In general, investment “fund” vehicles are less desirable (because of the typical high fees and chronic underperformance), but the two closed-end funds (“CEFs”) described in this report are attractive for a variety of reasons. For example, they’ve both thrived and outperformed for decades (net of all fees and expenses) thanks to their disciplined management teams, they both pay big healthy dividends (5.4% and 5.5%, respectively), trade at attractively discounted prices (versus NAV), use a small prudent amount of leverage (a good thing), have compelling sector/style allocations, and market conditions remain attractive coming out of the pandemic. You might consider buying a little (we own both) and just hanging on. You’ll keep getting paid big healthy dividends for if/when you need them, otherwise just reinvest the cash and enjoy the powerful long-term compound growth.

The two CEF’s we’re talking about are:

Royce Value Trust (RVT), Yield: 5.5%

The Fund’s primary investment objective is long-term capital appreciation. Current income is a secondary investment objective. It uses a core approach that combines multiple investment themes and offers wide exposure to small-cap stocks (generally market caps up to $3 billion) by investing in companies with high returns on invested capital or those with strong fundamentals and/or prospects trading at what Royce believes are attractive valuations.

Royce Micro-Cap Trust (RMT), Yield: 5.4%

RMT invests primarily in companies with market capitalizations below USD300m, with the aim of exploiting the potential for higher returns. It uses a core approach that combines multiple investment themes and offers wide exposure to micro-cap stocks by investing in companies with strong fundamentals and/or prospects selling at prices that Royce believes do not fully reflect these attributes.

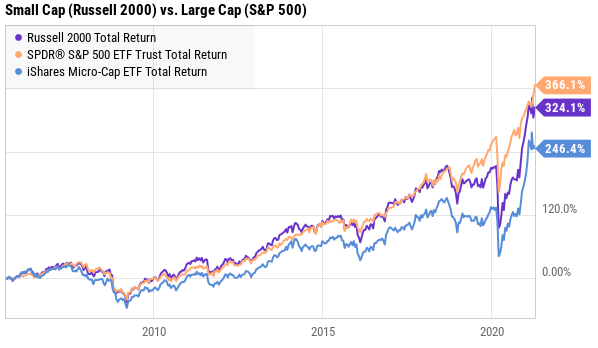

And here is a look at their long-term performance (net of fees) versus the benchmark, “small cap index” (Russell 2000) and the S&P 500.

What is a Closed-End Fund?

Before getting into the details of why we like these two particular CEFs (RVT and RMT), it’s worth first reviewing what a CEF actual is. If you don’t know, a closed-end fund is an exchanged traded product that can offer a big attractive distribution yield. Its price fluctuates throughout the course of the trading day based on a combination of its net asset value (the aggregated market value of the individual holdings within the fund) and supply and demand. The supply and demand dynamics of a closed end fund can cause it to trade at a significant premium or discount versus its NAV throughout the course of the day (and over time), especially versus exchange traded funds (ETFs). Unlike CEFs, ETFs have creation units where ETF management can create more shares of the ETF through the open market which helps keeps the discount/premium on an ETF small (generally only a few basis points). On the other hand, CEFs have no creation units (they’re closed-end) and therefore CEFs can trade at large discounts and premiums relative to their NAVs thereby creating opportunities and risks.

CEFs come in many shapes and sizes. Examples of CEF categories include diversified equity funds, sector funds, corporate bond funds, commodities funds, and asset allocation funds, to name a few. In this article, we focus on two “small cap” CEFs offered by Royce Investments Partners, known as “small cap specialists.”

What is Attractive About RVT and RMT?

To get right into it, let’s just start reviewing the attractive qualities of these two CEFs…

Small Caps Are Attractive

Small cap stocks can be an important investment opportunity set that many investors often miss out on. Small caps (as measured by the Russell 2000 index) consist of 2000 stocks with small market valuations (whereas the S&P 500 consists of 500 of the largest market cap stocks). And as you can see in the chart below, small caps can go in and our of favor (versus the rest of the market) over time, and recently they have lagged the rest of the market (depending on your timeframe), but could be due for a continuing strong rebound as the world gets a grip on covid (which has hit smaller companies particularly hard).

Some investors believe that over very long time periods (for example many decades) small cap stocks should outperform (because smaller businesses have more room to grow, and because they are not as closely followed as large caps thereby leaving more pricing inefficiencies). And rather than simply buying all small cap stocks (such as a Russell 2000 ETF), there are opportunities for good management teams (such as Royce) to actively hand select attractive small cap stocks for investment.

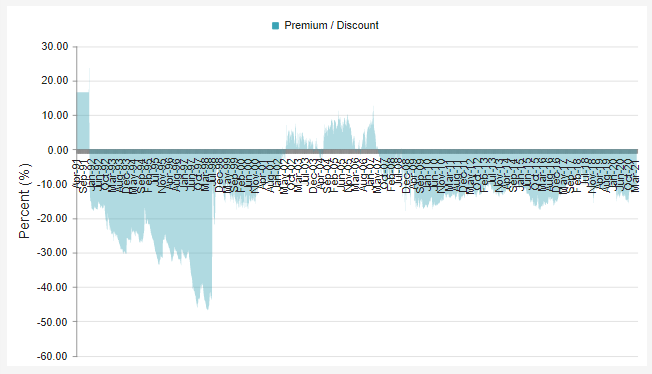

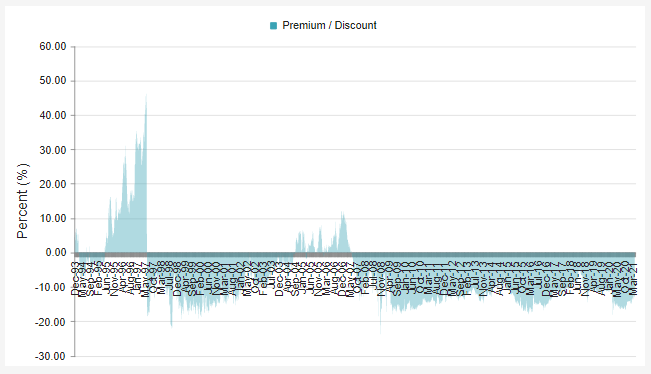

The Price is Attractive (Discount to NAV).

One of the unique characteristics of CEFs (as mentioned earlier) is they can trade at significant discounts or premiums to the value of their underlying holdings (i.e. net asset value or “NAV”). And by buying a CEF at a discounted price, you are getting to buy the underlying stocks at a discounted price. This is the case for both Royce Funds (RVT and RMT), as you can see in the following charts.

RVT Historical Premium/Discount:

RMT Historical Premium/Discount:

Of course there is no guarantee that the discounts will ever revert back to par (or even to a premium, for that matter), but by buying at a discount, you are getting to purchase (through the fund) the underlying stocks at a discounted price, and we greatly prefer to purchase attractive investments at a discount.

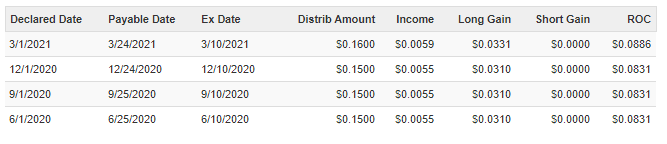

The Dividend Is Attractive

The current dividend yields offered by RVT and RMT (5.4% and 5.5%, respectively) are attractive for a variety of reasons. First, they’re large. For perspective, the S&P 500 offers a dividend yield of only around 1.4% and the Russell 2000 small cap index yields even less at around 0.9%. So how are the yields on RVT and RMT so much larger? The answer is these dividends consist of a combination of dividends (paid by each fund’s underlying holdings) and capital gains (price appreciation on the underlying stocks) as you can see in the following tables.

RVT Dividend (Distribution) Composition:

RMT Dividend (Distribution) Composition:

As you can see in the tables above, the quarterly distributions (dividends) paid by the funds consist of a combination of income (dividends paid by the underlying holdings), long-term gains (on the underlying holdings) zero short-term capital gains (which is good for tax reasons) and a return of capital. These different sources of income can have different tax consequences (for example, dividends are taxed as income, long-term gains are taxed at the long-term capital gains tax rate, and Return of Capital can work to reduce your cost basis, thereby potentially increasing your long-term gain if/when you eventually do sell shares). This information is also neatly and conveniently organized by Royce for tax purposes when you receive your annual tax statements.

Some people don’t like that distributions paid by these CEFs bounce around a little bit from time to time (small increases or decreases), but this is actually a good thing as the Royce team is working to optimize the mix of distribution sources.

Also important, when you need a little extra dividend income, it’s nice to know RVT and RMT consistently pay these big healthy distributions. And when you don’t need the income you can simply reinvest it in the funds and watch your investment compound and grow significantly over time. In this regard, RVT and RMT offer a highly attractive mix of high income and strong compounding and growth potential.

Management Team

Both of these CEFs (RVT and RMT) are actively managed by a highly experienced team. By “actively managed” that means the management team is actively selecting the investment opportunities they believe are most attractive for the fund, and that includes individual stocks as well as sector weights and allocations. While these funds are focused on small and micro-cap stocks, respectively, they do have a lot of leeway on which of those types they select, and they have historically selected well as evidenced by the funds’ strong performance.

Here is a look at the RMT management team:

And here is the RVT management team:

Chuck Royce has one of the longest tenures of any active fund manager, and he is known as a pioneer in small cap investing. Importantly, he is supported by a highly experienced and credentialed team that is highly experienced with Royce Funds, and ready and able to run the funds long into the future.

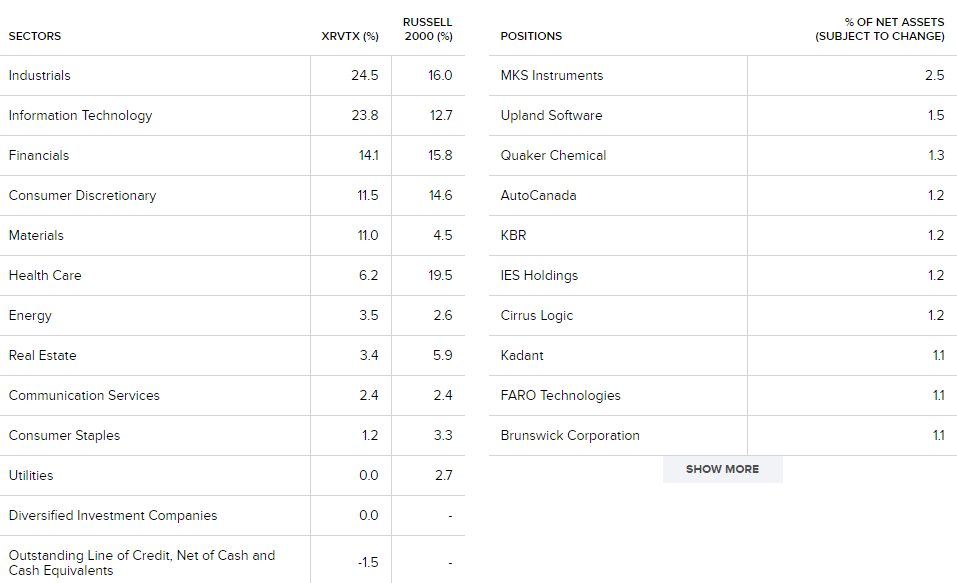

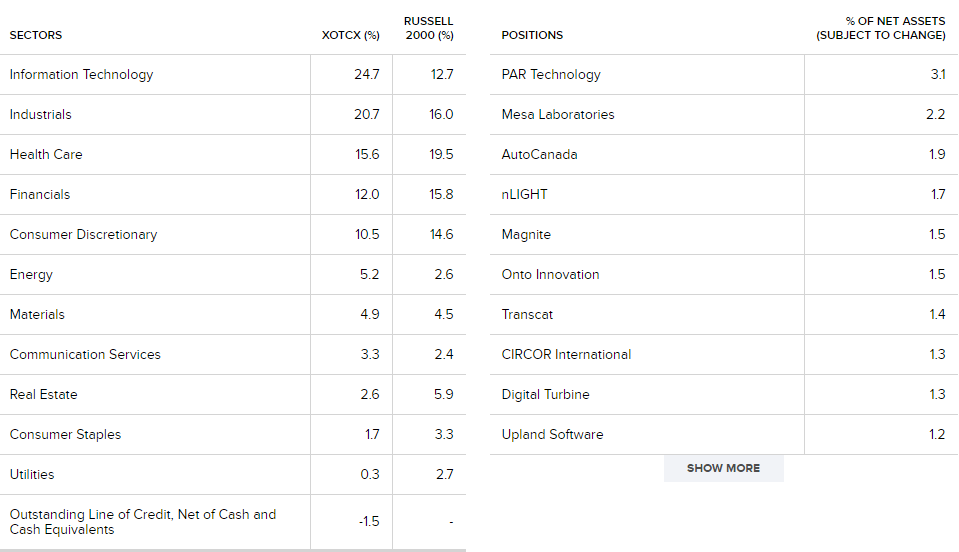

And for more perspective, here is a look at the funds’ current sector exposures and top holdings weights, and the differences versus the benchmark weights is an indication of the potential (but no guarantee) for continuing outperformance versus the benchmark.

RVT Holdings (as of 3/31/21):

RMT Holdings (as of 3/31/21):

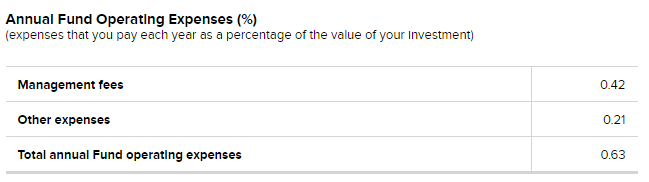

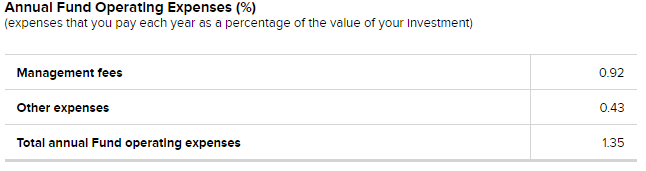

Management Fees and Expenses:

Management fees and fund expenses are another important consideration when investing in a closed-end fund, and in the case of both RMT and RVT they are reasonable, especially considering the strong performance and disciplined investment process of the management teams and of Royce Investment Partners in general. For starters, here is a look at the management and expense ratios for RVT.

A management fee of only 42 basis points (0.42%) is quite reasonable for an actively managed CEF of this level. And the other expenses (such as operating expenses and the cost of leverage or borrowed money) are also quite low (0.21%). Overall, at 63 basis points, the fees and expenses of RVT are very reasonable, especially considering the strong performance and ongoing future performance potential.

The fees for RMT are slightly higher, which is to be expected in the micro-cap space, especially considering the fund has less assets (~half a billion AUM vs ~$2 billion AUM for RVT) and the economies of scale (while still very attractive) are smaller than those of the larger RVT fund. Micro-caps are a tricky space to invest in, and it helps to have a strong management team (such as Royce Investment Partners) to invest in the space.

We are comfortable with these fees and expenses, especially considering what you are getting for them. And especially as compared to many other CEFs that charge much higher fees and have much higher expense ratios. RVT and RMT are attractive in this regard.

The Leverage is Prudent and Attractive

Some CEFs use leverage (or borrowed money) and some do not. Leverage can magnify returns in the good times, but magnify losses in the bad times. There is a regulatory limit as to the amount of leverage stock CEFs can use (and it is generally not to exceed 30%). In the case of these two Royce funds, RVT currently uses 3.13% leverage and RMT currently uses 3.59% leverage. We view these levels as prudent and attractive. Specifically, we don’t like high leverage because it magnifies volatility risks and can cause a fund to get into trouble (for example with margin calls at the exact worst time, which can force a fund to lock in losses—a bad thing). On the other hand, we like the small amount of leverage used by these funds because it essentially covers operating expenses and any cash drag which can put a drag on long-term returns. The amount of leverage used by these funds helps optimize performance, in our view.

What are the Risks?

There are, or course, a variety of risks associated with investing in these CEFs. For example, they are concentrated in small and micro-cap stocks, and if these two categories significantly underperform the rest of the market then these funds will likely be challenged too. Another risk is simply that the price discount could get significantly wider, which would be a drag on performance/returns. Yet another risk is that the main portfolio manager, Chuck Royce could retire (or be carried out in a pine box) soon. However, there are a variety of well-tenured assistant portfolio managers for each fund that are ready to take over with a smooth and consistent transition.

The Bottom Line

At the end of the day, both RVT and RMT have been delivering powerful gains and high income for a very long time, and both CEFs are positioned to keep doing so for many years into the future. The 5.4% and 5.5% yields are impressive and comforting, and so is the strong management team.

We like the idea of having some allocation to small caps (and micro caps) within your prudently diversified long-term investment portfolio because they offer powerful opportunities that many investors often overlook. We also like such allocations now, as we continue to emerge from the pandemic (which took a particularly hard toll and small business and small stocks). Further still, the discounted prices (versus NAV) are compelling.

We currently own a small allocation to both funds, and we are looking forward to continuing high income and powerful growth for many years into the future.