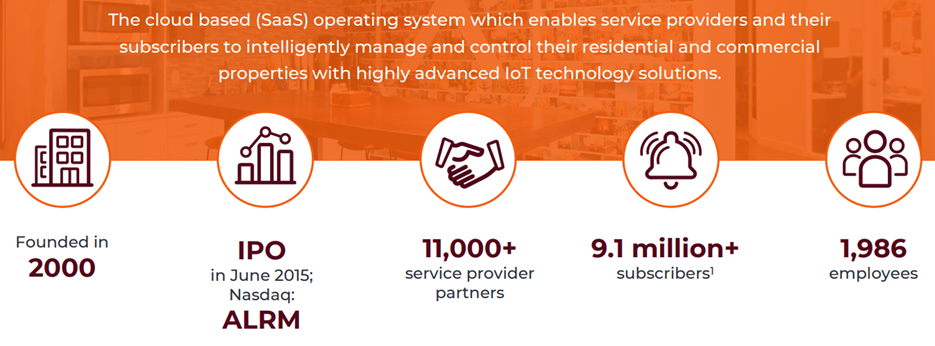

The Software-as-a-Service company we review in this report has a lot of attractive qualities, including a leadership position in a large total addressable market (“TAM”) where growth is being driven by increasing cloud-based connectivity (i.e. the Internet of Things (“IoT”)). It’s also a “smid” sized company ($2.7B market cap) and trades at a compelling 3.1x forward sales. In this report, we review the business, the growth opportunity, the valuation and the risks. We conclude with our strong opinion on investing.

Overview: Alarm.com (ALRM)

Alarm.com is a leading provider of home (and business) security and other interactive systems. For example, its solutions include video doorbells, video surveillance, commercial access control, as well as growth areas such as HVAC analytics, energy analytics and other business intelligence information.

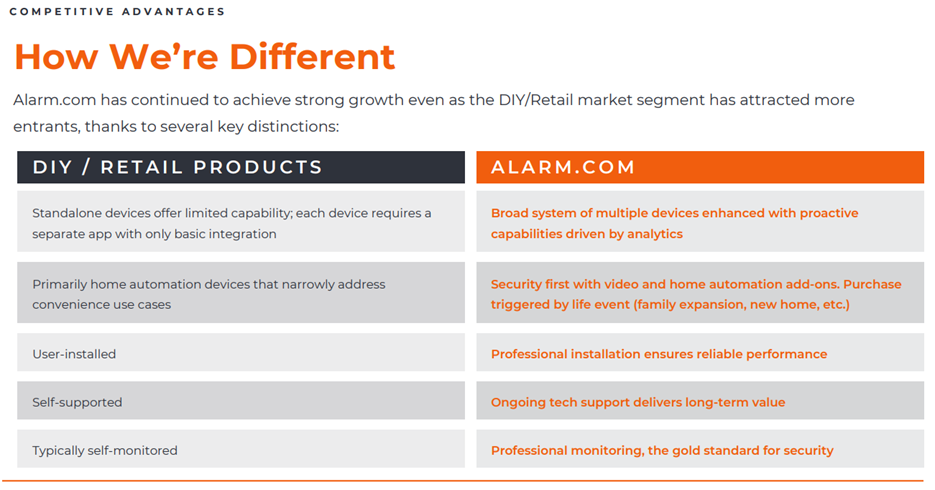

Alarm is unique versus multiple types of competitors. First, it’s mainly a software company (it provides a small amount of hardware too), and this provides distinct advantages versus competitors that install security hardware too. Specific advantages of this business model include:

Software is a very high gross margin business (in the low to mid 80%’s for Alarm), and high renewal rate business (in the mid 90%’s for Alarm).

The ability to work with multiple service providers and installers thereby increasing customer reach and decreasing operational risks as compared to competitors that provide one-stop-shop solutions.

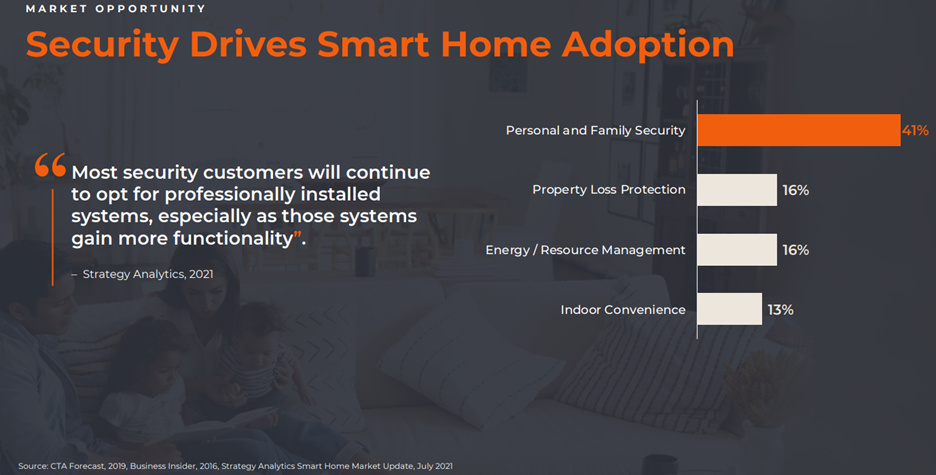

Additionally, Alarm is unique versus do-it-yourself home security solutions (mainly superiority with regards to trustability, as you can see in the following graphic).

High Growth Opportunities

We also really like Alarm because of its high growth trajectory, thanks to the large TAM, the expanding Internet-of-Things (IoT) and it placement as a gateway into the home to expand into more solutions (a bit of a “trojan horse”), as you can see in the graphic below.

To back up on growth, here is a look at the company’s high growth trajectory:

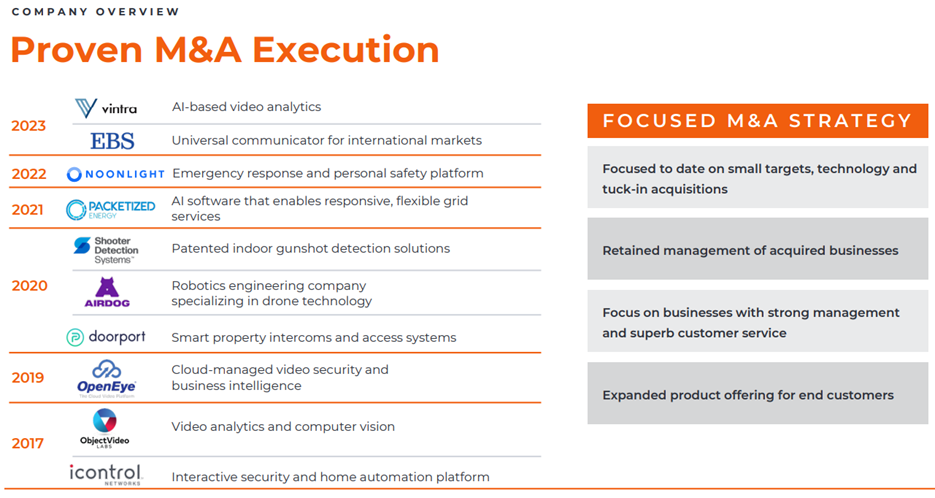

And notably, some of this high growth has been driven by a prudent “mergers & acquisitions” strategy.

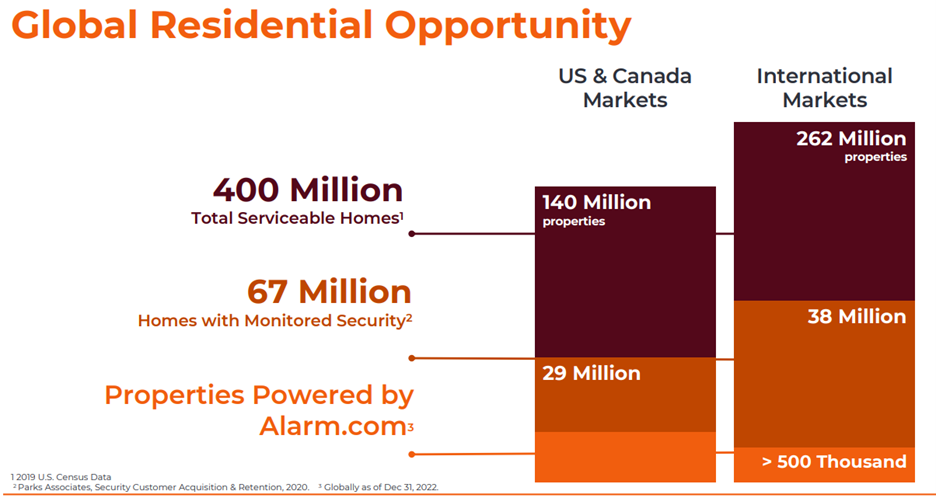

And here is a look at the large total addressable market opportunity (“TAM”) with regards to home and business solutions (as well as some perspective on how much of the market Alarm has already captured versus the competition).

Also critically important to the ongoing growth strategy is expansion into adjacent markets (as mentioned security solutions can be an entry way to expand to other new innovative products, driven by the expanding IoT, cloud-migration and even artificial intelligence).

More explicitly, here is a summary of growth drivers

And also worth mentioning, this company is even leveraging artificial intelligence (the latest mega secular trend, which appears to have long-term legs and room to run) to improve the value of the solutions Alarm offers, as you can see in the following graphic.

This is a highly innovative company, with a strong management team, and lots of room for significant growth ahead.

Current Valuation:

Unlike a lot of growing SaaS companies, Alarm is actually profitable (a good thing, especially in our increased interest rate environment whereby borrowing to cover losses and raise capital becomes even more expensive and costly to shareholders).

What’s more, Alarm is profitable even after heavy spending on Research & Development costs (also a good thing considering innovation will help drive growth for this disruptive business on a continuing go-forward basis).

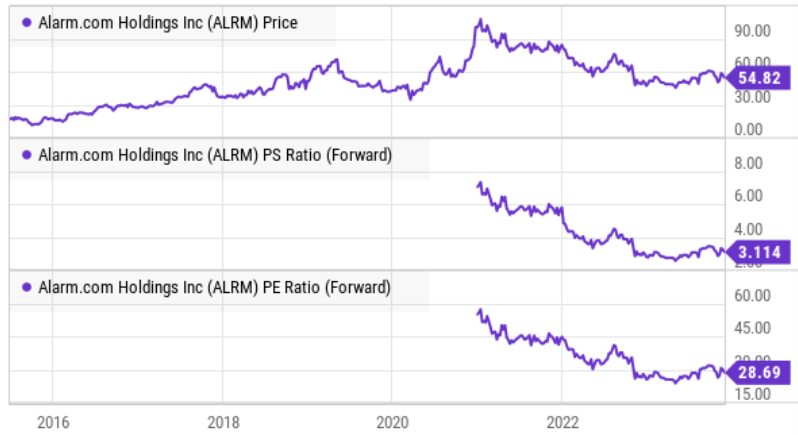

Alarm currently trades at around 49x forward earnings (on a GAAP basis) and 29x forward earnings (on a non-GAAP basis). This may seem expensive, but recall the company has been spending heavily on R&D (as high as 25% of revenue in 2021).

However, Alarm trades at only 3.1x forward sales, which is very reasonable in the SaaS space (especially considering the companies competitive advantages and large TAM), and it will benefit from increasing economies of scale as it continues to grow.

And as you can see in the chart above, the share price has come down, as this company got caught up the zero-interest-rate pandemic bubble (like so many other SaaS businesses). However, unlike other SaaS businesses, Alarm is actually profitable.

Also important to note, the company is cash flow positive (free cash flow was $60 million in the most recent quarter), and long-term debt ($492 million) is less than cash and short-term investments ($680 million).

Overall, we view Alarm’s balance sheet as healthy and its valuation as reasonable, especially compared to it large long-term growth potential.

Risks:

Alarm faces a variety of risks that should be considered. For example, the company does face competition from existing businesses (such as ADT) and a myriad of do-it-yourself startups. However, Alarm has distinct advantages in terms of business model (i.e. software-based and hardware light) as well as strong and growing relationships with existing service partners (which Alarm wants to help succeed—a good thing).

Slowing growth is another potential risk, considering significant growth has been funded through acquisitions, and considering revenue growth in the most recent twelve-trailing months was only 4.1% ($863.6 versus $829.7).

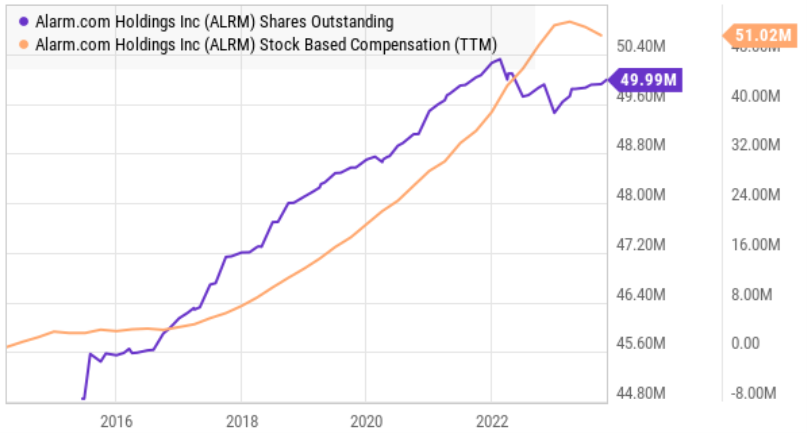

Stock-based compensation is also worth mentioning as a risk because it remains high (see chart below), but has come down, and the growth in shares outstanding (dilution) has also slowed (a relatively good thing).

The Bottom Line

Alarm.com is an attractive business (profitable, growing, industry leader), benefiting from a powerful secular trend (the cloud, IoT and even AI), and trading at a reasonable price (especially as the share price and valuation have both come down following the “pandemic bubble”). We do not currently own shares, but we like this business, and may add shares (to our Disciplined Growth Portfolio) in the relatively near future.