If you like to generate big steady income, REITs, BDCs and CEFs can be attractive for their high yields (often in excess of 5-6%). And while these are dramatically different types of investments, they can be prudent building blocks within a well-diversified, income-focused, investment portfolio—when selected carefully. In this report, we share data on over 75 big-dividend investments (25+ REITs, 25+ BDCs and 25+ CEFs), review some of the attractive qualities and risks of each, and then dive into three specific names from the list that are particularly attractive and worth considering for investment.

25+ Big-Dividend REITs

Real Estate Investment Trusts (“REITs”), are an income-investor favorite for their often big, steady, dividend payments. The underlying assumption for many, is simply that there is a certain degree of long-term safety in owning, operating and/or financing income-producing properties, as REITs do. And for perspective, here is recent performance data on over 25 REITs that currently pay dividends of 5% and above.

The table is sorted by REIT industry, and you may notice some interesting data on a few of your favorites on the list. For example, notice the very strong 1-year performance for many of the REITs on this list.

The S&P 500 has returned about 33% over the last year, and many of the REITs on our list have doubled that. The strong performance has come as pandemic lockdown restrictions have eased, and panic REIT selling has reversed. The important takeaway is the value of being a contrarian investor. Specifically, if you had panicked and sold all your REITs when the pandemic set in last year, you’d have missed out on tremendous returns over the last year.

On the other hand, if you’d have just stayed put, and held onto your REITs for the last year, you’d have earned strong price returns, and you’d have kept receiving some big steady dividend payments. For example, you’ll notice columns in the table showing the consecutive years of dividend increases for these REITs, as well as the dividend change percentages over the last one, three and five years. We’ll have more to say about a specific attractive REIT from this list later in this report.

25+ Big-Dividend BDCs

Business Development Companies (BDCs) basically provide financing (debt and sometimes equity) to middle-market companies (annual revenues between $10 million and $500 million). Middle market companies are often considered riskier than large cap blue chip companies, and that’s why BDCs can pay such high yields (they lend money to businesses at very high rates).

Interestingly, BDCs often lend to companies that traditional banks cannot lend to (because they are too risky, especially as compared to post-financial crisis big bank balance sheet rules). However, BDCs are able to eliminate some of this risk by building diversified portfolios of loans (and because the big bank lending rules are quite conservative). This creates attractive income opportunities for selective BDC investors.

Here is a look at data recent performance data on over 25 BDCs, many of them currently yielding in excess of 6%.

In the table, you’ll notice performance data. Specifically, you’ll see that similar to REITs, BDCs have posted some very impressive returns over the last year as they’ve rebounded hard since the onset of the pandemic.

You’ll also notice price-to-book value metrics in the table, which is a popular BDC valuation metric. Just because BDCs have performed well over the last 1-year, that doesn’t mean there are not attractive opportunities for investment now. There are, and we’ll review one such opportunity later in this report.

25+ Big-Distribution CEFs

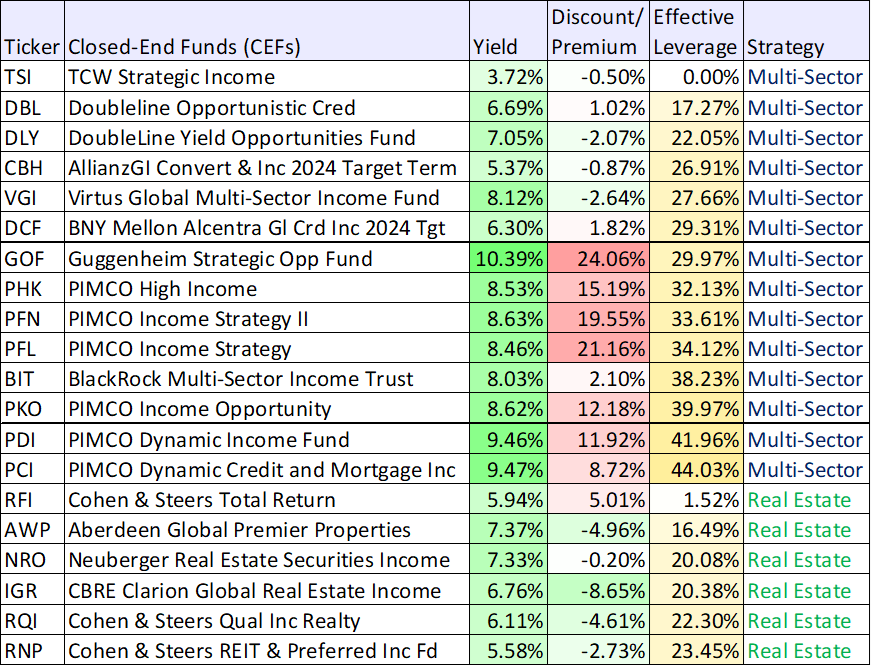

Closed-End Funds (CEFs) are investment vehicles that hold a basket of underlying investments (for example, there are bond CEFs, real estate CEFs and stock CEFs, to name a few). And unlike Mutual Funds or Exchange Traded Funds, there is no mechanism in place to keep the price of CEFs very close to the net asset value of the underlying holdings; and as such, CEFs can trade at significant discounts and premiums to their net asset values, as you can see in the following table

Aside from the big yields and discounts/premiums, there are are a variety of other important metrics to consider when investing in CEFs, such as leverage (CEFs often magnify returns by using significant borrowed money), management, and your outlook for the specific types of things a particular CEF is investing in.

The table above provides a lot of interesting data on many popular high-yield CEFs, and we’ll have more to say about one CEF in particular, later in this report.

Attractive Big Dividends (1 BDC, 1 CEF, 1 REIT):

For your consideration, we’re highlighting three particularly attractive big-dividend opportunities from the lists above.

1. BDC: Ares Capital (ARCC), Yield: 8.4%

Ares is an attractive big-dividend BDC. It provides capital (usually loans) to privately-held US middle-market companies. And it has has paid 47 consecutive quarters of stable to growing dividends.

source: earnings presentation

Aside from the big dividend, we also like Ares for its large size, seasoned management team, strong balance sheet and attractive valuation.

From a valuation standpoint, Ares shares currently trade at a slight premium to net asset value (~1.1x), however this is fairly normal, as you can see in our earlier table (in the last 5 years it has ranged from 0.5x to 1.5x). Also worth mentioning, the company was recently able to raise more capital (and strengthen its balance sheet further) by issuing more shares at a premium to NAV.

Its also worth noting that Ares maintains a healthy level of undistributed taxable income that can be used for spillover to add safety and cover the dividend. This is important as Ares continues to recover from the pandemic because in recent quarters, Net Investment Income per share has fallen short of its dividend per share. Nonetheless, the spillover and continuing pandemic recovery give us increased confidence in the dividend and the firm.

Of course there are risks to investing in Areas (such as floating rate investment yields, the higher credit risk of middle market companies and conflicts of interest from the external management structure). However overall, we believe Ares is a well run business with an increasingly healthy dividend that will continue to thrive thanks to it strong business and continually improving post-pandemic market conditions. We’ve written about ARCC extensively in the past, and we currently own shares.

2. CEF: BlackRock Multi-Sector (BIT), Yield: 8.0%

As for CEF’s, we currently own a variety within our Blue Harbinger Income Equity portfolio, but one that we particularly like is the BlackRock Multi-Sector Income Trust. Specifically, we like that it offers well diversified exposure to a deep portfolio of fixed income investments that would be impossible for any individual investor to buy on their own (BlackRock enjoys massive economies of scale).

We also believe this fund uses a prudent amount of lever (borrowed money) to magnify returns (leverage was recently approximately 38%). We’re much more comfortable having BlackRock manage this leverage (than if we were to try to do it on our own) because BlackRock has a highly disciplined process as well as access to institutional borrowing rates (i.e. they can borrow money much more efficiently that most individual investors).

We also like BIT because it does not currently trade at a huge premium to Net Asset Value, as some other CEFs do. For example, popular PIMCO CEFs oftern trade at 20% premiums (or more) and this can make it very difficult for some investors to purchase any CEF trading at this much of a premium.

As a side note, there are some attractive qualities to PIMCO CEFs trading at big premiums (as we previously wrote about here), but for some investors, it just makes sense to buy a little closer to the actual net asset value.

BlackRock CEFs also charge more reasonable (lower) management fees (BIT’s is ~0.8%—excluding the cost of leverage, which is dramatically lower than some other fixed income CEFs). Importantly, BlackRock has massive resources at their disposals (due to economies of scale—BlackRock is huge) to help the manage their CEFs.

Overall, if you are looking for well-managed high-income at a reasonable price, BIT is attractive and worth considering. We currently own shares.

3. REIT: W.P. Carey (WPC), Yield: 5.5%

W.P. Carey is a highly-diversified and highly-attractive property REIT that pays a big healthy dividend. We recently wrote in great detail about WPC here, including a variety of pros and cons to investing, such as the attractive real estate portfolio, the strong financial position, the dynamic business model, and the big growing dividend, to name a few.

W.P. Carey continues to trade at a relatively price, as the yield is a bit higher than normal and the price to AFFO ratio (~16.4x) is also reasonable. Lastly, we’d be remiss to not mention WPC has raised its dividend for more than 10 consecutive years in a row.

Source: 2Q21 Investor Presentation

Overall, if you are looking for a big-dividend property REIT to add to your portfolio, WPC is worth considering. We currently own shares.

Conclusion:

At the end of the day, every investor needs to understand their own personal goals, and then invest accordingly. And if you are an income-focused investor—it can make a lot of sense to own attractive opportunities from a variety of categories (such as REITs, BDCs and CEFs).

In addition to the 75+ names in our initial table, we highlighted three particularly attractive opportunities in this report (W.P. Carey, BlackRock’s Multi-Sector Trust and Ares Capital); and if you are looking for more ideas, you might also consider our recent report, Top 10 Dividend Growth Stocks. Above all else, know that disciplined, goal-focused, long-term investing has been a winning strategy throughout history, and it will be this time too.

Beyond W.P. Carey, BlackRock’s Multi-Sector Trust and Ares Capital, we also own 4 additional BDCs, 6 additional CEFs and 7 additional REITs within our Income Equity Portfolio. You can view all of our current holdings here.