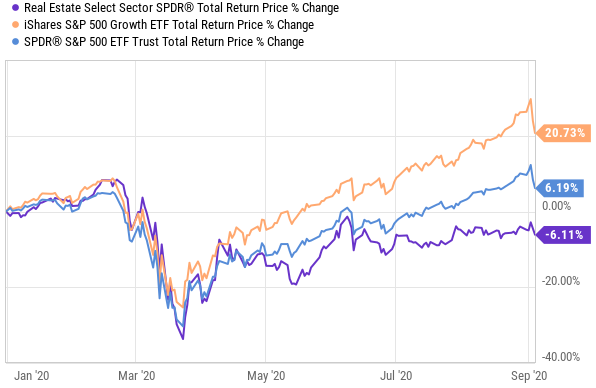

Over the last six months, Real Estate (XLRE) has been one of the worst performing sectors of the market, but that could be about to change. With the amazing growth stock rally starting to wobble, select REITs are looking particularly attractive as the world begins to get a better grip on covid. Obviously, the pandemic challenges are great and in many cases they add to the struggles of a secular demise in some brick-and-mortar commercial real estate. Nonetheless, select REITs are particularly attractive, and this report ranks our top 10 big-dividend REITs (5% yields and above), counting down from #10 to #1.

image source: yCharts

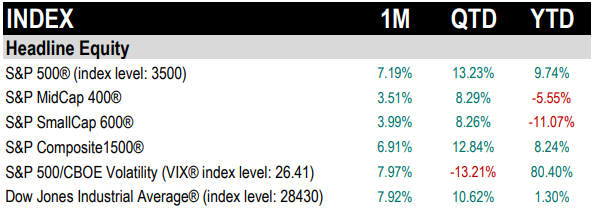

Before getting into the rankings, it’s worth considering the various REIT sub-categories because they face very different types of challenges (i.e. not all REITs are created equally). For a little perspective, the following tables show recent market performance by sectors (including Real Estate) as well as REIT performance by REIT sub-category.

image source: Standard & Poors

data source: StockRover as of 3-Sept-20

From a high level, you’ll notice that real estate has significantly lagged other market sectors (such as technology and consumer discretionary) as covid has been a major impact.

From a REIT sub-category perspective, one thing you’ll notice is that industrial REITs have actually performed relatively well, as even during covid, much online commerce still requires industrial real estate properties as an important part of the supply chain. This is why industrial REITs like East Group Properties (EGP) and Stag Industrial (STAG) have performed relatively well this year. Another sub-category of REITs that has performed well is data center REITs. These tend to be industrial REITs that house farms of servers that are an important part of many industries, including the many technology companies that have performed relatively well this year (considering they were less impacted by covid and have strong needs for cloud-based data). For example, data center REITs such as Digital Realty (DLR) and CyrusOne (CONE) have performed well this year.

On the other hand, you’ll notice that both Retail REITs and Hotel & Motel REITs have performed extremely poorly this year as non-essential shutdowns have had dramatic negative impacts on these businesses. Within our top 10 list, we have included at least one retail REIT as well as at least one mortgage REIT (another REIT sub-category that has been hit hard by the pandemic, as you can see in the table above).

Rather than just blindly buying REITs because their share prices have fallen (a bad idea), it’s important to understand the unique businesses and the factors and conditions that are impacting them. And with that in mind, here are our top 10 big-dividend REITs that we believe are worth considering for investment.

10. Brookfield Property REIT (BPYU), Yield: 11.5%

Brookfield Property REIT (BPYU) offers an 11.5% dividend yield that is hard to ignore. While clearly there are concerns given its exposure to malls and retail, we believe the backing of parent, Brookfield Asset Management (BAM), will help it weather the storm. BAM’s decision to fund BPYU’s tender offer is a vote of confidence in the business, and it also signals to investors that the current valuation may be a bargain. If you have a higher tolerance for volatility and risk in your portfolio, you may want to consider adding shares. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about investing. You can access our Brookfield report here.

9. CareTrust REIT (CTRE), Yield: 5.1%

For years, investors have chased healthcare REITs with tenants funded by “private pay” because they feared ongoing government pressure on reimbursement rates. However, in this pandemic, it turns out they had it all wrong. CareTrust (CTRE) is a “mostly skilled nursing facilities” healthcare REIT, and it has benefited from generous government support during this pandemic. And on top of that, the CEO claims COVID hasn’t been as economically devastating as narratives suggest. This article reviews the health of the business, valuation, risks, dividend safety (it yields around 4.8%), and concludes with our opinion on investing. You can access our CareTrust report here.

8. First Realty Investment Trust (FRT), Yield: 5.2%

Despite having just increased its dividend for the 53rd consecutive year, retail REIT Federal Realty Investment Trust (FRT) has been hit hard by the current pandemic. Conditions have started to improve (e.g. more tenants are re-opening and cash collections are increasing), but in order to succeed FRT will need to make smart capital allocation decisions and manage its liquidity carefully (its dividend payout ratio is near the high end of its historical range). This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion on whether FRT is worth considering if you are a long-term income-focused investor. You can access our First Realty report here.

7. Simon Property Group (SPG), Yield: 11.2%

Retail REITs have been among the hardest hit stocks during COVID19 lockdowns, and blue-chip Simon Property Group (SPG) has not been spared. Its dividend has been reduced significantly and its share price has fallen dramatically. Furthermore, its former Taubman Centers (TCO) deal, recent retailer buying spree and rumors of a deal with Amazon (AMZN), complicate matters further. In this article, we review the health of the business, valuation, risks, dividend safety, and conclude with our opinion about whether SPG is worth considering if you are a long-term income-focused investor. You can access our SPG report here.

6. Industrial Logistics Properties (ILPT), Yield: 6.1%

This small cap industrial REIT is well positioned to keep benefiting from its high exposure to ecommerce logistics. The dividend is very well-covered, and management remains highly confident. However, its relatively high leverage and exposure to one big risk in particular is important to consider. In this article, we review the business, dividend safety, valuation, and conclude with our opinion on why the company’s biggest risk may actually provide an additional boost to the share price as the economy emerges from the most challenges stages of the global coronavirus pandemic. You can access our ILPT report here.

5. The Geo Group (GEO), Yield: 17.3%

Mr. Market was already unfairly punishing this big-dividend REIT, but the recent market wide turmoil has made the price absurdly low and attractive. In this report, we analyze the company’s income profile, growth, dividend prospects and political risks. We conclude with our opinion on whether this big yielder is worth considering for a spot in your prudently-diversified, long-term, income-focused investment portfolio. You can access of full reports on GEO here.

4. Spirit Realty (SRC), Yield: 6.9%

Spirit Realty Capital (SRC) is a leading self-managed net-lease REIT that owns single-tenant commercial (mostly retail) real estate properties across the US. Investor sentiment turned sharply negative in February due to the Covid-19 outbreak, but the shares have experienced a marginal recovery in recent weeks. In this report, we consider the common shares, the preferred shares and the relative attractiveness of generating upfront income by selling out-of-the-money put options for investors fearing a second wave coronavirus sell off. In particular, we consider the business, Covid-19 impacts, ability to meet financial obligations, dividend and income prospects and finally conclude with our views on investing. You can access our SRC Report here.

3. W.P. Carey Group (WPC), Yield: 5.9%

WPC is particularly attractive considering management has been a sound steward of capital by simplifying the business model, lowering the cost of capital and growing the dividend. Further, this REIT may be poised to take advantage of current market distress thanks to its lower debt and the cushion it enjoys relative to debt covenants. If you are a long-term income-focused investor, this one is absolutely worth considering (we own it). You can read our recent WPC reports here.

2. Annaly Capital (NLY), Yield: 12.0%

Annaly is a mortgage real estate investment trust (mREIT) that invests primarily in residential mortgage backed securities (RMBS) but also in credits such as direct lending. The majority of the asset backed securities that Annaly buys are backed by US government sponsored enterprises (or GSEs) such as Fannie Mae and Freddie Mac or Ginnie Mae. That means these bonds have very limited default risk for all practical purposes. You can read our recent Annaly reports here.

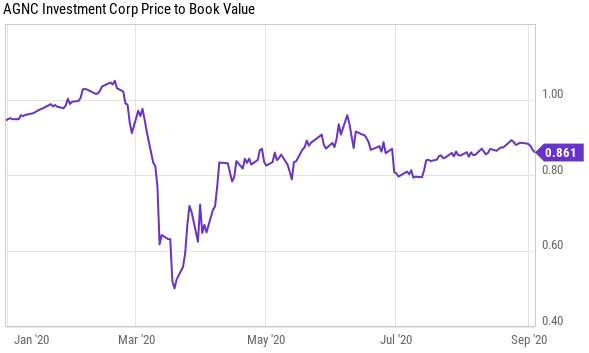

1. AGNC Investment Corp (AGNC), Yield: 10.4%

AGNC is an internally-managed mortgage REIT that invests predominately in Agency MBS. And this is one of the main markets the Fed has worked hard to support this year. Agency securities are issued by government-sponsored entities (e.g. Fannie Mae, Freddie Mac and the Federal Home Loan Bank), and they are the highest credit quality debt instruments after treasuries. AGNC owns predominately Agency MBS. The combination of high yield, discounted price and government backing of its main holdings, make AGNC a buy. You can read our previous reports on AGNC here.

Conclusion:

REITs have underperformed the rest of the market this year, and in many cases rightfully so considering the more dramatic impacts on some of their brick-and-mortar locations where social distancing is not possible and mandatory shutdowns have been implemented. However, not all REITs are created equally, and some are in a much better position than others—especially considering the covid pandemic is increasingly under control in many locations (knock on wood). From a purely contrarian and technical standpoint, REITs could be due for some relative outperformance as compared to the rest of the market, and in this article we have attempted to highlight the ones that are attractive to us.