Other than a Super Bowl watch party, most people hate commercials and advertisements of any kind. They are disruptive, often offensive and increasingly violate privacy. Nonetheless, Meta Platforms (formerly Facebook) continues to print and store massive piles of money it derives from advertising across its platforms, including Facebook, Instagram, Messenger, WhatsApp and others. And despite the fact that growth in traditional markets may be slowing, and its pivot to the Metaverse is wildly unproven, the low valuation (of this once growth now value stock) is hard to ignore. This report reviews the business, valuation, risks and concludes with our opinion on investing.

Overview:

Meta Platforms, Inc. develops products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, wearables, and in-home devices worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment’s products include Facebook, which enables people to share, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices through chat, audio and video calls, and rooms; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately. The Reality Labs segment provides augmented and virtual reality related products comprising virtual reality hardware, software, and content that help people feel connected, anytime, and anywhere. The company was formerly known as Facebook, Inc. and changed its name to Meta Platforms, Inc. in October 2021. Meta Platforms, Inc. was incorporated in 2004 and is headquartered in Menlo Park, California.

Meta Platforms makes money by selling advertisements (and advertising data) across (and gathered from) its various products.

Risks:

There are a variety of risks to Meta’s business, and perhaps the greatest is simply peoples’ hatred for disruptive advertising that increasingly targets them with private data they didn’t even realize Meta was gathering. This risk negatively manifests itself on Meta’s business in many ways, including users simply deleting Meta apps, regulators scrutinizing and fining Meta’s business, and constant industry pressures to thwart the targeted data gathering such as Apple’s iOS privacy plans and Google (now Alphabet) efforts to discontinue the use of third-party cookies—both of which cause fundamental disruption to Meta’s business. Meta attempts to overcome these risks with its strong network/ecosystem effects (which make it difficult for users to delete Meta apps), public relations and marketing/branding efforts (which seek to front run negative press) and ongoing innovation by Meta people to work around industry challenges, as they have done repeatedly throughout history (for example, it was once believe moving from desktop to mobile would be impossible for Meta—something they easily proved incorrect).

Other risks include the recent departure of long-time Chief Operating Officer, Sheryl Sandberg (although she will remain on the board, thereby quashing many fears that there were some sort of irreconcilable bad behaviors going on), and simply the risk of a broader economic slowdown (and perhaps nasty recession) that could further harm Meta’s business (although as we will see in the next section that this does not pose any significant financial risk considering Meta continues to generate massive free cash flow thereby increasing its already massive war chest of available cash on its balance sheet).

Finally, Facebook’s companywide strategic pivot into the Metaverse (this is why Facebook changed its name) poses monumental risks in some investors’ minds considering the company plans to spend enormous amounts of cash on this initiative in the years ahead, and it is a business that is totally new and unproven.

The Metaverse:

The metaverse is basically the company’s attempt to leap ahead of peers in the direction they believe the industry is ultimately going. It is also an effort to allocate excess capital to something that could be very profitable, especially considering growth in Meta’s legacy businesses is slower than it used to be (the company is still growing at a very high rate, just not as high as it once was). For reference, according to this source, the metaverse is:

“’an integrated network of 3D virtual worlds.’ These worlds are accessed through a virtual reality headset — users navigate the metaverse using their eye movements, feedback controllers or voice commands. The headset immerses the user, stimulating what is known as presence, which is created by generating the physical sensation of actually being there.”

Tech companies like Meta and Microsoft (MSFT) believe this is largely the future of the Internet, and it opens up incredible opportunities for businesses that can help define and built it.

Valuation:

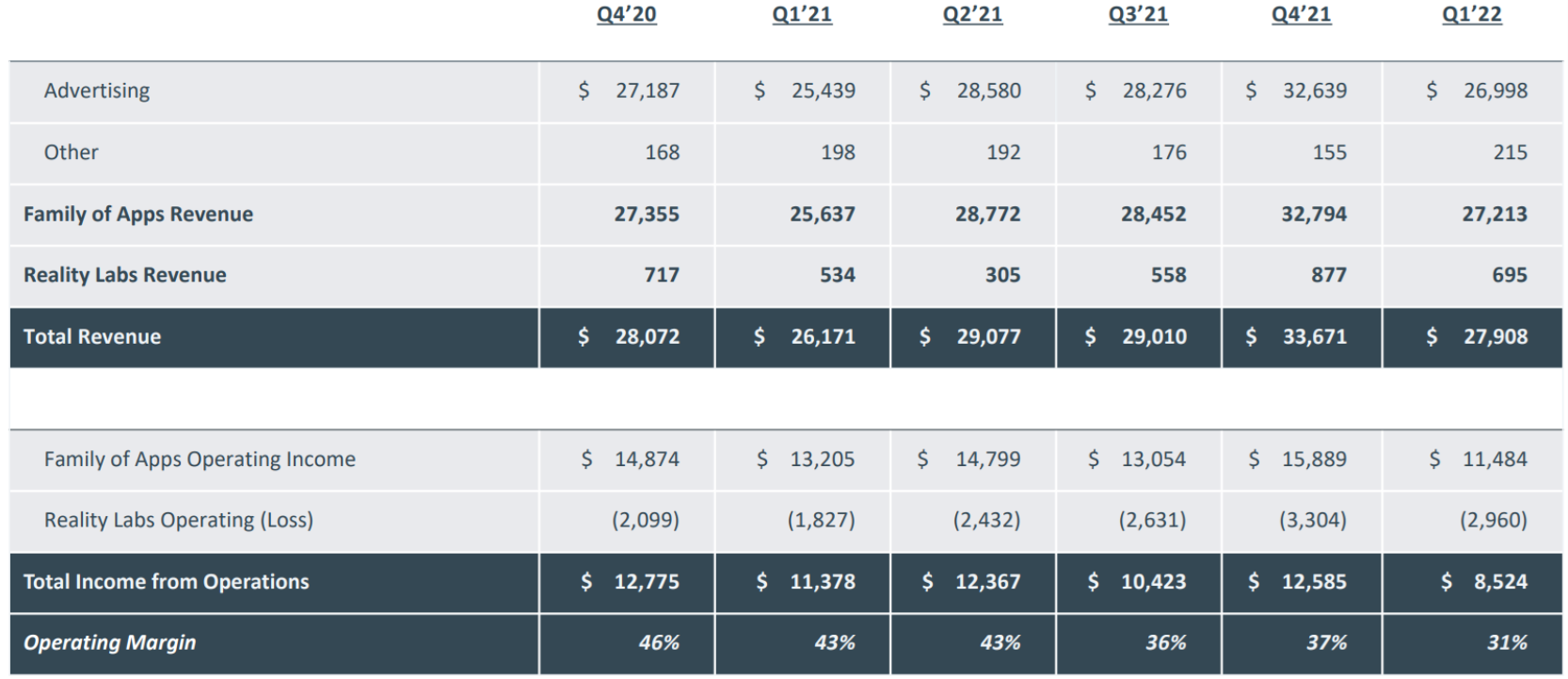

As mentioned, Meta is a hugely profitable and cash-rich business. Here is a look at the company’s revenues (by segment) and operating margins.

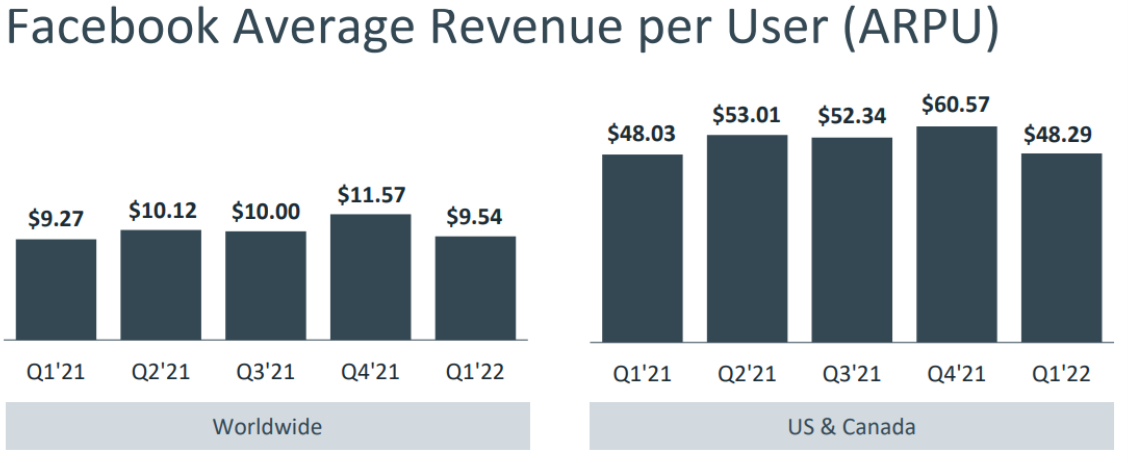

As you can see in the table, the Reality Labs segment (i.e. the “metaverse” segment) is not generating any income (yet), but legacy business is generating huge high-margin operating profits. To add a little perspective, here is a look at how much revenue per active user that Meta generates (basically from advertising dollars).

The revenue per user is large, even through most users never pay Meta a dime (advertisers pay Meta). Also noteworthy, the ARPU metric still managed to eek out only small gains due to tough pandemic (stay at home) comps, but are expected to reaccelerate going forward (and the quarterly numbers are still dramatically higher than pe-pandemic).

From price-to-earnings standpoint, Meta shares are extraordinarily inexpensive as compared to its profitability and high revenue growth expectations (for example, aggregate Wall Street analyst expectations are for revenue growth of over 16% next year—a rate many believe can continue for the next 5+ years, regardless of what happens with the latest metaverse push). Here is a look at Meta’s price-to-earnings ratio versus other big tech companies (as well as versus some other blue chip companies with much lower forward growth rates).

Despite its strong operating margins and high revenue growth, Facebook trades at an unusually low price-to-earnings valuation multiple. Too low, in our opinion, as fearful investors don’t know what to make of the Metaverse initiative, and they do know they hate intrusive targeted ads—such as those delivered up via Meta). In our view, it is the extreme pessimism that adds to Meta’s attractiveness (i.e. fear and uncertainty have helped push the share price too low).

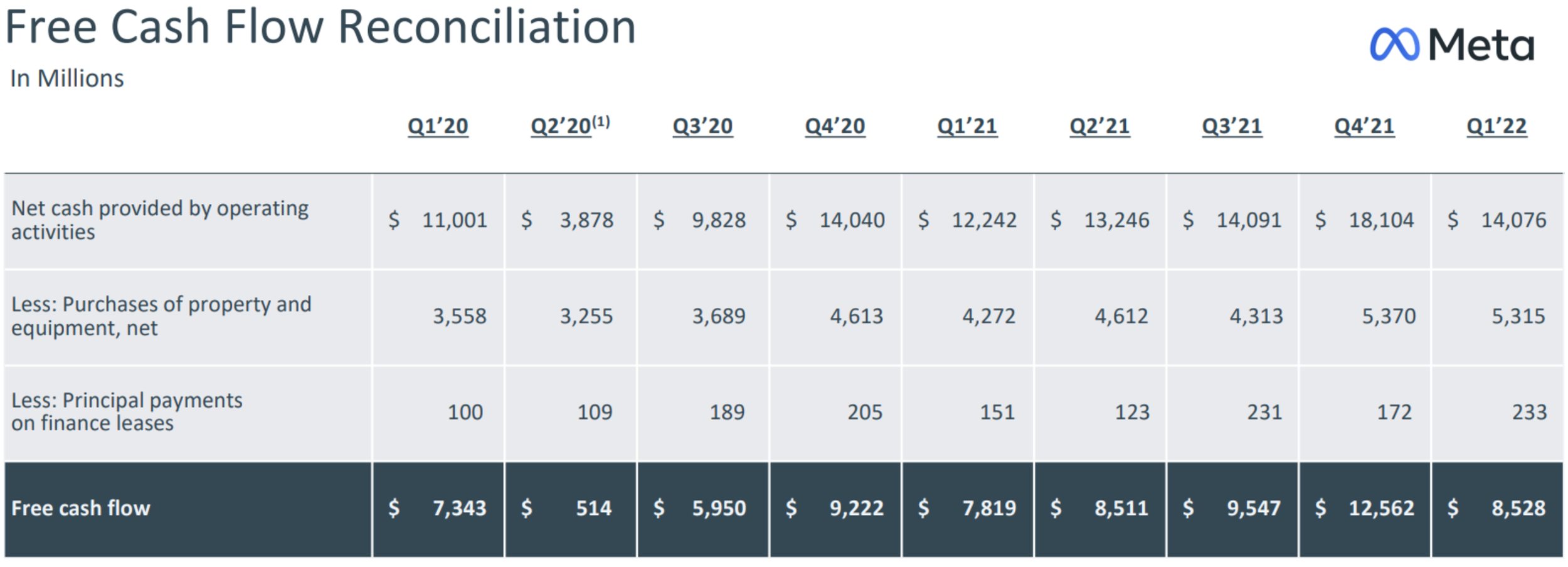

And as a reminder, Meta is a powerful cash flow generator with a ton of available cash on its balance sheet (recently around $15 billion).

For such a cash-rich company, with the ability to fund its own growth initiatives (instead of relying on the capital markets for funding, whereby increasing interest rates has made things more expensive for other companies), Facebook shares are simply trading way to inexpensively.

For a little more perspective on Meta’s current valuation, here is an excerpt from a recent research note from Morningstar analyst, Ali Mogharabi:

“Our fair value estimate is $384 per share, representing a 2022 enterprise value/adjusted EBITDA multiple of 14 times our adjusted EBITDA projection. We model 15% average annual growth over the next five years. As the firm plans to further invest in research and development and content creation and virtual reality and augmented reality offerings, in addition to data security, we see operating margin coming in around 37% on average over the next five years, comparable with the previous three years.

Meta’s revenue growth will be driven primarily by online advertising and increasing allocation of online ad dollars toward mobile, video, and social network ads.”

Mogharabi’s $384 price target leaves a lot of room for upside, considering the shares have fallen and currently trade around $162. And Mogharabi is not alone, and most analyst rate the shares a “strong buy.”

Overall, Meta shares are simply trading dramatically too low as compared to the company’s healthy margins, powerful earnings and ongoing growth. And that basically counts the costs of the metaverse expansion initiative, but conservatively ignores the potential long-term profits. Facebook shares currently present a highly-attractive long-term investment opportunity.

Conclusion:

Investors’ fervent hatred for commercials (including growing privacy concerns), uncertainty about the metaverse, and a market wide selloff in big tech, has resulted in a Meta Platforms share price that is far detached from its value. Said differently, Meta remains a high-growth, highly-profitable, money-printing machine, and even if its long-term metaverse inquisition results in no revenues (only expenses), its legacy advertising business is so powerful (and will remain so for many years) that the shares are still dramatically undervalued. At a time when the market wide selloff intensifies (and investor fear grows), Meta Platforms is absolutely worth considering for investment. We are currently long shares of Meta, and we believe the business is so healthy that the share price will rise significantly from here in the years ahead.