This is a quick note to inform you of several new trades in The Income Equity Portfolio. We’ll be updating the portfolio’s holdings sheet and providing more information later this week. But wanted to share this new trade information, briefly, right away.

The Trades (3 New Buys, 2 Trims)

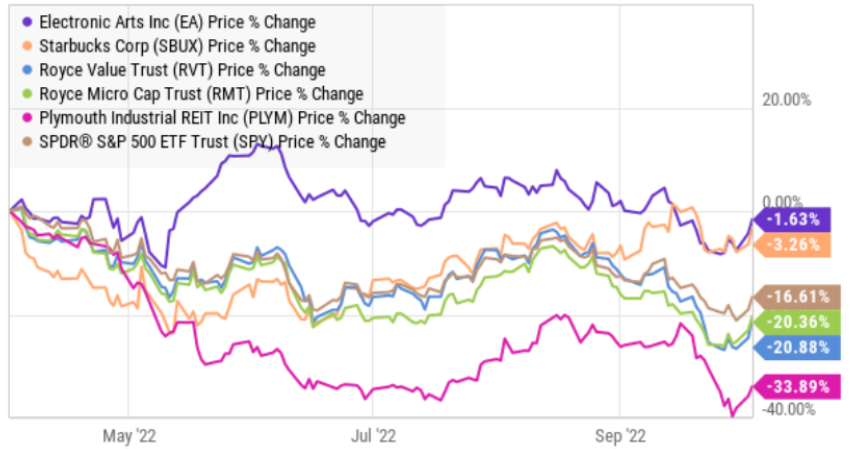

We took advantage of the market’s low prices (despite this week’s strong “faceripper” performance, we’re still close to the previous June lows and the new lows for the year), by initiating three new positions. We funded these new positions by trimming our positions in lower yielding stocks that had been performing very well since we added them (we trimmed our positions in Starbucks and Electronic Arts—both recent strong performers). To be clear, we still own both Starbucks (SBUX) and Electronic Arts (EA), just smaller position sizes.

Plymouth REIT, Yield: 5.1%

We initiated a position in Plymouth REIT. We like the industrial REIT space (which has sold off particularly hard this year), and the yield on Plymouth rose even higher than the 4.4% it offered when we wrote about it less than 3 weeks ago (read that report here). In the industrial REIT space, we now own Stag Industrial (STAG) and Plymouth.

Royce Value Trust (RVT) and Royce Microcap Trust (RMT), Yields: 10%+

Small cap stocks have been hit particularly hard this year, and that can be a great time to buy them. Royce is one of the best in the business at actively managing small cap funds, and we love the CEF vehicle because both RVT and RMT are currently trading at wide discounts to NAV (wider than normal). Even though these funds have much lower fees than other CEFs, we still don’t like buying funds because of the fees. Nonetheless, these two are so compelling right now (for high yields, discounted prices, and the potential for a very strong rebound) that we initiated positions in both. You can read our recent full report on these two here.

Bottom Line:

We’ll have more to say about these trades (and we’ll update the Income Equity Portfolio holdings sheet) soon, but wanted to share the new trade information right away. We believe these positions (RVT, RMT and PLYM) all all very attractive long-term income investments right now, and we were happy to raise funds to buy them buy trimming our positions in recent winners SBUX and EA.