FuboTV is a “sports first” streaming platform with a very high growth trajectory and a large total addressable market (i.e. lots of room to run). Specifically, it is benefiting from the the secular decline in traditional TV, the shift to connected TV advertising, and the potential growth in online sports wagering. This report reviews the health of the business, growth prospects, valuation, risks and concludes with our opinion on investing.

Overview:

FuboTV Inc. (FUBO) is a “sports first” TV streaming platform that offers subscribers access to live sporting events, news and entertainment content in the US as well as in Canada and Spain. The company was originally founded as a soccer streaming service in 2015 and rapidly evolved into a live TV streaming platform with more sports, news and entertainment channels than any other live platform. In April 2020 it merged with Facebank to create a leading “sports first” cable TV replacement service by combining its direct-to-consumer live TV streaming with FaceBank’s technology-driven IP in sports, movies and live performances. Today fuboTV offers a wide variety of premium sports and entertainment content featuring 100+ TV channels and tens of thousands of live sporting events.

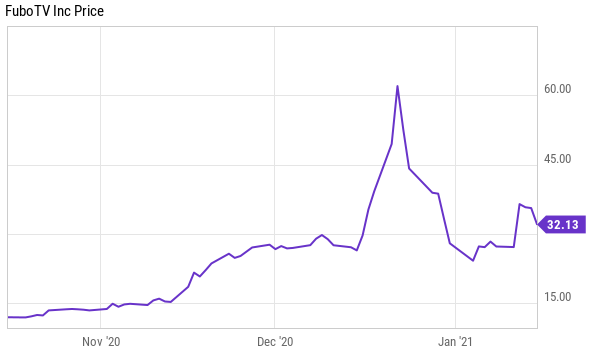

In October 2020, FUBO raised $183 million through a public offering of shares on the NYSE. Since then, the share price has seen significant volatility, due to its business fundamentals as well as certain external market factors in play.

Massive Addressable Market

As per the company, FUBO sits at the intersection of three mega trends, including:

A secular decline of traditional TV viewing: While traditional PayTV models (e.g. cable, satellite) still account for most of the ~$226 billion global PayTV services market (for 2019, as per Grand View Research), over-the-top (OTT) viewing has been rapidly becoming a mainstream behavior due to better viewing experience and affordability. This creates significant opportunities for virtual Multichannel Video Programming Distributors (vMVPD) such as FUBO.

For perspective, the average OTT viewing hours per month (per cord-cutting and cord-never households in the US) was already about 83 hours in May 2019 (as per Comscore). And OTT has increased further with the growing number of households that watch OTT daily (50 million at the end of May 2020, as per IAB), and as a result of the Covid-19 pandemic. vMVPDs contribute the second largest portion of streamed hours after major OTT players like Netflix (NFLX), YouTube (GOOGL), Hulu and Amazon (AMZN), which make up over three-quarters of time spent streaming OTT.

The shift of TV advertising dollars to connected TVs (i.e. advertising on streaming platforms): As consumers spend increasingly more time viewing streaming content, advertisers have been allocating more dollars away from advertising on traditional TV to streaming services. Substantiating this fact is the 25.2% growth in connected TV (CTV) advertising spend in the US in 2020 (as per eMarketer), and the promising forecasts, whereby 50% of advertisers will increase their advertising spend on CTVs in 1H 2021 (as per Verizon’s survey on digital advertisers). Also, streaming currently attracts only 5% of total TV advertisement spending, while its accounts for 15% of total TV hours viewed. This creates an additional opportunity, estimated to worth over $10 billion (on top of the ~$5 billion advertising spend on streaming platforms), as advertising spending rises to levels commensurate with the current share of viewing hours.

Online sports wagering: FUBO believes its “sports first” product offering is well suited to facilitate sports wagering in the future as a natural extension of its sports content. Sports wagering presents a large and growing market opportunity. The global online sports wagering market was estimated to be approximately $70 billion in 2019, but saw massive decline in 2020 as a result of the pandemic (as per H2 Gambling Capital). Nonetheless, the US online sports betting market is expected to lead the global market’s growth in 2021 and beyond as sports betting become legalized in more states in the US.

Altogether, these trends have created massive market opportunities for FUBO to address, presenting it with a significantly long runway for growth.

Sports Content Mix is a Key Competitive Differentiator

FUBO provides its subscribers with the most sports content options as compared to its competitors. The company has over 50,000 sporting events on its platform, and is getting average household subscribers to watch them for over 120 hours per month. It is the only vMVPD to stream over 130 live sports events in 4K, and subscribers can also watch up to four live streams simultaneously through its recently updated Multiview feature on Apple TV (AAPL). It also has content partnership with Disney (DIS) for the streaming of sports events on ESPN and ABC to its subscribers. Also, it offers add-on storage on Cloud DVR through which subscribers can watch any saved sports content later. All of these create a highly differentiated platform that enhances FUBO’s competitive positioning in the large and rapidly growing content streaming market.

Rapid Growth, Improvement in Operating Metrics

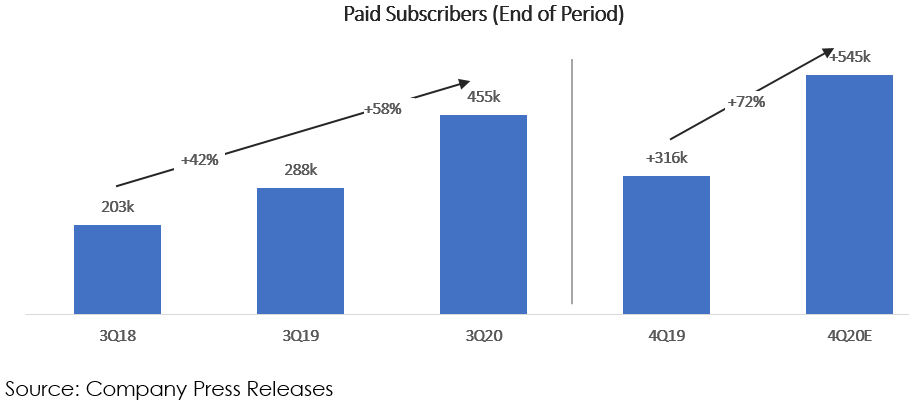

FUBO generates revenue from subscriptions and advertisements on its platform. Since its inception, it has seen rapid growth in its paid subscriber base and consequently in its revenue. As of 3Q20, the company generated about 88% of its revenue from subscriptions and 12% from advertising. While advertising is a small part of the total revenue, its growth (+153% y/y in 3Q20) has been outpacing subscription revenue growth (+64% y/y in 3Q20) by a huge margin. This partially reflects the secular shift of advertisers from advertising on the traditional pay-TV models to online streaming platforms.

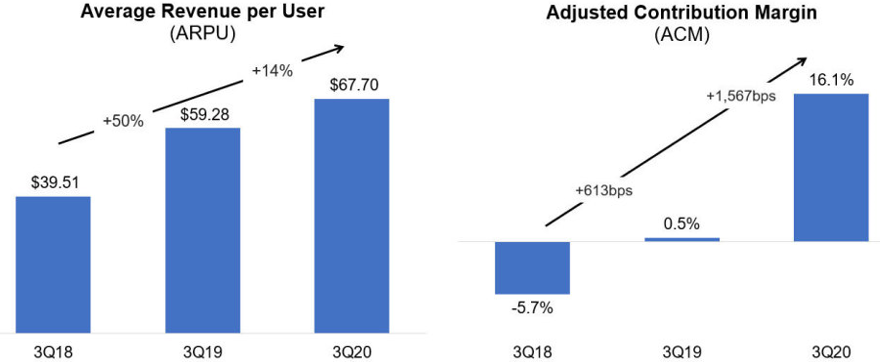

FUBO’s average revenue per user (ARPU) was $67.70 in 3Q20, and included advertising ARPU of over $7.50, which was ahead of its expectation of $6.50. It estimates its long-term opportunity from advertising is roughly about $20 per user per month as it monetizes its growing subscriber base through investing in data and advertising technology and productizing the data on its platform. This bodes well for FUBO from a long-term perspective as increasing advertising revenue will be a key factor that will help drive its profit margins, which are presently in the negative territory, as is typical with almost every young company in its growth phase.

Source: 3Q20 Press Release

While investing in technology and subscriber acquisition will negatively impact profit margins in the near-term, it will have a highly positive impact on long-term profitability and value. For example, the recent high growth in advertising revenue has played a key role in the company’s growth in adjusted contribution margins from 0.5% in 3Q19 to 16.1% (10.5% adjusted for one-time items) in 3Q20.

Contributing further to margin improvements (from advertising growth on the platform), strong attachment rates (on value-added services such as cloud DVR storage and the ability to stream on multiple devices) will also help the company improve its margins over time.

Recently, FUBO announced preliminary 4Q20 revenue and subscriber results, which are significantly ahead of its previous outlook. The company anticipates 4Q20 revenue to be between $94-$98 million, up 77%-84% y/y, and paid subscribers at 2020 year-end to exceed 545k, up 72% y/y (this implies a solid 90k+ new subscriber adds during the quarter) against prior 4Q20 revenue guidance of $80-$85 million and 500,000-510,000 subscribers at year end.

Accelerating Online Sports Wagering Entry

As part of its long-term strategy, FUBO intends to expand into fantasy league free-to-play games and then expand into sports betting. As a first step, in December 2020 FUBO acquired Balto Sports, a company that develops tools for users to organize and play fantasy sports games. FUBO plans to leverage Balto’s content automation software with its own proprietary technology to launch a free to play standalone gaming app, available to everyone, by the summer of 2021, and later integrate it directly into fuboTV.

Furthering the strategy, last week FUBO announced its intent to acquire Vigtory, a sports betting and interactive gaming company. The acquisition gives FUBO access to Vigtory’s sportsbook platform, and its pipeline of market access agreements (for example, it already has a deal secured in Iowa through Casino Queen). FUBO plans to leverage the Vigtory and Balto acquisitions to launch a sportsbook app and integrate it into its live TV streaming platform to provide an integrated viewing and wagering offering.

In combination, these acquisitions have significantly advanced FUBO’s push into online sports wagering, and once its service launches (which we expect to be toward the end of 2021 or early 2022), it will have a new revenue stream. Also, FUBO will be able to drive significant operational synergies as the sports wagering service can leverage a lot of the existing sports streaming content on the platform, as well as the subscriber base, thereby also helping to improve its profitability, going forward.

A Focused Management Team

FUBO is led by its Co-Founder and CEO David Gandler, a broadcasting and cable industry executive who was named in the Goldman Sach’s “100 Most Intriguing Entrepreneurs” (2019), Variety’s “Dealmakers” (2019 and 2020) and Broadcasting and Cable’s “Power 100” (2017) list. He brings over two decades of experience having worked with companies such as Scripps Networks, Time Warner and NBCUniversal. He has been highly instrumental in building a strong team targeted at achieving the company’s longer-term growth targets. For example, in June 2020, he brought in the seasoned media and digital sales and advertising executive, Diana Horowitz, to lead the advertising business of FUBO. And with the recent acquisition of Vigtory, David has added Sam Rattner and Scott Butera to FUBOs team to accelerate its sports wagering market entry. While Sam brings the experience of developing and integrating sports betting content and technology, Scott brings interactive gaming experience with his prior stints in MGM Resorts and other entertainment and gaming businesses.

FUBO’s other Co-Founder is Alberto Horihuela, who acts as its Chief Marketing Officer and is responsible for driving the company’s overall marketing vision, from brand positioning to subscriber acquisition, engagement and retention. Prior to founding FUBO, Alberto was the head of Latin America for SVOD service DramaFever, which was later acquired by Softbank and is a part of Warner Bros. He had also co-founded Primerad Network, a digital video ad network, and was named in the Multichannel News “40 Under 40” list in 2016.

In addition to the Co-Founders, the company’s management team boasts of executives who bring decades of media, cable and broadcasting industry experience and have a demonstrated history of leading an organizations’ growth. The team’s collective efforts have helped FUBO quickly evolve into the leading “sports first” vMVPD platform that it is today.

Valuation

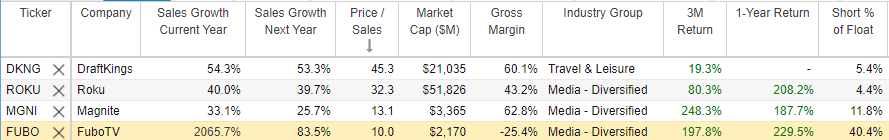

As compared to its high revenue growth rate and large total addressable market, FUBO remains relatively inexpensive. However, this is a young company in a nascent industry and will inevitably face high volatility and uncertainty as the industry and the business evolve. For a little perspective, here is a look at FUBO’s expected sales growth rates for 2020 and 2021, plus its price-to-sales ratio.

And while the 10x price-to-sales is encouraging versus the very high growth rate, this is still a business with negative gross margins (as described) and a long-way to go in terms of maturing and expanding. What is most encouraging about FUBO (aside from the high growth rates and large/expanding total addressable market) is the strong subscriber growth and high (and growing) average revenue per user (ARPU).

On a comparative basis, FUBO trades at a significant discount to Roku’s 32x price-to-sales ratio (ROKU is the only publicly traded TV streaming platform—other platforms such as Sling, Youtube TV, Hulu + Live TV, and AT&T TV are business units of other companies). And while Roku is a much more mature company and has better margins (which justifies its higher multiple), we believe FUBO’s trading multiples are also reasonable and have scope for further expansion if the company is able to successfully execute on its opportunities from the aforementioned megatrends, and on sportsbook/sports betting in particular.

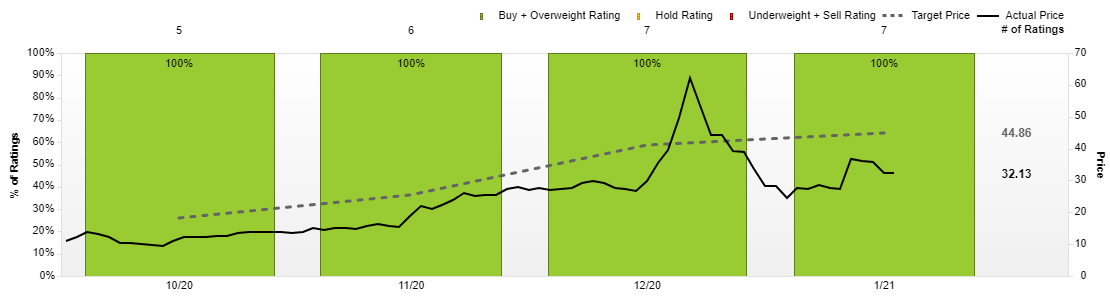

For a little more perspective, here is a look at the average price target and rating of the 7 Wall Street analysts covering FUBO and reporting to Factset.

source: Factset

These analysts unanimously rate the shares a buy, and believe they are significantly undervalued.

Additional Risks

Lack of Profitability: FUBO currently has a highly unprofitable business, with negative gross margins on its subscriptions. The company will need to continue investing in the business to run its operations and also to acquire subscribers, and as such it is highly unlikely to be profitable anytime soon. Also, the improvement of its profit margins is highly dependent on growth in advertising on its platform and a successful entry into the higher margin sports betting market.

Execution Risk: FUBO’s future is largely dependent on its ability to execute. Specifically, the company must operationally execute on the previously mentioned megatrends. These megatrends present immense opportunity for growth, but there is significant risk to the business if the company does not successfully execute.

Conclusion

FUBO is a young high-growth business with immense expansion opportunities. Megatrends (such as a secular decline in traditional TV, a shift to connected TV advertising and online sports wagering) all make the long-term growth potential incredible. However, FUBO faces significant execution risk, uncertainty and share price volatility. If you are a disciplined long-term investor with a high tolerance for uncertainty and volatility, you might consider adding a few shares of FUBO to your portfolio. We currently have no position, but the shares are high on our “Disciplined Growth Portfolio” watchlist.