In this quick note, we share updated data on 40 big-dividend BDCs plus our opinion on investing in them against the backdrop of rising interest rates and slowing economic growth.

BDC Overview:

Business Development Companies (BDCs) provide financing (mostly loans) to smaller (middle market sized) businesses. More specifically, they generally provide the types of loans that are too small, too unique and/or too risky for traditional banks (especially following the more stringent bank lending requirements following the Great Financial Crisis of 2008-2009). As such, BDCs generally pay large dividends (they are mostly exempt from corporate income tax) based on the higher rates they earn on the higher risk loans they provide.

Economic Risks:

As economic conditions become more challenging (i.e. rising rates, slowing growth), BDCs face increasing risks. For example, as rates rise, the risk of loan defaults rises (because it becomes increasingly challenging for many loan recipients to stay current on their floating rate loans). It also makes it harder for BDCs to originate new loans (simply because the economy has slowed, and their are less healthy middle market businesses looking for loans).

BDC Financial Health:

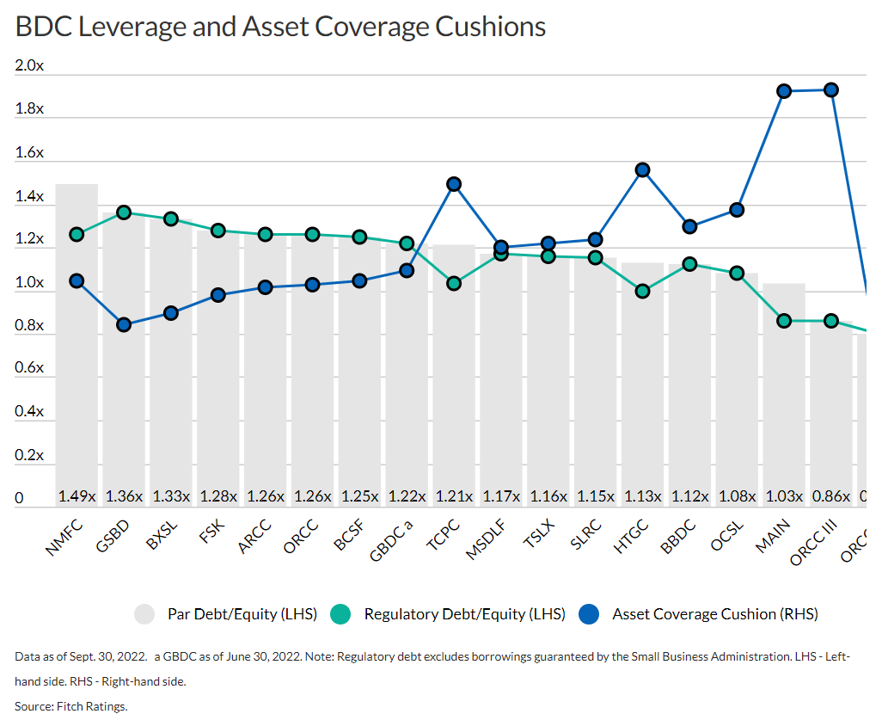

However, we believe despite deteriorating economic conditions, BDCs will remain relatively healthy for one main reason: Strong Balance Sheets. For example, BDCs are allowed financial leverage up to 2.0x (this is up from only 1.0x prior to new regulations passed in 2019), and most BDCs remain well below this level. For example, you can see in following table that most BDCs have debt-to-equity ratios of just over 1.0x (well below the 2.0x regulatory limit).

Data as of Tues, Feb 28, 2023. source: StockRover

And here is similar data showing BDC leverage and asset coverage ratios remain healthy.

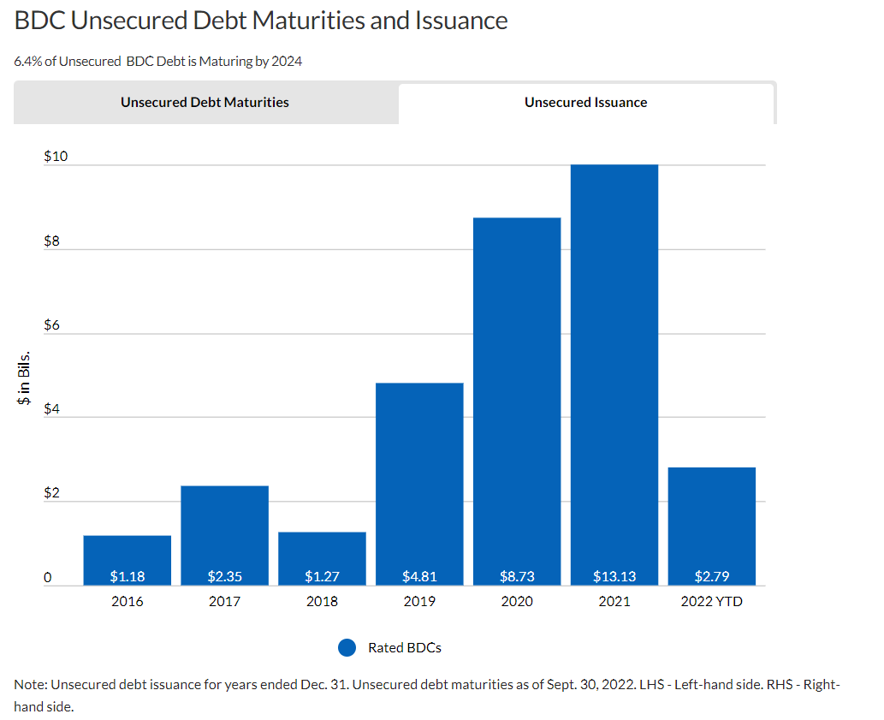

Further still, BDCs generally don’t have to refinance much of their debt this year (because they recently took on their debt in 2020 and 2021 when rates were lower).

Of course, every BDC is different (and faces its own unique risks).

For example, popular BDCs like Ares Capital (ARCC), Owl Rock (ORCC) and Main Street Capital (MAIN) are well diversified across industries and investment strategies. However, other BDC are concentrated in certain sector of styles, such as Hercules Capital (HRCC) and Triple Point Venture Growth (which are focused on growthier sectors of the economy).

The Bottom Line:

As long as the economy doesn’t great dramatically worse, BDCs generally have plenty of strength to weather current economic challenges. For example, asset write downs have been relatively tame so far, and balance sheets are healthy and well below regulatory leverage limits. That’s not so say things can’t get worse (they can), but they’d have to get a lot worse before most BDCs get into any serious financial challenges. As such, we continue to believe select BDCs offer attractive income and long-term investment opportunities.