It can make a lot of sense for income-focused investors to generate some of their income from something other than dividends. And in this article we review an outstanding opportunity to generate attractive income through price appreciation. Specifically, this particular stock has a SaaS-style (Software as a Service) business model with predictable cash flows, a first-mover advantage (in the Applied Health Signals category), a large and growing addressable market, improving profitability (as revenue scales up), a strong financial position (i.e. enough liquidity to meet growth capital needs). Furthermore, its premium valuation is understandable (given the very attractive long-term opportunity), but some investors may choose to only nibble at this opportunity now while hoping for a pullback to load up on more shares.

Introduction:

Livongo (LVGO) is one of the fastest-growing health tech companies and among the select few that have seen their value propositions become more evident as a result of the COVID-19 outbreak. The same is reflected in the company’s stock performance and premium valuations. In this report we analyze Livongo’s business model, the impact of COVID-19 on the company, its competitive position, its balance sheet, and finally conclude whether the company’s common stock still offers upside potential to investors despite the incredible rally this year.

Overview:

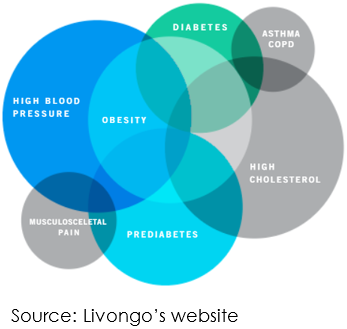

Headquartered in Mountain View, California, Livongo is a healthcare technology company that provides digital chronic disease management solutions using applied health sciences. The company was incorporated in 2008 as EosHealth, Inc. and later changed its name to Livongo Health, Inc. in 2014. Initially offering solutions for Diabetes, the company has now expanded its product portfolio to include Hypertension, Prediabetes, Weight Management, and Behavioral Health related solutions. However, diabetes solutions still form a significant portion of the company’s revenue.

Livongo follows a subscription-based business model where clients are billed primarily on per participant per month (“PPPM”) basis and the contract term generally ranges between one to three years. As of March 2020, the company had 1,252 clients which included employers, health plans, government entities as well as labor unions and ~328,500 diabetes members across United States. Livongo’s solutions allow timely monitoring, treatment, and prevention of chronic conditions for members thereby helps clients lower overall healthcare costs. Subscription fee includes testing strips, lancets, as well as coaching sessions for members.

Leveraging technology to derive better outcomes

The company provides Applied Health Signal solutions to members by leveraging artificial intelligence and machine learning capabilities. Its technology is built on four pillars called AI+AI: Aggregate, Interpret, Apply and Iterate. Livongo aggregates member data from several sources including meters and devices which are then uploaded to a centralized database. The collated data is then processed to generate insights pertaining to the member’s health condition. Livongo then sends personalized guidance and health nudges to the members based on all the intelligence it generates. Post-delivery of health nudges, health signals are then received in real-time as feedback. Here machine learning is applied to improve recommendations in the future thus making the whole process work in a self-improving loop.

Livongo enables members to monitor real-time data, receive health nudges whenever required, and get around the clock access to virtual and live coaching, all from the comfort of their homes. Members can also order test strips and lancets hassle-free through Livongo’s mobile app. By leveraging its database, Livongo’s coaches can get a more detailed picture of underlying problems faced by members thereby enabling more personalized guidance.

Livongo with its 328,000+ members has real-time biometric data comprising of over 500 million health signals. The larger user base leads to more data points thus boosting the usefulness and accuracy of health nudges as the company grows.

“As Livongo’s AI+AI engine aggregates more data, our platform continues to improve by providing a more personalized care experience. We are able to leverage a combination of machine learning and clinical studies to continue to improve outcomes, drive down health care costs, improve utilization, and empower people to better manage their diabetes.” - Dr. Bimal Shah, Chief Medical Officer

Large and growing addressable market

Diabetes has become a common chronic condition in the US. As per a CDC report, ~13% of US adults or 34.2 million people had diabetes in 2018, and each year over 0.5 million people get diagnosed with diabetes. The chart below shows the increasing county-level prevalence of diagnosed diabetes. Median county-level prevalence has increased from 7.8% in 2004 to 13.1% in 2016.

Livongo estimates that there are 39.6 million people that suffer from Hypertension and 31.4 million people have diabetes in the US. People with diabetes and hypertension are the focus for the company and the opportunity translates into an addressable market size of $46.7 billion.

The company’s current diabetes member count is close to only ~1% of the total diabetes cohort in the US, indicating that Livongo has just scratched the surface and there is immense potential for growth.

Significant tailwind from COVID-19 pandemic

COVID-19 has accelerated the shift to virtual-care delivery model which enables people with chronic conditions to reduce hospitals and clinics visits for their check-ups or guidance. Livongo provides virtual or live coaching sessions besides enabling members to conduct regular testing and tracking glucose levels from the comfort of their homes. Moreover, people with chronic conditions such as diabetes and hypertension are among the most vulnerable groups targeted by the COVID-19 virus. As per CDC report, based on 10,647 COVID-19 patients deceased between February 12 to April 24, 2020, 39.5% people suffered with diabetes. Similarly, 78% percent of the ICU admissions of COVID patients were of those with preexisting health conditions. Therefore, prevention and management of these conditions have become more essential than before. Livongo’s diabetes meters that only had approval for home-use were temporarily allowed for hospital use as well, highlighting the importance of Livongo’s solutions in the current scenario.

“FDA, at the request of a number of health systems, has granted an emergency period waiver to allow any inpatient facility in the country to use Livongo's cellular-enabled diabetes meter, allowing people with COVID-19 to use our remote blood glucose meter within the hospital setting.” - Jennifer Schneider, President, Q1 earnings call.

Increased adoption of Livongo’s solutions led to substantial growth in client and member base in Q1 2020. We are expecting Livongo to continue delivering impressive results in the coming quarters as the contracts signed in Q1 start translating into new members. Infact, Livongo recently updated its Q2 2020 revenue guidance from $73-$75 million to $86-87 million due to a firmly positive backdrop.

First mover advantage and superior product provides competitive edge

Livongo faces competition from several companies that include Hello Heart, Teladoc Health, Virta Health Corp., Omada Health, Inc., Glooko, Inc., Lyra Health, Inc., among others. However, the scope of offering or focus areas sometimes differ between the company and its peers. Livongo enjoys the benefit of being the first mover in the applied health signal category as it has more data for machine learning than most peers. Large database also helps to enhance Livongo’s coaching experience through self-learning.

The company has an excellent net promoter score of 64 compared to 12 of average health plans which shows high customer satisfaction. Besides that, company had a strong retention rate of 94.2%. As per S-1 filing, the company’s clients were able to save on average $88 PPPM within first year of using Livongo’s diabetes solutions.

Impressive top-line growth driven by growth in client base and high retention rate

Livongo has delivered impressive top-line growth in recent years. Its recently updated Q2 guidance implies ~111% revenue growth year on year. In Q1 2020, the company reported revenue of $69 million, which represents a YoY growth of 115%. The strong growth is primarily a function of increase in clients as well as dollar based net expansion rate. Number of clients increased from 709 in Q1 2019 to 1252 in Q1 2020. Over 30% of the Fortune 500 companies are now Livongo’s clients which includes Microsoft, PepsiCo, SAP, among others. Partnership with large pharmacy benefit managers like CVS health and Express scripts also enables the company to gain traction in the commercial market.

Livongo has also been selected as a disease managing solution provider by several large government entities. These include Government Employee Health Association, New Jersey State, and School Employees' Health Plan, among others. Livongo is also an enrolled provider for Medicare Advantage members that accounts for 1/3rd of total Medicare members.

Growth in average revenue per client from $141.5k in 2017 to $212K in 2019 also provides evidence that Livongo has consistently been adding larger clients over the years. Dollar based net expansion rate which is used to measure Livongo’s revenue growth within existing client accounts stood at 110% at the end of Q1 2020. This ratio implies that apart from high retention ratio, the company has consistently been able to upsell its solutions among existing clients. Over 18% of Livongo’s clients purchased more than one solution as of Q1 2020.

Revenue scale up leading to improved profitability metrics

Livongo generates high gross profit margin and has been able to consistently maintain an adjusted gross profit margin of above 70%. Also, as evident from the chart below, Livongo has achieved significant improvement in EBITDA margins in the recent quarters as it generates leverage on operating expenses over a larger revenue base. Going forward, the company is targeting to become EBITDA positive by 2021 and the recent tailwind from the pandemic will lead to achieving profitability goals earlier than expected.

Robust financial position provides enough cushion to meet growth capital requirements

Livongo generates negative free cash flows because of higher growth expenditure. The company exited Q1 2020 with zero net debt and liquidity of $368 million on its balance sheet. Besides, the company has announced an issue of $475 million in convertible senior notes bearing interest rate of 0.875% annually. The proceeds will be used to pay $60 million cost of capped call and rest will be used for corporate purposes.

Please note that the company has been expanding its product portfolio through inorganic acquisitions. Livongo for Behavioral Health was introduced through the acquisition of myStrength in February 2019, whereas Livongo for Prediabetes and Weight Management was introduced after the acquisition of Retrofit in April 2018. We believe that the ~$750 million of liquidity post the debt offering, will provide enough cushion to Livongo to meet its strategic growth capital needs.

Valuation rich but fair considering long term growth opportunity

Like most high-quality tech companies, Livongo’s stock price has experienced a significant boost since COVID-19. The stock is currently trading at a P/S multiple of over 35 times, which is significantly higher than 6.5 times multiple at the time of its listing. Although the multiples may look rich, the current valuation needs to be looked upon in the context of the significantly large growth potential. Besides, Livongo is also enjoying substantial tailwinds from the pandemic which has accelerated the adoption of contact-less health care delivery through internet.

Risks:

Exposure to sensitive data: The company possesses large amount of confidential sensitive data of its members and clients, which if breached or leaked can attract legal consequences and tarnish the company’s reputation.

Inability to cope up with changing technology: The healthcare tech industry is highly competitive and dynamically evolving through continuous innovation. Livongo may lose clients if it is unable to stay ahead of competition through technological advancements.

Conclusion

Being a disrupter in the health care industry, Livongo has enjoyed impressive growth in recent years as its solutions gain traction in the customer base. It still has a large market to penetrate and is armed with a solid team and solutions portfolio to tap the opportunity. While we would have liked to see lower valuation multiples, for long term oriented investors, the stock still holds upside. And if you are looking to generate some income via growth, Livono is worth considering for a nibble now, and perhaps a bigger bite on any price weakness later.