If you like high income, but worry that your portfolio is too concentrated in traditional high-income sectors of the market, then this 5.9% yield (paid monthly) closed-end fund (“CEF”) is worth considering. This particular high-income CEF gives you important diversifying exposure to high-growth sectors (such as technology—a sector traditionally known for low yield), and it also trades at an attractive price. The price is attractive not only for the current discount to NAV, but because the underlying holdings are positioned for long-term gains—which will help the fund continue to pay you big steady income. It also employs a compelling covered-call strategy, it has a relatively low management fee (important!), and it has a rock-solid management company. In this report, we dive into the details.

BlackRock Science & Tech (BST): Yield: 5.9%

Launched in 2014, the objective of the BlackRock Science and Technology Trust (BST) is to provide income and total returns. It pursues this goal through a combination of current income, current gains and long-term capital appreciation. The method by which it pursues this objective is important because it reveals how the fund generates the high income it pays to investors—it’s not just from dividends paid by the underlying holdings (it currently holds ~125 positions) but also through gains generated by the underlying holdings (a big part of the steady monthly income it pays you—is generated by the long-term gains generated by the underlying holdings).

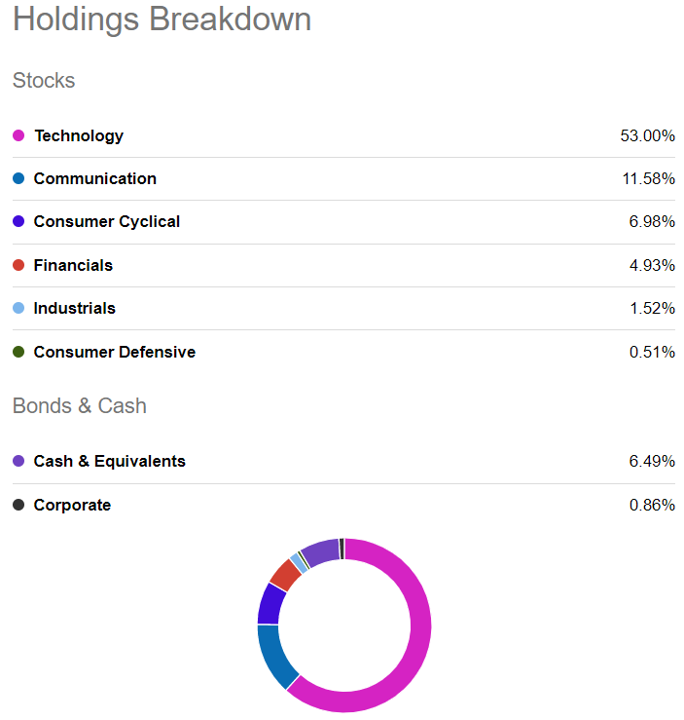

Most high-income investments generate income by investing in high-income sectors and industries, such as real estate, utilities and fixed income (bond) investments. However, BST’s biggest sector is technology (see table below), and this is very important because it can help income-focused investors avoid the long-term pitfall of piling all their assets into the same limited sectors of the market—it essentially reduces your risk while keeping your steady monthly income payments high.

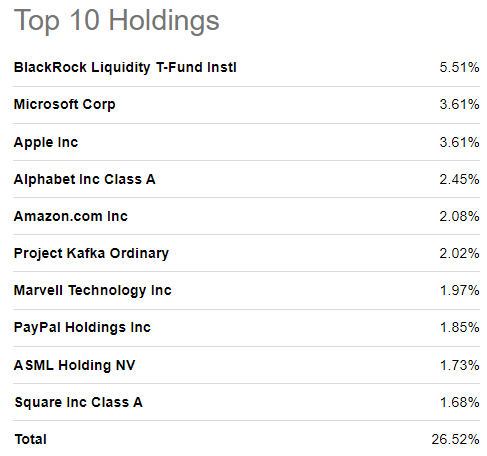

The above table and chart shows BST’s holdings by sector (the high exposure to technology is unusual, and attractive, for a high-income fund), and the list below shows the fund’s recent top holdings.

In our view, these non-traditional “high-income” sectors and holdings are attractive (again—because it helps diversify away some of you risks while still keeping your income high).

Also, important to note, and per BlackRock:

Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology (high growth science and technology stocks), and/or potential to generate current income from advantageous dividend yields (cyclical science and technology stocks).

Covered-Call Option Strategy

A unique and important feature of this fund is that it will use a covered-call strategy (i.e. selling covered call options on a portion of the common stocks in the portfolio).

If you don’t know, a covered call strategy is the least risky of options trading strategies and it basically creates an opportunity to generate a little extra income by collecting options premium. Specifically, the strategy entails selling call options (to generate premium income) on stocks that are currently held in the portfolio. For example, Apple (AAPL) is a top holding in the fund—and the fund might sell a call option against its Apple position, with a strike price of say $200 (Apple currently trades at around $180). If the price of Apple rises above $200 before the options contract expires—then the fund may be forced to sell its shares of Apple at $200 (representing a price gain of about 11.1%). And even if the shares don’t get called away before expiration, the fund gets to keep the premium income it generated for selling the call option—no matter what. Again, covered calls are the least risky of options strategies, and it is away to generate a little extra income on your portfolio.

The downside of a covered call strategy is that if Apple suddenly rises to $250, you could be forced to sell your shares at $200—thereby missing out on some of those gains. However, overall, we view the covered call strategy as attractive for the objectives of this fund and for more income-focused investors in general.

Attractive Price—Discount to NAV

The next thing we like about this fund is its price—and we like the price for two reasons: (1) it trades at a discount to NAV, and (2) technology stocks have recently sold off a bit—thereby providing a more attractive entry point for buyers (especially consider the sector has attractive ongoing long-term growth potential).

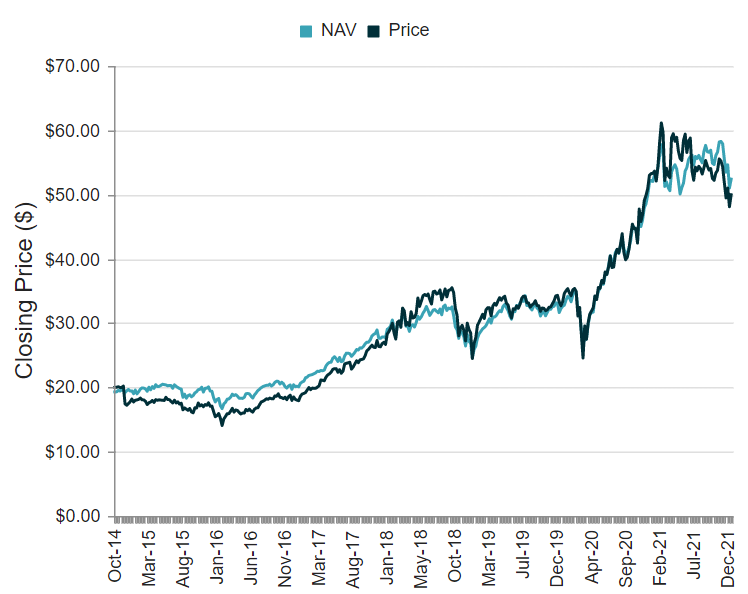

For starters, here is a look at BST’s historical share price versus it’s net asset value (“NAV”).

source: CEF Connect

It’s a little hard to see, but the fund currently trades at about a 3.04% price discount as compared to its NAV, and this is attractive on absolute terms and relative to the fund’s own history. If you don’t know, NAV is the aggregate value of all the fund’s underlying holdings (we listed the top holdings earlier). CEFs are unique (as compared to other funds, such as open-end mutual funds and exchange-traded funds) because there is no immediate mechanism to keep the market price of a CEF close to its NAV—and as such they can trade at premiums and/or discounts to NAV (this can create attractive opportunities and risks). We generally prefer to buy good CEFs at discounts to NAV because it is akin to buying something attractive “on sale.”

For a little more perspective, here is a look at BST’s historical price performance versus NAV performance (below). We really like to see good funds that have recent price performance that lags NAV performance because its means the discount has widened (or the premium has decreased), an all-else-equal this is a more attractive time to buy in our view (i.e. “buy low”). Specifically, you can see the price has underperformed the NAV over the last 3-months, 6-months and 1-year; this is attractive in our view because it increased the margin of safetfy for buyers, in our view.

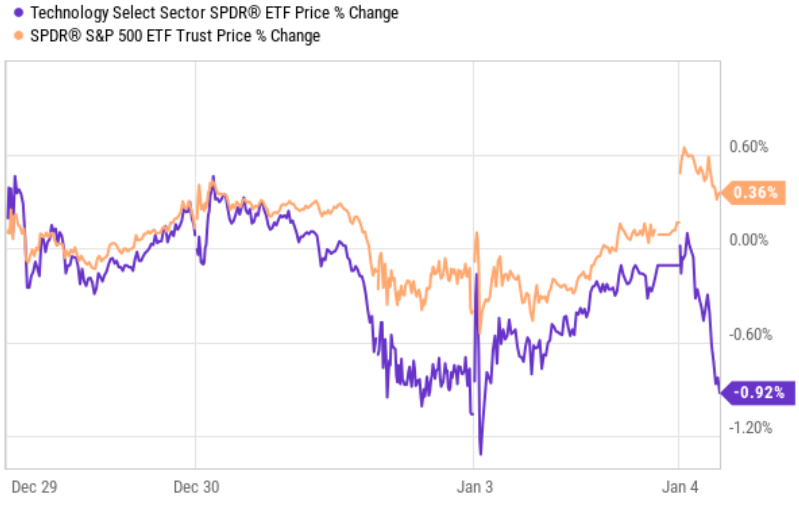

Next, it’s important to note the technology sector in general has experienced some recent weakness relative to other sectors of the market, yet we believe the long-term strength of technology stocks/businesses remains intact—thereby this also is an attractive “buy-low” opportunity, in our view.

Strong Management Company

This fund is managed by BlackRock, which happens to be one of the largest and most well-resourced investment companies in the world. BlackRock has the financial and intellectual wherewithal to manage this fund effectively. Further, the fee on this fund is 1.0%—and this is attractive relative to other closed-end funds which typically have higher management fees and expenses.

Also important to note, this fund does not currently use any leverage (or borrowed money). This helps reduce risks versus other funds that use high levels of leverage (which can increase returns in the good times, but cause devastating performance issues in the bad times). You can read more about the fund and portfolio managers on BlackRock’s website here.

Sources of Distribution Payments

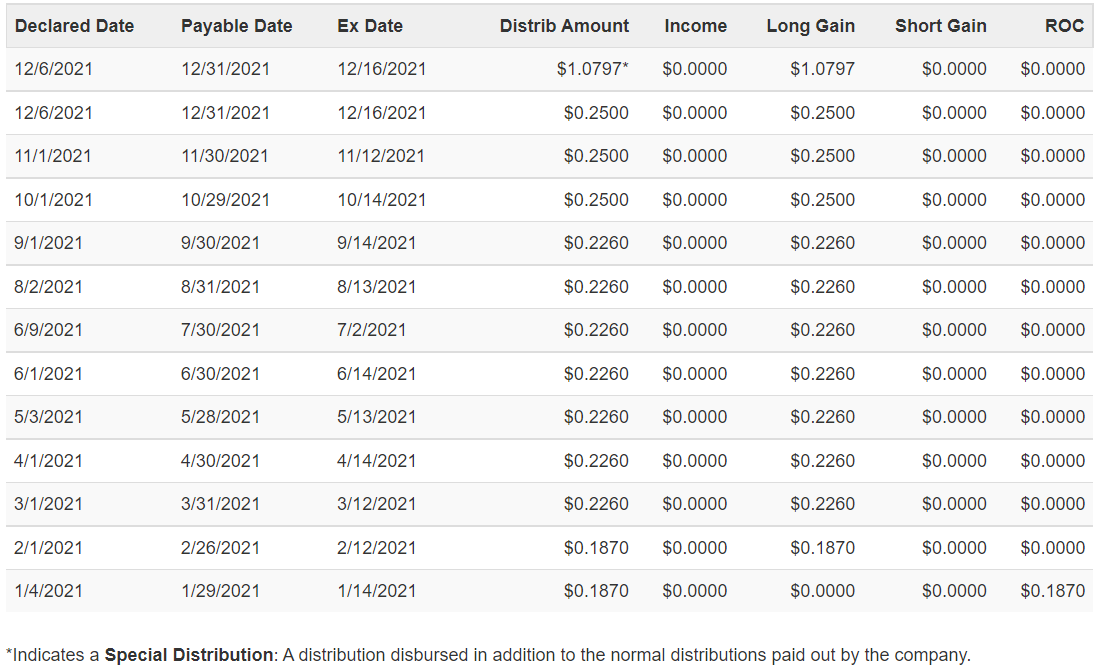

As mentioned, this fund generates part of the distribution income it pays to investors through capital gains. You can see the recent distribution source breakdown in the following table.

Specifically, the sources include dividends/interest (Income), long-term and short-term gains, and return of capital (“ROC”). This is important because it can impact your taxes if you hold the shares in a taxable account. Specifically, long-term capital gains may qualify for a lower tax rate and ROC may act to reduce your cost basis thereby generated a higher capital gain if/when you do sell the shares. These are important factors to keep in mind.

Conclusion:

The bottom line on this investment is that if you are an income-focused investor, BST is worth considering. It offers attractive advantages including its discounted price, non-traditional income-sector exposure, “income boosting” covered call strategy, and rock-solid management company. The covered call strategy could reduce your long-term gains slightly in a very sharply rising stock market, but overall this fund will likely generate strong total returns over time, and it will continue to pay steady monthly income that a lot of investors seek. If you are an income-focused investor, BST is worth considering for a spot in your prudently diversified portfolio.