Mortgage REIT AGNC Investment Corp (AGNC) announced quarterly earnings on Monday, and not surprisingly—book value took a hit (amongst all the interest rate and agency-spread movements). The yield has now mathematically climbed to over 12%, and some investors are left wondering if the shares are worth owning or if the risks are too great. In this report, we review the business, the outlook, valuation and risks, and then conclude with our opinion on investing.

Business Overview:

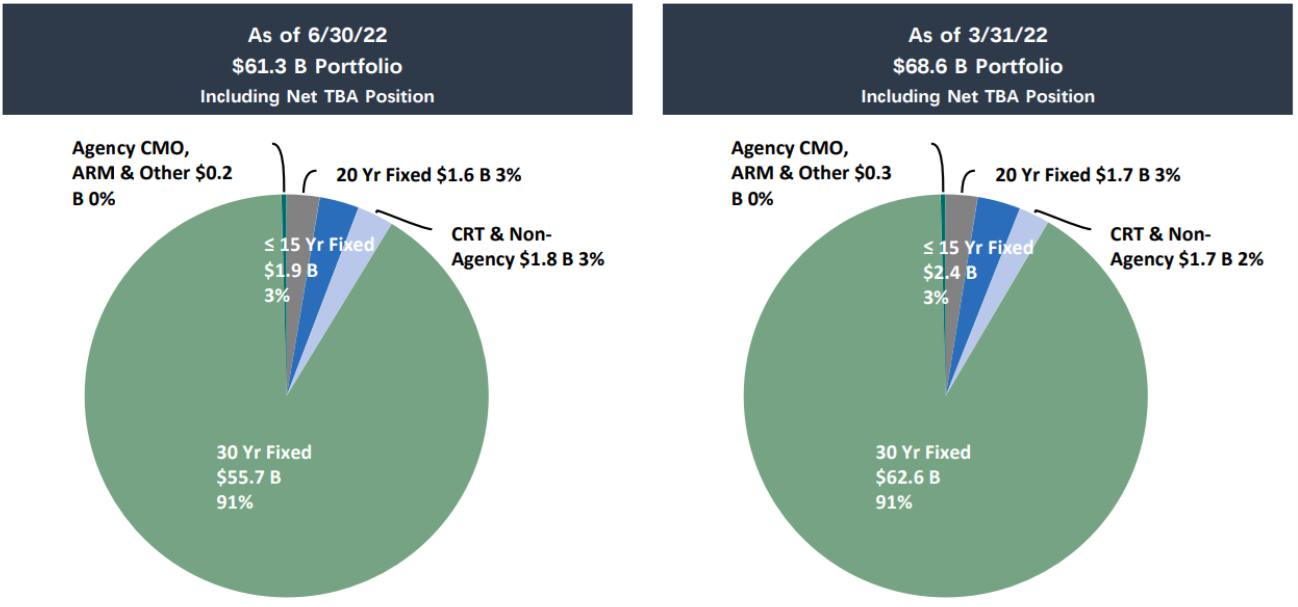

Unlike property REITs (that own actual real estate), mortgage REITs own mortgage-related assets. For example, AGNC (one of the largest mortgage REITs with a market cap of around $6 billion) owns mostly mortgage-backed securities issued by US government agencies (i.e. “agency MBS”). And this creates an entirely different business model and risk profile for mortgage REITs.

In the case of AGNC, it may sound like a safe investment, considering most of its assets (i.e. agency MBS) are basically backed by the US government. However, AGNC buys these assets with significant leverage, or borrowed money (the balance sheet is currently levered about 7.4 times) and this introduces a dramatically higher level of risk for investors.

For example, the leverage helps get the yield up to around 12% (because agency MBS don’t yield anywhere near that high on their own), but the leverage also magnifies the risks—especially when interest rates and agency spreads (versus treasuries) are moving dramatically (like they have been this year).

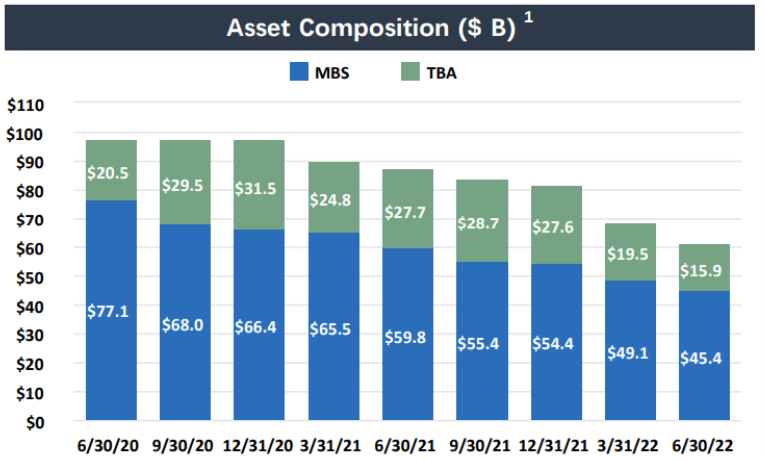

In fact, all the recent interest rate volatility caused AGNC’s book value (which is updated and released only quarterly) to fall to $11.43 per share (it was $13.12 per share last quarter).

And a falling book value matters a lot because book value is the major factor that determines how much money mortgage REITs can borow (i.e. leverage). And when book value falls, mortgage REITs are basically forced to sell off some of their assets to keep the leverage at an appropriate level for lenders to keep lending).

Business Outlook:

As mentioned, because book value has declined—the amount of money AGNC can earn has decreased (all else equal). However, all else is not equal in this case because as interest rates are now higher—AGNC can earn a higher rate of return on its assets.

So far, we have oversimplified AGNC’s business model, considering they do own some assets that are not agency MBS, and considering their balance sheet is dramatically more complicated as they attempt to hedge away some of their interest rate and credit spread risks (which is expensive and never exact).

According to AGNC CEO, Peter Federico:

"Looking ahead, while the near-term outlook continues to be uncertain, the longer-term outlook for Agency MBS has improved substantially. At current valuation levels, Agency MBS are extremely attractive relative to historical levels. The Federal Reserve has begun to reduce its portfolio organically, but that runoff will occur at a slower pace than previously anticipated as a result of reduced prepayments. Finally, and perhaps most importantly, the net supply of Agency MBS is now expected to be meaningfully lower than prior expectations.

"These positive developments provide reason for optimism that this period of weakness in the Agency MBS market is nearing its end. The favorable returns associated with Agency MBS in this wider spread regime and an improving technical outlook for mortgage supply and demand should provide a supportive backdrop for Agency MBS investors. Moreover, in this compelling investment environment, we believe AGNC is well-positioned to generate strong risk-adjusted returns for our stockholders."

Also worth mentioning, AGNC is currently taking a defensive position and utilizing lower leverage because of the current market uncertainty. According to Bernice Bell, EVP and CFO:

"As a result of the challenging market conditions during the quarter, AGNC continued to maintain a defensive position, highlighted by lower leverage and our low interest rate exposure."

Valuation:

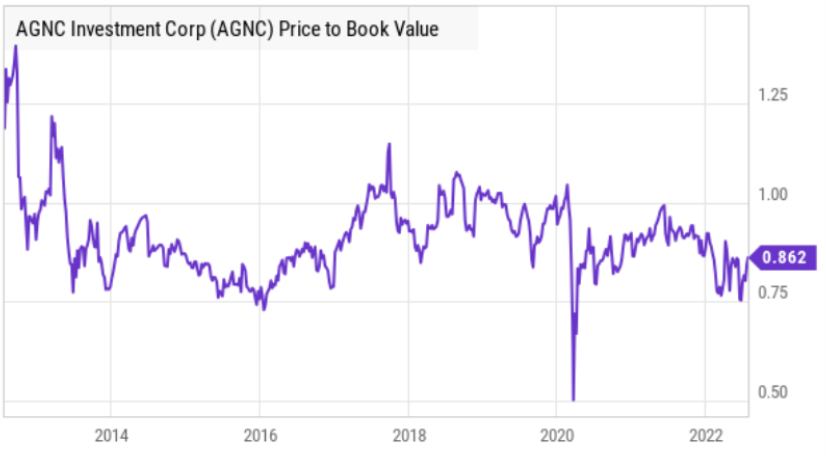

Price to book value is one of the most common and most basic ways to value a mortgage REIT, and AGNC currently trades at $11.89—which is a slight premium to its most recent book value of $11.43 (its about a 4% premium). For perspective, here is a look at the historical price-to-book value for AGNC.

Keep in mind the above chart does not yet reflect that brand new book value per share ($11.43 which was just released after hours), it reflects the old book value of $13.12 (that’s why it shows a discount to book—it’s yesterday’s price versus the old book value of $13.12).

Arguably, now that interest rates and agency spreads have increased—AGNC has more earnings power (even though leverage is lower by historical standards). In fact, the lower leverage provides more dry powder to invest at better yields once AGNC feels the environmental uncertainty has returned to a more reasonable level.

Risks:

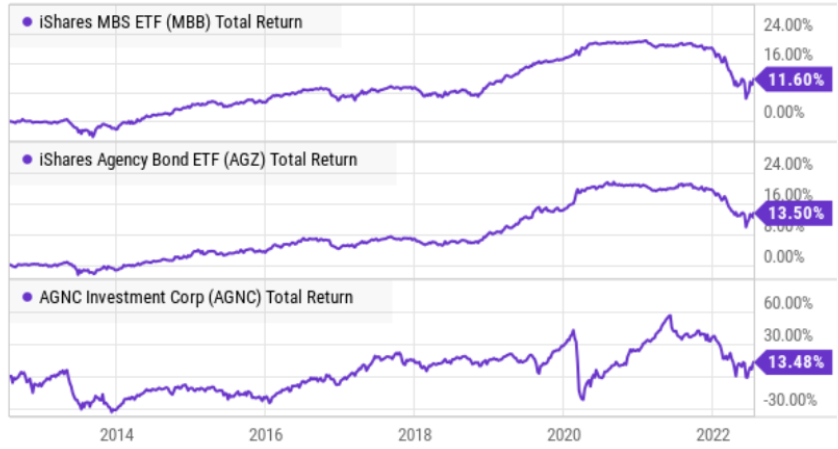

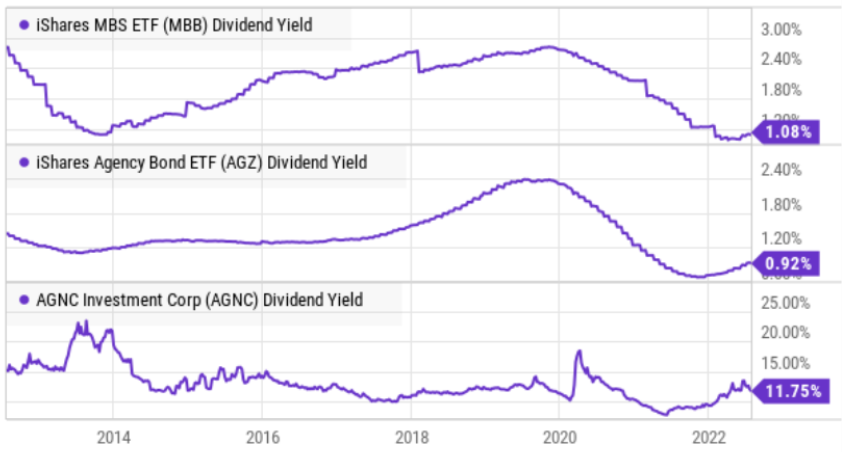

To step back for a moment to understand the big picture risks of investing in AGNC, it is worth comparing its historical returns and yield to those of basic, passive, non-levered, MBS and Agency ETFs, such as MBB and AGZ (pictured below). And as you can see, over the least 10-years, the two ETFs have followed very similar return patters, and AGNC has too—just with a lot more volatility (due mainly to the leverage, the various balance sheet hedges, expenses, and small allocations to other types of assets). In fact, you might have expected AGNC to have delivered much higher returns than the non-levered ETFs, but that is not the case because of the added risks (and losses) of the intricacies and nuances of AGNC’s complicated balance sheet.

And while the returns in the above charts include dividends (i.e. they are total returns), it is worth comparing the three by yields as well.

As expected, AGNC has a much higher yield (and it’s important to realize that a much larger percent of total returns in our earlier charts come from yield in the case of AGNC than from actual price returns). Also, the yield follows a very different pattern considering the hedging programs and periodic dividend cuts for AGNC (such as the one right after covid hit, as well as several others in the past 10-years).

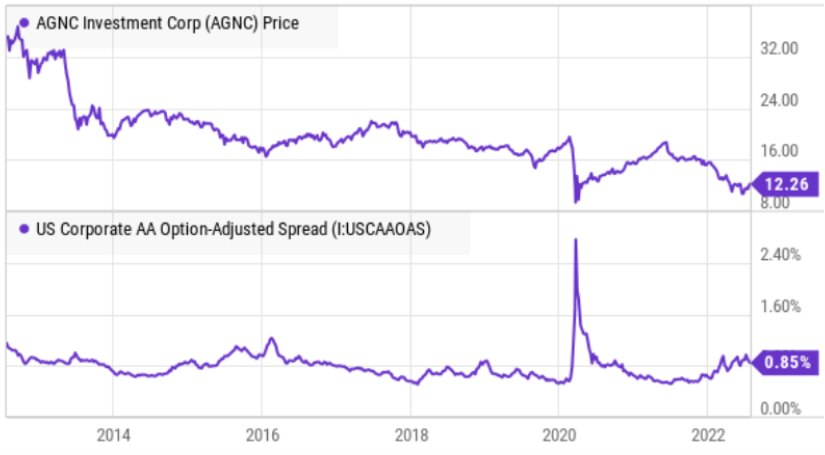

In a nutshell, AGNC is like a bond fund (that invests in agency MBS bonds), but with a lot more leverage and balance sheet nuances and complexities. And every time interest rates move a lot—or when agency spreads widen—AGNC faces significant risks and often pays for it with forced assets sales to cover leverage and that hurt its book value (like we just saw this last quarter). Using corporate credit spreads as a proxy (in the chart below), we can see when the market gets bumpy—AGNC shares tend to take a hit.

Conclusion:

If you like big dividend yields, AGNC is worth considering, especially after the hit it just took to its book value and considering it’s now positioned for stronger returns going forward (because it has more dry powder (less leverage) and because yields are higher going forward). However, just know that the majority of it’s long-term returns come from income—not price appreciation. And know also that the shares tend to suffer price losses (and book value losses) every time the market gets bumpy.

If you are a very long-term growth-focused investor, AGNC is probably not right for you. But if you love those big dividends (and care less about price returns) AGNC may be worth considering. We have owned shares of AGNC in the past (in our Income Equity Portfolio), but we currently do not own shares.