The CEF we review in this report is attractive for a variety of reasons, including its big monthly distribution payments (which have never once been reduced since the fund’s inception in 2014), its discounted price (it trades ~10.0% below NAV), its reasonable use of leverage (~20.0%) and its compelling sector-specific holdings. We review all the details in this report, and conclude with our opinion on who might want to invest.

Tekla Healthcare Opportunities (THQ), Yield: 7.0%

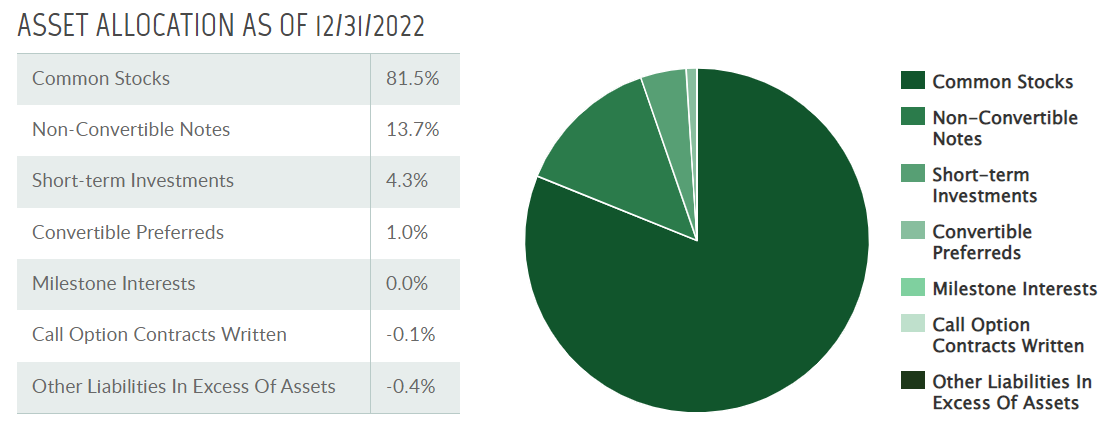

The objective of The Tekla Healthcare Opportunities Fund is to seek current income and long-term capital appreciation. To accomplish this goal, under normal market conditions, the THQ expects to invest at least 80% of its Managed Assets in U.S. and non-U.S. companies engaged in the healthcare industry (“Healthcare Companies”) including equity securities, debt securities, and pooled investment vehicles. Here is a look at the current fund holdings, by asset class.

So as you can see in the graphics above, this in not purely a common stock fund, but it also owns other healthcare related assets such as convertible notes, preferreds and even has the ability to write covered calls (covered call writing is a strategy the fund admittedly did more of in its early months and years, but less so now).

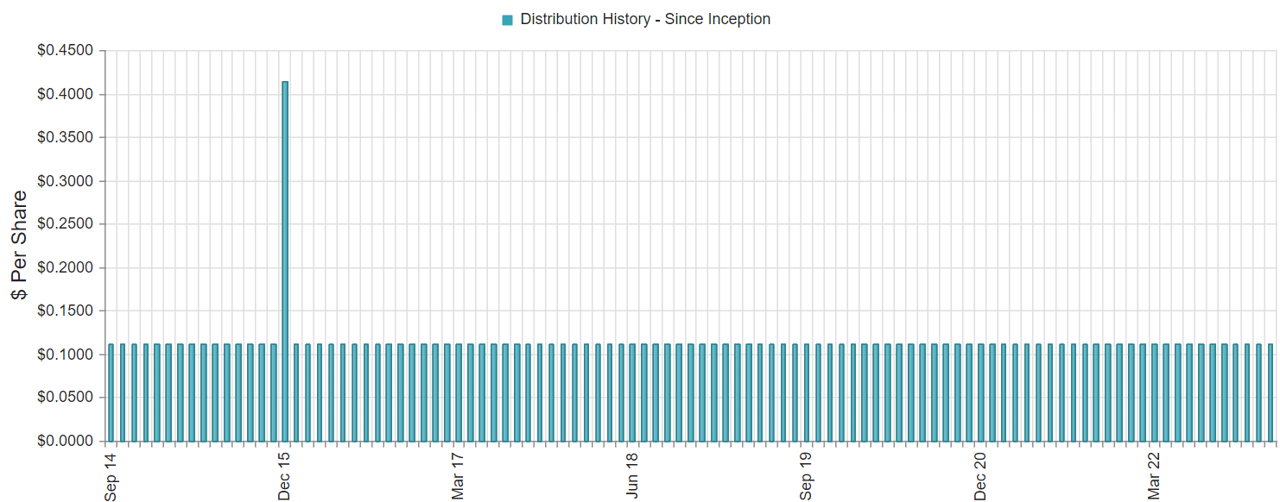

Big Steady Income and Gains:

And with regards to the fund’s goal of current income and long-term capital appreciation, the fund has delivered. For example, you can see in this next chart that THQ has never reduced its big monthly distribution since inception.

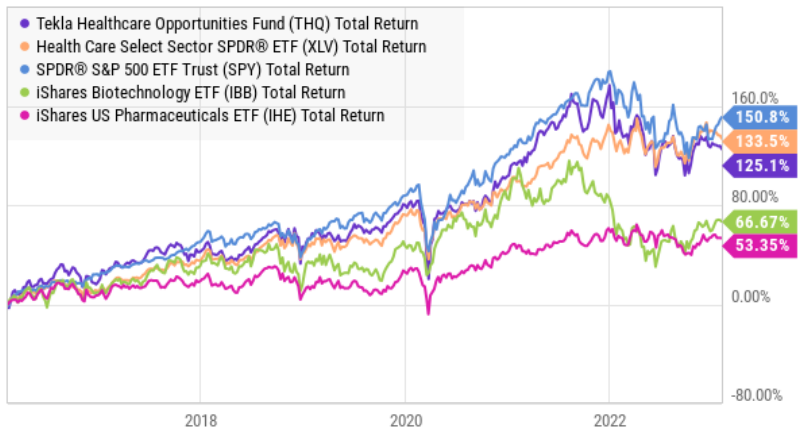

Further still, THQ has a healthy track record of delivering total returns (price gains plus dividends reinvested) as you can see in the chart below.

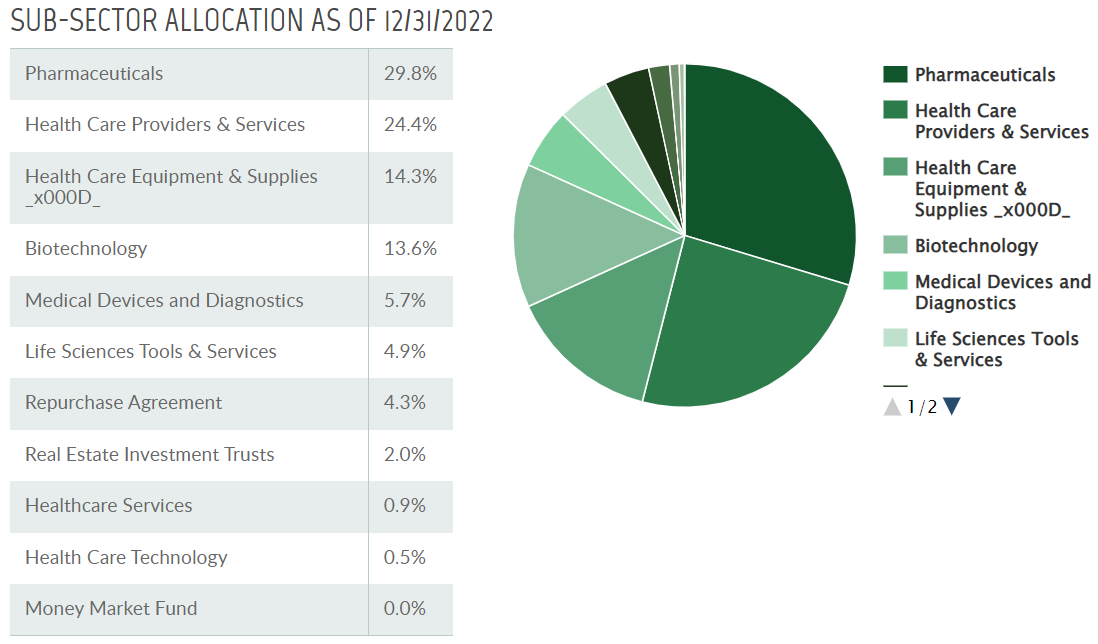

We compared THQ (purple line in the chart above) to the S&P 500 (blue line) and the healthcare sector (orange line), but keep in mind this is a bit of “apples to oranges” considering those are pure equity strategies, whereas THQ is not. We also included biotechnology stocks and pharmaceutical stocks because THQ has a healthy allocation to those sectors, as you can see in the graphic below.

Why Healthcare Now?

Healthcare stocks can deliver both steady results (think big blue chips like Johnson & Johnson) as well as some contrarian opportunity (think pharma and biotech, as pictured in our earlier graph). For perspective, here is a look at THQ’s recent top holdings.

Closed-End Fund Considerations

Importantly, THQ is a closed-end fund (or “CEF”) which means it has some unique characteristics that need to be taken into consideration, such as those described below:

Holdings: CEFs have widely different strategies (ranging from bonds, to REITs, to sector-specific equities). And because CEFs are funds they have many underlying holding (often ranging from 50 to 60 underlying holdings and all the way up to 1,000 to 2,000 or more!). This helps create some instant diversification of risks within each fund’s target strategy. THQ recently had 150 holdings.

Price Discounts and Premiums: Another important characteristic of closed-end funds (which is different from other mutual funds and exchange traded funds) is that CEF’s can trade at wide price premiums and/or discount to the aggregate market value of their underlying holdings (i.e. net asset value, or “NAV”). This can create significant risks and opportunities. We greatly prefer to buy attractive CEFs at discounts (not premiums) and that is currently the case for THQ, as you can see in the following THQ chart.

Leverage: CEFs often use leverage or borrowed money. This can help magnify returns and income in the good times, but it can also magnify risks and losses in the challenging times (such as 2022). CEFs use a wide range of leverage (depending on their strategies), but bond fund are generally limited to 50% leverage (by regulation) and equity funds to 30%. THQ recently had a leverage ratio of ~20%. We view this as an attractive way to increase THQ’s long-term performance, and prudent considering the fund’s current holdings (mostly common stocks, but not entirely).

Distribution Sources: As you may already know, CEFs don’t usually source 100% of their distribution payments from dividends or income on their underlying holdings. Rather, a portion of the distribution is often comprised of capital gains (short-term versus long-term can have different tax consequences—if you hold them in a taxable account) as well as even a return of capital in some instances (which can act to reduce your cost basis thereby resulting in some unexpected capital gains taxes if/when you do sell, again assuming you hold it within a taxable account). In THQ’s case, the distributions are sourced from a mix of all of the above. We view this strategy as prudent. Further, THQ has the luxury of a long-term track record (it’s not a new fund) which has allowed it to store up some “rainy day” capital gains that can be used to help support the distributions (a luxury many newer CEFs don’t yet have).

Fees and Expenses: CEFs have a variety of fees and expenses, and this ultimately detracts from your performance. For example, management fees often range from 0.50% to 2.00% per year. Further, operating expenses (including the interest expense on borrowed money—remember some use leverage) also rolls up into the total expense ratio. Some investors avoid CEFs because they cannot stand the fees, whereas others don’t mind the fees as long as the bottom line performance meets their needs. We often prefer to purchase individual securities instead of CEFs (to avoid the fees), but in some cases CEFs are attractive regardless of the fees (for example, some funds have access to securities that we cannot buy on our own, and CEFs also generally have access to lower cost (and more operationally efficient) leverage than do most individual investors—which is a legitimate “value add” for select CEFs, including THQ). For reference, THQ’s annual management fee is 1.00% of the average daily value of the Fund’s Managed Assets (includes leverage). Managed Assets means the total assets of the Fund minus the Fund’s liabilities other than the loan payable. Further still, the fund has operating expenses plus the cost of leverage (borrowing). THQ’s total annual expense ratio was recently 1.87% (reasonable).

Dividend Reinvestment Plan

THQ has an attractive dividend reinvestment plan that helps investors prudently benefit from market price discounts and premiums (versus NAV) when the dividend is paid. Here is some information from the THQ annual report explaining the details:

“If on the payment date of a dividend or distribution the NAV per share is equal to or less than the closing market price (plus estimated per share fees in connection with the purchase of shares), the Plan Agent will invest the dividend or distribution in newly issued shares. The number of newly issued shares to be credited to each participant’s account will be determined by dividing the amount of the participant’s cash dividend or distribution by the greater of the NAV per share on the payment date or 95% of the closing market price per share on the payment date. If on the payment date the NAV per share is greater than the closing market price per share (plus per share fees), the Plan Agent will invest the dividend or distribution in shares acquired in open-market purchases. The per share price for open-market purchases will be the weighted average price of the shares on the payment date.”

Risks:

THQ does face risks that should be considered. For example, it is concentrated in the healthcare sector (which may or may not perform better or worse than the overall market). It also uses leverage (as discussed) which may boost returns in the good times but hurt returns in the bad times (we believe the leverage is a good thing in the long term). Further, THQ currently trades at a large discount to NAV (which we view as attractive), but there is no guarantee that the discount ever reverses. Lastly, the total fund expense ratio will detract from your long-term investment results (as compared to if you just bought individual securities on your own—in which case there would be zero management fee), however considering the uniquenesses of the strategy and the competencies of Tekla—we view the total expense ratio as reasonable (especially again considering the price discount versus NAV and the prudent use of leverage).

The Bottom Line:

If you are looking for a big steady monthly distribution trading at a discounted price—THQ is worth considering. We especially like the strategy now from a sector standpoint, a price-discount standpoint and a long-term holding standpoint. We believe disciplined long-term goal-focused investing will continue to be a winning strategy.