CrowdStrike (a rapidly growing cybersecurity company) announced earnings after the close on Tuesday. The results were better than the street’s already lofty expectations, plus the company raised forward guidance (both good things). This brief note is an update and follow up on our previous CrowdStrike report, and a reminder to readers on how we feel about investing in this stock, at this time.

CrowdStrike (CRWD)

As we mentioned in our previous report, Crowdstrike is a cybersecurity company focused on endpoint security. It is benefiting from the ongoing cloud migration secular trend (with very high sales growth), and it will likely keep benefiting for a long time considering its leadership position and the massive total addressable market (the cloud is huge and growing, and so is the need for cybersecurity).

Earnings Announcement

As mentioned, CrowdStrike announced strong quarterly results on Tuesday after the close. Specifically, the company announced Non-GAAP EPS of $0.36 (beating expectations by $0.09), revenue of $535.1M (beating expectations by $18.66M) and raised its FY23 guidance (all good things).

To summarize, here is a quote from CEO George Kurtz during Tuesday’s quarterly call:

Taking a moment to summarize and put everything we have shared with you today into context. Customers want a trusted platform that seamlessly unifies endpoint, cloud, identity and data, redefining what core cybersecurity means. CrowdStrike is leading this replatforming with Falcon, and we see no other competitor with a comparable offering. I believe the CISO of a company on the East Coast said it best, and I quote, it’s hard to remember the days when I didn’t have immediate 24/7 remediation, vulnerability reports on every device, discovery of every asset on my network and a clear understanding of every account login, but I’m never going back.

Why Are the Shares Down?

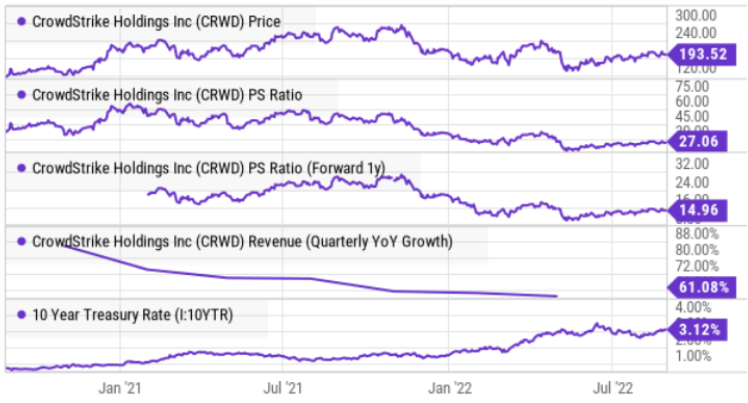

CrowdStrike shares currently trade at about 35% below their all-time high (achieved back in 2021), yet the business has only continued to improve since that time. The reason has to do a lot more with multiple contraction than anything else.

Specifically, CrowdStrike’s price-to-sales multiples have come down since 2021 (see chart above) because of overall market conditions (not anything CrowdStrike did wrong). More specifically, the US economy is arguably in a recession as conditions have deteriorated as the Fed aggressively attempts to fight inflation by rapidly hiking rates. And as the Fed hikes, future growth expectations have slowed (because higher rates makes it harder for companies to borrow money to fund growth). For example, CrowdStrike’s potential clients will have less cash to upgrade to CrowdStrike’s software and services.

Additionally, the valuation multiples of high-growth businesses (like CrowdStrike) generally do come down as rates rise, and also potential future earning are worth a lesser amount because they are discounted back to the present value at a higher interest rate. Not to mention, the earnings numbers reported above are non-GAAP, but on a GAAP basis—CrowdStrike’s net income is still negative (something that scares many shorter-term investors away).

Is CrowdStrike Investable Here?

Considering the current macroeconomic environment, and considering CrowdStrike’s continuing high growth, whether or not the shares are investable depends on your situation and goals. For example, if you can NOT handle high short-term volatility (like we expect for the share price of CrowdStrike) then you probably should NOT invest. But if you are a long-term investor with a long expected holding period, then—Yes—CrowdStrike is a very attractive long-term buy-and-hold stock.

The Bottom Line

CrowdStrike is an exceptionally attractive long-term growth stock, and we currently own shares of CrowdStrike in our Disciplined Growth Portfolio because we suspect the share price will eventually be dramatically higher in the long-term, and because we are comfortable with the high short-term share-price volatility. However, if you are an income-focused investor—you may want to stay away from CrowdStrike because it pays no dividend and the share price can still fall much lower before it eventually goes much higher (knock on wood) in the long term.

For reference, you can view our previous (and more detailed) CrowdStrike report here.