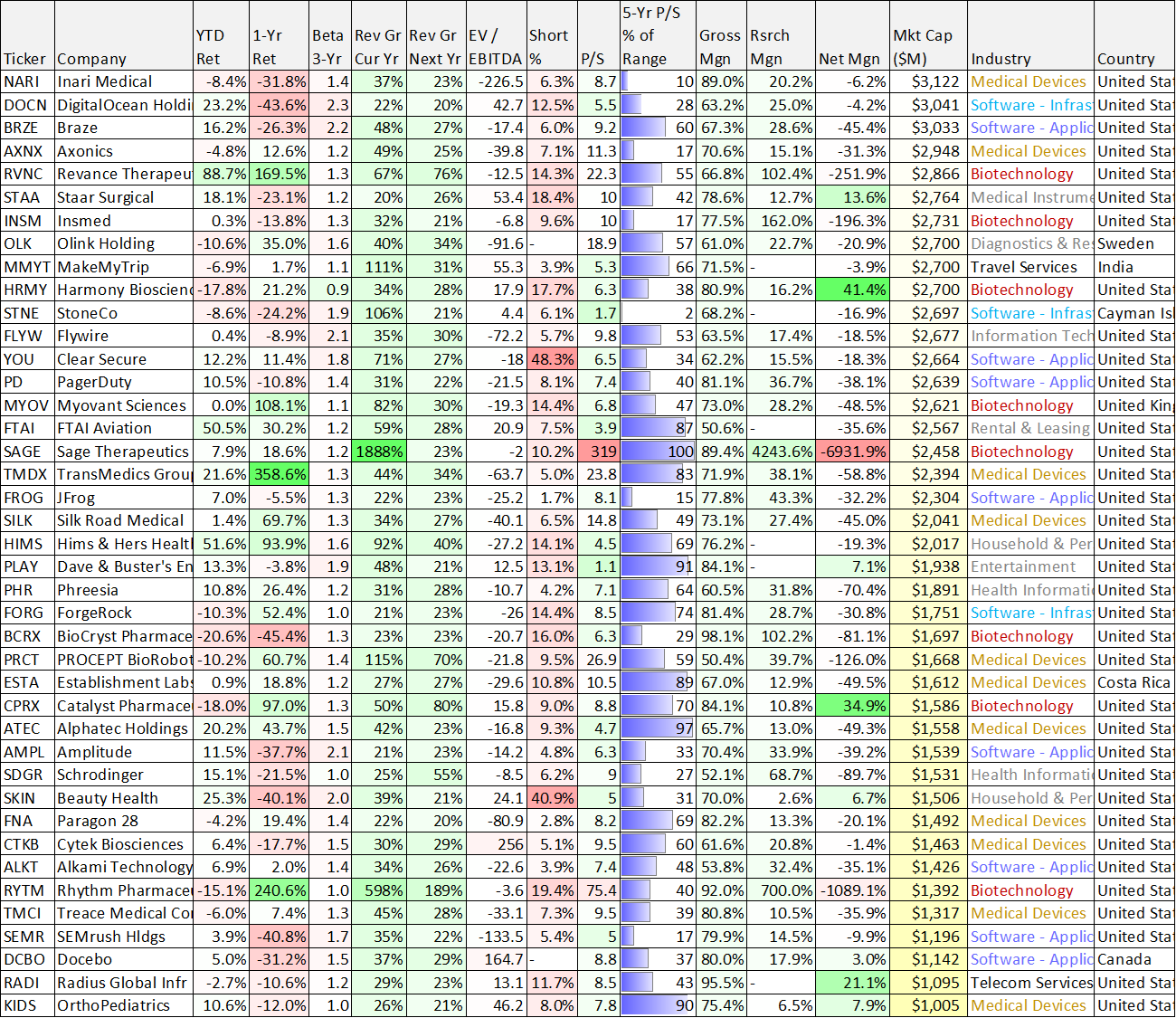

In this very quick note, we share updated data on top growth stocks (those with at least 20% revenue growth expectations for this year and next). You’ll notice the names with positive net margins have performed relatively better over the last year (quite the opposite of when the pandemic bubble had full momentum behind it and growth revenue growth rates were all that seemed to matter). The table also shows recent performance, short interest, margins, various valuation metrics (e.g. EV / EBITDA, P/S, 5-Year P/S range) and more. It’s hard to take a contrarian view, but that’s often a profitable approach for selective long-term investors at lower points in the market cycle (i.e. right now).

Of course the reason growth stocks have sold off so hard is because the market has turned south as fiscal and monetary policies have shifted from stimulative (during the height to pandemic fears) to now hawkish as inflation is the leading economic concern stoking recession concerns. But the reality is that the market has overcome challenges in the past, and it will this time too. And when it does, many of the names in the above table will lead the way dramatically higher.

Growth stocks are not right for everyone, and of course you should select opportunities that meet your own personal situation and goals. We believe disciplined, goal-focused, long-term investing will continue to be a winning strategy. And 5 years from now, many of the names in the above table will be trading dramatically higher than they are now. For example, in our Disciplined Growth Portfolio, we are long ServiceNow (NOW), Snowflake (SNOW) and Paylocity (PCTY), to name a few.