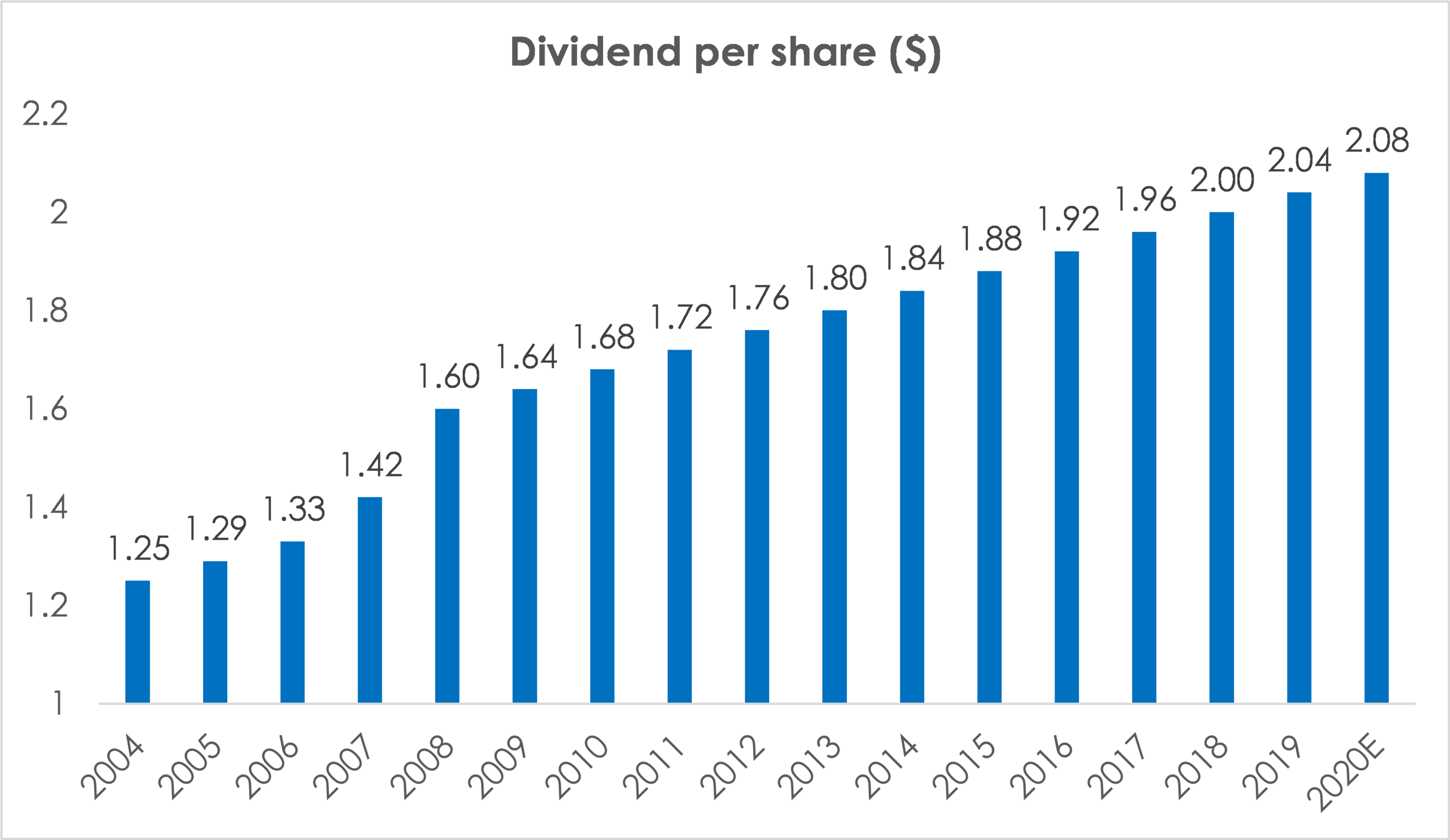

AT&T’s (T) share price has declined dramatically this year (due to the global Covid-19 pandemic), similar to declines when the Tech Bubble burst (early 2000’s) and during the Financial Crisis (2008-2009). However, AT&T’s dividend has continued to steadily rise for over 36 consecutive years (it’s a dividend aristocrat), and the current yield (over 7%) is the highest it’s been during the past two decades. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about investing in AT&T.

Price History:

For a little perspective, here is a look at AT&T’s dividend and share price during big historical market declines, including the Tech Bubble bursting (early 2000’s), the Financial Crisis (2008-2009) and the current global Covid-19 pandemic (2020):

One important takeaway here is that even through the share price has been volatile during historical (and current) market declines, the dividend has kept steadily growing, thereby providing some outstanding “buy low” opportunities. But is this current dramatic market decline different? Let’s take a closer look at the business and the financials in the paragraphs below.

Overview:

AT&T (T) offers traditional telecom services including wireless, Internet, and cable television. It also offers DirecTV satellite television. AT&T conducts most of its business in the US, although it does have a meaningful presence in Latin America. AT&T generated ~$181 billion in revenues in 2019 and $41.6 billion in Q220. It primarily conducts its operations through three business segements.

Communications (~81.9% of revenue): this segment provides mobile, video, internet and other communications services to more than 155 million subscribers in the US.

WarnerMedia (~16.6% of revenue): this segment includes Turner, HBO and the Warner Bros studio. It develops, produces and distributes feature films, television, gaming and other content. AT&T entered this business with the acquisition of Time Warner in 2018.

Latin America (~2.9% of revenue): this segment provides entertainment and wireless services in 12 countries outside of the US.

AT&T Just recently reported decent Q220 numbers in-line with its earlier revenue guidance and expectations. Worth noting, the covid pandemic did impact WarnerMedia as social distancing policies extended and movie releases were postponed. The economic hardship among consumers due to the pandemic could accelerate the video cord cutting trend as well. The launch of HBO Max was a success and it hit all the targets laid out by the company. Management has confidence in its ability to generate cash flow given the resiliency of its wireless services, broadband and business connectivity operations.

Dividend: Secure, Backed by Solid Free Cash Flow

AT&T has increased its quarterly dividend for 36 consecutive years now. The most recent dividend of $0.52 per share results in annualized dividend of $2.08 and a yield of over 7.0%. While the pandemic has created economic uncertainty and is likely to adversely impact business operations, AT&T noted that the dividend will be safe. The dividend is backed by solid free cash flow. Even with the crisis, AT&T expects its dividend payout ratio to be in the 60s which should provide enough comfort to investors. Even for Q2-20, AT&T generated free cash flow of ~$7.6 which gives us confidence that it will be able to meet its full-year goal of a total dividend payout ratio in the 60% range, likely at the low end of that range. Management recently noted (in the Q220 earnings call):

“We remain committed to our dividend, which we’ve increased by 36 consecutive years. We finished the quarter with a dividend payout ratio of about 50%. We expect to end the year with our payout ratio in the 60s, likely at the low end of that range.”

Debt Levels: AT&T’s high debt load has been a cause of concern among investors, but the company addressed this directly its latest earnings call explaining it has enough liquidity at hand. The company recently issued $17 billion in in long term debt at rates significantly below its average cost of debt (a good thing). This allowed it to materially reduce its near-term debt obligations, making the overall debt for the next few years very manageable. Adding to its financial strength are proceeds from asset sales. The company expects to close about $2 billion in sales from CME, real estate, and tower monetization this year, and will continue exploring other opportunities.

“We have strong cash flows that allow us to allocate capital effectively. We’re continuing to invest significantly in our growth areas of fiber, 5G which is nationwide as of today, FirstNet and HBO Max.”

Given the free cash generation, we believe that dividends are not only secure and sustainable, but also likely to grow.

source: Company data

HBO Max Launch to boost wireless revenue

HBO Max is a high quality premium video on-demand service, launched in May 2020. The service has done reasonably well since its May 27th launch, and is on track with management targets regarding subscribers, activations and revenues. In the Q2 earnings call, management noted:

“Customer engagement has exceeded our expectations. It’s the early days, but the average number of weekly hours spent viewing Max is 70% more than on HBO now, clearly demonstrating the strength of our library and our success broadening the appeal of the product to more family members.”

HBO Max aspires to appeal to everyone in the family based on its diverse library, and widening its reach across a much broader demographic than the traditional HBO service. AT&T is offering HBO Max for free on its premium wireless and fiber plans. The anticipated upgrade cycle driven by 5G adoption is an opportunity to distribute the service more widely. HBO Max is available to consumers through nearly every content distributor in the United States including Amazon Fire, Apple TV and Google Chromecast. With HBO Max, AT&T will offer consumers more than twice the amount of programming for the same price as HBO. As a result, we expect the company expects its wireless service revenue growth rate to be higher in the second half of 2020. AT&T also expects that offering HBO Max for free on unlimited plans will improve the overall churn.

While HBO Max is off to a healthy start, the main concern remains around production which if not resumed soon could derail subscriber growth for 2021. In the streaming business, considering the content library is key to keeping customers. However, it’s the new originals that drive subscriber acquisition. Regarding production, management noted the following in its Q2 earnings call:

“it’s one of our more challenging things we’re doing to respond to the pandemic and it’s going to take time to return to our February production levels. We view getting our production back online as critical to making our 2021 subscriber plan.”

Valuation:

From a valuation standpoint, we believe AT&T shares are appealing because of the dividend yield and potential price appreciation. For perspective, we have compared AT&T to other wireless players as well cable/satellite and media players (however, in our view, the primary competitors are the two main wireless players—T-Mobile & Verizon). Among this group, AT&T is the largest (by market capitalization) and has the highest dividend yield. And on an EV to EBITDA basis, AT&T is reasonably priced when compared to other wireless peers. Also, over the past 10 years, AT&T has traded in a range of 4.8-13.8x EV to EBITDA, and the current multiple (~7.5x) offers room for significant share price appreciation (if the company is can successfully execute on its growth strategy).

(source: Yahoo Finance)

Risks:

Wireless competition: We could see competition intensifying in the wireless market as companies try to maximize market share. This could mean pricing pressure which could adversely impact ARPU growth, thereby slowing down revenue growth.

Debt concerns: The company ended Q220 with overall debt of ~$153 billion. This remains a worry for investors as it pushes down earnings (due to high interest expense) and also limits balance sheet flexibility to fund future growth. While debt remains high, we believe AT&T can manage it given its high free cash flows and the non-core asset monetization drive. Furthermore low interest rates help. In our view, these factors gives us confidence that AT&T can manage (and even pare down) its debt over the next few years.

Cord-cutting: This remains a major risk for AT&T’s pay-TV and media business as consumers move away from traditional cable services towards streaming content. We note that AT&T is aggressively focusing on its on streaming service via HBO max, which helps to mitigate this risk.

Conclusion:

Overall, we view AT&T as attractive. It has increased its dividend for 36 consecutive years, and is on track to keep increasing it based on its high free cash flow and its low dividend payout ratio. Furthermore, the current pandemic has driven the share price too low, thereby creating the potential for share price appreciation. Brave investors that added shares after the Tech Bubble burst and during the depths of the financial crisis were handsomely rewarded with significant dividend and share price increases in the years that followed. Similarly, we view the current covid-19 sell off as an attractive buying opportunity. Of course, there are risks such as cord-cutting and less new content creation as the pandemic has forced social distancing. However, HBO Max will help offset cord cutting, and new content creation will eventually ramp back up. If you are a long-term income-focused investor, AT&T shares currently preset an attractive buying opportunity.