Like much of the economy, materials companies were impacted dramatically by pandemic disruption. In particular, lockdowns in the US and internationally caused demand to halt and share prices to plummet. However, with countries and companies continuing to reopen, and share prices still depressed, highly compelling opportunities exist. In this report, we review an attractive materials company that offers a strong and growing dividend (currently yielding 2.5%) plus attractive share price appreciation potential.

Celanese Corp, Overview:

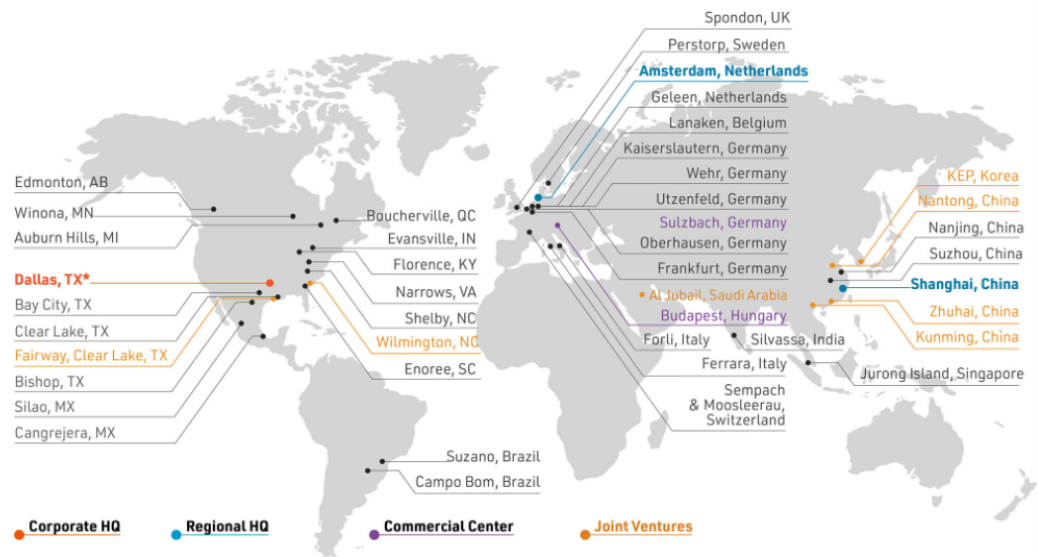

Celanese is materials company. It manufactures performance engineered polymers and it is also the world's largest producer of acetic acid (and its chemical derivatives). It divides its business into four product segments, including engineered materials, cellulose acetate, food ingredients and acetyl chain.

Celanese materials are used in a very wide variety of things from automobiles, medical applications, consumer electronics and many more. The company currently offers 63 different products, and a few examples are displayed below.

Pandemic Disruption / Slowdown:

Like much of the rest of the world, Celanese’s business was disrupted by the pandemic (specifically by supply chain disruptions and manufacturing shutdowns, both in the US and abroad). The shares are down nearly 40% over the last year. Celanese is a value stock.

Low Cost Advantages:

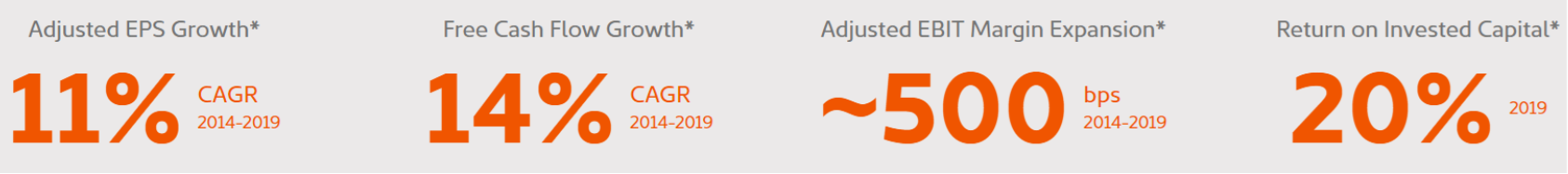

We view Celanese as an attractive contrarian value stock because it has cost advantages over peers (due to its scale and because it has access to low cost feedstocks courtesy of its Clear Lake Texas operations and low cost US natural gas), and because we are near a low point in the market cycle (hopefully!) that was caused by pandemic disruption.

Also contributing to cost advantages, Celanese recently acquired DuPont’s (DD) mobility and material portfolio, which will compliment Celanese’s existing portfolio and low cost leadership.

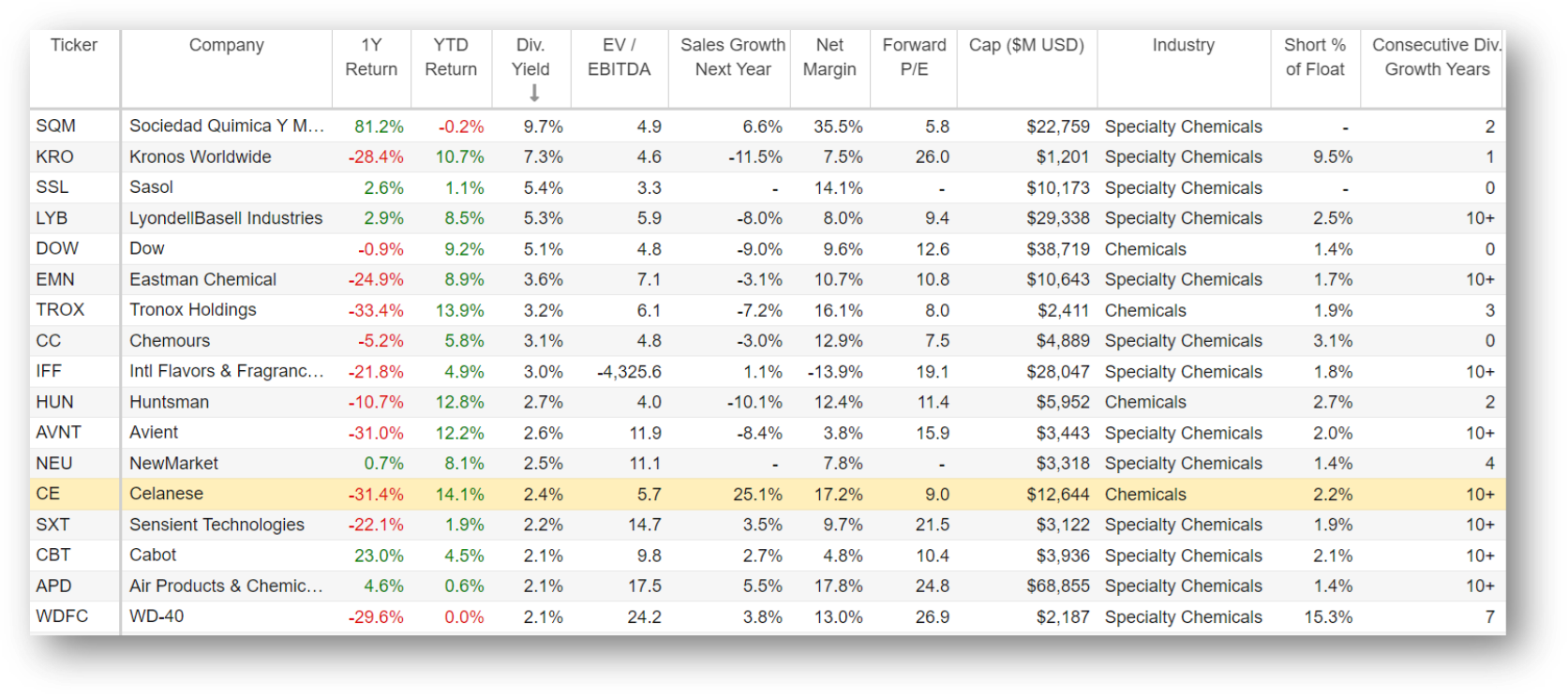

Low (Attractive) Valuation and Dividend Growth:

Trading at 9x earnings, with a net margin of 17.2%, and having grown its dividend to investors for 13 consecutive years, we view Celanese as an attractive contrarian opportunity with significant share price appreciation potential as pandemic supply chain disruptions resolve and Celanese emerges as the low cost leader with increasing economy-of-scale advantages.

The Bottom Line

If you are looking for an attractively priced contrarian opportunity that also pays a big growing dividend, Celanese is worth considering. We do not currently own shares, but it is high on our watchlist, and we may add shares to our Income Equity portfolio in the near future.