One of the largest and most diversified midstream pipeline operators in the US, the company we review in this report is focused on deleveraging its balance sheet and positioning for future distribution increases. And despite the recent strong price gains, the company continues to trade at discount to peers and has more upside ahead considering the healthy fundamentals. In this report, we review the health of the business, valuation, risks, dividend safety, and conclude with our opinion on investing.

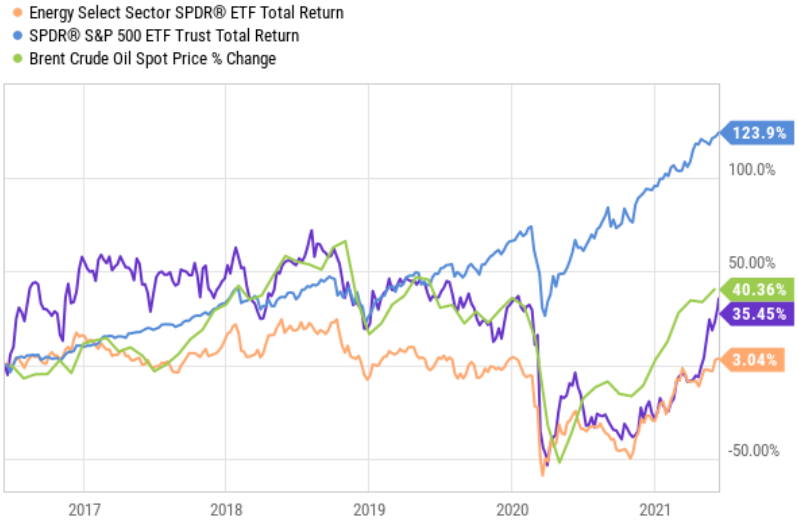

The purple line is Energy Transfer (ET)

Overview: Energy Transfer (ET), Yield: 5.4%

Energy Transfer LP (ET) owns and operates a diversified portfolio of midstream energy assets. ET’s operations include crude oil, natural gas and natural gas liquids (NGL) pipeline services and storage, and natural gas midstream gathering and processing activities. It conducts its operations primarily in the Texas and the US midcontinent region. Additionally, ET owns the Lake Charles LNG Company, as well as a general partner interest in Sunco LP (SUN) (including incentive distribution rights and 28.5 million common units) and a general partner interest in USA Compression Partners, LP (USAC) (including 46.1 million common units).

The company consists of five core segments:

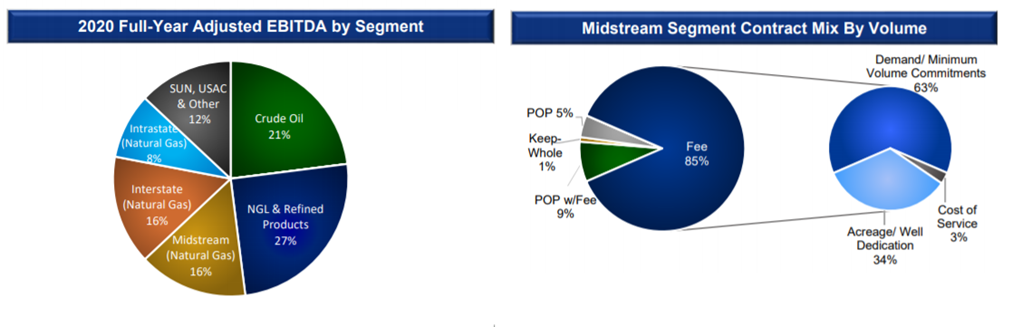

Crude Oil (~25% of revenue and 21% of EBITDA): segment owns and operates ~10,850 miles of crude oil trunk and gathering pipelines in the southwest and midwest United States.

NGL & Refined Products (~22% of revenue and 27% of EBITDA): segment includes approximately 4,823 miles of NGL pipelines as well as ~2,918 miles of refined products pipelines.

Midstream (~5% of revenue and 16% of EBITDA): segment owns and operates natural gas gathering and NGL pipelines, natural gas processing plants, natural gas treating facilities and natural gas conditioning facilities.

Interstate Transport & storage (~4% of revenue and 16% of EBITDA): segment directly owns and operates 12,340 miles of interstate natural gas pipelines with 10.7 Bcf/d of transportation capacity and additional 6,780 miles via joint venture interests.

Intrastate Transport & storage (~13% of revenue and 8% of EBITDA): segment includes ~9,400 miles of natural gas pipelines and 3 natural gas storage facilities in Texas.

Energy Transfer is well diversified with no segment contributing more than 30% of overall adjusted EBITDA.

source: Company data

The company reported strong Q1-21 numbers—earning record net income of ~$3.3 billion and adjusted EBITDA of $5.0 billion. The strength was driven by a massive windfall gain of $2.4 billion triggered by winter storm Uri. This gain has allowed ET to repay ~$3.7 billion in debt during Q1, taking it closer to its target leverage of 4-4.5x. This is positive for investors as the company can now look to return additional capital to shareholders via distributions and repurchases.

Earnings Supported by Fee-Based Contracts

Energy Transfer generates revenues predominantly from fee-based contracts which limits exposure to commodity price risk and provides stability to earnings and cash flow.

source: Company data

To further enhance its fee-based earnings, ET announced the purchase of Enable Midstream Partners for $7.2 billion earlier this year. The acquisition adds complimentary assets to ET’s portfolio, including thousands of miles of natural gas and crude oil pipelines and a number of storage facilities, that will enhance its midstream infrastructure and provide increased connectivity throughout the midcontinent and Gulf Coast.

The acquisition is expected to be immediately accretive to cash flows and also add significant fee-based contracts earnings. In fact, pro forma ET expects to generate ~95% fee-based cash flows, which will further strengthen its strong cash flow visibility and stability.

Higher Distributions Expected Amid Balance Sheet Deleveraging

Energy Transfer had a long history of increasing distributions, but was forced to cut by one half in the third quarter of 2020, as it struggled with debt levels. The company maintained a reduced distribution of $0.1525 per unit during Q1 2021 (or yield of 5.4%). However, with improvement in cash flows during Q1, we expect the distribution to revert higher.

Distributable cash flows (DCF) increased significantly to $3.91 billion in Q1 (vs. $1.42 billion in Q120). And due to this massive improvement in cash flows, the distribution coverage increased to 9.50x in Q1-20 (from ~1.72x perviously). ET also lowered its growth capex forecast to $500-$700 million per year for 2022 and 2023, which is significantly lower than the $3-$4 billion spent earlier. Additionally, the reduction in debt provides flexibility to increase the distribution in the future.

On its recent earnings call, Energy Transfer addressed the high debt load (that has been concerning to investors) by explaining it has ample liquidity on hand. Specifically, the company expects 2021E adjusted EBITDA of ~$12.9-$13.3 billion, which gives us confidence that it will be able to meet its distribution target for the year as well as further reduce debt. During the Q1-21 earnings call management explained its intention to increase the distribution in the future once it reaches its target leverage.

“We continue to focus on accelerating debt reduction and achieving our leverage target of 4 to 4.5x on a rating-agency basis. Once we have reached our leverage target, we will look to return additional capital to unitholders in the form of unit buybacks and/or distribution increases with the mix dependent upon our analysis of market conditions at the time.”

ET’s liquidity position continues to remain strong with $355 million of cash and equivalents and $5.08 billion available under its revolving credit facility.

Valuation:

From a valuation perspective, ET’s trades at an EV/EBITDA multiple of 7x, which is a steep discount as compared to midstream peers. And from a yield perspective, ET trades at a distribution yield of 5.4%, which is again towards the lower end of the peer group. We expect this discount to narrow as the quality of ET’s midstream assets and stability of its cash flows increase. We believe ET offers investors an attractive opportunity for investors given its solid dividend yield and optionality for capital gains. Further, there is high likelihood the distribution will increase given the strength of the company’s balance sheet.

(source: Yahoo Finance)

Risks:

High leverage: ET noted that its current adjusted net debt is ~$44.3 billion. This could be a cause of concern if there are any disruptions to its expected cash flows. However, the situation is increasingly under control as expected cash flow projections are strong which and will be used to continue deleveraging the balance sheet.

Delay in Projects: ET undertakes capital projects with the expectation that they will deliver an acceptable level of return on capital invested. Most large-scale projects take several years to complete, and during this multi-year period, market conditions can change from those forecasted earlier, and the company not be able to realize the expected returns. This could negatively impact results of operations, cash flows and overall return on capital employed.

Conclusion:

If you are looking for an attractive distribution yield, Energy Transfer is worth considering. As the company deleverages its balance sheet, distribution increases will likely follow. Further, the current valuation is low and suggests there is more price appreciation potential ahead—especially considering the improving fundamentals of the business. We don’t currently own shares of ET (we own EPD instead), but it remains high on our watch list, and we may add shares in the near future. You can view all of our current holdings here.