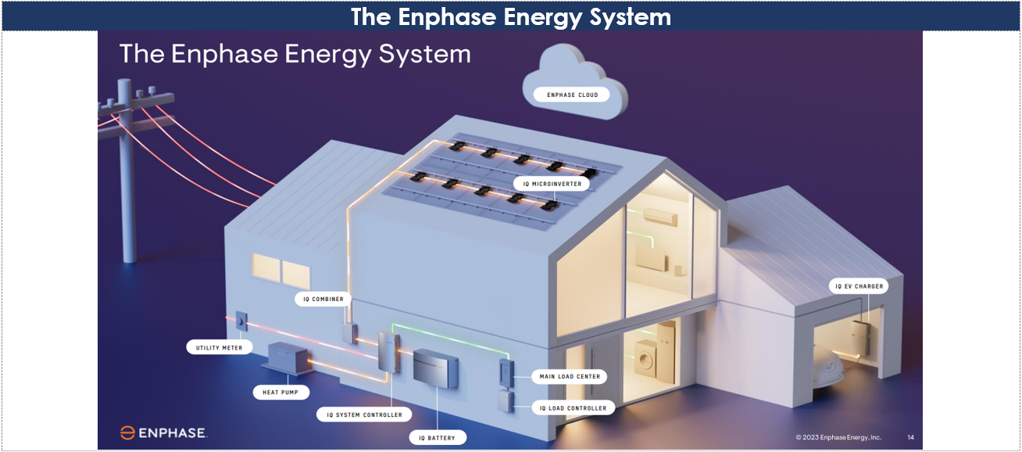

Enphase was initially established as PVI Solutions in 2006 and later rebranded as Enphase Energy in 2007. It specializes in the design and production of advanced microinverter systems for both residential and commercial solar applications. The company offers a cloud-based platform that streamlines solar generation, storage, and real-time monitoring of the systems. Its comprehensive product lineup includes IQ Microinverters, IQ batteries, Electric Vehicle (EV) chargers, and grid services. Enphase caters to distributors, large installers, Original Equipment Manufacturers (OEMs), and strategic partners. In Q1 2023, the company derived 97% of its total revenue from products delivered at a point in time whereas the rest was accounted by products and services delivered over time.

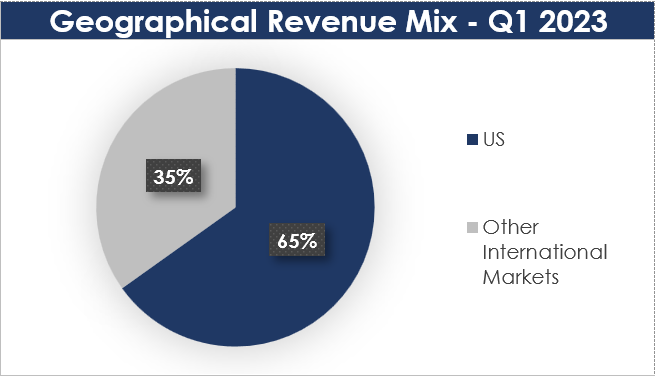

Enphase’s geographical focus extends to residential and commercial markets in the US, Canada, Mexico, Europe, Australia, New Zealand, India, Brazil, the Philippines, Thailand, South Africa, and selected Central American and Asian markets. With a global presence, the company has supplied ~63M microinverters and installed over 3.3M residential and commercial systems in more than 145 countries worldwide as of March 2023. Enphase is proactively expanding its global presence. In fact, the company's revenue share from the US has decreased from 84% in 2017 to 76% in 2022 and 65% in Q1 2023, as shown in the following pie-chart.

Source: Company’s 10-Q

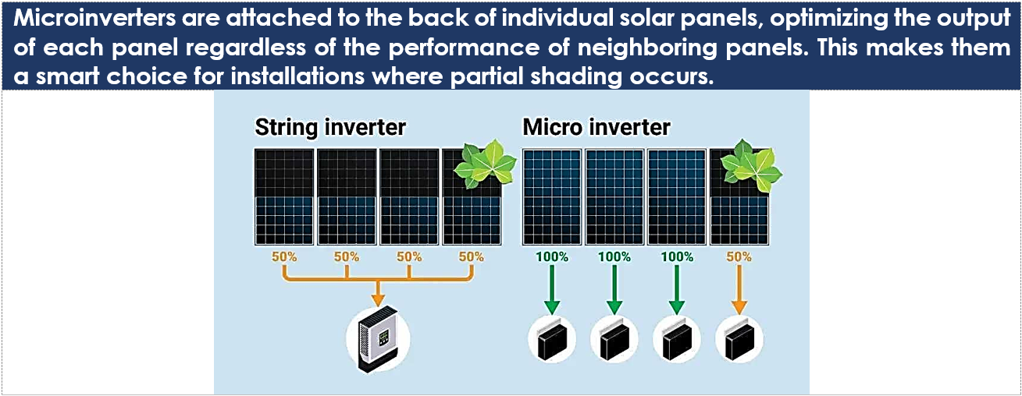

Pioneered Semiconductor-Based Microinverters for Efficient Individual Solar Module Conversion

Enphase has pioneered the use of semiconductor-based microinverter technology, converting DC to AC energy at the level of individual solar modules. Unlike a traditional string inverter that works with the entire array of modules and is susceptible to various issues such as reduced power output when shaded by the weakest panel, limited flexibility in deploying solar panels, and safety concerns, Enphase's microinverters offer more precise control and efficiency at the module level and eliminate risks pertaining to single point of failure. The accompanying image highlights one of the numerous advantages that microinverters offer over traditional string inverters.

Source: Positive Energy Solar

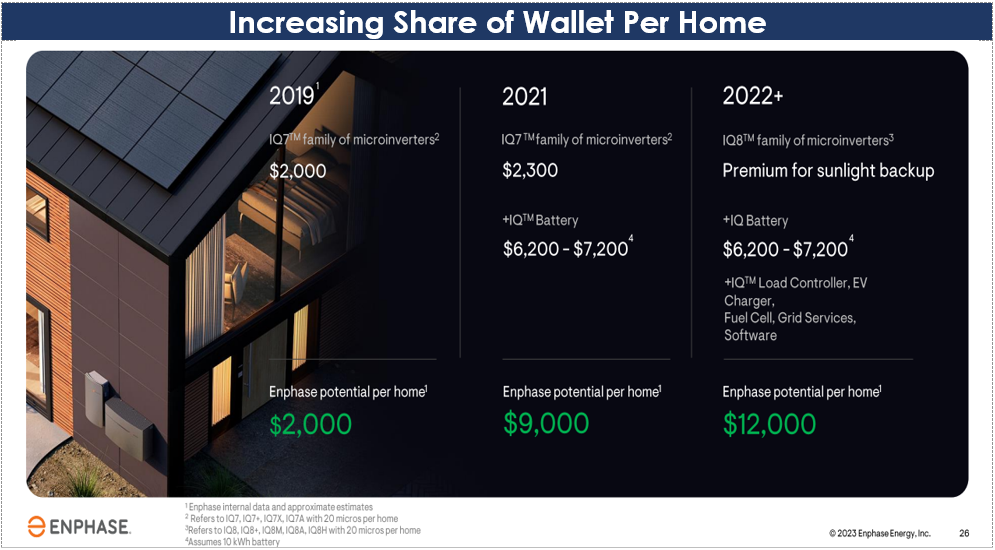

Interconnected Innovative Offerings Resulting in Increasing Share of Customer Wallet

Enphase has a strong track record of continuous innovation, evident in its core microinverter technology, as well as its strategic expansion into new product offerings. A notable addition to its portfolio is the IQ Battery launched in 2021, which offers optimized energy utilization, enhanced energy independence, and reliable backup power during grid outages. What sets Enphase IQ Batteries apart is their utilization of AC coupling, ensuring seamless compatibility with various solar installations and inverters. Additionally, the company’s commitment to innovation is further demonstrated by the introduction of other innovative products in 2022, leading to a substantial increase in its potential earnings per home.

Source: Company Presentation

Over a span of just three years, the company has experienced an impressive rise in its revenue potential per home from $2,000 in 2019 to $12,000 in 2022, reflecting its continuous focus on innovation and market expansion.

Source: Company Presentation

Significant Growth Prospects in the Rising Solar Energy Market

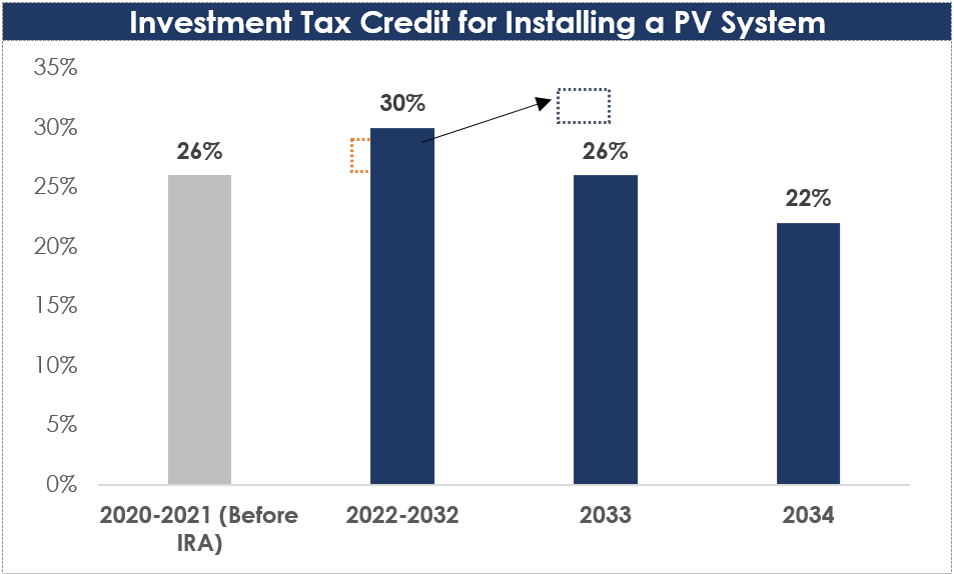

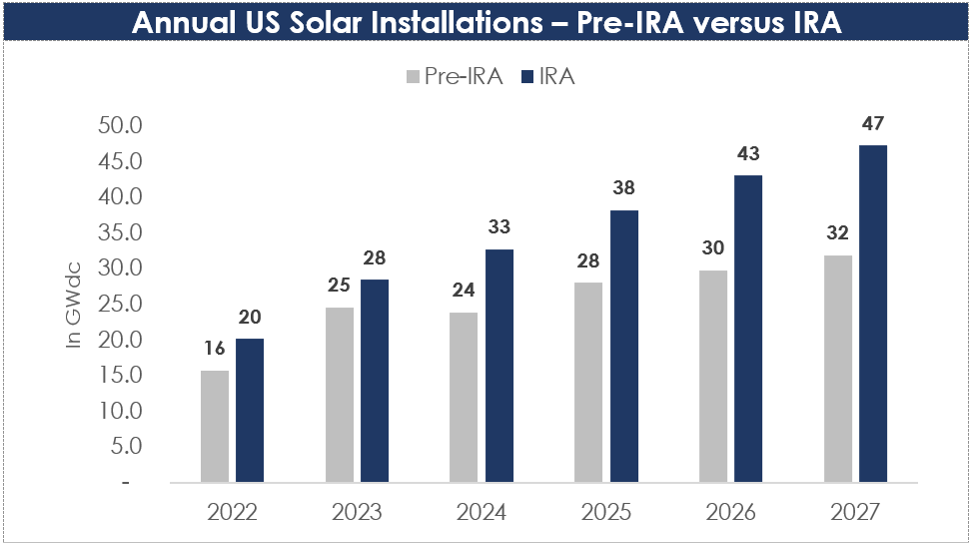

The solar energy industry has faced major hurdles in the form of high installation costs in the past. However, over the last decade, these costs have seen a significant decrease of more than 50% driven by improved technology due to consistent research and development (R&D), economies of scale, supply chain competitiveness as well as favorable initiatives, such as tax credits introduced by federal agencies to promote clean energy. In 2022, President Biden signed the Inflation Reduction Act (IRA), which has played a pivotal role in the recent uptick in solar installation. This act expanded the Federal Tax Credit for Solar PV, also known as the Investment Tax Credit (ITC). In addition to federal tax incentives, several state policies such as Net Energy Metering (NEM), which compensate solar customers for the energy they contribute to the grid are also acting as growth catalysts for the industry, driving adoption at scale.

Source: Energy.gov

The IRA has positively impacted the solar industry's future. Its long-term tax incentives and manufacturing provisions are expected to boost solar deployment by over 40% in the next five years, exceeding pre-IRA estimates as per the Solar Energy Industry Association (SEIA). Given the growing demand for solar energy, Enphase estimates its serviceable market to reach $23B by 2025.

“As we discussed last quarter, the IRA, Inflation Reduction Act, will help bring back high-tech manufacturing to the US and stimulate economy through creation of new jobs. We are opening manufacturing lines with three different manufacturing partners, adding a capacity of 4.5M microinverters per quarter, bringing our overall global capacity to 10M microinverters per quarter as we exit 2023. We expect to begin US manufacturing with one partner in Q2 and with the remaining two in Q3.” - Badri Kohimarama, CEO of Enphase Energy

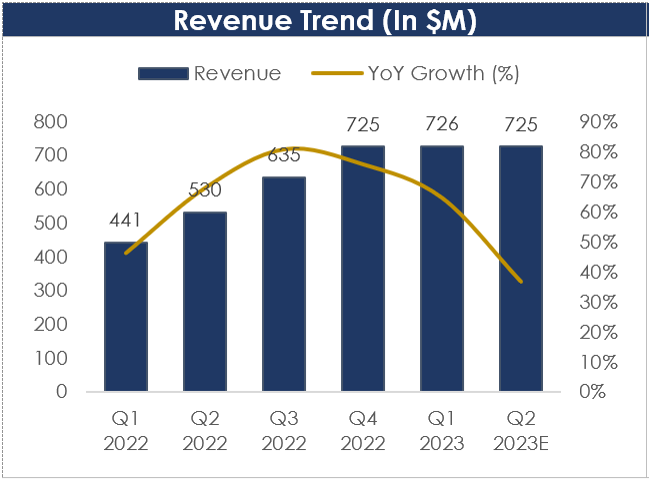

Robust Top-Line Growth Amidst Macroeconomic Headwinds and Newly Passed NEM 3.0 Related Demand Uncertainties

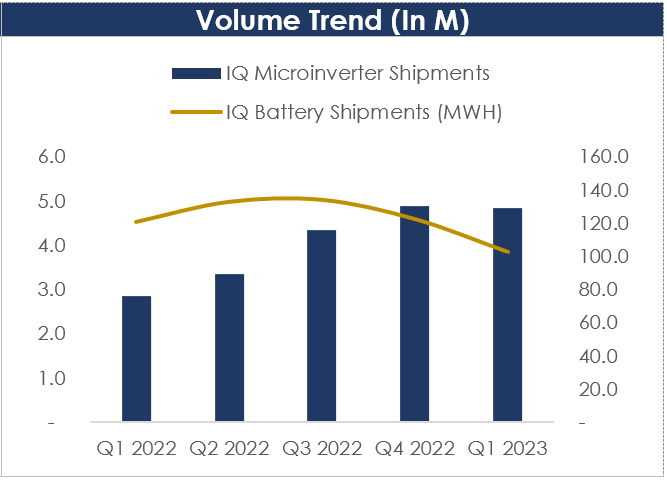

In Q1 2023, the company’s revenue rose 65% YoY to $726.0M, fueled by a significant 70% YoY rise in unit shipment of microinverters, with 4.8M units sold in Q1 2023 versus 2.8M units in Q1 2022. The Average Selling Price (ASP) of its microinverter products also increased by 6% YoY in Q1 2023, contributing a $26.8M YoY increase in revenue. The rise in ASP was primarily driven by a favorable product mix with the company selling more IQ8 microinverters (advanced version) relative to IQ7 microinverters.

Source: Company Filings

This strong growth was delivered despite slowing macroconditions due to rising rates, which has worsened the economics of loan financing. Moreover, the passage of the NEM 3.0 bill in California, reducing credits for excess electricity sent back to the grid relative to NEM 2.0, has created demand uncertainty among California’s installers. In Q1 2023, the company capitalized on NEM 2.0 related microinverter demand pull, which allowed for greater monthly savings and a shorter payback period as compared to NEM 3.0.

Source: Burgeons

On the positive note, NEM 3.0 will necessitate the use of solar battery storage, as homeowners will prefer to utilize all their energy rather than selling it back to the grid. This presents an opportunity for the company to increase revenue per customer by offering battery solutions alongside microinverters.

“We believe when the stockholders aren't expanding their crews to accelerate installation, they're laser focused on their cash flow due to the high interest rate environment and are looking for clarity -- for clarity on the NEM 3.0 demand. The sell-through of our batteries in California was 23% lesser in Q1 compared to Q4, as installers focused mainly on solar. We expect this trend to continue for the next three to four months. After that, we see NEM 3.0 as a net positive for California and expect strong demand to resume for solar plus storage.” - Badri Kohimarama, CEO of Enphase Energy

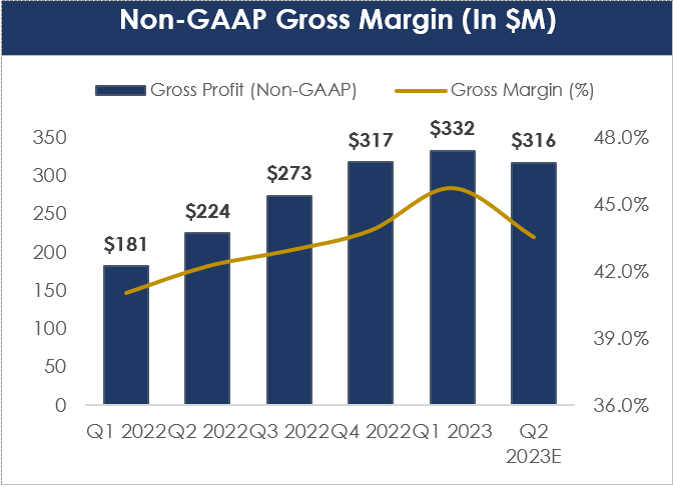

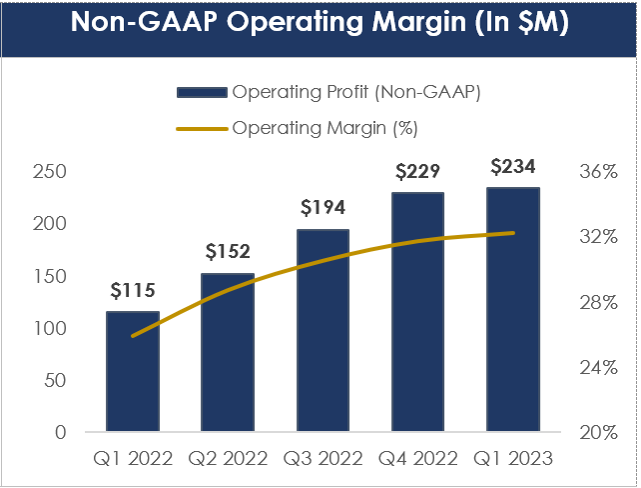

Cost Efficiencies Resulting in Margin Expansion

The company’s non-GAAP gross profit increased by 83% YoY to $332M, resulting in margin expansion of 470-bps YoY to 45.7% from 41.0% in Q1 2022. This growth was driven by factors such as a higher proportion of IQ8 products, price increases, cost management efforts in reducing freight costs, and strong performance in key markets, particularly in Europe and the US. In Q2 2023, the company projects a non-GAAP gross margin between 42.0% to 45.0%, translating into a 130-bps YoY expansion at the mid-point. On the operational front, Enphase reported non-GAAP operating profit of $234M in Q1 2023, up from $115M in Q1 2022, with margin increasing to 32.2% from 25.9% in Q1 2022, aligned with the top-line growth.

Source: Company Filings

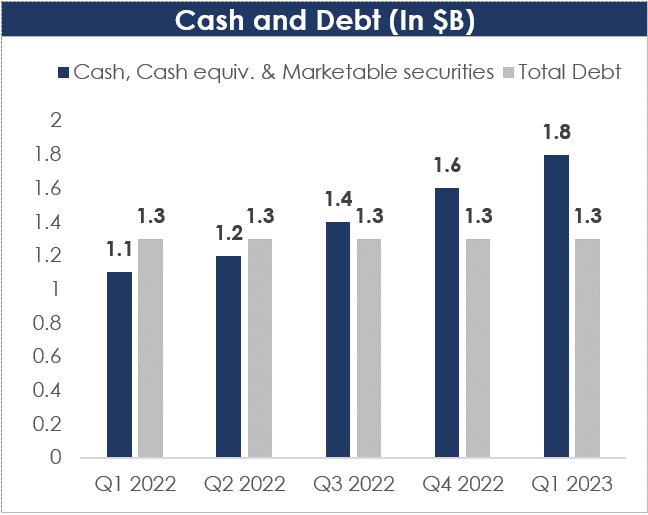

Healthy Balance Sheet with Solid Free Cash Flow Generation Providing Scope to Pursue Accretive M&As

Enphase ended Q1 2023 with $1.8B in cash, cash equivalents, and marketable securities. It also had debt of $1.3B, which is well covered by its current liquidity. The company has clear capital allocation priorities, focusing on business needs, advantageous mergers and acquisitions, and potential share buybacks if cash is available. Recent acquisitions have fueled the company's growth, as shown in the table below.

Source: Company Presentation

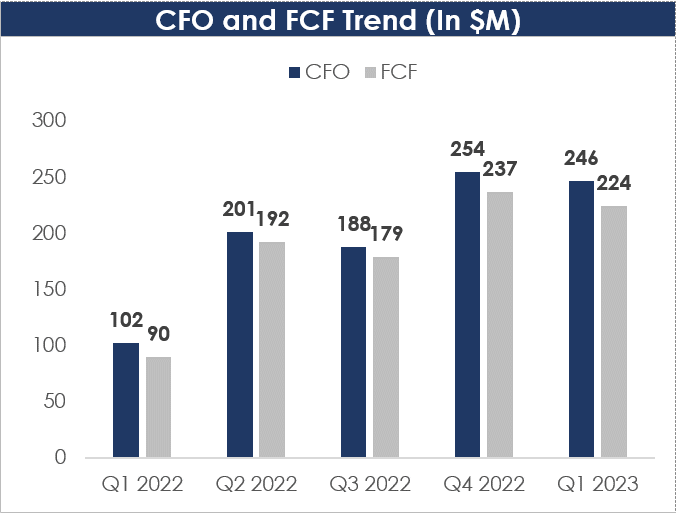

In Q1 2023, Cash Flow from Operations (CFO) grew to $246.2M from $102.4M in Q1 2022, led by improved profitability. Capital expenditures increased 82% YoY to $22.5 in Q1 2023, on increased manufacturing in US. Resultantly, Free Cash Flow (FCF) improved to $223.8M in Q1 2023 from $90.1 in Q1 2022.

Source: Company Filings

Valuation:

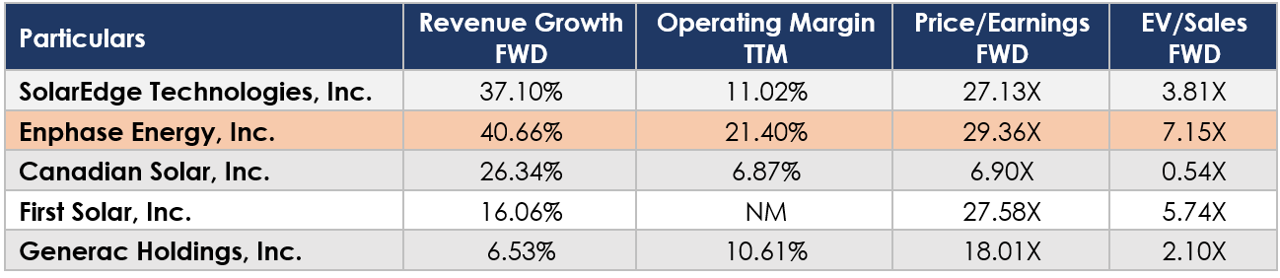

The company's stock has experienced a significant 35% decline year-to-date, primarily driven by cautious management guidance resulting from near-term demand uncertainties linked to macroeconomic headwinds and the impact of NEM 3.0. Currently, the stock is trading at a forward EV-to-Sales multiple of 7.2x, which represents a nearly 30% discount compared to its five-year historical average. While the company's valuation appears to be at a premium compared to its peers, this premium is justified by its strong top-line growth rates, robust margins, and significant potential for further expansion.

Source: Seeking Alpha

Risks:

Intense competition: Enphase competes with SolarEdge, Fronius, SMA SolarTechnology, AP Systems, Generac, Tesla, Huawei, Ginglong, Sungrow, Solax, and Hoymiles, LG Chem, Sonnen, Generac, Panasonic, BYD, E3/DC, Senec, etc. To mitigate the competition risks, Enphase should focus on enhancing its product portfolio through innovation, maintaining strong customer relationships, investing in R&D, and expanding into new markets or product segments. Also, the increasing competition may result in pricing challenges for Enphase, necessitating the company to address them by employing differentiation strategies and optimizing costs.

Conclusion:

Enphase has disrupted the solar energy market with its innovative microinverter technology. The company is focused on geographic expansion and driving penetration among its current customer base via continuous product innovation and diversification. Although near-term transitory challenges may affect revenue growth and margins, the company's long-term prospects remain strong, driven by growing traction of alternative energy supported by government policies. Furthermore, the recent decline in stock prices presents an attractive risk-reward opportunity for patient long-term investors looking to capitalize on the solar energy tailwind. We currently own shares of Enphase in our Disciplined Growth Portfolio.