The office REIT we review in this report is attractive for a variety of reasons, including its healthy dividend (it’s well covered and has been paid for 25 consecutive years), favorable geographic economics, ongoing growth trajectory, and the trend for companies to bring employees back to the office. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with some final thoughts worth considering if you are a long-term income-focused investor.

Overview: Kilroy Realty Corp (KRC)

share price

Kilroy Realty Corp (KRC) is an internally managed triple net REIT focused on developing, acquiring, and managing office and mixed-use projects. Triple net lease structure means the tenant, rather than the landlord, is responsible for paying the main property expenses such as property taxes, insurance, and maintenance. This reduces operating expenses for KRC allowing it to keep more of its rental income, which can then be returned to shareholders through dividend payments. At the end of September 30, 2021, KRC's portfolio consisted of 121 office properties totaling 15.1 million sq. ft. of rentable space and 1,001 residential properties.

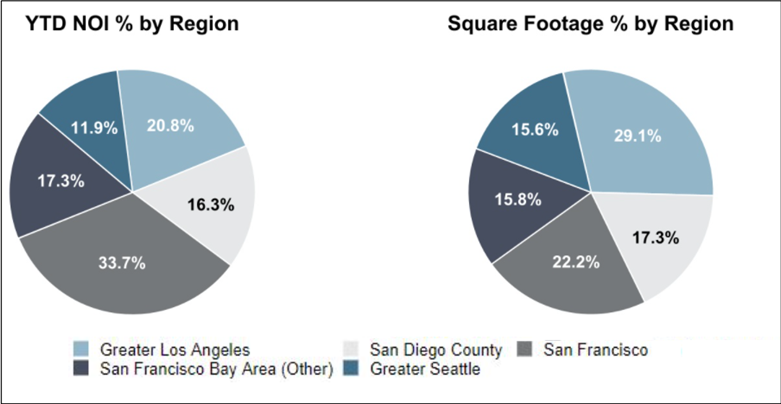

KRC’s geographical focus area is the West Coast region of the US, with a presence in well-located major metropolitan areas, such as San Diego, Greater Los Angeles, the San Francisco Bay Area, and the Greater Seattle area.

(source: Company Presentation)

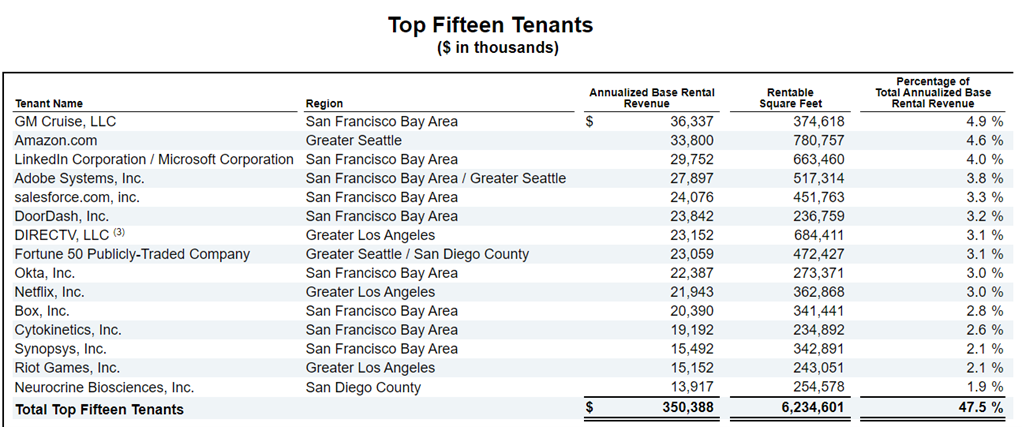

KRC’s tenant base is highly diversified (see figure below) with no single tenant accounting for more than 4.9% of its annual rent. In fact, the top 15 tenants only account for 47.5% of its total annual rent. And 14 of the top 15 tenants are investment grade.

(source: Company Presentation)

The list of tenants reads a bit like a “who’s who” of west coast tech companies, but on point of concern among investors is the heavy dependence on the technology sector. Specifically, the technology sector comprised 58% of the total rent in FY 2020. And with the increase in remote work, especially in the Technology sector, there has been significant concern that it may lead to lower demand for office space, thereby impacting occupancy for company’s portfolio.

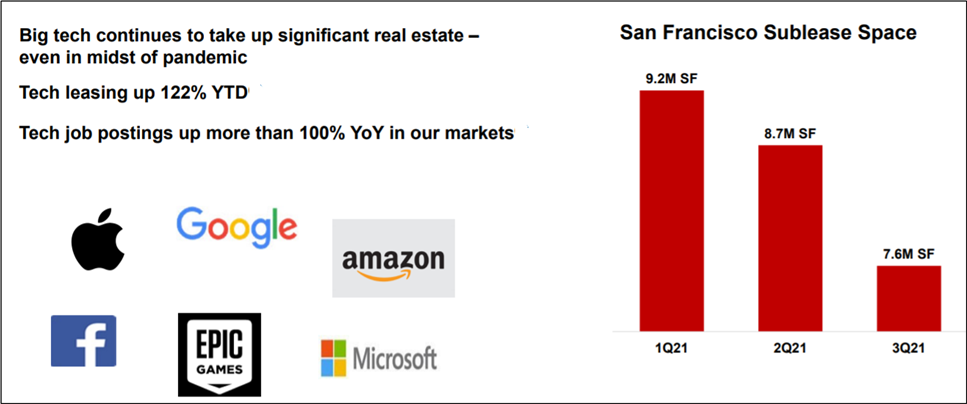

However, we think these concerns are somewhat temporary and largely overblown. For example, many technology companies including heavyweights such as Apple and Google have signaled their intention to bring people back to the office. This suggests that while employees might get the flexibility to work from home on some days, the office will still be there. The company noted the same in its Q3 earnings call.

“the net impact of hybrid work, we think, is going to be minimal in terms of space demand reduction or footprint shrinkage. Recently, CBRE conducted a survey nationally of 185 companies and only 9% of those surveyed expect to experience a decrease in square footage.”

KRC also noted that it is seeing a pickup in activity across all of its markets. Specifically, San Francisco which is its largest market, is seeing a decrease in sublease space. Also, tenants and investors are attributing premium rents and values to high quality modern creative offices. Kilroy owns one of the most modern and youngest portfolios (average age just 11 years), which is ideally suited for today’s user requirements.

KRC Market Observations

(source: Company Presentation)

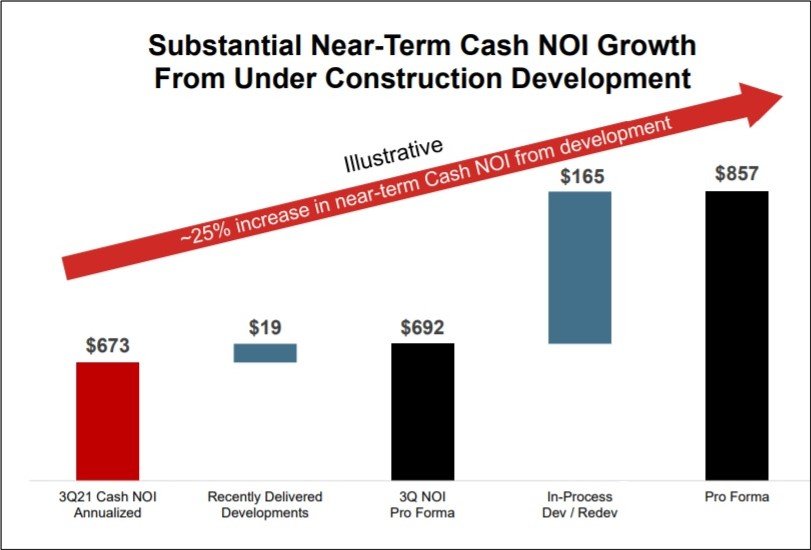

We are also encouraged by the project completions, acquisitions and development pipeline, all of which are likely to add future NOI growth. Year-to-date, KRC has made total acquisitions of $1.2 billion. Overall, there is nearly $2.6 billion of development pipeline under construction which is likely to be completed over the next two years. The pipeline is 52% leased and will generate approximately $170 million in incremental cash NOI when stabilized, which is an improvement of nearly 20% versus the current annual NOI. A large percentage of this increase will be contributed by the Life Sciences portfolio. KRC expects the Life Sciences portfolio to rise to 5.5 million sq. ft. and account for nearly 30% of total NOI.

(source: Company Presentation)

Encouraged by Strong Leasing Momentum

KRC is experiencing an increase in the level of leasing activity across its portfolio. The company signed more leases in the third quarter of 2021 than the first two quarters of 2021 combined. The demand from both technology tenants and life science tenants remains healthy. Both sectors continue to grow and seek more modern, efficient work environments.

In life science, the third quarter was particularly active for KRC. It signed three leases totaling 330,000 square feet of headquarters space with publicly traded companies in San Diego, including Tandem Diabetes Care, DermTech (a company Blue Harbinger has written about) and Sorrento Therapeutics. The mark to market rent increases on these three leases were approximately 45%, with an average term of approximately 12 years.

Other macroeconomic factors also point to continued strong leasing activity. For example, venture capital funding remains healthy as early-stage companies in San Francisco received over $3.7 billion in funding, the highest quarter on record. This is translating into a war for talent, growth in job postings and additional real estate procurement. And as you can see in the following chart, Q3 leasing activity was strong.

(source: Company Presentation)

Dividend Strength

The company has paid a dividend every year since 1997 and the annual growth in the distribution from 2015 to now has been very steady. KRC’s dividend has grown at an average rate of 7% since 2015 and stands at an estimated $2.04 for 2021. At today’s price of around $67, the dividend yield stands at 3.1%. The company did guide for $3.77 FFO-per-share at the midpoint for 2021, implying a payout ratio of just 54% for this year. KRC has no significant debt maturing until 2023 which provides it with ample cash flow to continue to invest for future growth. This supports KRC’s ability to not only pay its dividend but continue to raise it over time. This adds to KRC’s dividend strength and the likelihood for additional meaningful increases over time. Here is a look at Kilroy’s attractive and growing dividend history:

(source: Company Data)

Valuation:

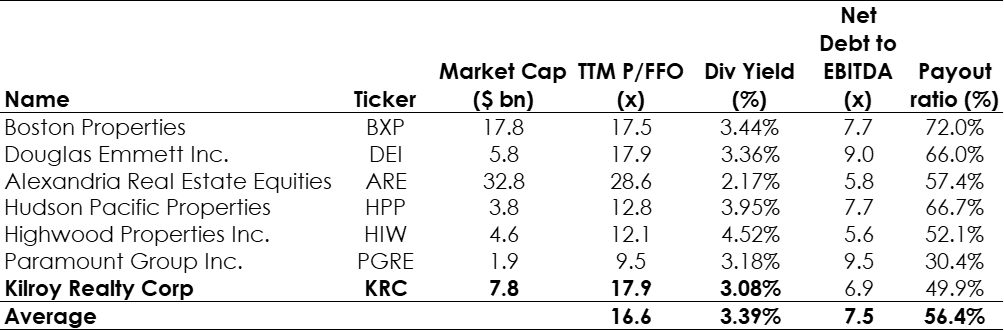

On a Price to Funds from Operations (“FFO”) basis, KRC trades at the upper end of its peer group range. Specifically, KRC trades at P/FFO multiple of 17.9x, which is ~8% higher to its peer group average multiple of ~16.6x. However, we view this as an indication of the safety of the company and strength of the dividend. More specifically, the quality of KRC’s portfolio is reflected in the price to FFO multiple. And as such, this dividend payer may appeal to more risk averse income-focused investors (although a 3.1% dividend yield is significant too).

(source: Yahoo Finance, Company data)

Risks:

Interest rate risk: The potential for interest rate increases could put near-term pressure on some operations as well as pressure on the shares. For example, as tenants adjust to the potential for rising rates, it will impact their ability to pay rent. However, as mentioned, KRC tenants tend to be healthy investment-grade and have little risk of default. Additionally, REITs are often seen as an alternative to bonds, and REITs are currently attractive as they offer higher yields than bonds. But as the fed raises rates, the spread narrows. Nonetheless, we don’t expect the Fed to raise rates too high (because the US government would be crushed under the weight of its own interest payments), plus rising rates likely means inflation and rising rents. All things considered, we don’t view near-term interest rates as overly disruptive to the business.

Execution risk. The company boasts of a development pipeline of $2.6 billion. While the cycle/tenant demand in the West Coast appears strong, any downward trend could hamper the company’s ability to lease its upcoming inventory. This could result in slower than expected growth. However, we do note that nearly 52% of the under-construction pipeline is already leased as of Q3 2021.

Remote working: The work from home trend remains a risk for KRC. It could lead to lower demand for office properties and could result in higher vacancies. However, employers are beginning to call back employees to offices. Big tech giants such as Apple and Google have also said that they plan to call back employees to office.

Conclusion:

Kilroy is an attractive, west coast, office REIT. It will benefit from its west coast presence (favorable macroeconomic headwinds), its relatively younger and more modern properties, and the “return to the office” trend. It also trades at a reasonable price and has a healthy well-covered dividend. If you are looking for an attractive yield (3.1%) that offers steady long-term dividend growth and share price appreciation, Kilroy Realty Corp is worth considering for a spot in your prudently-diversified, long-term, income-focused portfolio.