There is a lot to like about this large dry bulk shipper, not the least of which is its attractive 6.4% dividend yield. More specifically, the company is benefiting from a cyclical rebound in dry bulk shipping rates, on both the supply and demand sides. It’s expected to announce earnings on August 5th, and its 8.0% yield baby bonds are expected to be called at the end of this month. In this report, we review the business, market conditions, prospects, valuation and risks, and then conclude with our opinion on investing.

Overview: Star Bulk Carriers, Yield: 6.4%

Star Bulk Carriers Corp. (SBLK) provides worldwide seaborne transportation of dry bulk cargoes, including major bulks such as iron ore, coal and grains, and minor bulks such as bauxite, fertilizers and steel products, through its fleet of 128 vessels, which have an aggregate capacity of 14.1 million deadweight tonnage (dwt). The company is headquartered in Athens, Greece and maintains executive offices in Oslo, New York, Limassol (Cyprus) and Singapore. Oaktree Capital Management (OCM), through its affiliated funds, beneficially owns 27.75% of SBLK’s common shares. OCM’s stake in SBLK will come down to ~25.42% after the conclusion of the sale of ~2.4 million shares in a recently priced secondary public offering.

In addition to common shares, SBLK has a publicly traded unsecured bond (SBLKZ) maturing on 11/15/2022 and offering 8.3% coupon. However, these baby bonds are reported to being called at the end of this month.

Benefiting from Optimistic Dry Bulk Shipping Outlook and Tight Ship Supply Demand Balance

The dry bulk shipping industry is cyclical in nature and highly sensitive to economic conditions. Revenues of dry bulk shippers tend to be volatile and depend on shipping rates, which to a large extent move in line with the prevailing and expected market conditions. There are also some seasonal patterns such as low shipping rates and consequently low revenue during the first quarter of the calendar year. However, the performance of each shipping company varies and depends on company-specific factors like shipping capacity and diversity, timing, and negotiated rates with clients.

The Baltic Exchange Dry Index, which is a composite of three sub-indices that measure different sizes of dry bulk carriers, the Capesize, Panamax and Supramax, and takes into account 23 different shipping routes carrying coal, iron ore, grains and many other commodities, provides a benchmark for the price of moving dry bulk cargo by sea. It recently peaked to a 10 year high and is expected to reach even higher in the next twelve months according to forecasts by Trading Economics (as we can see from the encircled region in the chart below).

Baltic Exchange Dry Index:

Source: Trading Economics

This expected rise in shipping rates is driven by the optimism surrounding the trade of dry bulk commodities as economies around the world emerge from the pandemic led downturn. As a matter of fact, the pent-up demand for commodities resulted in a very strong recovery in the dry bulk shipping market during the first quarter of 2021. While there still remains heightened levels of uncertainty related to the ongoing economic recovery from the COVID-19 pandemic, with the billions of dollars worth of fiscal stimulus and the optimistic consumption outlook with the advent of vaccines, many countries have started to significantly recover from the 2020 downturn and have been actively rebuilding commodity stockpiles. This is expected to create robust global demand for dry bulk commodities, especially for the stimulus driven infrastructure commodities such as iron ore and coal, going forward. To meet this expected spur in demand, many producers are ramping up their production. In addition, the record high commodity prices are also incentivizing producers to further expand their production.

Iron Ore: For example, the Brazilian miner Vale is targeting iron ore production of 315-335 million mt for 2021 (up from 300 million mt in 2020), and at the end of 2021, the production capacity working rates should grow to 350 million mt/year, reaching 400 million mt/year at the end of 2022. Also, Australian mining major Rio Tinto has guided to 325-340 million mt iron ore production for 2021, which is roughly at par with 2020 production of 331 million mt, despite the negative impact in the second quarter due to the adverse climatic conditions and also because of the fresh restrictions related to a surge in COVID-19 cases. Further, smaller miners and exporters from Canada, South Africa, India, and Chile are all expanding their production to take advantage of the strong iron ore prices, which is expected to add to the ton-mile shipping demand.

Coal: Similarly, the global coal demand is steadily recovering from the lows seen in 2020, when it declined by 4%, the biggest drop since World War II. The International Energy Agency (IEA) estimates the coal demand growth for 2021 will be 4.5%, driven by the rapid increase in coal-fired power generation in Asia, which is expected to account for three-quarters of the global rebound in 2021. Currently, the power production is far outpacing thermal coal output in the largest coal consuming countries, China and India, resulting a significant drop of stockpiles. In addition to the demand growth, the ongoing China-Australia political tension has forced many power retailers, as well as steelmakers that import metallurgical coal from Australia, to diversify and seek cargoes from longer distance sources such as South Africa, Colombia, the US and Canada, thus inflating the ton-miles shipping growth, a positive for dry bulk shippers.

Other: Trade in other dry bulk commodities such as grains and other minor bulks is also surging. For example, Brazil, the world’s top soy supplier, is forecast to produce a record 137 million mt of soybeans in 2020-21 and export an all-time high volume of 86 million mt.

Overall, trade in dry bulk commodities is expected to be on very strong footing, and this will create additional shipping demand and further lift the outlook for dry bulk shipping rates, going forward. For more perspective, please see below the charts compiled by Clarkson Research and presented in SBLK’s 1Q21 financial results presentation, which show the expected growth in the trade and ton-miles of dry bulk commodities.

In addition to the optimism surrounding the trade of dry bulk commodities, the constrained supply of bulk cargo ships on the seas due to the uncertainty on new fuel standards (IMO regulations, expected to kick off in 2023) and future propulsion has been keeping new orders for bulk cargo ships under control. The existing shipyard capacity is also quickly filling up with very strong orders for container-ships (carrying most seagoing non-bulk cargo), for which orders are now extending out to 2024 and beyond (as per Clarkson Research Service), and crude oil tankers. In fact, the container-ship orderbook-to-fleet ratio is almost triple the dry bulk ratio. This is expected to tighten the dry bulk ship supply demand balance, which, we believe, will continue to support higher shipping rates, going forward.

Total Orders of Dry Bulk, Tanker and Container Ships (2020-2021)

Source: BIMCO, Clarkson

SBLK invested heavily into its fleet at the bottom of the cycle, both in terms of adding new vessels (it nearly doubled its fleet size by adding as many as 60 vessels in the last four years), as well as opting to upgrade its vessels by retrofitting scrubbers into them to meet the IMO 2020 regulations on Sulphur content in marine fuels. As a result, it has become the largest dry bulk shipping operator, both in terms of fleet size and on a deadweight tonne basis (DWT), with the most diversified dry bulk fleet that includes ships ranging from Supramax to Newcastlemax, with carrying capacities between 52,425 dwt and 209,537 dwt. Also, despite having a number of older vessels (~16% of the fleet is above 15 years of age), the company’s overall fleet is relatively younger than many of the other dry bulk shipping operators.

Source: company presentations, Blue Harbinger Research

With the large size, capacity and diversity of the fleet, SBLK is very well positioned to transport volumes higher than any of the other dry bulk shippers, and will thus immensely benefit from higher shipping rates, both in terms of revenue, as well as in terms of profits, as it derives higher operating leverage. In fact, the company already has the lowest average daily operating costs per vessel, implying relatively lower breakeven rates and higher profits compared to other operators.

Going forward, we also expect SBLK to benefit from a scrubber premium on its fleet in the form of higher profits as the fuel spread, the cost differential between the refined very low sulphur fuel oil (VLSFO) and the cheaper unrefined high sulphur fuel oil (HSFO) used by ships with scrubbers, widens. Notably, SBLK’s scrubber investments have not been able to generate planned paybacks as the pandemic had destroyed the worldwide refining demand and lowered the spread last year. However, it is now improving and is tracking above $100 per MT in most of the major ports (as we can see from the below chart), and this will help SBLK attain higher profit levels than the operators that did not install scrubbers on their existing fleet.

Source: Marine Bunker Exchange (MABUX)

For perspective, the following charts show the incremental profit (EBITDA) that SBLK can earn annually for certain dollar increase in the shipping rates and the fuel spread.

Further, amid the current optimism, SBLK is pro-actively managing its contracts for various vessel types without locking in medium to long term fixed charter rates. In fact, it has not entered into any one-year time charter contracts recently. SBLK’s CEO Petros Pappas noted in the 1Q21 earnings call:

“We're very positive about the rest of this year, as we're positive about next year as well. And in general, we're positive for several years come for various reasons……Now, we are not worried about the short term at all. Actually, we think that it could be even better than what the present FFAs show for the year, which is like $34,000 for capes and $24,000 for the other two types. But having said that, if for example we see a Supramax and an Ultramax offering us $30,000 for four to six months, we would fix that. First of all because it's above FFA and it's a decent number. It could get higher than that. But the idea is that we fix, we stay spot in general. If we see rates that are higher than FFAs or much higher than FFAs then we fixed those for the short period.”

Capital Allocation Policy Prioritizing Dividends

Under SBLK’s current capital allocation framework, it is prioritizing dividends, using 100% of the cash balance at the end of each quarter that exceeds a minimum threshold per vessel toward dividend payments, while growth investments (i.e., purchase of vessels), if any, are planned to be funded using shares. Debt reduction is also a focus, but with the loan-to-value (LTV) ratio substantially below the anticipated range (SBLK does not disclose its LTV ratio), the leverage is much lower today, providing it the cushion to go slow on deleveraging.

The capital allocation policy is clearly prioritizing the dividend. We will certainly look at attractive acquisitions of vessels. But as I said before, we'll try to do that using our shares as we've done in the past. And we do want to reduce leverage. But we're doing that slowly while maintaining this dividend policy. - President, Hamish Norton on the 1Q21 earnings call

For the unversed, SBLK had devised its variable dividend policy in late 2019, setting forth minimum cash threshold per vessel for the next several quarters. The policy essentially entails using the cash flow from operations, net of loan amortization, for dividends. Any cash that flows in from the sale of vessels or any source other than income and expenses will be reserved for share repurchases, debt prepayment and vessel acquisitions and will not be utilized for dividends.

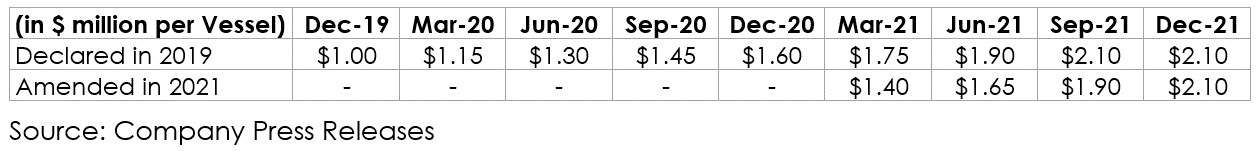

Owing to the impact of the pandemic, SBLK was not able to meet the threshold requirement in 2020 and accordingly withheld dividend payments. With improved performance and an encouraging outlook, it amended the policy in favor of shareholders by meaningfully reducing the thresholds and reinstated dividend payments during the first quarter of 2021. For perspective, the following table shows a comparison of the previous and the current cash thresholds per vessel.

As we can see from the table above, the threshold was set at $1.40 million per vessel for March 2021, and based on the 125 vessels and $206.6 million of cash balance at that time, it paid out the excess cash of $31 million, or $0.30 per share, as dividend to its shareholders. While it is difficult to estimate the future dividend payouts, given the variability of the policy, what looks certain is the fact that the company will leverage its vast scale, capacity and diversity to take advantage of the high expected rates, which, combined with its very low breakeven rates (stemming from its scale advantage, scrubber investment payoffs and operational excellence), will result in meaningful cash build and drive notable amounts of dividend payout, going forward.

A testament to this thesis is the fact that the majority of SBLK’s fleet is exposed to the spot market for 3Q21 and ahead, and 82% of available days in 2Q21 (as of 1Q21 earnings release date) have already been booked at $21,168 (vs. 1Q21 daily TCE per vessel of $15,461), which is almost double the breakeven rate of ~$11,000. Notably, the breakeven rate includes loan amortization, which makes it even more attractive. Based on the available data, we calculate that SBLK will have net excess cash flow of at least over $55 million in 2Q21 for dividend payment, as shown below.

Source: Blue Harbinger Research

Valuation

Star Bulk’s share price has experienced significant gains this year, driven by optimism for the industry (as economies around the world emerge from the pandemic), as well as company-specific drivers.

Source: YCharts

However, the share price has been volatile in recent months, due to a late May earnings release (below expectations) and attributable to the Biden administration’s suggestion to regulate shipping costs, as well as a possible resurgence in COVID-19.

We remain constructive on the shares as the market continues to gain appreciation for the company’s solid cash flow dynamics and dividend payout potential.

Risks

Regulation of Shipping Costs: Recently, the Biden administration announced its intention to ask the Federal Maritime Commission to take steps to regulate the shipping costs in order to protect American exporters from the high costs imposed by the ocean carriers. Should the steps be stringent enough to cause meaningful decline in shipping rates, the profitability of shippers such as SBLK will be significantly impacted.

Rate Volatility: Given the cyclical nature of the dry bulk shipping industry, charter rates tend to be highly volatile, and can adversely reflect on the earnings power of companies operating in this industry. SBLK contracts most of its fleet on spot rates, which makes it all the more exposed to charter rate volatility.

Lower Fuel Spread: Should the spread between HSFO and VLSFO decline or be low for prolonged time periods, the comparative low operating cost advantage that SBLK enjoys due its scrubber investments will be impacted, resulting in lower operating margins.

Supply Side Risk: While the new build orders for dry bulk ships are presently very low, a strong increase in ordering will be a warning sign as this would imply more supply of shipping capacity in the future, and thus lower rates.

Political Risk: The potential escalation of political tensions between China, which is presently driving most of the dry bulk demand, and a number of countries could cause a prolonged correction of Chinese imports. However, the demand from the rest of the world is growing at very high rates, which will mitigate some of the short-term slowdown from China.

Conclusion

The dry bulk shipping market is widely cyclical, and we believe we’re currently at an attractive point in the cycle based on both supply and demand. And in addition to attractive industry dynamics, we believe Star Bulk has a number of attractive company-specific characteristics, such as its scale, capacity, diversity, lowest breakeven rates, operational excellence and the possibility for more dividend growth. Some short-term headwinds have caused a recent share price dip, but we remain positive on the outlook, and view this as a buying opportunity for investors seeking high income plus the possibility of attractive (albeit volatile) share price appreciation.