The current yield on this healthcare dividend aristocrat is near all-time highs as frustrated investors lose patience with the slower-than-expected pace of the post-pandemic recovery. And despite risks (which we will cover), the business remains healthy (profitable with tons of cash flow) and growth will return. If you are an income-focused contrarian investor (that likes long-term price appreciation), this impressive dividend grower is absolutely worth considering. We are long.

Medtronic: Business Overview

Medtronic is a medical device company. Specifically, it develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. It breaks its business into four segments, as you can see in the graphic below.

And to help you understand the size of these segments, here is a look at the most recent quarterly revenue by segment and geography.

Recent Performance:

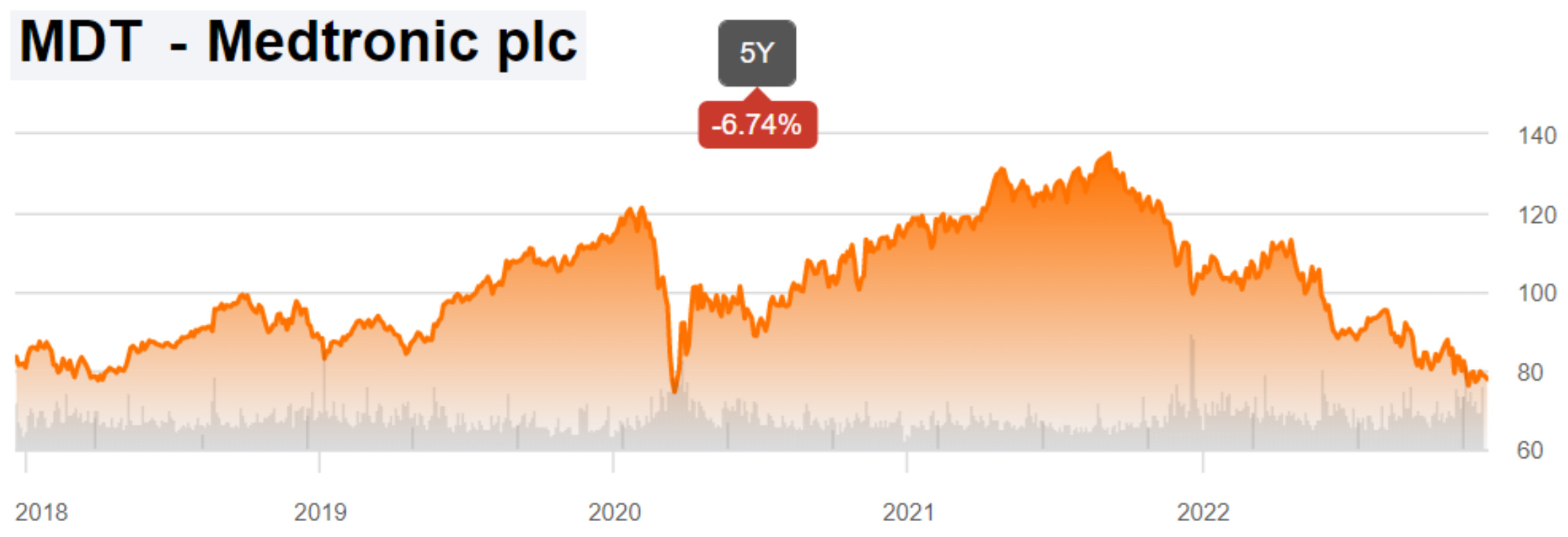

Medtronic’s business has performed relatively poorly in recent years due mainly to a slower than expected (and ongoing) recovery to the pandemic. Specifically, patients delayed procedures during the pandemic, and now that they are resuming there is a shortage of hospital workers.

Further, Medtronic provided softer than expected revenue guidance during its latest earnings release. And this has been part of a trend this year. Per CEO, Geoff Martha:

"Slower than predicted procedure and supply recovery drove revenue below our expectations this quarter. We continue to take decisive actions to improve the overall performance of the company, including streamlining our organizational structure, strengthening our supply chain, driving a performance culture, and strategically allocating capital to support our best growth opportunities with the investments they deserve”

“We’re seeing the benefit of these changes - along with new incentives and strong execution - in certain businesses, and we’re focused on ensuring these efforts translate into improved performance across the company. Looking ahead, we’re confident we have a clear path to delivering durable growth and increased shareholder value.”

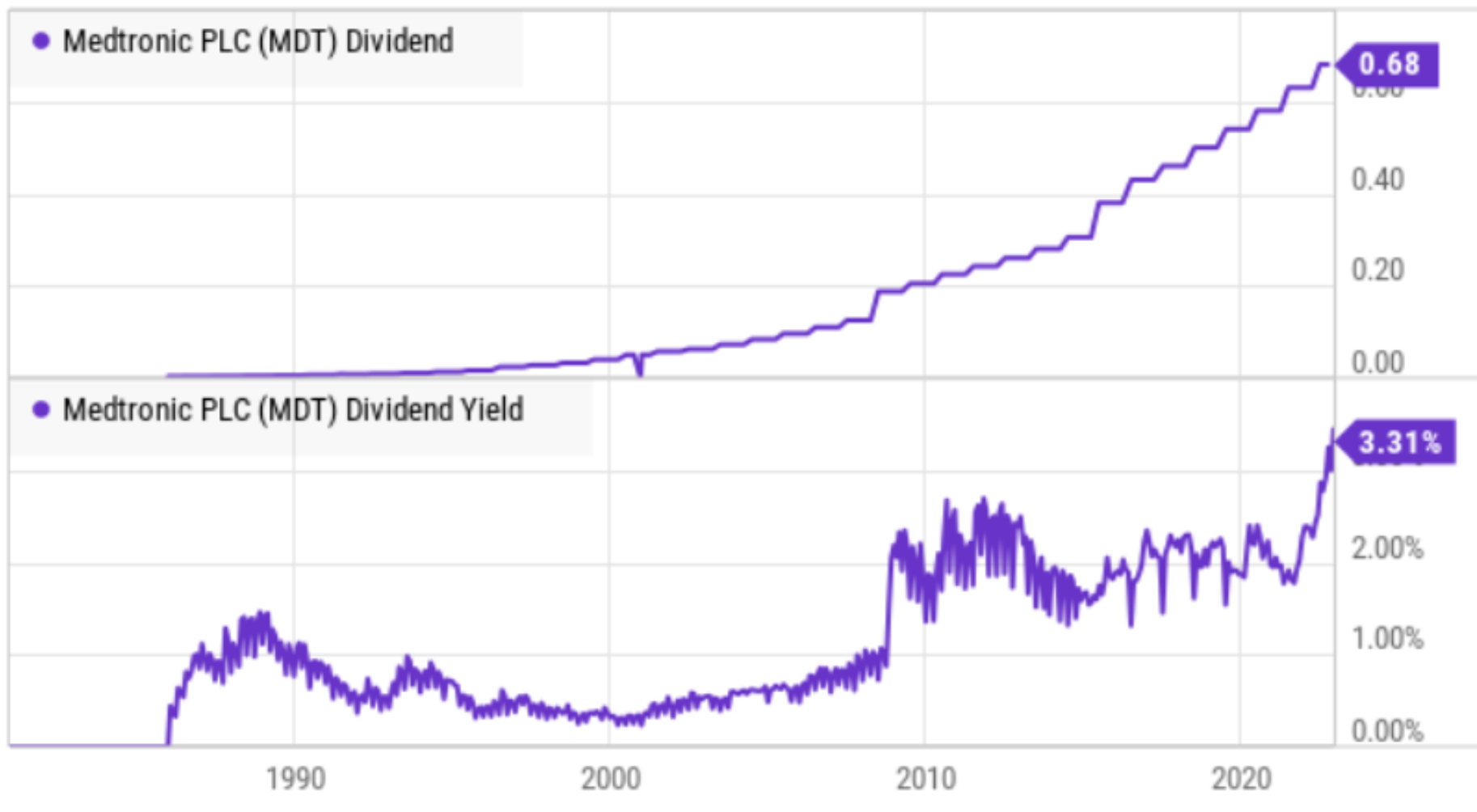

Dividend Yield Near All-Time Highs:

As Medtronic’s share price has recently fallen, its dividend yield has mathematically risen to new all-time highs. To some investors, this is an indication of an attractive contrarian opportunity, especially considering Medtronic has continued to raise its dividend for 45 years in a row.

Capital Allocation

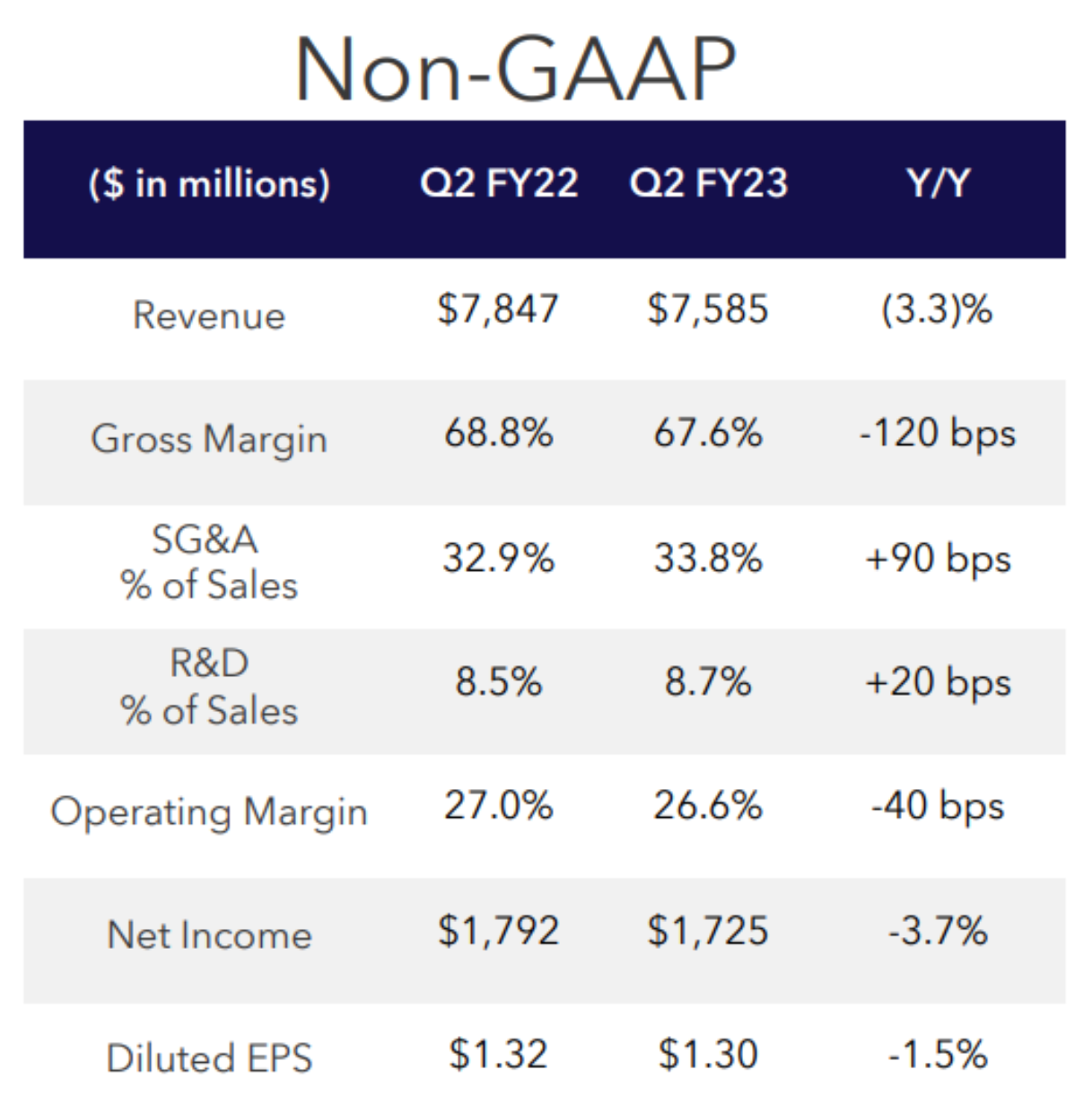

Medtronic is a highly profitable business with very strong margins.

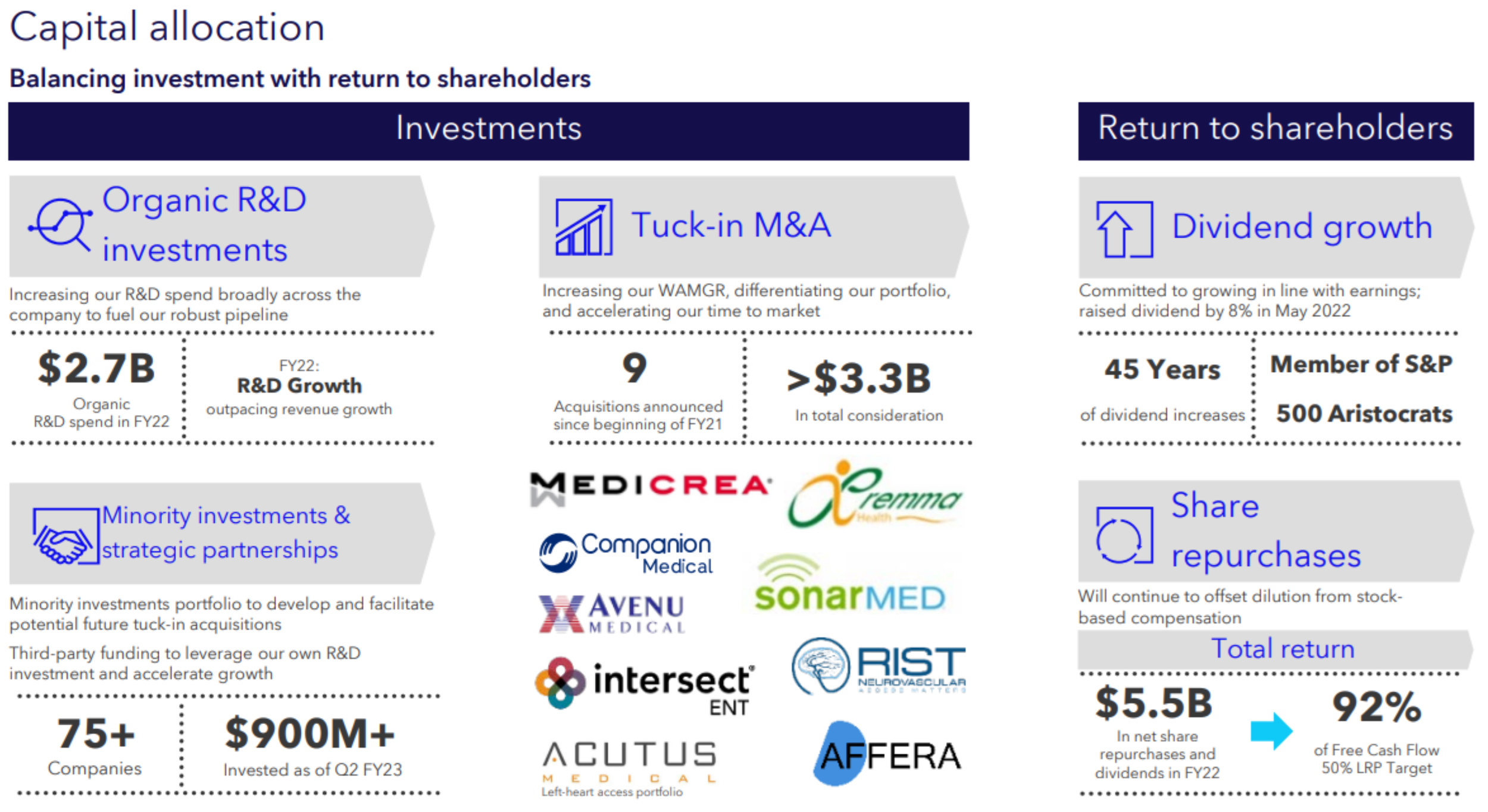

And it is the company’s strong profits and strong cash flow generation that allow it to invest heavily in many opportunities, including research & development, acquisitions, dividends and share repurchases.

Medtronic’s quarterly dividend of $0.68 is well-covered by EPS of $1.30 and cash flow from operations of $2 billion so far through the first two quarters of Medtronic’s year. Medtronic has also reported $1.3 billion in free cash flow during this same two-quarter period (and has approximately 1.3 billion shares outstanding). Plus the company has over $4.8 billion in cash and equivalents on its balance sheet as of the end of the most recent quarter.

Competitive Advantages:

Also worth mentioning explicitly, Medtronic has a variety of competitive advantages. Aside from its massive profitability, cash and free cash flow generation, Medtronic benefits from high switching costs (surgeons don’t easily switch to new company products). For example, Medtronic holds approximately 50% of the market in its core cardiovascular products. It also leads in spinal pumps, insulin pumps and certain neuromodulators, to name a few.

Further still, Medtronic benefits from its extensive sales rep relationships with medical professionals, thereby adding to its industry leadership and competitive advantages.

Valuation:

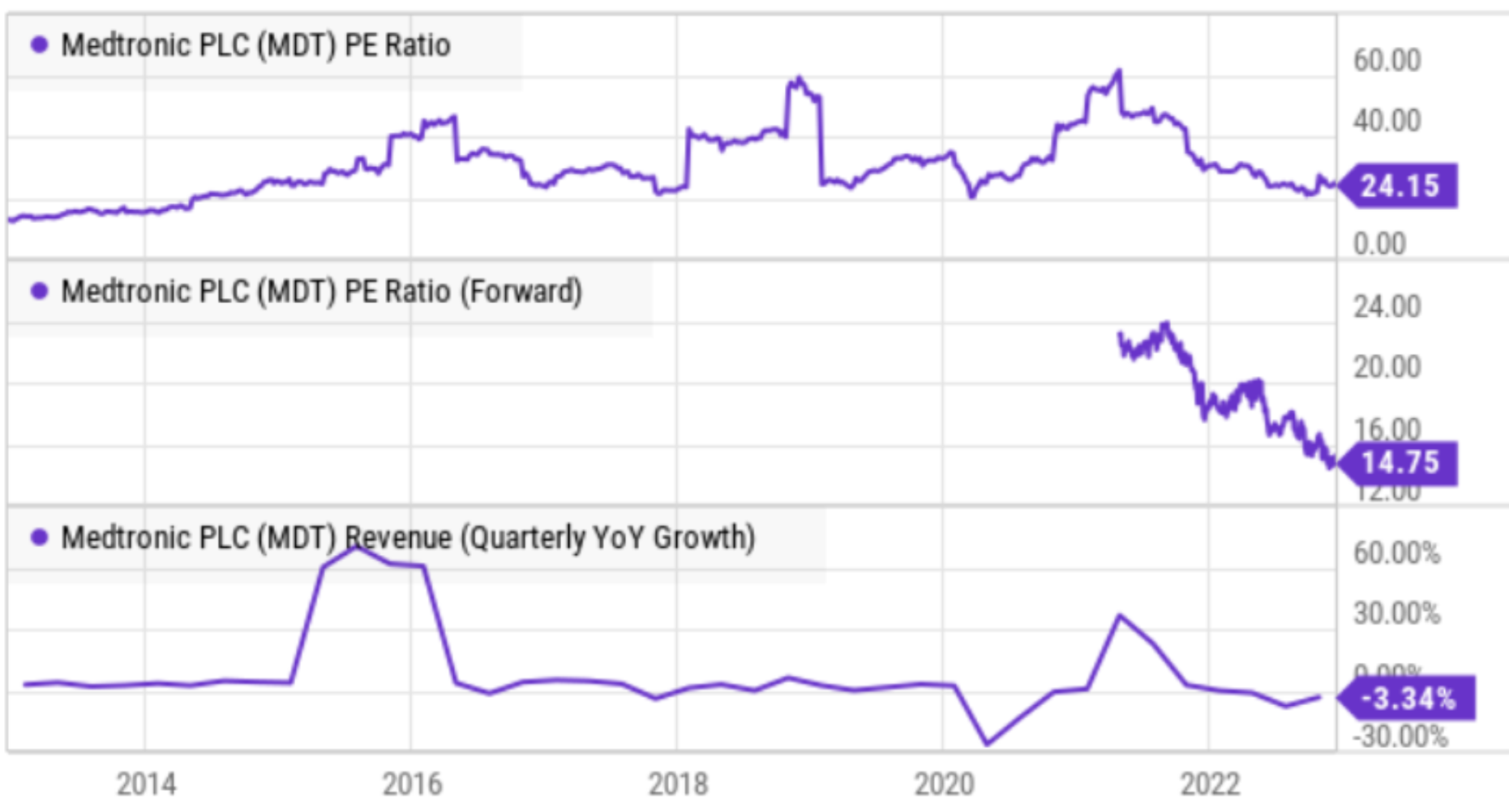

As a well-established and highly profitable company, simple price-to-earnings (and forward P/E) metrics can provide important high-level insights on current valuation. And as you can see in the chart below, Medtronic’s current P/E ratio is low by historical standards.

It’s important to keep current valuation in perspective relative to growth. And as you can also see above, MDT’s growth has gone from positive to slightly negative since the start of the pandemic. Growth was expected to return to positive by now, but it has not and this is a big part of the reason the share price is down (recent growth has been negative and below expectations).

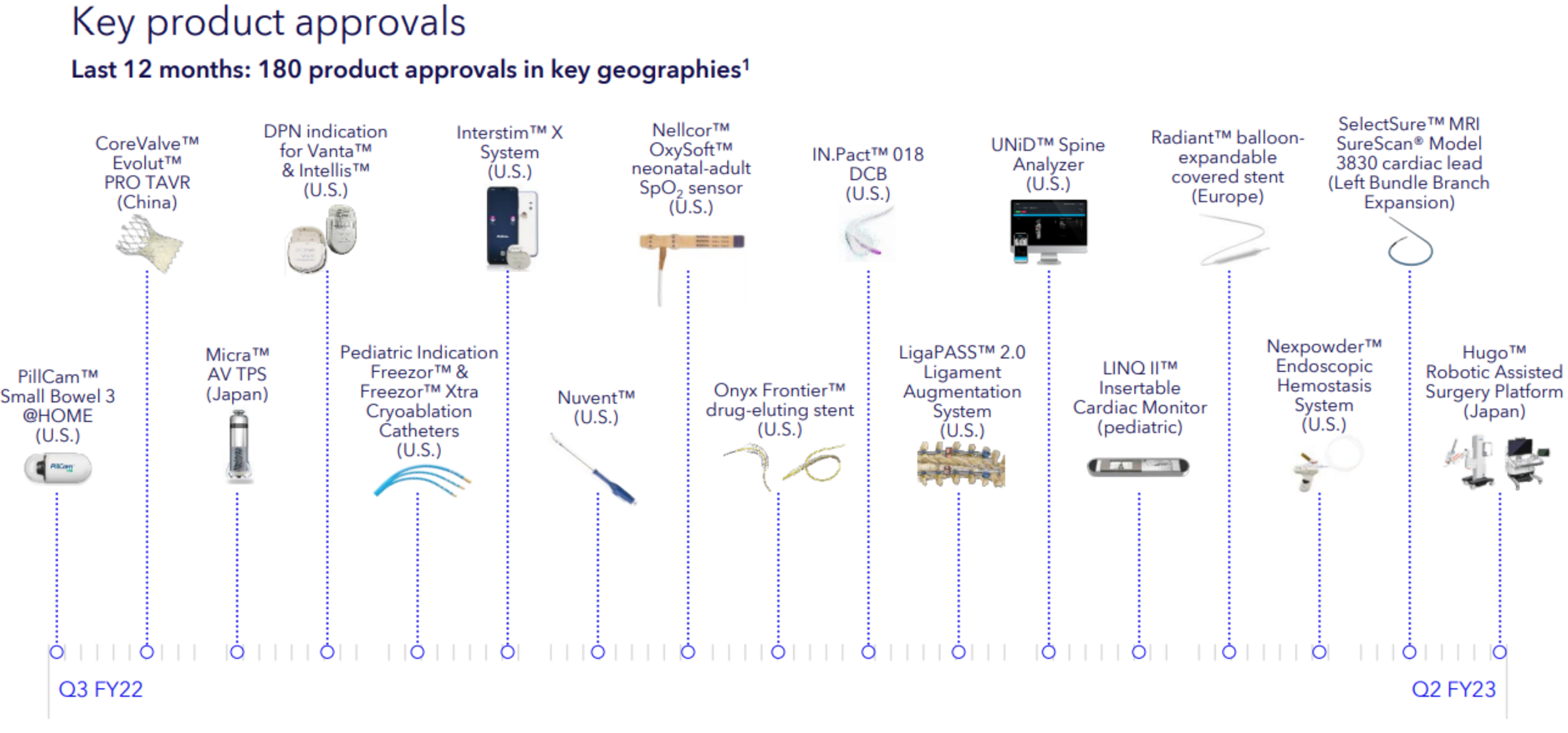

The good news is the company and analysts expect the growth to return, and it makes sense that it will as healthcare needs have not been reduced (they’ve grown and show indications of being pent up). For reference, here are examples of recent new key product approvals (and future growth drivers) for Medtronic.

According to a November 22nd research note from Morningstar Senior Equity Analyst, Debbie Wang:

“We project 3% average annual top-line growth through fiscal 2027, as procedure volume returns and stabilizes closer to prepandemic levels over the next 18 months.”

In our view, Medtronic’s competitive advantages, combined with demand for healthcare, will lead to future revenue growth, especially considering the industry slowdown still hasn’t fully recovered from Covid yet.

Risks:

Medtronic does face a variety of risk factors. For example, the market appears heading into a recession and that can slow demand for certain procedures that use Medtronic devices. Also, Medtronic constantly faces the risk of product recalls and lawsuits. Further, competition is another factor. While Medtronic leads in its core products, innovation opportunities are threatened by competitors. Further still, medical reimbursement pressures (Medicare) are also an almost constant headwind and threat. Also important to note, costly acquisitions are another risk factor. As we saw in our earlier chart, the company has used a heavy dose of free cash flow to fund acquisitions (which can be costly) to help augment organic growth. The risk over overpaying for inorganic growth remains a risk for Medtronic.

Conclusion:

Medtronic is a highly profitable “wide-moat” business, currently trading at a relatively low valuation multiple, and offering 45 years of dividend increases and a current yield near all-time highs (an indication from management that the shares are undervalued, in our view). There are absolutely risks to this business, and things can still get worse before they get better. However, we believe things will eventually get better, and Medtronic currently offers a highly-attractive contrarian opportunity for long-term investor. We are currently long shares of Medtronic in our Income Equity Portfolio.