Quick Note: Briefly sharing some updated data on big-yield CEFs on our watchlist. You’ll note a few standout for bigger than normal discounts and smaller than normal premiums (as per z-scores). Returns have been healthy for equity CEFs, but weak for bond CEFs (as interest rates have been rising). However, the interest rate environment is changing, and so are the opportunities going forward.

In particular, many bond CEFs have performed poorly (negative returns) over the last two years as interest rates were rising (as rates rise, bond price fall, all else equal). But with inflation now much tamer, the fed is not expected to hike rates again this year (and expected to actually cut rates next year), bond CEFs are looking particularly attractive (or at least more normal in terms of big yields with more price stability).

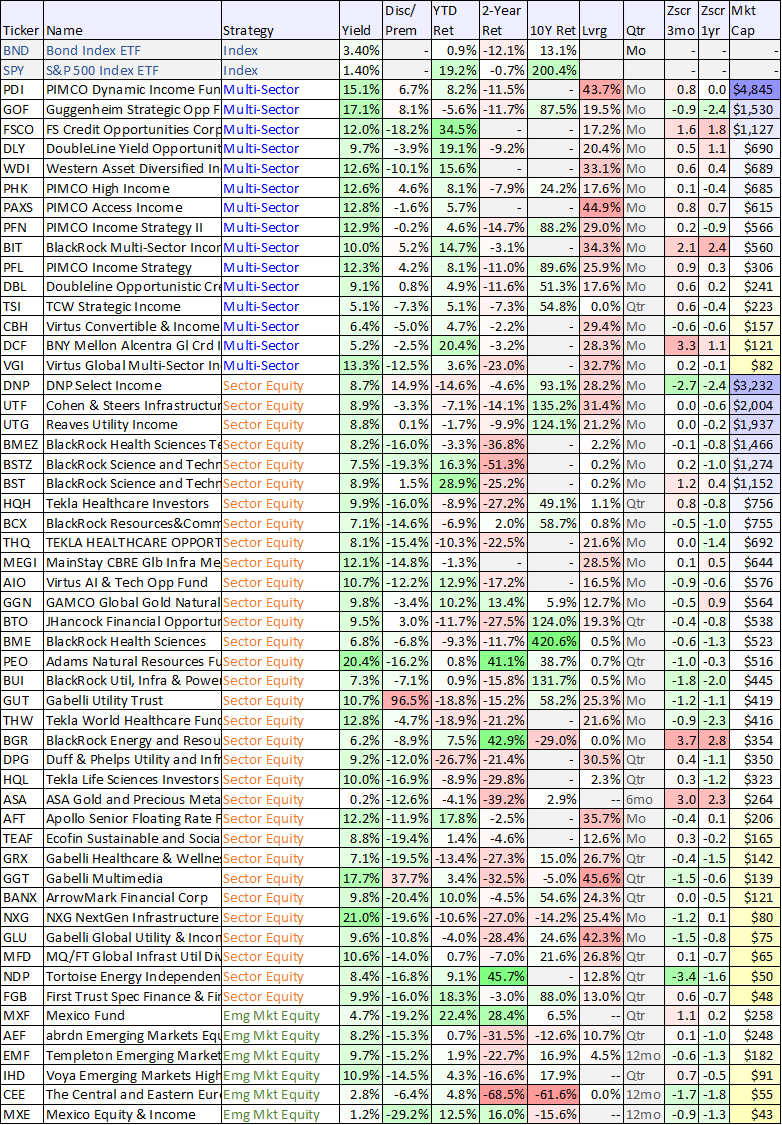

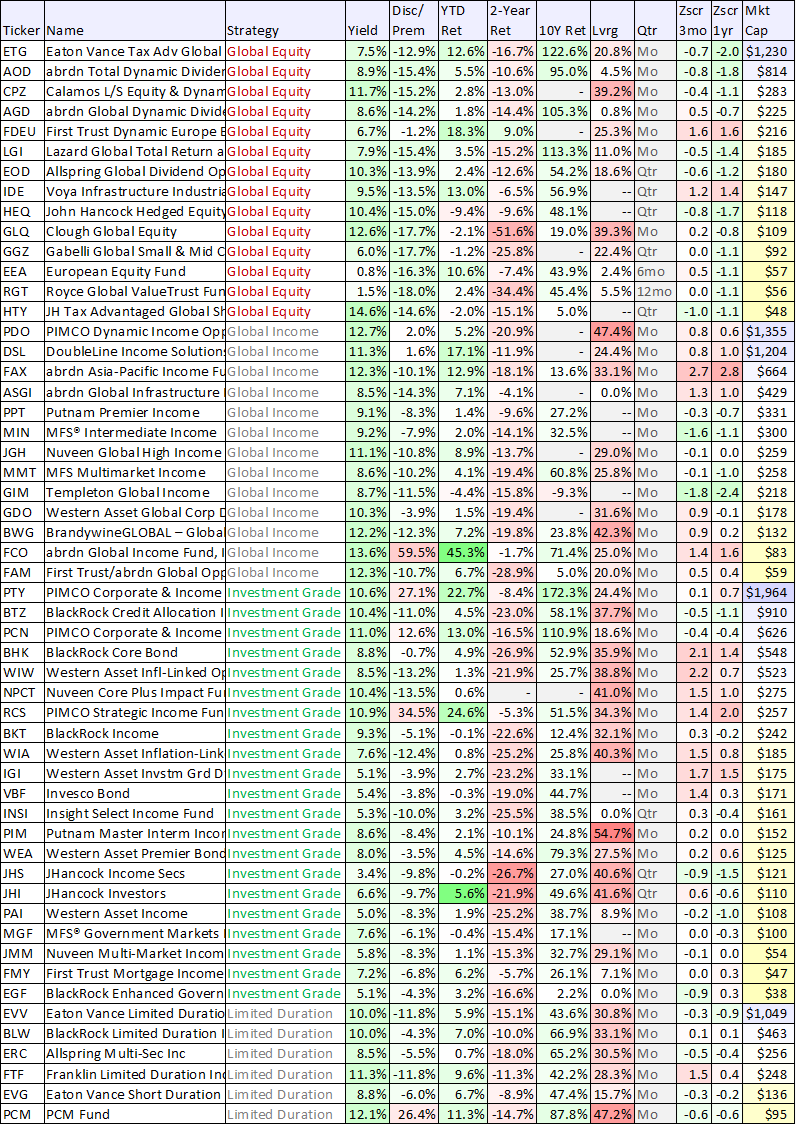

And for your reference, here is expanded data on over 150 big-yield CEFs.

Data as of Fri 17-Nov-23, source: CEF Connect, StockRover