UPDATE: Unbeknownst to many investors, PIMCO’s big-yield funds, PDI and PTY, are including a significant return of capital in their beloved big distributions (and it’s largely hidden through derivative swaps transactions). We reached out to PIMCO for comment, and found their replies (included in this report) concerning. These two big-yield PIMCO funds are simply not as good as many investors believe. Caveat emptor.

Summary:

PIMCO’s big-yield funds, PDI and PTY, are income investor favorites thanks to their long track records of big monthly distributions, which are widely believed to have never been sourced from the dreaded ROC (return of capital) that plagues so many other “lessor funds.” However, a look under the hood reveals these two PIMCO trophy funds have absolutely been using ROC to cover their distributions. After providing an overview of the two funds, we explain why ROC is bad, why many investors falsely believe the funds don’t use ROC, and why PIMCO is strongly incentivized to hide it. After also considering the growing risks of a big “ROC event,” we conclude with our strong opinion about investing in these two big-yield funds--buyer beware!

About PDI and PTY:

Big monthly income from a top-of-the-line management company (PIMCO) makes these two world-class closed-end funds (“CEFs”) extremely popular. We’ll explain more about what these two bond funds own momentarily, but it’s important to first quickly review the uniquenesses of CEF investments.

Unlike exchange-traded funds (“ETFs”) and other mutual funds, CEFs are “closed-end” which means they generally issue a fixed amount of shares and then trade at market prices based on supply and demand (unlike other funds which are frequently creating and eliminating shares outstanding to deal with fund flows). Because of this, CEFs often trade at wide discounts and or premiums to the net asset value (“NAV”) of their underlying holdings (this creates unique risks and opportunities), whereas ETFs and other mutual funds typically trade at market prices almost exactly equal to their NAVs. In PIMCO’s case, their CEFs frequently trade at large premiums to NAV because many investors appreciate the long track records of success. For example, PDI recently traded at a 10.2% premium to NAV and PTY at a 21.2% premium (investors really like these funds).

Another thing about CEFs (that arguably makes the premiums more justifiable) is they often use leverage (or borrowed money) to magnify income and total returns. Both PDI and PTY use significant amounts of leverage (recently 48% and 40%, respectively).

Regarding fund objectives, according to PIMCO, PDI “seeks current income as a primary objective and capital appreciation as a secondary objective.” And here is a look at the fund’s recent sector allocations.

Similarly, according to PIMCO, PTY “seeks maximum total return through a combination of current income and capital appreciation.” And here is a look at the fund’s recent sector allocations.

What is ROC and why is it bad?

Important to understand, closed-end funds (such as PDI and PTY) can generate their big monthly income payments from a variety of sources. For example, interest (or coupon payments) received on the underlying bond holdings, capital gains on the underlying bond holdings (both short-term and long-term) and even through a return of capital (“ROC”). ROC is generally not preferred because many investors simply don’t like having their own investment dollars returned to them as part of the monthly distribution payments, but also because ROC reduces the NAV of the fund, thereby also reducing the future earnings power of your shares (unless you’re able to reinvest the ROC distributions at NAV or lower, net of tax consequences).

Why investors believe there is no ROC

If you review online content about PDI and PTY, you’ll quickly notice many investors love the funds because they believe they are NOT using ROC to fund the distributions. For example, here are a few instances (screen shots below) of investor comments laying praise on the funds for having no ROC (see highlighted sections).

One reason investors believe there is no ROC is because the webpages for these funds do NOT show any ROC. Specifically, there appears to be no Section 19 Notices (typically required when part of a distribution includes ROC).

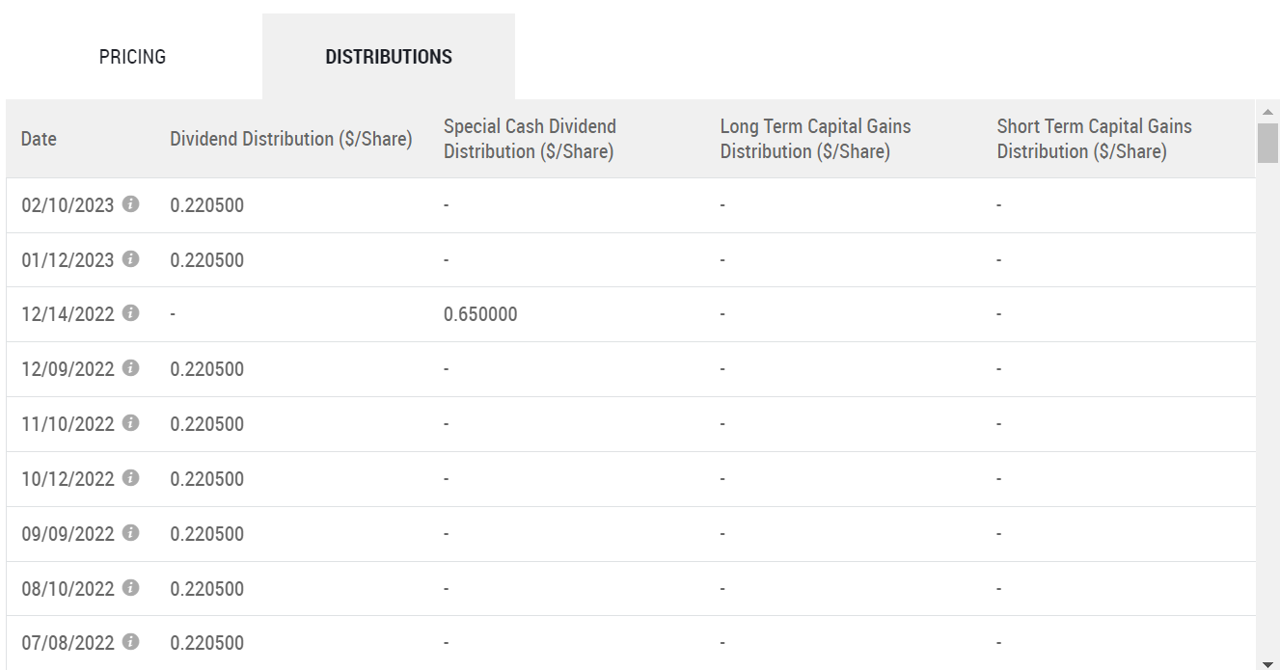

Also, the historical breakdown of distribution sources for these funds doesn’t show any ROC either. For example, here is a look at what the PDI webpage shows.

Conveniently, the above data shows a column for “Special Cash Distribution/Dividend” (because investors love those so much), but they don’t even bother to include a column for ROC.

PIMCO’s omission of an ROC column in the above table is glaring as compared to other popular CEF companies, such as BlackRock. Below you can see what BlackRock shows on their website for their popular bond CEF (BIT). Specifically, BlackRock discloses ROC.

Also, BlackRock includes the 19a notices going back many years (PIMCO appears to show zero Section 19 Notices on the fund webpages).

Another reasons investors believe PDI and PTY have no ROC is because popular CEF website, CEF Connect, shows no ROC for these PIMCO funds. For example, here is what CEF Connect shows for PTY (i.e. zero ROC) and there is no ROC as far back in the history as is available (i.e. many years).

Meanwhile, CEF Connect does show ROC for many of PIMCO’s competitors.

So if there is any historical ROC for PDI and PTY, it’s almost as if PIMCO is trying to hide it from investors (more on this later).

Why we suspect there is ROC

Many investors believe PIMCO is able to support the outsized distributions without using ROC because they think PIMCO’s skill is so great. Others believe that the funds’ use of leverage makes the high distribution yields achievable. However, in our view, the numbers just don’t add up.

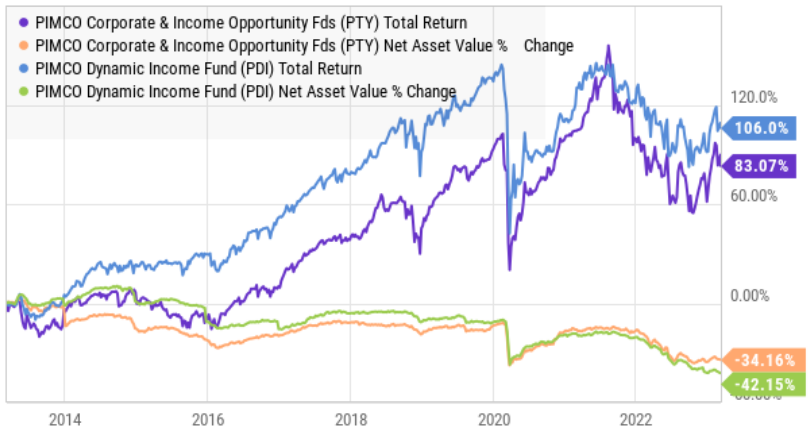

For example, anytime the total return (NAV plus distributions reinvested) is less than the just the distribution yield—that means the NAV is in decline. And while some argue the recent NAV declines for these funds (see chart below) are due to rising interest rates—that still doesn’t explain all of it.

Some investors even believe it is PIMCO’s great security selection skill that allows the funds to offer higher yields than competitors. But in reality, these funds are so large and so well-diversified (they own over 1,000 securities) that it’s simply not feasible (i.e. not enough active share) for the funds to deliver such superior yields without ROC.

For some perspective, here is a look at recent total returns for PTY and PDI versus total returns for lower yielding BlackRock bond CEFs (BIT) and (BTZ). And even though the BlackRock funds more clearly disclose their ROC histories, the recent returns haven’t been all that different (and they have been roughly what you’d expect considering their varying degrees of leverage and differing discounts versus premiums).

Further, if you look at the yields on the bonds PDI and PTY actually own, they don’t come anywhere near the distribution yields the funds pay (especially as compared to a year ago when rates were significantly lower). And even after you factor in the use of leverage and manager skill—it’s still not enough—ROC has to be part of the distributions.

How we know there is ROC:

Here are excerpts from PIMCO’s most recent annual reports showing explicitly that PTY and PDI, respectively, are using ROC to fund a portion of their distributions (see column: “Tax Basis Return of Capital” that shows how the “Distributions to Common Shareholders” are being sourced from ROC).

IMPORTANT: And what’s more, there is probably (very likely) significantly more ROC than what is being disclosed in the financial statements because of the accounting for derivatives (swaps) that these two funds are using in a very big way—to delay the recognition of ROC (see below).

PIMCO effectively hides ROC with Swaps:

To put it concisely, it appears PIMCO is using derivatives (swaps) to effectively harvest capital losses and recategorize them as income flows. Specifically, according to the annual report:

“For instance, a portion of a Fund’s monthly distributions may be sourced from paired swap transactions utilized to produce current distributable ordinary income for tax purposes on the initial leg, with a substantial possibility that a Fund will later realize a corresponding capital loss and potential decline in its NAV with respect to the forward leg (to the extent there are not corresponding offsetting capital gains being generated from other sources).”

In plain English, the funds are using swaps (derivative instruments) to boost monthly distributions while simultaneously “kicking the ROC can down the road.” And if they aren’t able to offset these transactions in the future with capital gains then they will eventually take a big ROC hit. From an economic standpoint, the significant ROC hit to NAV has already occurred (a big part of the reason the NAV is down), but from an accounting standpoint—these funds are likely not yet fully recognizing it.

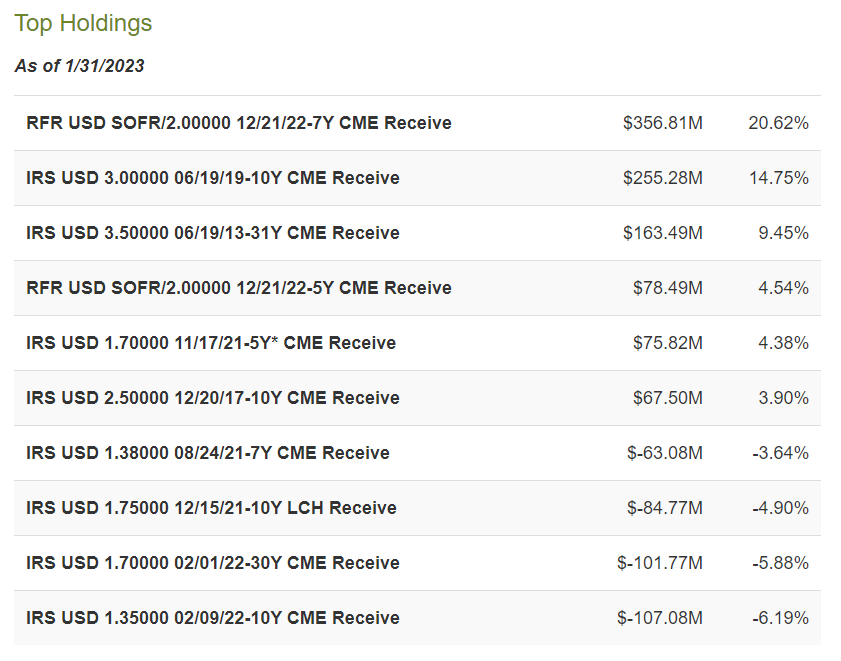

And if you want an idea of just how significant swaps are within these funds, here is a look at the recent top positions in PTY (i.e. swaps make up a significantly large portion of the holdings).

Note: IRS stands for “interest rate swap” and SOFR stands for “secured overnight financing rate” with regards to forward-looking interest rate estimates, calculated and published for 1-month, 3-month, 6-month and 12-month tenors”.

And again, ROC matters because it is lowering the NAV of the funds and thereby decreasing their future earnings power (not to mention, they’re sourcing part of the big distribution by just giving you back some of your own original investment dollars—yuck!).

PIMCO Benefits if investors believe there is no ROC

As shown with examples earlier, many investors love PTY and PDI (these funds have massive assets under management) because they believe there has been no ROC. In fact, it is the success of these funds that helps PIMCO raise assets for new funds, such as (PDO) and (PAXS) (both were launched within the last few years, and thereby generate lots of new fee-based income for PIMCO). Investors keeping bidding up the price of PDI and PTY (and also keep pouring money into PIMCO) because they don’t realize part of the outsized distributions are just a return of their own capital. Investors actually believe it is the great skill of PIMCO, and this is a big part of the reason these funds (and many other PIMCO funds) trade at huge premiums to NAV (investors bid up the share price because they think PIMCO is that much better than competing CEFs). Investors are paying significantly more for PTY and PDI than if you add up the actual value of the underlying holdings (i.e. again, they trade at large premiums to NAV).

PIMCO enables investors to believe there is no ROC

PIMCO needs to do a better job of disclosing ROC to investors. For example, as noted earlier, PIMCO appears to show zero Section 19 Notices on its PDI and PTY webpages. And PIMCO makes no obvious disclosures that ROC is actually occurring (unlike competitor BlackRock, that makes these critical ROC disclosures obvious to investors).

Further, investors are obviously falsely believing these funds have no ROC (as shown in just the very small sample of comments provided earlier). And even though PIMCO likely has no control over data provided on other companies’ websites (such as CEF Connect mentioned earlier), it seems unlikely they are not aware that investors incorrectly believe there is no ROC (and it’s not encouraging to realize PIMCO benefits financially if investors are misinformed because it helps them gather (and retain) more assets under management and ultimately more fee income).

Further, there appears to be a lot of “lawyerly” wordsmithing and maneuvering on the PTY and PDI webpages, instead of just an open disclosure about the ROC. For example, it appears to be PIMCO’s policy to only show Section 19 Notices on its website for all funds for only one year (whereas competitors like BlackRock show the history for many years); this appears to cloud the ROC issue for many investors (especially since the swap transactions effectively delay ROC and recognize it retroactively). Further, instead of just disclosing ROC, PIMCO makes cloudy disclosures like this one (emphasis ours):

“Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the fund. Because the distribution rate may include a ROC, it should not be confused with yield or income.”

and this one buried in the most recent annual report.

“It is important to note that differences exist between the fund’s daily internal accounting records, the fund’s financial statements prepared in accordance with U.S. GAAP, and recordkeeping practices under income tax regulations. It is possible that the fund may not issue a Section 19 Notice in situations where the fund’s financial statements prepared later and in accordance with U.S. GAAP or the final tax character of those distributions might later report that the sources of those distributions included capital gains and/or a return of capital.”

The above quote is a reference to the use of swaps (we know because it mentions the swaps specifically in the following paragraph) to kick the ROC can down the road for accounting and disclosure purposes, even though the economic reality is already occurring. We believe PIMCO should just disclosure the ROC very directly in a place where investors will see it.

PIMCO’s response to our inquiries:

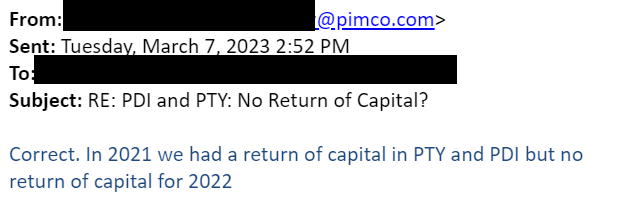

We reached out to PIMCO multiple times for comment regarding ROC for PTY and PDI, and we received varying responses from variying sources. For example, this is a relevant portion of an email we received from a general email contact at PIMCO (emphasis ours):

Thank you for contacting PIMCO Funds. We have received your inquiry regarding distributions that include return of capital for the PIMCO Dynamic Income Fund (PDI) and the PIMCO Corporate & Income Opportunity Fund (PTY)…

…PDI have not had any portion of distributions come from sources other than undistributed net investment income in recent years, therefore no Section 19 Notice or Form 8937 is available.

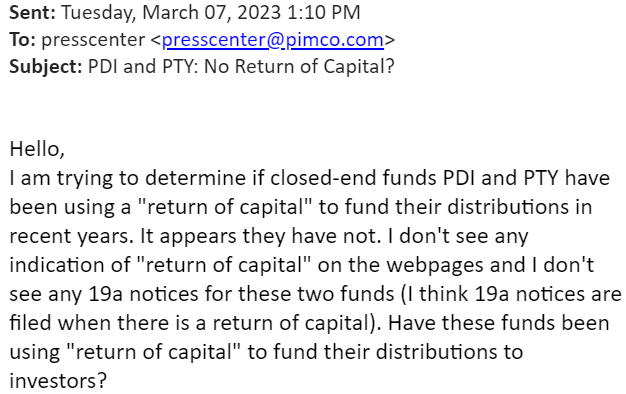

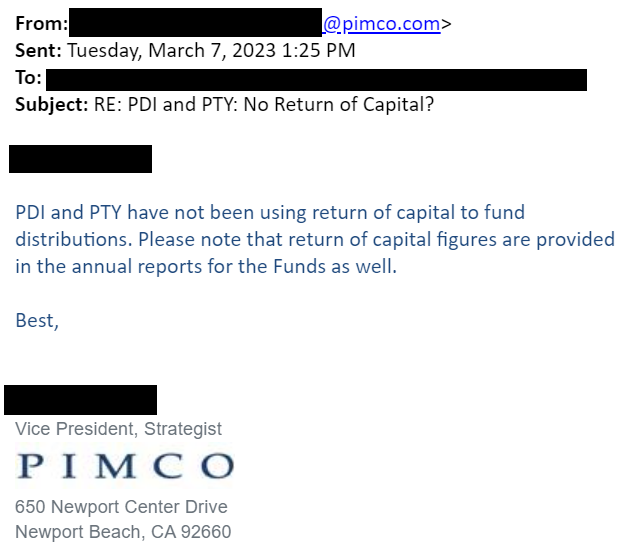

At first this seems to corroborate an email response we received from a Vice President at PIMCO (however, we got him to change his tune a bit). Here are the details of that email exchange:

Hello, I am trying to determine if closed-end funds PDI and PTY have been using a "return of capital" to fund their distributions in recent years. It appears they have not. I don't see any indication of "return of capital" on the webpages and I don't see any 19a notices for these two funds (I think 19a notices are filed when there is a return of capital). Have these funds been using "return of capital" to fund their distributions to investors?

At first, the VP corroborates that there is zero ROC in recent years.

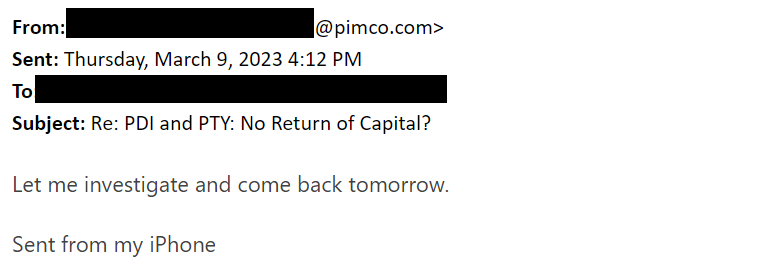

But after he suggests reviewing the funds’ annual reports, we sent him the same annual report excerpts from earlier in this report, and his tune changes slightly (remember, our original question (above) was about ROC in “recent years”).

Finally, we got him to acknowledge that:

“We [PIMCO] did not send out notices for PDI but we did for PTY; they should be available on the website for 1 year. I’ve attached them here. Let me know if this helps.

Again, the fact that they (section 19 notices) are available on the website for only one year, seems unhelpful to investors considering the funds retroactively recognize past ROC in the future based on the second leg of the swap transactions. Plus, they never sent any notices for PDI, despite the fact that ROC in PDI has clearly occurred (only some of which is disclosed in the annual report) in recent years. Investors benefit greatly from ROC information, but PIMCO is not doing a good job disclosing this vital information.

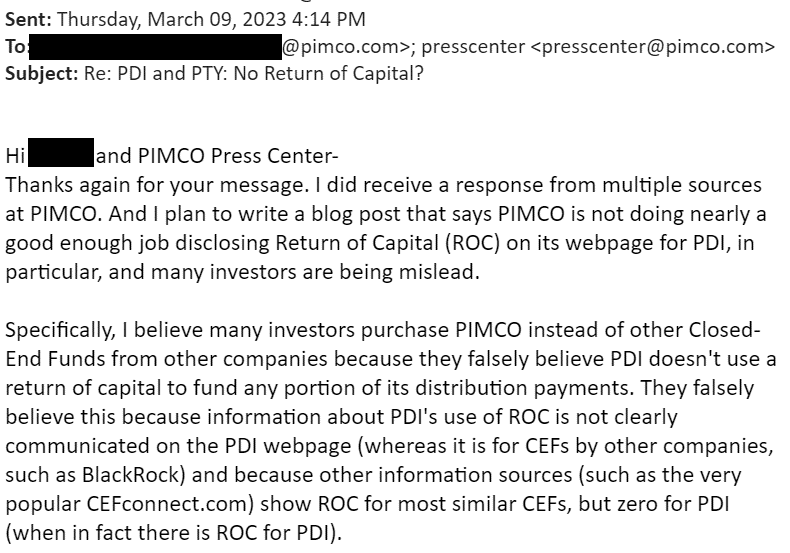

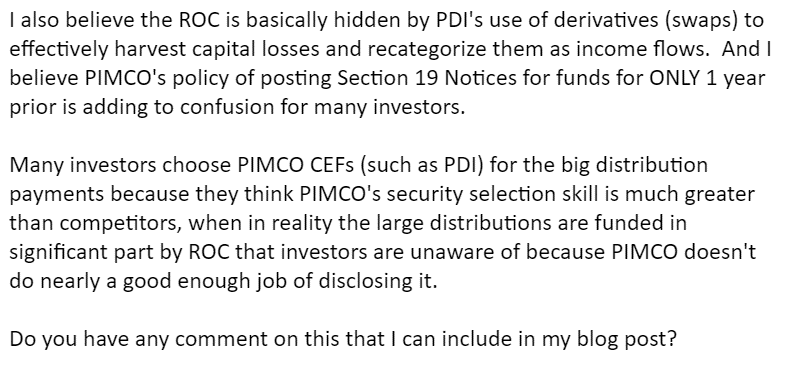

Finally, we also reached out to PIMCO with this inquiry:

PIMCO asked we give them a day to investigate and reply.

But as of 24 hours, we haven't yet heard back.

PIMCO’s History of Red Flags

PIMCO does have a history of red flags with regards to these funds, such as those described below.

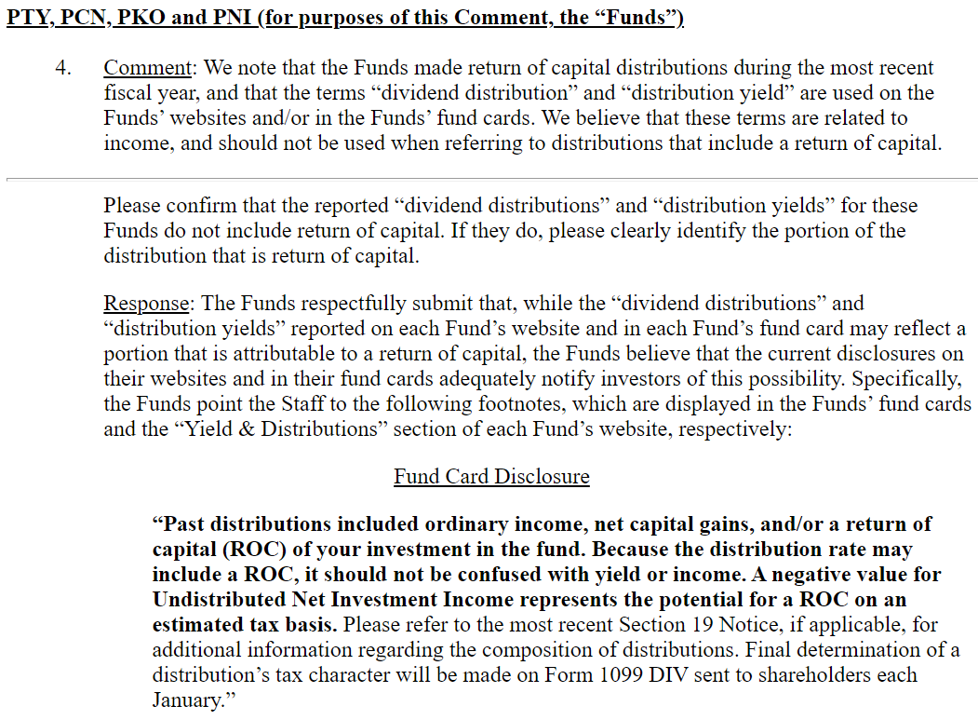

2018 SEC Staff Comments: The Securities and Exchange Commission (“SEC”) provided some concerning comments to PIMCO about PTY and PDI in 2018, and PIMCO’s response is a red flag in our opinion. Here is an excerpt.

We find PIMCO’s response concerning because they still refuse to openly and decisively acknowledge the ROC, and because they appear to have been misleading investors with words like “yield” instead of “distribution.” These SEC concerns resulted in changes to disclosures about the funds, but the ROC still needs to be more clearly disclosed on the funds’ websites.

2021 Fund Consolidation: At the end of 2021, PIMCO combined three large closed-end funds (PCI, PKO and PDI) into one fund: PDI. On the face of this transaction, operational efficiencies appear to be an obvious benefit. However, the transaction is a red flag to us because it clouds the ROC issue further. Specifically, reporting on unrealized ROC or lagged ROC (via swap transactions) that would have been reported in the financial statements seems unavailable on the PIMCO website (because PCI and PKO don’t exist anymore). And because by combining the funds, PIMCO may have been using unrealized capital gains in some of the funds to offset capital losses in other funds thereby eliminating the need to report the dreaded ROC (even if retroactively due to the second leg of swap transactions) that so many investors believe doesn’t exist.

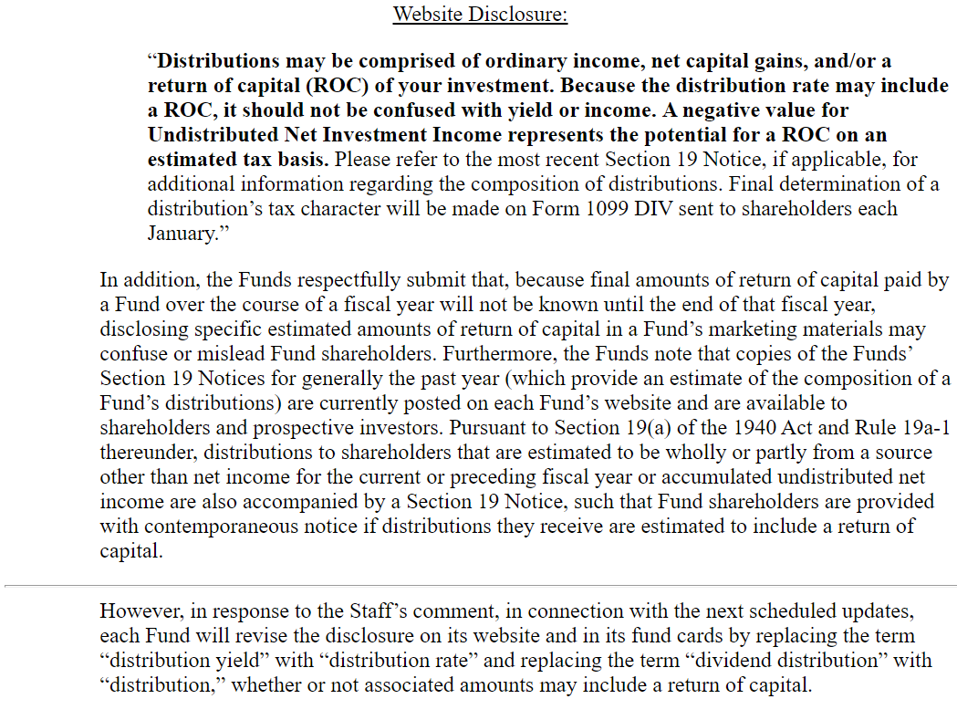

Rising Interest Rates and High Leverage: Another red flag for these funds is the significant use of leverage (particularly for PDI) as they backup against regulatory leverage limits (50%) and as rising interest rates keep working against the funds (both funds have a duration of around 4 years). As rates rise, bond values fall. And as bond values fall, the funds’ unrecognized capital losses rise. This is particularly concerning because the funds would need capital gains to offset the second leg of swap transactions that have likely been delaying the full recognition of ROC. Further, there are minimum amounts of actual securities these funds are mandated to hold. The combination of rising rates, high leverage and significant derivatives (swaps) increases the likelihood that these funds will need to recognize significant amounts of ROC soon (i.e. they can only use swaps to kick the ROC can down the road for so long). Remember, rising interest rates hurt these funds, and here is a look at what's been happening with interest rates in recent years.

PTY and PDI are Not all Bad

Despite the cloudy ROC disclosures (and the many investors that falsely believe PDI and PTY aren’t using ROC), these funds still have attractive qualities. For example, PIMCO does have world-class resources and investment managers that can use leverage effectively to magnify income and returns (they have more disciplined operations and better access to lower rates than the average investor) and PIMCO can access bond opportunities that are otherwise unavailable to individuals. And from an NAV standpoint, these fund appear to be doing the right things (aside from the possibility that the portfolio managers are engaging in goofy swaps transactions to delay ROC and that may be distracting them from carrying out more meaningful duties to investors).

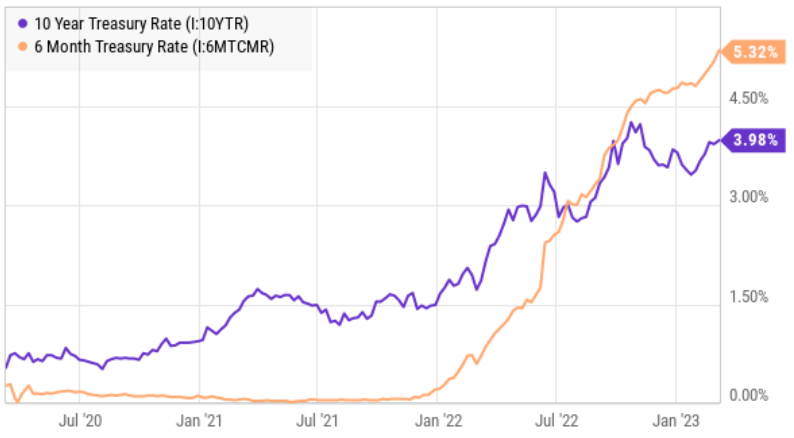

Further still, the US federal reserve has a strong interest in supporting the bond markets that these funds invest in. For example, the US central bank stepped in quickly during the liquidity shortage in early 2020 (as covid hit) to ensure bond markets continued to operate in an orderly fashion (and to the benefit of both PDI and PTY), as you can see in the fed balance sheet chart below.

In a nutshell, PDI and PTY are comparable to many other bond CEFs in terms of funding the distributions from a mix of sources (e.g. interest income, capital gains and ROC), it’s just that investors are frequently not aware of the PIMCO ROC because PIMCO harvests it and then recategorizes it as income flows through the use of swaps transactions. And despite the high price premiums on PDI and PTY, PIMCO is able to keep delivering high distribution “yields” through the use of ROC combined with a higher level of leverage than many other CEFs.

The Bottom Line:

Despite the ugly ROC (and the growing risks for these funds to recognize significantly more), we still like PDI and PTY (we own scaled back positions in both). But for goodness sake—diversify! Don’t put all your eggs in one basket. Especially considering the interest rate risk, high leverage, large premiums, heavy use of derivatives and growing potential for larger and more fully-disclosed ROC events in the near future.

These two PIMCO funds (PDI and PTY) are good, but they’re not as great as so many investors seem to believe. We offer many attractive alternative big-yield opportunities (for investors to at least partially diversify into) in our High Income NOW portfolio.

However, at the end of the day, you need to invest only in opportunities that are right for you, based on your own personal situation and goals. We believe disciplined, prudently-diversified, long-term investing will continue to be a winning strategy.