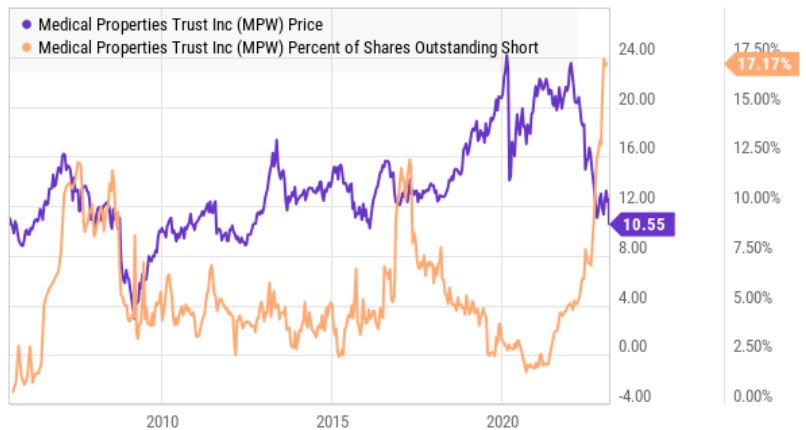

Medical Properties Trust (MPW) is a big-dividend healthcare REIT (the current yield is 10.4%) that has increased its dividend for 10 years in a row. This makes it tempting to a lot of investors. However, MPW short interest (i.e. investors betting against the shares) has also increased to a very high level (and the shares are down significantly). We previously wrote up MPW in detail here. In this quick note, we provide an update on MPW highlighting a few important things for investors to consider.

For starters, here is a look at MPW’s recent share price (you can see the steep price decline—which has mathematically driven the current dividend yield so high) and the recent short interest (which shows a lot of people are betting against the shares).

Short Seller Thesis:

The basic short-seller thesis is that:

MPW has some significantly troubled hospital operators (i.e. the groups MPW leases its hospital properties too), and

MPW has a lot of debt (which is becoming more expensive as interest rates rise).

Further, some short sellers argue that some of MPW’s assets are significantly overvalued (for example, see this short seller report).

Further still, some short sellers are using the latest announcement that the current CFO and co-founder’s newly announced retirement is a bad omen (even though he is 68 years old and not retiring until September).

MPW Strengths:

In our view, all of the above are very real challenges that MPW has to deal with (to varying degrees). However, the situation is not as dire as the short sellers want you to believe. Specifically, here are a few important points (strengths) to keep in mind:

MPW received a Ba1 Stable credit rating from Moody’s as recently as Nov 3, 2022. Ba1 is the highest “below investment grade” rating, so there is clearly some risk. But here are a few positive things Moody’s mentioned in that report:

The rating affirmation reflects the healthcare REIT's large size, global diversification, and stable cash flows supported by long-term triple-net lease investments in hospital real estate. The outlook was revised to stable from positive, reflecting Moody's expectation that it will be challenging for MPT to reduce its large tenant concentration with Steward Health Care (30% of 3Q22 revenues) as the capital markets climate has made execution of accretive acquisitions more challenging. Additionally, Moody's notes that even as the REIT has reduced debt levels, leverage is more consistent with its existing rating category.

MPW’s dividend is still well covered by funds from operations. In its latest quarterly earnings announcement (released on on Thursday 2/23) FFO was $0.43 per share (meeting expectations) versus its quarterly dividend of only $0.29. This is a good thing (i.e. the dividend is still well covered).

MPW current trades at an extremely low (attractive in our view) price-to-FFO ratio (forward) of only 6.6x (super low!) and a forward price to Adjusted FFO (non-GAAP) of 8.7x (also super low—attractive).

The Bottom Line:

MPW is a risky investment, and it is NOT appropriate for the most risk averse investors. However, if you can handle the uncertainty, MPW is worth considering for a spot in a prudently diversified income-focused portfolio. The company will face challenge, but we believe it can continue to work through them (and the current situation is not as dire as the market price (and short interest) suggest). We currently have a very small position in MPW (>1.0%) in our Income Equity and High Income NOW portfolios.