It’s not often that a tech company can successfully reinvent itself considering immense global competition in a rapidly changing marketplace. However, this report covers a semiconductor (chip) company, that has successfully turned itself around and has continuing powerful long-term price appreciation potential ahead. In this report, we take a detailed look at the business, the market opportunity, risks and valuation, and then conclude with our opinion on investing.

Overview:

AMD (AMD) was founded in 1969 and has since grown into a global semiconductor company with over 12,000 employees. It is listed on the Nasdaq under the ticker “AMD” and is headquartered in Santa Clara, California. Its products include Central Processing Units (CPUs) and Graphics Processing Units (GPUs) for desktops and notebooks, Accelerated Processing Units (APUs) that include both CPU and GPU on a single chip, System-on-Chip (SoC) that includes nearly all components of a computer (CPU, GPU, memory, and more) on a single chip, chipsets, processors for servers and processors embedded in casino gaming devices amd medical imaging devices, to name a few. AMD also develops tailored solutions to meet customer-specific needs by leveraging its existing CPU, GPU, and multimedia technologies.

The company’s customers include OEMs (original equipment manufacturers), Data Centers, Original Design Manufacturers (ODMs), other contract manufacturers, system integrators, and independent distributors. Sony Interactive Entertainment is the company’s largest customer accounting for more than 10% of FY 2019 revenue. On a geographical basis, in FY 2019, it derived nearly 26% revenue each from the USA & China, 12.5% of revenue from Japan, and the remainder from other countries. AMD’s trademarks include AMD, Athlon, EPYC, FirePro, FreeSync, Geode, Opteron, Radeon, Ryzen, etc.

The company operates under two reportable segments:

Computing and Graphics: Under this segment, the company offers microprocessors and chipsets for desktops and notebooks, GPUs for data centers and other electronic devices (including PCs), APUs, SoCs, and chipsets. It also provides development services and licenses a portion of its IP portfolio. GPUs can be discrete or integrated into the company’s APUs (generally used in notebooks) & SoCs. The company also offers: enterprise-class solutions for PCs (AMD PRO series processors) to meet the performance and security requirements of commercial clients; professional graphics products (AMD Radeon Pro series) to meet requirements of 3D designers, architects and engineers; Data Center graphics (AMD Radeon Instinct) for application in data centers to improve flexibility and performance. The Computing and Graphics segment accounts for more than 2/3rd of the company’s revenue and delivered an operating margin of 23% in Q3 2020.

Enterprise, Embedded, and Semi-Custom: Under this segment, the company offers embedded and server processors, development services as well as semi-custom products designed to meet a client’s specific requirements. AMD’s server processors include AMD EPYC series processors (for Data Centers) and AMD Opteron X and A-series processors (for personal and small business needs). Its embedded processors are used to address computing requirements for medical imaging devices, casino gaming machines, and networking, security, storage systems. The company’s semi-custom SoC products have been used in the past to power some of Sony’s PlayStations and Microsoft’s Xbox gaming consoles. This segment delivered an operating margin of 12.4% in Q3 2020.

Xilinx Acquisition: Please note that recently the company announced that it entered into a definitive agreement to acquire Xilinx (XLNX) in an all-stock deal valuing Xilinx at an enterprise value of $35B. The acquisition is expected to complete in 2021 subject to shareholders' approval. Post-acquisition Xilinx shareholders will hold 26% shares in AMD. Xilinx is a provider of adaptive computing solutions and is the inventor of Field-Programmable Gate Array (FPGA) which is an integrated circuit that can be used to program chips for a desired workload. It also invented programmable SoCs. Xilinx is the market leader in FPGA and derives nearly 77% of its revenue from it while the remaining revenue comes from SoCs.

Large addressable market

The company has multiple factors fueling its industry growth. An increasing number of endpoint devices like tablets, smartphones, PCs, and other embedded devices as well as the growing use of accelerators in Data Centers (CPUs, GPUs, FPGAs, etc.) along with a vibrant gaming industry are all important business drivers for the company going forward.

The Data Center accelerator market is expected to witness one of the fastest growth rates at nearly 50% CAGR from $1.6B in 2017 to $21.2B in 2023 as per a report from MarketsAndMarkets.com. This growth is driven by increasing cloud adoption and the need to efficiently manage high-performance computing workloads as well as enhance machine learning and deep learning capabilities. The microprocessor market is expected to grow at a CAGR of 4.1% from $83.3B in 2019 to reach $115B in 2027. This growth has been further propelled by work from home and e-learning initiatives driven by COVID-19.

The company had an addressable market of $79B which has now gone up to $110B with the acquisition of Xilinx. This consists largely of Data Center and PC market opportunities. Xilinx’s strong portfolio of FGPA & adaptive SoC products for the embedded segment (with application in automotive, aerospace and defense, for example.) and data centers has led to expansion in the company’s addressable market.

Acquisition of Xilinx a gamechanger for AMD

Xilinx is a far more profitable and cash flow generative business as compared to AMD’s existing business. Below is a comparison of AMD and Xilinx on several financial metrics:

We also expect the combined company to have a more diversified revenue stream that would bring more revenue stability. Moreover, as per management, the acquisition is expected to result in synergies of $300M on annualized basis within 18 months due to lower operating cost and COGS which would further boost the bottom-line. The combined company’s dominance would increase in the data center market with AMD’s computing solution (CPUs & GPUs) and Xilinx’s programmable/customizable solutions (FPGAs). AMD would also benefit from Xilinx’s strong presence in 5G communication infrastructure, automotive, industrial, aerospace and defense, and other markets that would allow it to cross-sell and up-sell its product offerings. Additionally, strategic integration by combining AMD’s solution with Xilinx’s offerings can also lead to additional value creation for customers. For example, integrating AMD’s microprocessor & GPU with Xilinx’s accelerators, software stacks. Besides that, Xilinx would also broaden AMD’s technological capabilities by bringing in more talent and by adding an additional 4,800+ patents to its portfolio.

Transformational leader - Lisa Su

Lisa Su became the President and CEO of AMD in October 2014 and is responsible for turning around the company from when it was on the verge of bankruptcy with losses and debt piling up. It has now become one of the most innovative companies with a rising market share.

The semiconductor industry has a long product lifecycle therefore decisions taken by management on technology enhancements and product development 3-5 years back are now coming into play. Under Lisa’s leadership, the company shifted its focus more to specific products where AMD had a relative advantage and less on non-core products such as chips for smartphones. The company also bet on “where the future is going” and therefore focused on high-performance processors and data center technology. Other areas where the company increased its focus include microchips for gaming consoles, virtual reality, among others. Lis also brought large well-known brand names (Google (GOOGL), Microsoft (MSFT), Amazon (AMZN), Twitter (TWTR)) onboard in order to help validate the company’s products.

“My mantra to the team was focus on great products, our most important customers, and just simplifying everything that we do. And that has held with us for the past four and a half years.” – Lisa Su, President and CEO

Lisa Su has a B.S., M.S., and Ph.D. degree from MIT University and has over two decades of experience in the industry including 13 years at IBM. She was ranked second after Elon Musk in the Fortune Businessperson of the Year 2020 list and has received many other awards and recognitions in recent years.

Recapturing market share in its core product line while facing mixed trends in Graphics market

The company operates in a highly concentrated industry with cut-throat competition and rapidly changing technology. It competes with Intel (INTC) in microprocessors and CPU server markets and with Nvidia (NVDA) in graphics and GPU server markets. Both Intel and Nvidia are dominant players in their respective core markets.

The company has remained focused on delivering a high benefit to cost ratio to its customers. With the AMD EPYC series, the company is disrupting the Data Center market by delivering strong benefits to customers while keeping the cost low in order to capture market share. As per the company’s financial analyst day presentation, AMD derived 15% of 2019 revenue from Data Centers and is targeting over 30% revenue share to come from Data Centers product portfolio in the long run. AMD’s market share in the server chip market has gone up consistently since the launch of EPYC processors for Data Centers from less than 1% to over 10% in 2020.

Similarly, AMD has also been able to expand its market share in Desktops, Notebooks, and commercial markets with its Ryzen processors and Radeon graphic cards over the years. While the company consistently lost market share through 2016, it has again started to capture market share primarily from Intel with the company’s renewed focus on computing and therefore improving product line and brand building. Its market share in all CPUs market currently stands at 39.3%.

Moreover, as per CPU Benchmarks, the company has recently crossed Intel in the Desktop CPU market with a market share of 50.3%. Its market share in the laptop CPU market remains low at 19% but still significantly higher than the 8% market share it had in 2017.

While the company is firing on most cylinders, AMD has faced mixed trends in the discrete graphics market in the last 12 months as it saw its market share fall from 29% in Q2 2019 to 20% in Q2 2020. Having said that, despite market share loss to NVIDIA in this segment, AMD’s GPU shipment increased 8.4% from Q1 to Q2 2020. Additionally, the company is working on improving its product mix in this segment. AMD introduced Radeon RX 6000 graphics cards powered by RDNA 2 in October 2020 with improved performance and efficiency. This would help the company compete better with Nvidia.

Expanding & revamping product portfolio

The company is spending aggressively on product innovation and development. It has been investing over 20% of its revenue in R&D. We have seen multiple new product launches and enhancements in recent years. The major launches include the first AMD Ryzen processor and AMD EPYC processor in 2017 and collaboration with Sony (SNE) and Microsoft to launch gaming consoles (PlayStation and Xbox). It introduced next-generation Ryzen 5000 series processors with new Zen 3 core architecture (19% more Instructions Per Clock, and 24% better power efficiency over the previous generation). The company has also doubled the number of AMD-based business notebooks for major OEMs in the commercial market. AMD is also going to launch its 3rd generation AMD EPYC Milan processor series for Data Centers in Q1 2021 which would further improve its market share in the server processors market.

While the new Zen 3 architecture with 7 nm technology (for CPUs), RDNA 2 GPUs (for gaming), and CDNA accelerators (for data center) are expected to be growth drivers and market disruptor in the near-term, the company is also on track to introduce other disruptive technology by bringing in Zen 4 architecture with 5 nm technology, RDNA 3 GPU architecture & CDNA 2 GPU architecture by 2022.

Strong leadership and innovation, improved growth outlook

The company has experienced strong double-digit growth in recent years with revenue growing at a 3-Year CAGR of 19.9%. This is an incredible improvement relative to the first half of the decade when the company was facing declining revenue growth and losing market share. The company’s renewed focus and multiple initiatives by the management have led to improving top-line performance. The Data Center product line is expected to drive revenue further. and the improving product portfolio has been the key to improving market share and in turn high revenue growth. A COVID tailwind led to increased cloud adoption, digitization, and PC sales resulting in strong Q3 and YTD returns with revenue growing 56% and 42%, respectively. Strong demand for Ryzen and EPYC processors, and Semi-custom SoC products was seen in Q3 2020. The company has a long-term revenue growth target of over 20%. Continued product innovation and enhancement would help the company maintain this growth target.

Consistently improving profitability

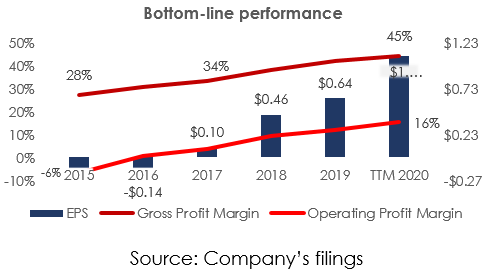

Along with growth in the top-line, the company also saw significant improvement in profit margins. As we can see below, AMD’s adjusted margins have consistently expanded in recent years while adjusted EPS has also gone up from -$0.54 in 2015 to $1.1 per share over TTM 2020.

The company expects to see further improvement. It has set a long-term target of over 50% gross margin and mid-20s operating margin. Higher gross margins are expected to be largely driven by an increasing share of the high-margin Data Center product line while increasing pricing power due to innovation would also add to margins. As discussed earlier in the report, margins are going to rise further with the acquisition of Xilinx.

Robust financial position to provide growth capital

AMD had a strong liquidity position of $1.8B in cash, cash equivalents, and short-term investments with total debt outstanding of only $0.4B as of the latest quarter. The company also generated strong cash flows with CFO of $517M and FCF of $297M YTD 2020. This provides the company with resources to fund investments in technology as well as acquisitions to improve its product portfolio and market position.

Valuation premium

AMD trades at a premium valuation with a Price-to-Sales ratio of 12.8 times as compared to its 5-Year average of only 2.0 times however the premium is justified due to substantial changes in the company’s growth outlook. In our view, the shares remain attractively valued considering the strong growth momentum and rapidly improving operating margins.

For a little more perspective, here is a look at the average price target and recommendation as per the 35 Wall Street analysts covering the stock and reporting to Factset.

As you can see, the analyst price targets tend to be near-term focused in recent years and simply follow the share price. In our view, AMD is dramatically undervalued by these chronically short-term-focused analysts that are not only not recognizing the transformed business deserves a higher valuation multiple, but the analysts process systematically ignores the mid-to-long-term—a timeframe where the company has a very large and growing market opportunity to continue growing rapidly.

Competitive Risks

AMD faces fierce competition from Intel and Nvidia in markets dominated by them. While we believe the company is well-positioned to capture incremental market share, more aggressive than expected competition from these major players may restrict AMD’s ability to expand its market share in the future.

Conclusion

AMD has delivered tremendous performance in recent years with its strong product portfolio, increasing market share, and successful re-entry into the data center segment. Further, AMD has also been able to cut its debt significantly and improve cash flows. Further still, the company has a strong and growing product portfolio, the Xilinx acquisition will be transformational, and Lisa Su is a visionary leader. Overall, we believe AMD shares have tremendous long-term price appreciation potential.