With dividend yields ranging from 4.4% to 8.2%, shipping container leasing company, Triton International (TRTN), presents some interesting investment opportunities for income-focused investors that also like the potential for share price appreciation. This report reviews the company, its competitive advantages, current market conditions, valuation, risk factors and then concludes with our opinion about investing in the common shares as well as the five series of preferred stock.

Overview:

Have you ever seen those large 40-foot metal “intermodal” containers on the back of trucks or stacked on transportation ships at sea? Triton International is the world's largest leasing company for those containers. Triton divides its business into two segments, but “equipment leasing” is by far the largest at $417.1 million in revenue last quarter, versus about $34.1 million in revenue for the equipment trading segment. And for a point of reference, in 2021 the average duration for a Triton container lease was about 13 years.

Competitive Advantages:

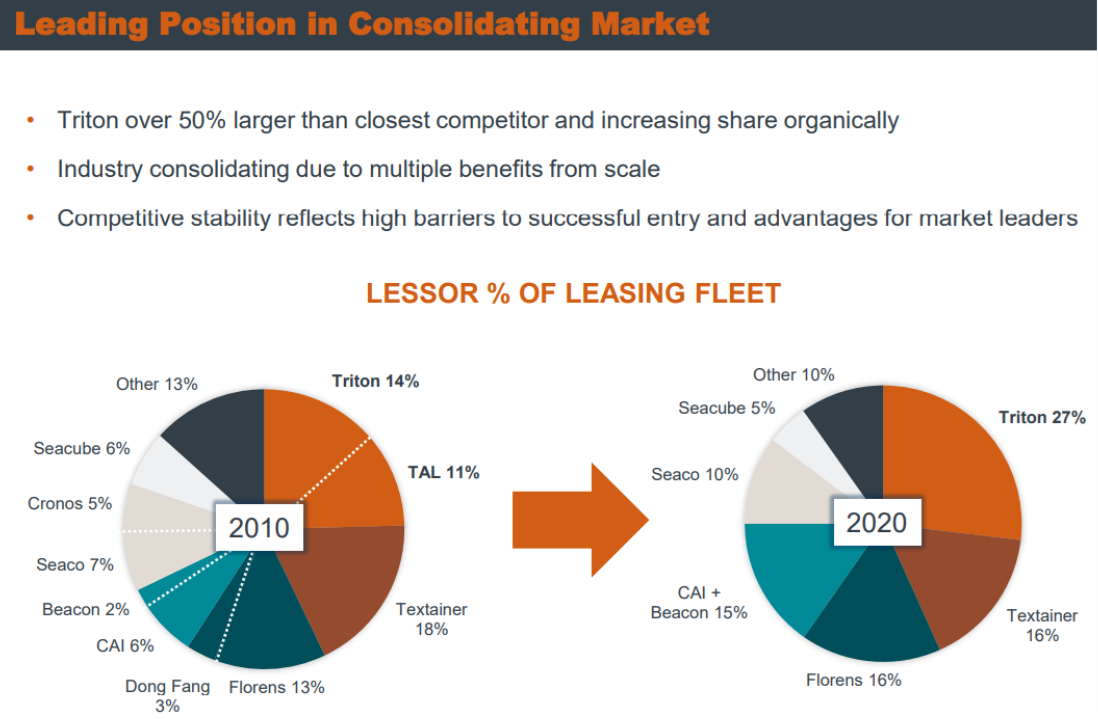

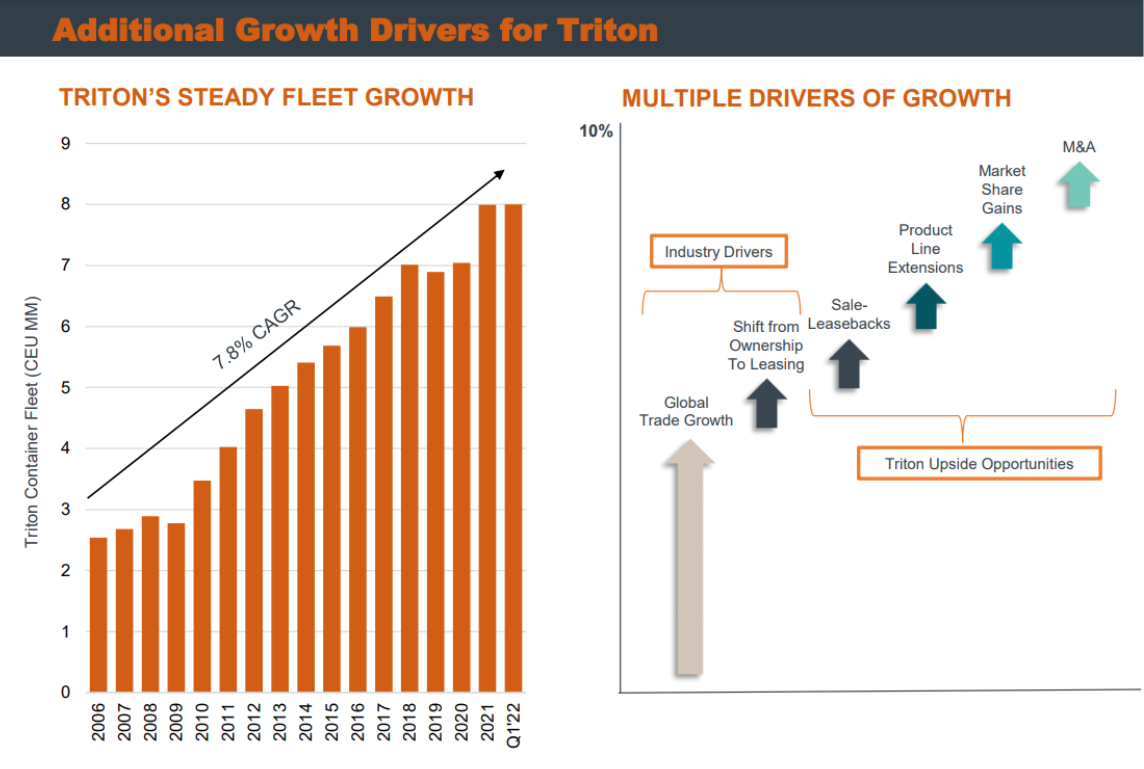

As the largest intermodal container leasing company, Triton has several competitive advantages, including simply its growing economies of scale versus the competition thereby enabling it to provide some lost-cost advantages.

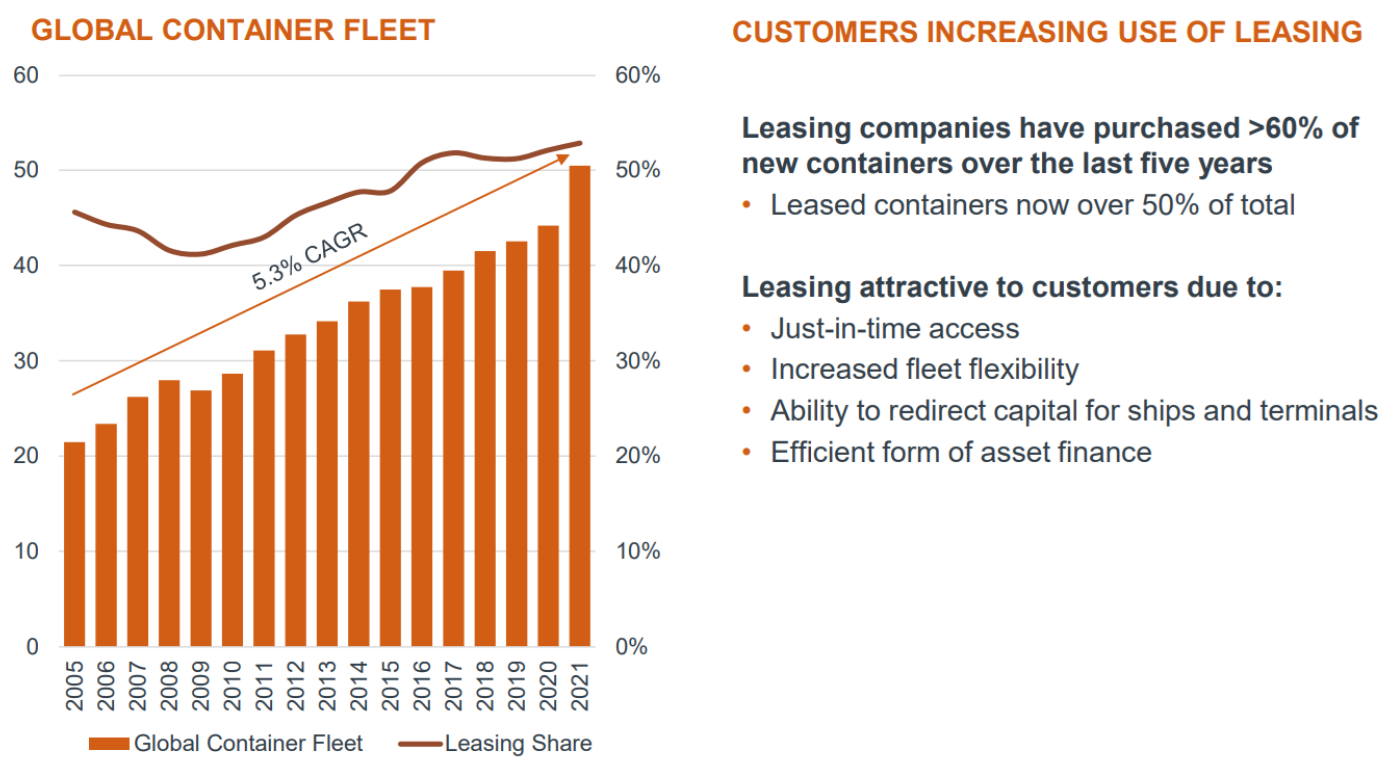

Another advantage is that companies are increasingly turning to leasing, instead of buying their own containers, and this works to the benefit of Triton.

Further still, the continuing growth in global trade simply adds to Triton’s ongoing growth, as you can see in this next graphic.

Yet another competitive advantage is Triton’s investment grade balance sheet (corporate debt ratings were upgraded to BBB- by Fitch and S&P in October 2021). Further, the strong balance sheet and cash flows allow the business to better weather industry cyclicality (it’s a high-beta industry) by being opportunistic when business opportunities present themselves and by repurchasing shares when attractive opportunities present themselves.

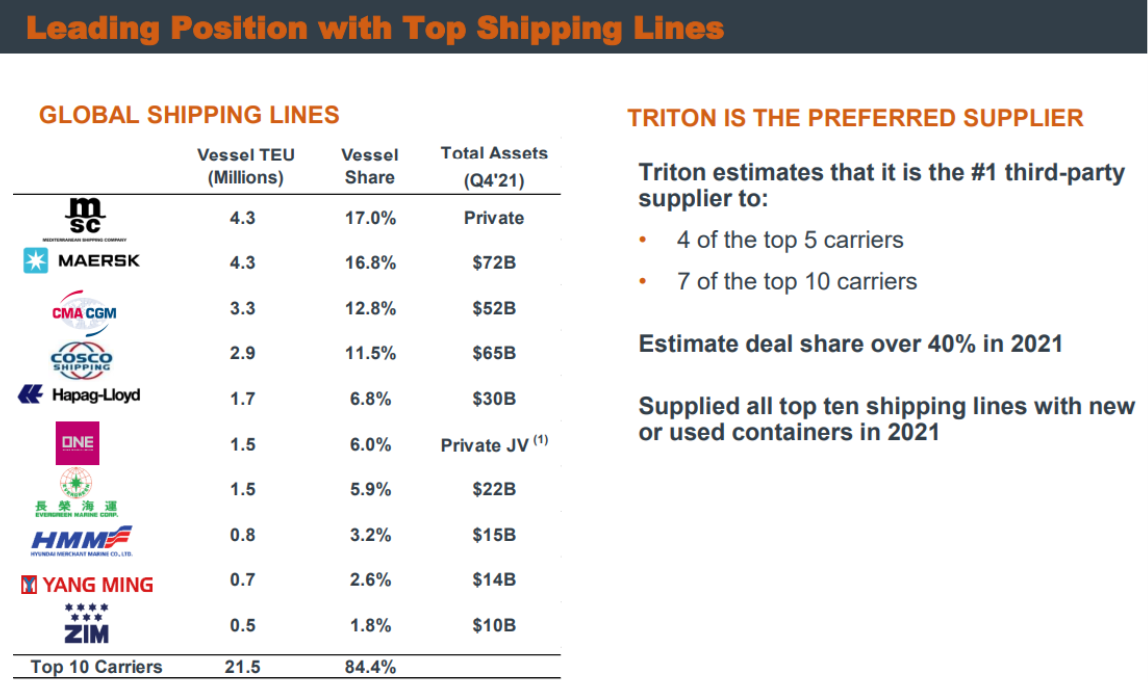

For additional perspective, Triton’s customers include most of the top global shipping lines.

Overall, Triton benefits from its balance sheet, cost advantages from scale, supply capabilities and broad operations infrastructure.

Current Market Conditions

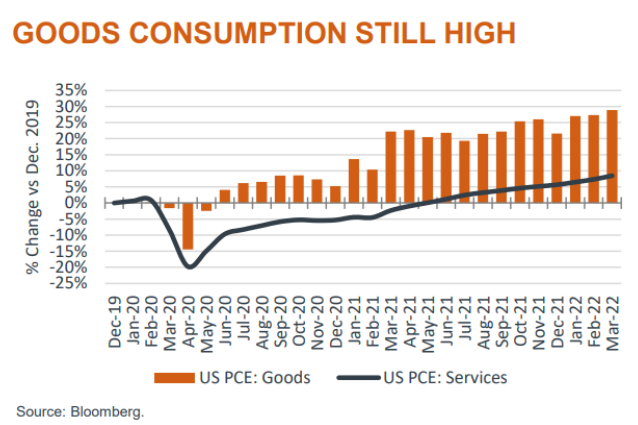

As central banks around the globe raise interest rates to slow inflation there are concerns that this could drive the economy into an ugly recession. However, from Triton’s perspective, global consumption still remains high (a good thing) and trade growth is expected to continue (also a good thing).

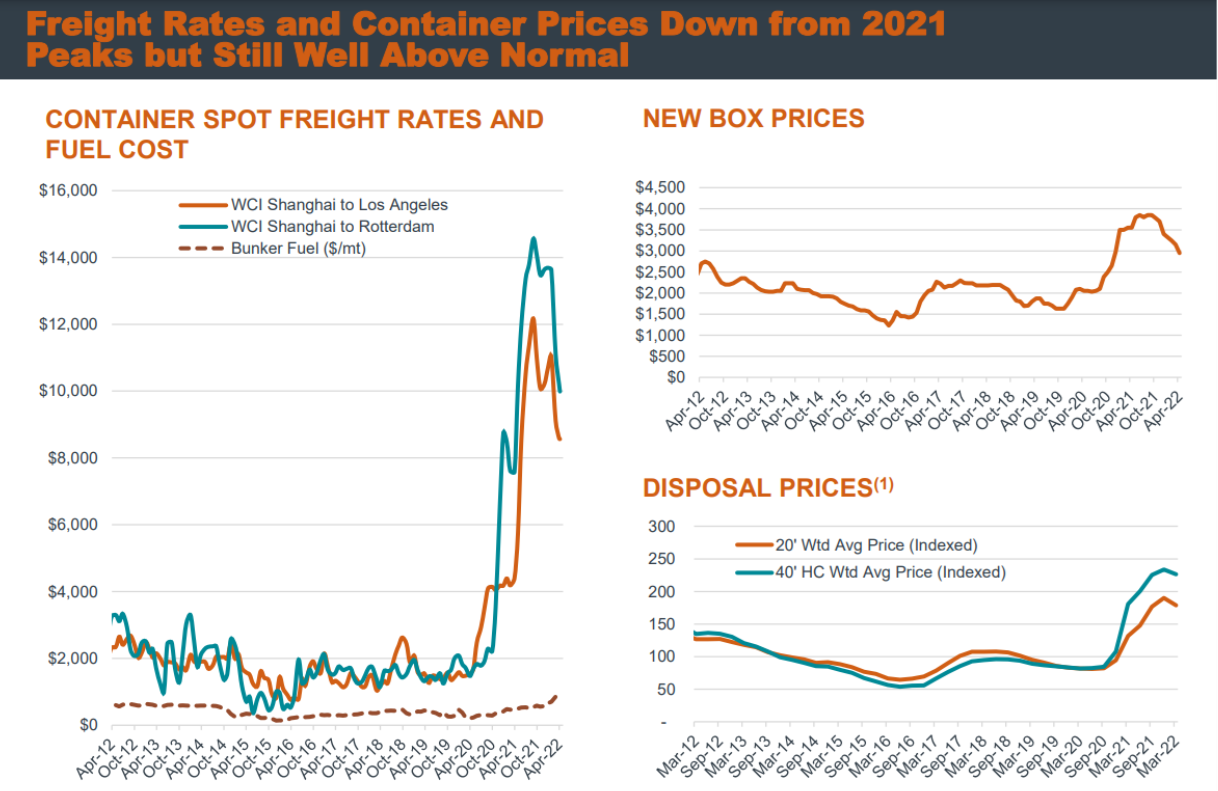

And from an inflation standpoint, container spot rates are down from 2021 highs, but still significantly elevated from historical levels (a good thing for Triton). And new box prices are high (incentivizing customers to lease instead of buy on their own).

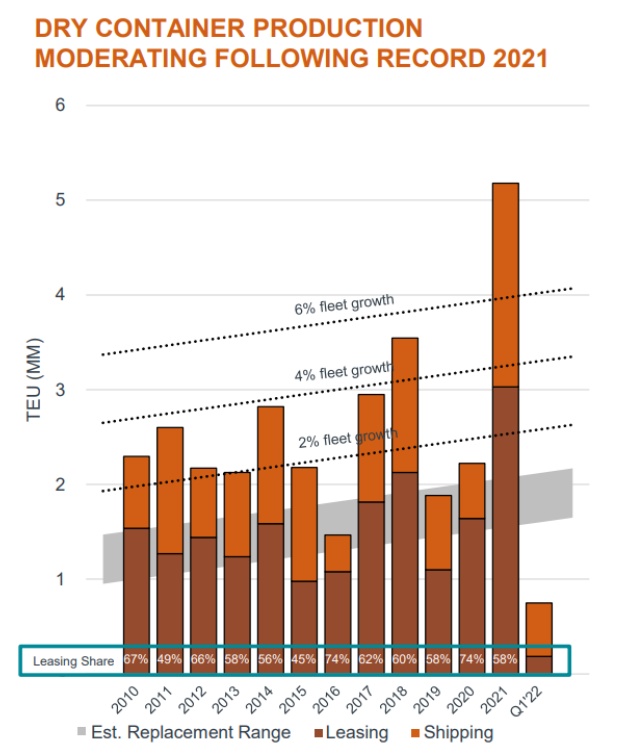

Further, dry container production has slowed, which is also a good thing for Triton from a supply and demand standpoint.

Valuation

As you can see in the chart below, Triton’s share price (violet line) is down this year (much like the rest of the market), however its valuation multiples have also declined—an indication of value based on the longer-term strength of the business.

For example, price-to-earnings and EV/EBITDA have come down, but the longer-term industry growth potential remains healthy and strong.

Also important, Triton has continued to repurchase shares (2.7% of shares outstanding so far this year)—an indication of financial strength, and an indication that management believes the shares are undervalued (not to mention, a good way to return more of future earnings to shareholders).

Preferred Shares

Also important to note, Triton currently has five series of preferred shares outstanding and offering stated yields ranging from 5.75% to 8.5%.

As a reminder, preferred shares sit higher than common stock but lower than bonds in the capital structure (if there were to be a bankruptcy situation), and these particular preferred shares have a redemption price of $25 (meaning Triton can basically call the shares (after specific stated dates) at $25 (if they ever want to retire them so they don’t have to keep making those interest payments).

Also, the share prices of the preferreds have declined this year because they have fixed dividend rates while market interest rates have risen (in this sense, the preferred shares work a bit more like bonds than stocks—i.e. rising rates, falling prices). And we believe the falling prices of the preferred shares this year has made for an increasingly attractive buying opportunity considering the strength of the business. Just know that the preferred share prices generally won’t ever rise too far above $25, while the common shares have much more upside potential (because they’re not tied to a $25 redemption price).

Of course there are various nuances to every issue of preferred shares (Quantum Online is a great tool for preferred share details). For example, Triton preferred shares offer qualified dividend status to individual investors (so they can pay the lower tax rate on dividend income), and they can generally be called within 120 if there is a change of control event. Otherwise, they can be called (redeemed) per the following stipulations.

Triton International Ltd., 5.75% Series E Cumulative Redeemable Perpetual Preference Shares, liquidation preference $25 per share, redeemable at the issuer's option on or after 09/15/2026 at $25 per share plus accrued and unpaid dividends, and with no stated maturity… And…the company may redeem the Preference Shares before 09/15/2026 at $25.50 (102%) of their principal amount plus accrued and unpaid dividends if a rating agency event occurs. (see prospectus for further information).

Triton International Limited, 6.875% Series D Cumulative Redeemable Perpetual Preference Shares liquidation preference $25 per share, redeemable at the issuer's option on or after 03/15/2025 at $25 per share plus accrued and unpaid dividends, and with no stated maturity.

Triton International Ltd., 7.375% Series C Cumulative Redeemable Perpetual Preference Shares, liquidation preference $25 per share, redeemable at the issuer's option on or after 12/15/2024 at $25 per share plus accrued and unpaid dividends, and with no stated maturity.

Triton International Ltd., 8.00% Series B Cumulative Redeemable Perpetual Preference Shares, liquidation preference $25 per share, redeemable at the issuer's option on or after 9/15/2024 at $25 per share plus accrued and unpaid dividends, and with no stated maturity.

Triton International Ltd., 8.50% Series A Cumulative Redeemable Perpetual Preference Shares, liquidation preference $25 per share, redeemable at the issuer's option on or after 3/15/2024 at $25 per share plus accrued and unpaid dividends, and with no stated maturity.

Also worth noting, upon the occurrence of a change of control resulting in the common shares of the surviving entity no longer being listed on the NYSE, the AMEX or the Nasdaq exchanges, Triton will generally have the option within 120 days to redeem the preferred shares at $25 per share plus accrued and unpaid dividends.

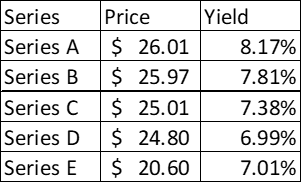

For reference, here is a look at the current prices and yields of these preferred shares.

We like the series C, D and E, simply because they don’t trade at too much of a premium relative to the redemption prices, but realistically they’re all relatively similar considering none have preference versus the others in regard to the payment of dividends (and they’re all subordinate to the company’s senior debt and senior to the common shares). Series E may appear relatively low-priced, but remember it’s dividend is only 5.75% when the shares trade at $25, so the market has driven the price lower to make the current yield comparable (higher).

Risks

Of course, Triton does face a variety of risks. For starters, container leasing is a high-beta industry, meaning when the market is strong—Triton can be really strong, but when the market is challenged—Triton can be even more challenged. It is somewhat reassuring to know Triton has a strong balance sheet and an investment grade credit rating, but that will not totally insulate it from the risks of dramatic industry changes in the many years ahead. The average lease term is 13 years, but massive client bankruptcies can happen in this industry, and when the 13 years are up, there is no guarantee that Triton will have been able to steadily replace them with newer leases over the years.

Conclusion

In our view, Triton is a healthy business trading at a reasonable price. The common shares offer long-term (albeit volatile) price appreciation potential (from industry growth and Triton’s leadership position) and a relative strong dividend yield (the current dividend yield is 4.4%). And if you are willing to sacrifice some of the long-term price appreciation potential, the preferred shares offer even higher yields (we prefer series C, D and E). Not to mention, the dividends are qualified, meaning you’ll pay the lower qualified dividend rate if you own them outside of a tax-exempt retirement account.

Overall, and depending on your goals, if you are in income-focused investor, Triton offers a compelling long-term investment opportunity. We do not currently own shares, but it remains on our watchlist, and the preferred shares remain particularly interesting (within the context of a prudently diversified portfolio) for higher income-focused investors.