This powerful consumer internet company operates a leading digital entertainment business as well as an e-commerce platform and a digital financial services operation in Southeast Asia. The company operates in some of the fastest growing economies in the world. And it is benefiting from the tailwinds of global “Stay-at-home” orders. Not surprisingly, the stock has rallied over 200% since the start of the year. In this report, we analyze the business model, competitive strengths, financial position and finally conclude with our opinion on the stock’s risk-reward (as well as an interesting options trade idea that generates attractive upfront premium income).

Overview: Sea Limited (SE)

Headquartered in Singapore, Sea Limited (SE) was incorporated in 2009 as Garena Interactive Holding limited. The company initially began as an online platform for people to discover and play online games, however, it also diversified into a digital financial services business in 2014 and an e-commerce platform in 2015. Later in 2017, the company changed its name to Sea Limited and went public. Sea Limited primarily focuses on emerging countries in the Southeast Asia region, namely Taiwan, Indonesia, Vietnam, Thailand, Philippines, Malaysia, and Singapore. Southeast Asia accounted for 63.4% of total revenue in FY 2019 while rest of Asia contributed 22.5% to the top-line. It is also exploring market opportunities in Latin America which now accounts for 13% of the business. Sea conducts its business operations through three segments:

Garena/Digital entertainment: Garena is the largest gaming developer and publisher in Southeast Asia by annual revenue. It also licenses and publishes games developed by third parties. Garena contributes 58% to the total business of Sea Limited. The revenue stream is highly concentrated with top five games accounting for almost all of the annual sales. It is also the company’s key cash generator with strong EBITDA margins. As of Q1 2020, Garena had 402 million Quarterly Active Users (QAUs), out of which ~9% were paying users.

Shopee/E-commerce platform: Shopee is the company’s mobile-centric online marketplace where buyers and sellers connect. It is Southeast Asia’s leading e-commerce platform in terms of GMV transacted and total number of orders processed. Shopee has a broad product category exposure ranging from toys, essentials to beauty products and electronics. The platform is monetized by charging transaction-based fees from sellers, offering paid advertising services and other value-added services to sellers. The company also buys inventory and sells directly to buyers on its platform. Shopee launched its services in Brazil in Q4 2019. The segment is incurring heavy losses currently as the company invests in establishing and growing its footprint. Shopee processed GMV of ~$20.3 billion and ~1.4 billion orders on a TTM basis.

SeaMoney/Digital financial services: This is the smallest segment of the company in terms of revenue contribution. Through SeaMoney, the company offers e-wallet services, payment processing and other financial solutions. It operates under several brands including AirPay, ShopeePay and ShopeePayLater. The company earns a commission from third-party merchants for e-wallet services. As a payment provider, this segment has strong synergies with rest of the company. With ShopeePayLater, the company also offers credit services to buyers on which it earns interest. Currently, it holds credit service license in Thailand and Indonesia.

In January 2020, the company announced that it had applied for digital full bank license in Singapore. In June 2020, as per an update from The Monetary Authority of Singapore (MAS), 5 retail bank applicants were shortlisted, out of which up to 2 retail licenses would be approved.

Large and expanding addressable market offers considerable ammunition for growth

Southeast Asia is one of the fastest-growing regions in the world. As per the company’s F-1 filing, the region’s real GDP is expected to grow at 2.1 times while the population is expected to grow at 1.6 times the growth rate in the US. Moreover, digital economy is expected to grow at an even faster pace given that out of the 585.3 million people in the region in 2016, only ~54% of the population had access to internet and only ~41% of the population had smartphones.

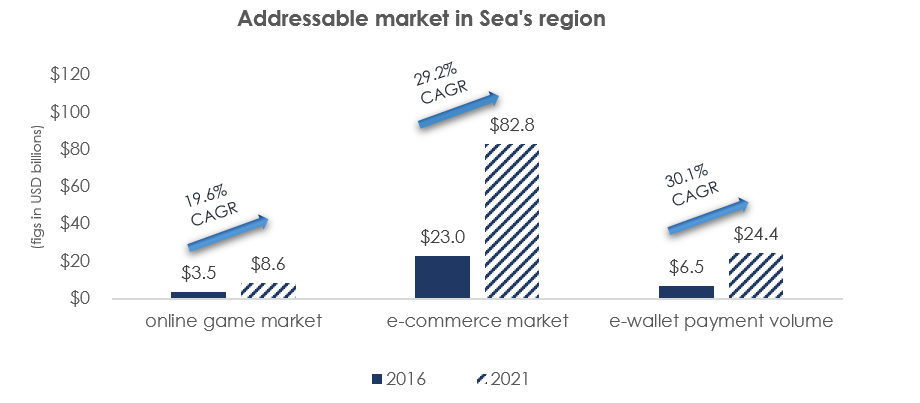

As per the company’s F-1 filing at the time of IPO, the online gaming market was $3.5 billion in 2016 and was expected to grow at a 19.6% CAGR between 2016-2021. Similarly, e-commerce was $23 billion in 2016 and was expected to grow at a CAGR of 29.2% between 2016-2021. Finally, e-wallet payment volume was $6.5 billion in 2016 and was expected to grow at a CAGR of 30.1% between 2016-2021. Please note that these forecasts were made before the pandemic and we believe that the magnitude of growth will see acceleration in the post-pandemic world.

Source: Sea Limited

Sea Limited also has attractive opportunities in the form of expansion into several untapped international geographies apart from its core Southeast Asian markets. In fact, revenue share from Latin America rose from 1.8% in 2018 to 13% in 2019 largely driven by company’s self-developed game, Free Fire in that region. Free Fire is available in over 130 markets globally.

COVID-19: a significant catalyst for digital transformation worldwide

It is well known how positive the unintended consequences of COVID-19 have been as it relates to revenue trends of a few industries including gaming and e-commerce. Sea’s offerings gained momentum as a result of the ‘stay at home’ economy following the outbreak. Garena’s self-developed game, Free Fire hit a record high of 80 million daily active users (DAUs) in April 2020, which is more than double the previous year.

In terms of e-commerce, the company introduced a feature called “Shopee for home” to address the rising demand of users for essential goods to be delivered directly at their doorstep. Moreover, COVID-19 has also resulted in more sellers and brands joining the e-commerce platform thus improving its value proposition for buyers on Shopee.

“We also on-boarded thousands of new merchants to help them migrate their business online during this difficult time and overcome the significant logistical and operational challenges imposed by the lockdown. As Shopee becomes an increasingly vital part of the retail landscape in our market, more and more of the world’s top brands are building up their partnership with us.” – Q1 earnings call, Chairman and CEO, Forrest Li

As per a study conducted by Bain and Facebook, based on a survey of 8,600 digital customers in six Southeast Asian countries during the year, it was found that 47% of the people had cut down their local in-person purchases while 30% had increased their e-commerce purchases. 45% had boosted their online grocery shopping spend while 84% of the people surveyed had explored new apps. Moreover, 83% of the people shopping online said that they would continue spending online at an elevated level even after the crisis subsides.

While a portion of this momentum will normalize on the other side of the pandemic, we believe some of the consumer habits have been altered forever to the benefit of Sea.

Gaming business – a steady grower that funds additional growth capital needs

The gaming segment has been a consistent performer over the years and generates strong margins. Revenue from the digital entertainment business has grown at a 3-Year CAGR of 51.3% and 5-Year CAGR of 48.9%. This strong growth has been fueled by consistently expanding user base along with increased monetization of the platform. The number of paying users as a percentage of total users has increased from 5.7% in Q1 2018 to almost 9% in Q1 2020.

EBITDA margins (TTM) stood at 58% relative to 40% in FY 2018 and 21% in FY 2017. Gaming earnings power is helping to offset losses stemming from investments in the e-commerce and payments side of the business. The company is also seeing a positive margin mix shift as a larger percentage of business is coming from self-developed games that command higher margins. In January 2020, Sea acquired Phoenix Labs, a Canadian gaming development studio with over 100 developers that would further enhance Sea’s in-house gaming development capabilities. With this acquisition and the success of its first self-developed game, Free Fire, the company is likely to build a larger pipeline of self-developed games in the future. Additionally, Garena allows gamers to do live-streaming, chat with their friends, view and share their gaming stats and win in-game prizes with spin wheels. This strategy allows Garena to increase user engagement and add user stickiness to its platform.

Please note that Garena has a strong backing from Tencent (TCEHY), the largest game publisher in the world. Tencent held 25.6% of Sea’s total ordinary shares as of March 15, 2020. We believe this strategic partnership has a net positive impact as it strengthens Garena’s ecosystem and also provides the company with broad consumer data insights. In November 2018, Garena entered into an agreement with Tencent which provided Garena with the right of first refusal to publish Tencent’s mobile and PC games in Sea’s core region (excluding Vietnam). Well-known examples of games owned by Tencent and published by Garena in its region include Arena of Valor, and League of Legends, among others.

Please note that President Trump recently issued an executive order banning transactions with WeChat and TikTok in the US. In terms of Sea, we believe the exposure is minimal as US is not its focus market.

E-commerce platform seeing hyper growth and has strong synergies with digital financial services business

The company’s e-commerce platform, Shopee has seen solid growth in recent years, up from $17.7 million in adjusted revenue in FY 2017 to $1,107 million in revenue over trailing 12 months. E-commerce now accounts for 34% of the total adjusted revenue as compared to just 3.2% in 2017. The segment is expected to gain greater prominence as the e-commerce market offers even more growth opportunities for Sea limited as compared to the online gaming market.

The company has been investing heavily in the e-commerce business in order to tap the growing market. In fact, Shopee became the region’s largest e-commerce platform in Q4 2019. Growth is not expected to be limited to Southeast Asia. The company also entered Brazil in Q4 2019. As the company expands in Southeast Asia and explores more untapped markets, we expect this business to significantly outperform the gaming business in terms of revenue growth.

As the region’s largest e-commerce player, the company will benefit from the strong network effect and economies of scale as the business grows and matures further. While competition is intense from Alibaba-owned Lazada as well as Qoo10 in the region, we believe there is ample space for the major players to grow.

The company also has been investing in its digital financial services business. Sea processed over $1 billion in mobile wallet total payment volume in Q1 2020 and had 10 million+ Quarterly Paying Users (QPUs) for mobile wallet services during the quarter. Moreover, in order to address the rising demand for an efficient digital banking system for millennials and SMEs in Singapore, the company had applied for a digital retail banking license as discussed earlier. If the company receives the license, it will further strengthen Sea’s digital ecosystem.

The digital financial services segment is also an enabler of growth at Shopee. SeaMoney enables Shopee users to make payments online through its e-wallet services or even buy goods on credit through ShopeePayLater. The digital financial services business was started in 2014 with the purpose of enabling gamers to pay easily for in-app purchases through e-wallet services. It has now become an integral part of the business by enabling digital payments on both Garena and e-commerce platforms. In Indonesia, over 40% Shopee orders in April 2020 were paid using SeaMoney’s e-wallet services.

Profitability suppressed as the company is in investment mode

Like most high growth tech companies, Sea is prioritizing market penetration and growth over near term profitability. It is investing heavily in expanding its capability in all its businesses to build scale and competitive edge.

As a result of the investments, the EBITDA margin of the e-commerce business may not turn positive anytime soon as the company focuses on expanding its user base. However, please note that as the size of the e-commerce business has grown, EBITDA loss margin has improved from -1,566% in 2017 to -96% as per TTM financials.

As evident in the chart below, there has been a massive improvement in the digital entertainment business while EBITDA losses from other segments have widened driven by heavy investments.

Robust financial position with ample liquidity

The company is net debt-free and had strong liquidity position of ~$2.6 billion in cash & cash equivalents as of the last quarter. Sea announced an issue of $1 billion convertible notes in May 2020 which would further improve its liquidity position.

Sea had positive CFO in FY 2019 for the first time in last 5 years driven by impressive cash flows from digital entertainment business and increased monetization of e-commerce platform however FCF was still negative at -$177.2 million during the year.

Valuation leaves little room for error

The stock is trading at a massive premium relative to its own history at the moment. The valuation has expanded primarily after the ‘stay at home’ stocks saw heightened investor interest. The company trades at a premium to most of its peers. Only MercadoLibre comes close but it is important to state here that MercadoLibre has a stronger competitive position in its core market and is also far ahead of Sea in terms of maturity of the business model.

Risks:

Competitive e-commerce market: The company faces competition from Qoo10 and Alibaba’s Lazada (BABA). Amazon (AMZN) and other global players could also be contenders in the future. Aggressive competitive activity could delay time to profitability in the e-commerce business.

Inability to consistently produce hit titles in the gaming segment: Since digital entertainment revenue is concentrated with the top 5 games accounting for 90%+ of revenue, it is essential for the company to maintain its gaming pipeline at all times. However, growth in e-commerce and payments will help reduce reliance on gaming segment in the future.

High regulatory barriers in Digital financial services business: The financial services business requires the company to meet stringent regulatory requirements. And an inability to do so could lead to loss of business as happened in the case of AirPay when it was blocked from allowing e-wallet users to top-up cash at AirPay counters in Indonesia.

Conclusion:

The company has a large addressable market and is investing in its business to capitalize on the opportunity. The market’s expansion as well as the company’s initiatives have led to strong revenue growth in recent years. Having said that, the company is still in its early innings in the e-commerce and payments business with the need to invest in these businesses to make them scalable and more competitive. Given the work that still needs to be done coupled with rich valuation at the moment, we think the risk reward for investors at this time is subpar.

However, if you are inclined, you may consider selling out-of-the-money put options to generate attractive upfront income now and to also give you the chance of owning the shares at a significantly lower price (if they get put to you before expiration). The upfront premium income available in the options market is quite high considering the shares are quite volatile and the company announces earnings next week (expected pre-market on 18-Aug). For example, the August 21st puts with a strike price of $110 are interesting considering that is over 10% out-of the money and the premium income is over 2.5% for a 1-week position (on an annualized basis—that is a very large amount of premium income).

If you are bold (and you’d be comfortable owning SE for the long-term), you might consider this trade. It’s an interesting way to play an attractive rapidly-growing business with a very large total addressable market.