The so-called “risk-reward” tradeoff is an investing adage whereby the more risk you take—the more potential reward (return) you will receive. While that is a useful analogy (and there may be some truth to it) the investment we review in this report offers a very high return (in the form of big monthly dividend payments) with relatively low risk, and it is a great place to temporarily park some of your cash (if you are willing to take on more risk than your FDIC insured bank account). In this report, we review the company’s business model, income profile, financial position and dividend prospects, and then finally conclude with our opinion on investing.

AGNC Investment Corp (AGNC), Yield: 8.8%

AGNC Investment Corp is a mortgage REIT that primarily invests in agency Mortgage Backed Securities (MBSs) by raising funds through short-term repurchase agreements as well as from equity holders. mREITs clearly faced turbulence in early 2020 (as COVID panic led to a freezing up of liquidity in the bond markets), however the Fed quickly intervened and AGNC has worked to strengthen its balance sheet further. The company is now healthy, and there are reasons to believe it will continue to grow in value. Also particularly important to mention, unlike most of its peers, AGNC invests almost entirely in US government agency securities—the safest of MBS and essentially guaranteed by the US government.

AGNC Share Price:

Overview:

AGNC Investment Corp. is a real estate finance company that operates as a REIT. Incorporated in 2008, the company primarily invests in residential mortgage assets that are backed by US government agencies, also termed as “Agency MBSs”. The company uses leverage through collateralized borrowings structured as short-term repurchase agreements and provides attractive levered returns to equity holders. The company’s earnings essentially consists of portfolio yield, net of cost of funds and other operating expenses. AGNC is an internally managed mREIT that uses an active portfolio management philosophy using hedges to protect its shareholder’s NAV over a wide range of market scenarios.

As of 31st December 2020, the company had a total investment portfolio size of $98B. Out of this, $65B (66%) was invested in Agency MBS, $32B (33%) was invested in a “to be announced” mortgage position, $1.3B was invested in Credit risk transfer securities & Non-Agency RMBSs, whereas $0.5B was invested in Agency collateralized mortgage obligations.

Agency MBSs are agency securities that carry minimal default risks as these are backed by guarantees from federal authorities such as Fannie Mae, Freddie Mac, or Gennie Mae. Agency MBSs are however exposed to interest rate risk and prepayment risk. “To be announced” mortgage positions are forward contracts to purchase mortgage-backed securities on a future date, however, the characteristics of mortgage loans to be delivered are not known until 48 hours prior to the settlement date. As indicated in the chart above, AGNC has parked the majority of its investments in agency backed MBSs (99%) and since the credit default risk is very limited, it can use significant leverage to magnify returns from these low-yielding Agency MBSs. Its tangible Net Book Value “At Risk” leverage, which primarily measures debt taken to finance its investments for each dollar of equity value stood at 8.4x at the end of 2020.

Federal Reserve intervention providing support to MBS markets after a period of extreme volatility

mREITs including AGNC faced difficult times because of unprecedented dislocation in financial markets caused by covid-19 pandemic. Economic-shutdowns, stay at home orders and high unemployment rates combined with mortgage forbearance programs announced in mid-march led to a sharp sell-off in mortgage backed securities, including Agency MBSs. The sell off wasn’t due to any risk of default (remember Agency MBS as essentially backed by the US government), but rather by a temporary lack of liquidity in the bond markets (which the fed stepped in and resolved).

As discussed earlier, AGNC operates a leveraged business model and a fall in its investment portfolio value (due to temporary poor liquidity in the bond markets) triggered significant margin calls in the repo market forcing it to liquidate its holdings to meet near-term financial obligations. The company’s shares declined sharply as AGNC lost 50% of its market cap in a few days. However, sanity was restored when the fed announced its intervention and flooded the mortgage markets with sizeable liquidity. The US Fed Reserve has already bought more than $1.3 trillion worth of MBS since mid-march. Keeping its dovish stance, the fed has communicated that it is not going to raise interest rates for the next couple of quarters at least and will continue to consistently buy assets to stimulate the economy, keeping mortgage rates around their record low levels.

Low interest rates helping expand margins in the near term

While low mortgage rates have put pressure on asset yields generated by AGNC’s investment portfolio (which has declined from 3.09% in Q4 2019 to 2.07% in Q4 2020), AGNC has been the beneficiary of declining cost of funds because of Fed’s record low interest rate policy. The average total cost of funds for Q4 2020 stood at just 0.05% as compared to 1.76% in Q4 2019. This was because of extremely low short-term repo rates combined with negative implied funding costs from “to-be-announced” securities because of the monthly dollar roll income generated. The favorable movement in funding costs helped AGNC deliver a net interest spread of 2.1% which represents an expansion of 69 bps from same quarter last year.

Adjusted earnings per share, which includes Net Interest Spread and TBA dollar roll income per share stood at $0.75 per share representing an increase of 32% on a YoY basis. Please note that these asset yields and net interest spread numbers exclude the impact of any increase in prepayment rates which is captured through amortization of “catch-up” premium. In Q4 2020 AGNC’s constant prepayment rate (CPR) increased to 27.6% as compared to just 15.4% in the same quarter in 2019. However, in January 2021, because of a slight uptick in interest rates, prepayment rates have some what stabilized. Going forward for the coming quarters, we expect the cost of funds to further decline as AGNC has already refinanced some of its repo agreements at lower interest rates (a good thing).

Hedges in place to temporarily insulate earnings from any sudden increase in interest rates

AGNC faces risk from the potential increase in base rates by the federal reserve which in turn may lead to rising cost of funds and hence contraction of net interest spreads of the company’s earnings. To soften the impact of rising interest rates in the near term, the company enters into payer interest rate swaps and swaptions. Further, it has also shorted US treasuries to compensate for any loss of book value of investments if the interest rates rise in the future. With interest rates at all-time lows and macroeconomic risk now shifting more towards higher interest rates, the company has already covered 80% of its funding liabilities with a hedge portfolio as compared to 71% in Q3 2020.

AGNC has always carried higher leverage on its balance sheet as compared to its agency peers (which is fine considering AGNC holds much safer assets that its peers—i.e. Agency MBS), however the company is following a conservative approach since the market dislocation last year, and has been taking significant steps to reduce its leverage position. In Q4 2020, AGNC’s net financial obligations to equity ratio stood at 8.5x, which was well below 9.4x as reported in Q4 2019.

The company ended 2020 with a strong liquidity position of $5.4 billion consisting of cash and unencumbered agency assets. With limited investment avenues due to low agency MBS yields, the company has returned some of its liquid balances to shareholders through share buybacks. In 2020, AGNC has repurchased almost 30 million shares representing over 5% of the total outstanding shares as of the end of 2019 for $402 million. This is an attractive return of capital to investors.

Well positioned to gain in a steepening yield curve environment

Investors must note that AGNC’s business benefits from a steepening of the yield curve. The company raises funds for shorter durations and constantly rolls it over while making long term investments in Agency MBSs. And with coronavirus vaccines being distributed and a large stimulus package being pushed by the current administration, investors are expecting economic expansion and higher inflation in the longer term which would lead to higher interest rates in the future. Whereas in the short term, the US economy looks gloomy and the Federal reserve is continuing to purchase bonds on a monthly basis, pushing liquidity into the market and keeping short term interest rates low. This has led to the US Treasury curve steepening to levels last seen in 2016 and AGNC has been attractively deriving gains from this yield curve shift.

Shareholder distributions poised to grow

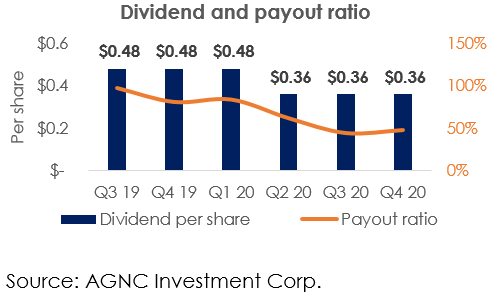

In line with several other mortgage REIT players, AGNC also cut its dividend by as much as 33% in Q2 2020 to preserve liquidity and book value in the extremely volatile environment back then. However, with business operations reverting to normal and net interest spreads expanding due to low cost of funds, the company is well placed to not only easily sustain current levels of dividends but also grow distributions in the near term. For Q4 2020, AGNC declared a dividend of $0.36 per share which represents a very conservative payout ratio of 48%. Management has been focusing on increasing book value per share through buybacks and liquidity conservation, however, if the company continues to generate these attractive interest spreads, AGNC will be forced to raise its dividend levels due to statutory regulations concerning REITs or pay tax on income. The company also may spend excess funds on buybacks which will lift book value per share (also a great thing for investors). According to CEO Gary Kain during the Q4 2020 earnings call:

“Look, we're going to continue to evaluate the dividend on a go-forward basis. And it is an important component of how AGNC takes care of shareholders. But it again isn't the only piece. And it's the combination of the dividend, book value, which then translates to stock price, we'll continue to be active in buying back stock when it makes sense. And we think in the long run that's the best overall equation for shareholders.”

Trading at an attractive dividend yield

During the broader market sell-off in March 2020, AGNC lost almost 50% of its market cap within a few days. Since then, the share price has substantially recovered from the lows and is currently trading at a price to book ratio of 0.98x which is only slightly below its pre-pandemic levels. The dividend yield stands at 8.8% which is below its historical averages, however very attractive in comparison to interest rates prevailing in the market. If the company increases its dividends back to pre-covid levels, at current prices, its implied dividend yield rises to 11.8%.

Risks of increase in cost of funds:

As discussed earlier, AGNC operates a leveraged business model. It raises funds primarily through short term repo agreements. Due to high turnover in these financial liabilities, any increase in interest rates is quickly reflected in the company’s cost of funds. A sharp increase in borrowing rates without an equal increase in asset yields may lead to a significant contraction of net spreads leading to lower earnings. Having said that, the company has a long history of operating in both rising and declining interest rate environments.

Conclusion

AGNC faced challenges in 2020, but fared better than peers (thanks to its focus on safe government agency securities—unlike many of its riskier peers). And now, AGNC is benefiting from calm returning to the market as well as low cost of funds given the Fed’s interest rate policy. Further, the company’s book value is on the rise again (a very good thing) and shareholder returns are poised to grow. Overall, we view AGNC as very safe (relative to its mREIT peers) because it holds safer assets, has a strong balance sheet and a very well covered dividend payout. Further, the US fed once again demonstrated that when distress hits the fixed income markets, Agency MBS is the first place it works to improve conditions (i.e. by buying tons of Agency MBS). If you are looking for an attractive high income investment (that pays monthly), AGNC is absolutely worth considering. We are currently long shares of AGNC.