The Real Estate Investment Trust (“REIT”) we review in this report offers a well-covered 4.5% dividend yield, and it continues to benefit from improving fundamentals in the US industrial REIT sector. Its unique strategy (of focusing on primary and secondary markets) continues to generate higher rental yields while also delivering superior rental growth. And with a payout ratio of only around 59%, the dividend is on solid footing. Moreover, the property portfolio continues to be highly resilient with ~99% rent collections throughout the pandemic. Yet despite the strong fundamentals, it trades at a significant valuation discount versus peers. In this report, we review the business, its health, valuation, dividend safety and risks. We conclude with our opinion on whether it offers an attractive opportunity for long-term income-focused investors.

Overview: Plymouth Industrial REIT, Yield: 4.5%

Plymouth Industrial REIT, Inc. (PLYM) is focused on single and multi-tenant industrial properties (such as distribution centers, warehouses, light industrial and small-bay industrial properties). PLYM currently owns and manages 173 buildings containing over 26 million square feet in 15 markets. The Company Portfolio was 96.6% leased to 351 different tenants across 34 industry types as of March 31, 2021. Its top markets include Chicago, Cleveland and Indianapolis which together accounted for 53.5% of total annualized rental income.

Plymouth is well diversified by tenant, geography, asset type as well as industry. The top 10 tenants account for just 19.8% of its total annualized base rent.

(source: Company Presentation)

Plymouth has a differentiated investment strategy, focusing on primary and secondary markets that possess large pools of skilled blue-collar workers (compared to competitors, focused primarily on gateway markets). Plymouth expects such markets to deliver superior and consistent cash flow returns versus primary gateway markets. Further, these markets arguably offer significantly better acquisition opportunities and there is greater potential for price appreciation of industrial properties in these markets versus gateway markets where valuation remain frothy.

The company’s inclusion of secondary markets allows for higher initial yields as well as substantial rent growth opportunities. For example, for Q1-21, new and renewal leases signed were 12% higher than expiring rental rates on a cash basis. PLYM has already addressed 68% of its lease expirations for 2021.

Further, Plymouth management remains excited about the outlook for its target markets. For example, the company noted the following during the recent Q4 earnings conference call:

“Rents are going up, new supply is constrained in our target markets, and now is the time to own these type of industrial properties that are positioned to benefit from a favorable supply demand dynamic, and access to large pools of skilled labor.”

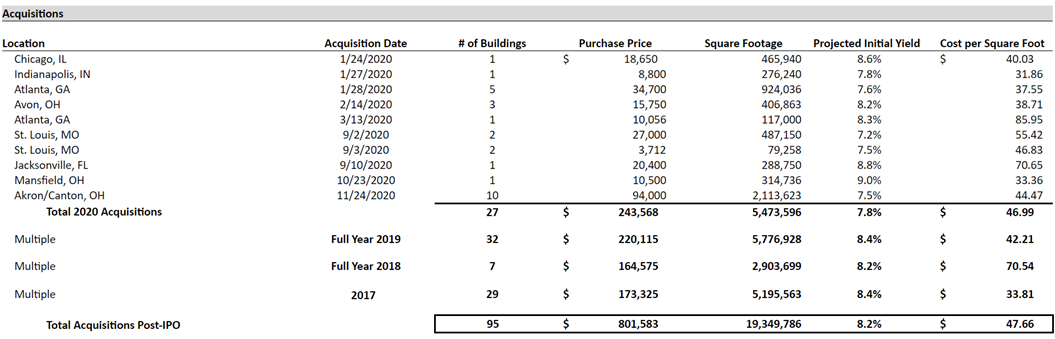

Strong Acquisition Pipeline

Plymouth has a strong pipeline of acquisition opportunities. PLYM is targeting properties with going-in cap rates between 6% and 7%. In terms of value, PLYM noted that it is targeting acquisitions of around $150 million for 2021.

The latest acquisitions are located in markets with access to large pools of skilled labor in the main industrial, distribution and logistics corridors of the U.S. The company also expanded the portfolio through a JV partnership with Madison that acquired a 28-property portfolio of industrial buildings totaling 2.3 million square feet in metropolitan Memphis for $86 million with a projected initial yield of 7.7%.

Plymouth’s discipline and selectiveness are impressive, as reflected by its less than 10% rate of closing on transactions initially reviewed. Since its IPO, Plymouth has acquired $801.6 million wholly owned properties totaling 19.3 million square feet.

(source: Company Presentation)

Strength in the Industrial Real Estate Sector

The US industrial real estate sector is experiencing rising rental rates and declining vacancy rates (these are very good things). This is primarily due to limited supply, economic tailwinds (increased industrial output), ecommerce growth and a resurgence in domestic manufacturing. For perspective, you can see strong condition in the following charts.

US Industrial Net Absorption and Rent Growth Above Historical Average

(source: CBRE Economic Advisors, JLL Research)

Further, demand for industrial space is expected to accelerate to an additional one billion square feet by 2025, according to real estate company Jones Lang LaSalle. This is due to accelerated e-commerce growth and the need for warehouse space. Also, the US retail industry is experiencing a major shift away from malls and shopping centers to e-commerce sales platforms. The trend for online shopping is a secular one and the COVID-19 pandemic has further accelerated the trend. For example, there is higher penetration of new products such as grocery and pantry goods in the e-commerce sector due to the pandemic which boost logistics real estate demand going forward.

(source: U.S. Census Bureau of the Department of Commerce)

Other factors will further increase the demand for warehouses. For example, e-commerce can typically require up to 3x more space to store inventory versus brick-and-mortar retail businesses. Further, the pandemic is forcing many companies to reevaluate their supply chain strategy, including options to move manufacturing onshore.

Overall, the growing demand for industrial and logistics properties will enable owners (like Plymouth) to maintain high occupancy rates and increase rents.

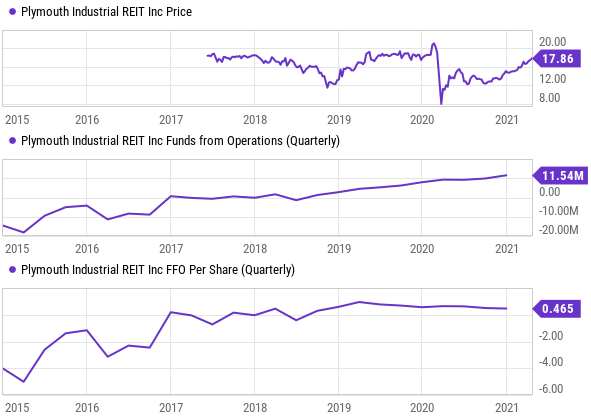

Dividend Safety

Plymouth has continued to strengthen its funds from operations (“FFO”) and pay quarterly dividends since it began trading publicly in 2017. Per the latest earnings call, core FFO and AFFO dividend payout ratios were a conservative 52% and 59%, respectively, for 2020. This suggests the dividend is healthy and well covered, especially considering FFO is expected to continue to grow (see table below). Management remained coy and aloof when asked about the potential for a dividend increase in the near future, as the analyst asking the question questioned mandatory dividend payouts to maintain REIT status. Specifically, Plymouth management simply stated “we’ve got to be cautious,” suggesting some near-term uncertainty as possibly more acquisitions (which would use up liquidity as well as likely contribute to long-term growth). In our view, the dividend remains strong and healthy, and will likely need to be increased at some point in the future, perhaps in upcoming quarters.

source: Factset, FFO results, guidance and estimates

Attractive Relative Valuation

On a Price to Adjusted Funds from Operations basis (“AFFO”), Plymouth is trading at ~12.3x its 2021E AFFO, a discount to the peer average in the table below. In our view, the discount is unwarranted, despite differences in the businesses, including Plymouth’s smaller size and higher leverage, plus its primary and secondary market focus (somewhat similar to STAG secondary market focus, but differentiated versus PLD’s primary industrial market focus). Further, PLYM’s investment portfolio is set to growth, as evidenced by its increasing FFO guidance.

Management has been vocal about valuation, for example explaining the following during the Q4 earnings call:

“We look at the data, we'll see an acquired investment basis of $41 a square foot versus a replacement cost of $75 a square foot. Compare that now to an implied total enterprise value of $46 a square foot based on yesterday's stock price. We are also seeing an implied cap rate quoted on us of around 8% versus acquisitions planned for 2021 at cap rates in the 7% range, and larger portfolios in our markets, trading with six handles in the cap rate. Looking across our industrial peers, we see implied cap rate and implied enterprise values per square foot well above to exponentially above ours. We think that the delta is unsustainable and quite frankly, unwarranted.”

(source: Company data, Yahoo Finance)

Risks:

Worth mentioning, Plymouth does face a variety of risk factors that should be considered, as described below.

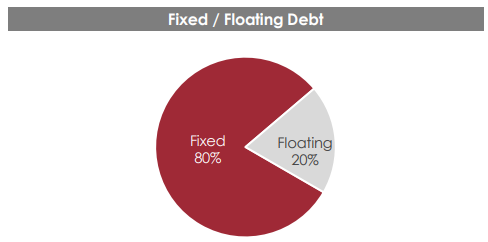

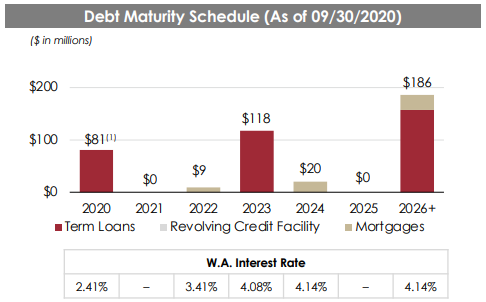

High debt: Plymouth’s debt remains high (see peer comparison above) which increases the risk given the inherent capital intensive nature of the business. It also increases interest expenses putting further pressure on earnings, FFO and cash flow. That said, the debt has been used to fund an attractive asset portfolio. Additionally, the high fixed rate and laddered maturities add to our confidence in Plymouth's ability to manage the debt.

source: Investor Presentation

Tenant bankruptcy: PLYM is exposed to the risk of tenants not being able to meet their rental obligations. The company is well diversified with no significant tenant concentration. However, should one or more of these tenants face financial trouble it could lead to future cash flow interruption.

Interest rate risk: Federal Reserve has cut interest rates to zero and even though we expect interest rates to remain relatively tame, dramatically rising rates could create challenges. As REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price. Also, higher interest rates put downward pressure on earnings as interest costs rise.

Conclusion:

Plymouth is an attractive industrial REIT to consider if you are an income-focused investor seeking long-term capital appreciation too. For example, we like the exposure to the industrial real estate sector during covid (which has spurred increasing demand for distribution centers and warehouses), but also because it benefits dramatically from the secular growth trend in e-commerce. And in our view, the shares remain undervalued, especially as compared to peers. Further, with a payout ratio of only around 59%, the 4.5% dividend yield is well covered and has the potential for long-term growth. Overall, Plymouth is worth considering for a spot in your long-term income-focused investment portfolio.