Skilled Nursing Facility (“SNF”) REIT, Omega Healthcare Investors (OHI) announced earnings on Thursday, and the business is in trouble. Despite Omega’s long history of paying big dividends (it currently yields 9.0%), it is currently facing more significant challenges now than at any other time in its operating history. In this report, we review the business, consider four pros and four cons, and then conclude with our opinion about investing.

Overview:

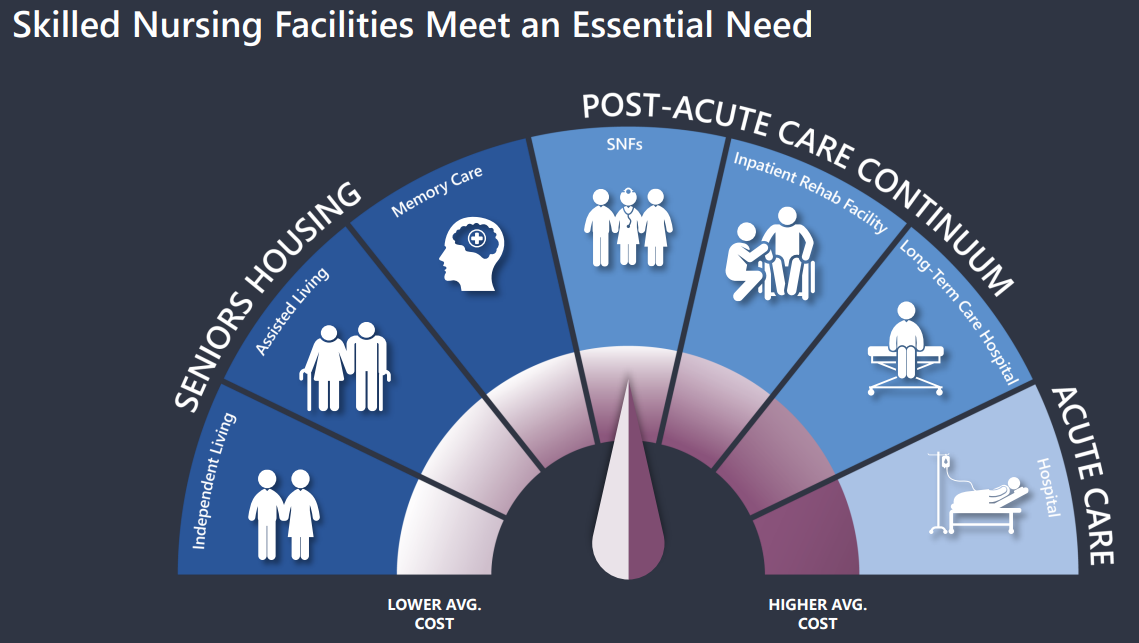

Omega Healthcare Investors is a big dividend (9.0% yield) REIT that focuses on skilled nursing facilities as well as senior housing, using long-term triple net master leases.

source: Omega Healthcare

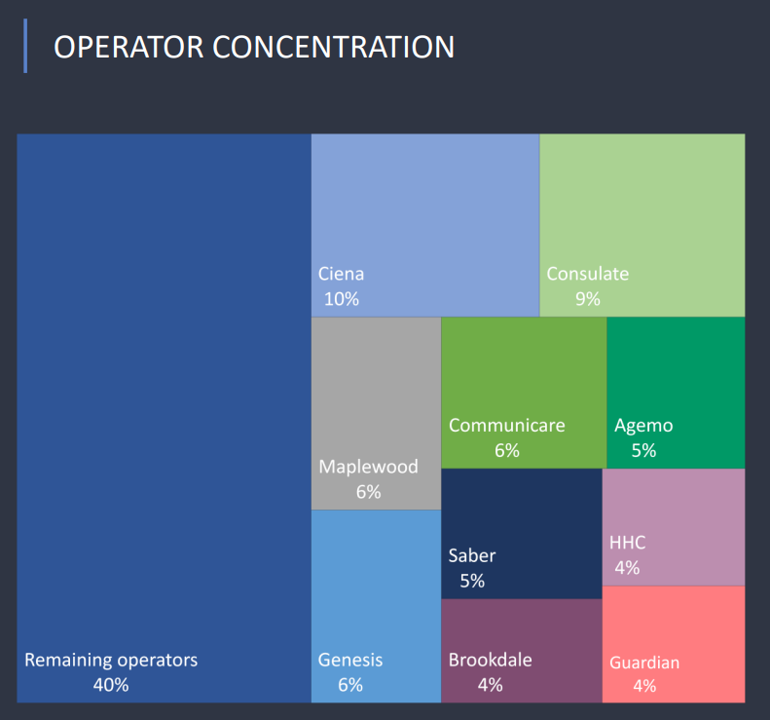

Omega is diversified across 949 properties with 65 operators in 42 states and the UK.

source: Omega Healthcare

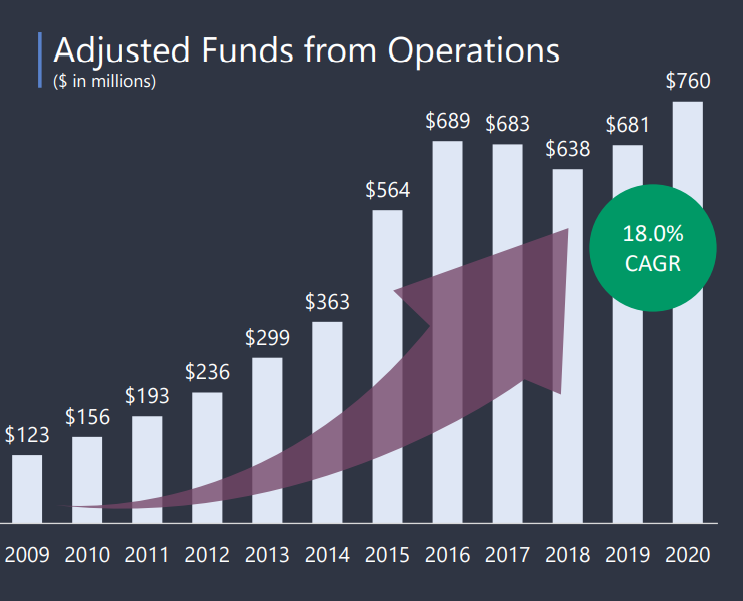

Omega has a long history of growth, but has faced challenges in recent years, as you can see in the following graphic.

source: Omega Healthcare

And in particular, Omega just announced quarterly results on Thursday, whereby year-to-date AFFO is only $619.4 million as the business continues to work through challenges.

The recent challenges stem mainly from the combination of struggling property operators and the COVID-19 pandemic, as we will explain further in the following sections of this report.

4 Pros:

There are a variety of positive and attractive things about Omega’s business, such as the four big ones we consider below.

1. Well Run Business: For starters, despite the current challenges, Omega is a well-run business. In particular, Omega is well-diversified (as we reviewed earlier), and the management team, led by CEO Taylor Pickett, has been navigating through significant challenges in recent years. For example, Omega has continued to successfully operate despite operators that have gone bankrupt and defunct (such as Orianna and Daybreak). The fact that Omega worked through these challenges provides an added level of confidence that the company is well equipped to deal with current operator challenges (as we will get into later in this report). Furthermore, Omega has healthy access to liquidity, no overwhelming near-term debt maturities and an investment-grade credit rating (all positives).

2. Attractive Supply and Demand: Next, Omega operates in an attractive supply and demand environment, in multiple ways. First, Skilled Nursing Facility demand is expect to outstrip supply by 2030, as seen in the following chart.

source: Omega Healthcare

This is driven by long-term demographic tailwinds, but also by supply constrains. Specifically, the supply of facilities and beds to meet increasing future demand is limited due to Certificate of Need (CON) and bed moratorium restrictions. And certified facilities and beds have remained steady for many years, with no net new supply.

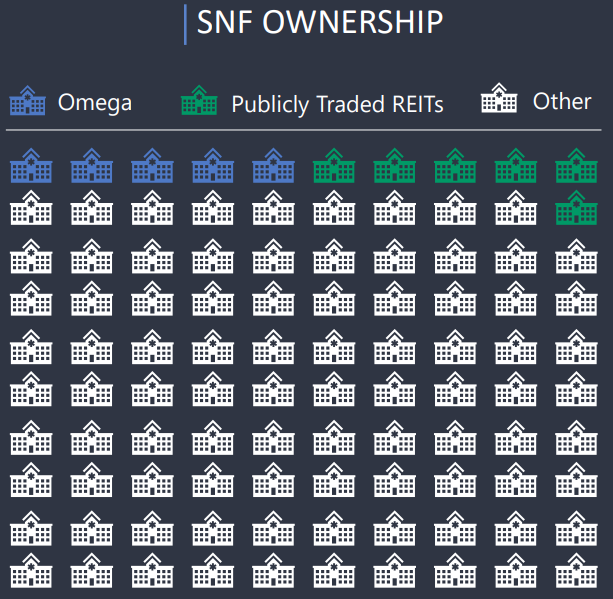

Furthermore, as the largest SNF facility operator, Omega still only owns 5% of the market, thereby leaving lots of room for growth through acquisitions in the fragmented industry. Omega’s management team expects the business to double in size over the next 10 years.

source: Omega Healthcare

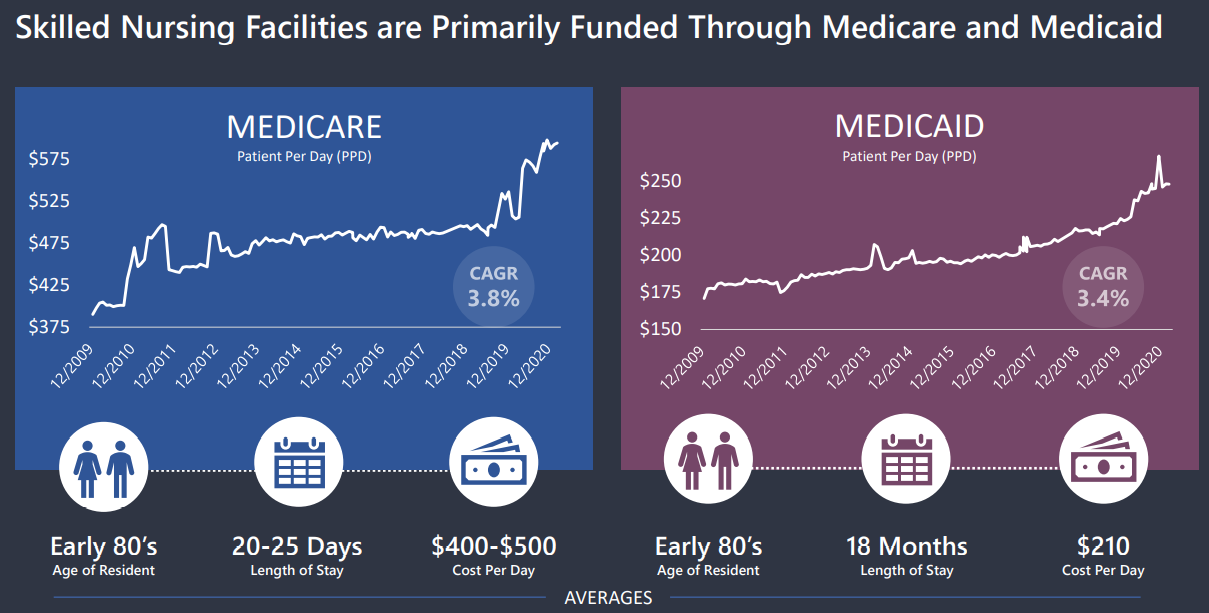

3. Government Support: Government support, through Medicare and Medicaid are another pro (and con, as we will discuss later). For example, in Thursday press release, CEO Taylor Pickett explained: viewpdf.aspx (omegahealthcare.com)

“many operators continue to rely on federal and state government support. While an additional allocation of federal support was announced in the third quarter…”

This has been a significant pro for Omega (versus other healthcare REITs that do not receive meaningful government support) because it has helped Omega survive the pandemic thus far.

source: Omega Healthcare

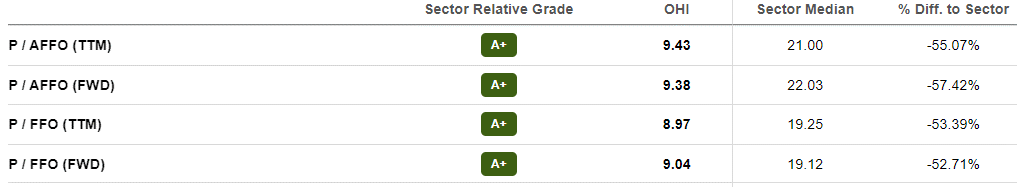

4. Temptingly Low Valuation: Omega currently trades a very tempting price multiples as compared to Funds from Operations.

However, there is a reason why these metrics are so low, and it is specifically because of the risks Omega faces, as we will review in the next section.

4 Cons

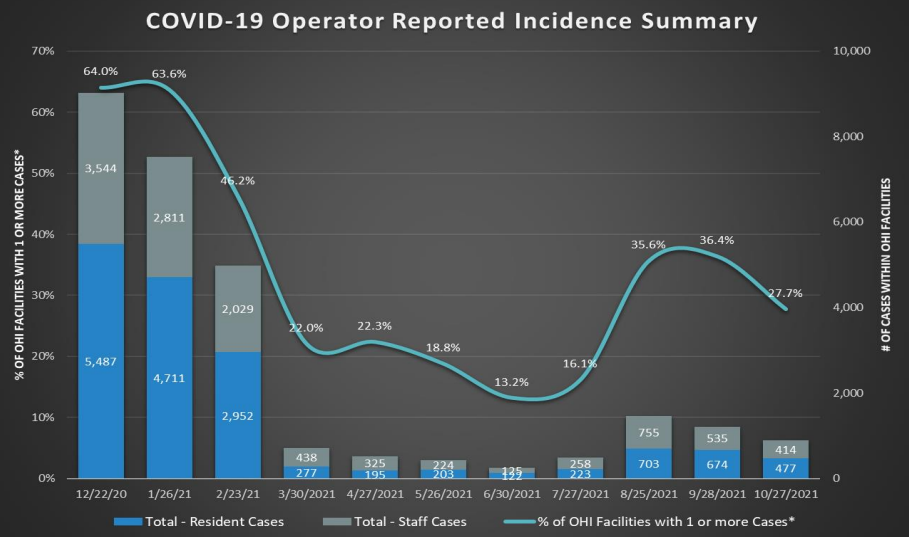

1. COVID-19 Challenges: The ongoing pandemic poses huge challenges and is a major con for Omega. For starters, on Thursday Omega reported that rent collections were up again (seemingly a good thing), however they are still significantly below pre-covid levels and this poses a big risk for Omega. As mentioned earlier, government support has helped Omega survive the pandemic thus far, but according to CEO Taylor Pickett, it’s not clear if this will be enough for some operators. In his words: viewpdf.aspx (omegahealthcare.com)

“While an additional allocation of federal support was announced in the third quarter, it remains to be seen whether this will be sufficient to fund operator obligations through this continuing pandemic.”

And as the following chart shows, incidences ae down, however the long-term impacts (such as patients reluctancy to enter SNF) is real and negative for the business.

2. Operators in Trouble: Another huge con for Omega are its struggling operators. For example, near the start of this report we saw the concentration and names of the top operators of Omega’s property, and it’s critical to note several of them are in serious trouble. For example, per the latest quarterly release: viewpdf.aspx (omegahealthcare.com)

Guardian – In October 2021, Guardian Healthcare (“Guardian”) failed to make contractual rent and interest payments under its lease and mortgage loan agreements. Guardian represents 3.7% of Omega’s third quarter 2021 contractual rent and interest. Omega is in active discussions to transition a significant portion of this portfolio to an unrelated third party but has not reached any agreement. Omega holds letters of credit from Guardian equal to $7.4 million.

and

Agemo – Agemo Holdings, LLC (“Agemo”) failed to pay contractual rent and interest to Omega from August 2021 through October. During August and September 2021, the Company recorded $8.4 million of revenue by drawing on Agemo’s letters of credit and through application of Agemo’s security deposit. Additionally, the Company recorded an aggregate provision for credit loss of $16.7 million on a $25.0 million working capital loan and a $32.0 million term loan with Agemo to reduce the value of these loans to the fair value of the collateral.

and

Gulf Coast – In June of 2021, Gulf Coast Health Care, LLC (together with certain affiliates “Gulf Coast”) stopped paying contractual rent under its master lease agreement for 24 facilities and the Company placed it on a cash basis of revenue recognition. In the third quarter, the Company recorded $7.4 million of revenue related to Gulf Coast through application of its security deposit and based on Omega’s ability to offset its uncollected contractual rent against the interest and principal of certain debt obligations of Omega. On October 14, 2021, Gulf Coast commenced voluntary cases under chapter 11 of the United States Bankruptcy Code. The Company has entered into a restructuring support agreement with Gulf Coast and has agreed to provide up to $25 million in senior secured debtor-in-possession financing, subject to certain conditions, to provide liquidity and assist with the transition of operations in the Company’s 24 facilities.

These business are at risk of bankruptcy. And even though Omega has successfully navigated operator bankruptcy and dissolution in the recent past (for example Orianna and Daybreak) these existing operators are a big risk.

3. Dividend Coverage Ratios Misleading: In Thursday’s release, Omega noted that encouraging FFO and Funds Available for Distribution (FAD). However, in reading the fine print, it is important to note, according to Pickett:

“Although we reported strong third quarter adjusted FFO and FAD, these results include approximately $16 million of revenue recognized by applying security deposits, letters of credit and collateral to Agemo and Gulf Coast’s contractual obligations. When this collateral is exhausted and if these tenants continue not to pay rent, we expect that this would reduce our near-term adjusted FFO and FAD financial results.”

At best, these numbers (which are non-GAAP numbers) are at risk; and at worst, they are flat out misleading.

4. Medicare and Medicaid Pressure: We noted earlier that government financial support was a pro for Omega. However, there are two sides to this coin. There is constant pressure from government to slow the growth rate of entitlement spending, and this puts pressure on Omega’s operators and ultimately Omega’s business.

Conclusion:

Omega is in trouble. Your first clue should be the elevated dividend yield and the depressed valuation multiples. And by looking under the hood of this latest earnings release, we get a clearer picture of why (i.e., COVID has exacerbated operator challenges).

In our opinion, if you are looking for a safe income investment, Omega is not for you. Rather, if you are a deep contrarian willing to take on very significant risks, then you might consider investing in Omega. As such, we've ranked many big-dividend REITs ahead of Omega in our new report: Top 10 Big-Dividend REITs. But most importantly, before you invest in anything, make sure you know your own personal goals and risk tolerance, and then select only opportunities that meet your specific needs. Disciplined, goal-focused, long-term investing is a winning strategy.