Spirit Realty Capital (SRC) is a leading self-managed net-lease REIT that owns single-tenant commercial (mostly retail) real estate properties across the US. Investor sentiment turned sharply negative in February due to the Covid-19 outbreak, but the shares have experienced a marginal recovery in recent weeks. In this report, we consider the common shares, the preferred shares and the relative attractiveness of generating upfront income by selling out-of-the-money put options for investors fearing a second wave coronavirus sell off. In particular, we consider the business, Covid-19 impacts, ability to meet financial obligations, dividend and income prospects and finally conclude with our views on investing.

Spirit Realty Common Stock Price (SRC):

Spirit Realty Preferred Share Price (SRC-A):

(image source: Seeking Alpha)

Overview:

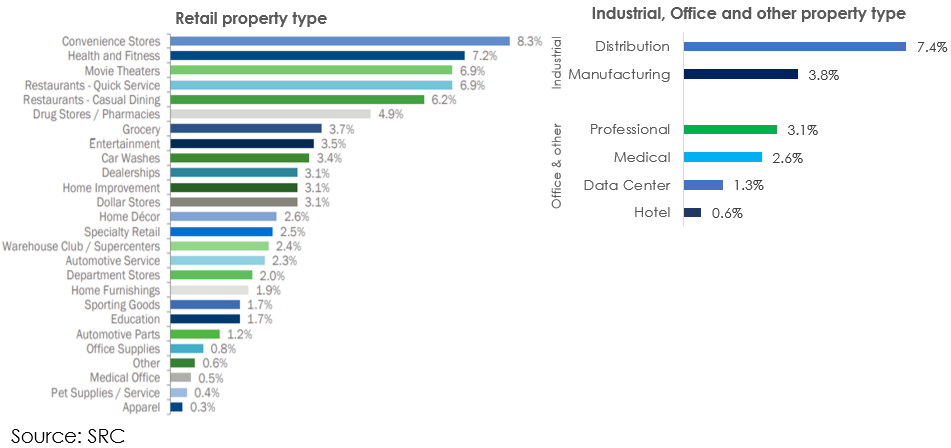

Headquartered in Dallas, Texas, Spirit Realty Capital is a triple net lease REIT that invests in single-tenant real estate properties across the US. The company owns a diversified portfolio of 1,772 properties with gross leasable area of 36.1 million sq.ft. The average remaining lease term on its contracts is ~10 years and 89% of the contractual rent is subject to automatic rent escalations in the future. SRC is primarily a retail focus REIT with 81% of the rent generated from the retail sector while the other 19% comes from sectors including industrials and offices. The occupancy rate stands at 99.4% as of Q1 FY 20. Historically, SRC has maintained an occupancy rate in the high 90s.

In terms of exposure to sub-sectors, SRC has the highest exposure of 8.3% to convenience stores. The exposure to adversely affected sectors by the COVID-19 shutdowns such as health and fitness, movie theatres, entertainment, and dining restaurants stands at almost 24%. Below is the list of tenant industries based on their property type with their respective contribution to contractual rent:

No single tenant accounts for more than 3% of total rentals. Below is the list of top 10 tenants with their contribution to contractual rent:

Stating the obvious: COVID-19 is going to impact the business

COVID-19 has led to unprecedented disruption in most commercial sectors across the US. However, the adverse impact has been much more pronounced in the retail sector because of mandated store closure and slowdown in consumer spending. According to Datex Property Solutions' findings in May, US retail chains paid only 58% of the billed April rent and nonpayers included gyms, movie theatres, and hair salons among others. Not surprisingly, as of May 28th, 2020, SRC was able to collect only 69% of the contractual rents from its tenants for the months of April and May. Among the company’s tenants, 24 hours fitness which accounts for 0.4% of base rent has already filed for Chapter 11 and plans to permanently close 133 gyms. Collection from movie theaters stood at just 11% for the 2 months while Home Décor stores which comprise 2.7% of the total base rent, were able to service only 9% of their scheduled rent due for March and April. The other struggling sectors with high rental deferrals include entertainment, car washes, and education. Total rent deferrals for April and May stood at 20.6% which SRC expects to collect in 12 months starting October 2020.

However, positive signs of recovery emerging post easing of lockdowns

While the retail industry has clearly faced one of its darkest times ever in recent months, the situation seems to be improving as states start to relax lockdown restrictions and consumer start to adapt to new social distancing norms. After reporting historic declines in March and April, retail sales grew by a record 17.7% in May 2020. While apparel stores saw the highest growth sequentially, furniture sales improved by 90%. For SRC, retail properties representing only 17% of the base rent remained closed as of May 28th, 2020. Life-time fitness which accounts for almost 2% of SRC’s revenues recently announced that they are reopening most of their facilities. Party City, SRC’s 10th largest client announced that 85% of their stores were open for business. Further, AMC theaters (AMC), the largest movie theater operator in the US, announced the reopening of its 450 U.S. locations from July 15 with seat limitations. While the uncertainty around the actual footfalls relative to pre-COVID will remain for sometime, reopening is still a progressive step towards normalcy.

“I'm encouraged by the fact that the country is opening, the people feel safe of going out, people who don't feel safe are staying home. And we'll know more as the week's go, we're going to be very close to our tenants and that's going to inform us on a lot of different things. But right now, that sounds pretty good.” - Jackson Hsieh, President & CEO on Q1 2020 call.

Please note that SRC has a weighted average non-cancellable lease terms of 10 years with 45.6% lease expiring after 10 years. This protects the company from short-term fluctuations in the real estate market and at the same time it also benefits from automatic rent escalators. So while rent deferrals are a near term cash headwind, the company’s cash flows should improve as restrictions on retail open up further.

Robust balance sheet and sufficient liquidity provides enough cushion to combat near-term challenges

Strong liquidity position is extremely essential for REITs during the current economic environment to service debt, provide rent deferral support to tenants in most affected industries and support dividends, if possible. After raising $400 million through an unsecured term loan, SRC now has liquidity of $900 million in the form of cash and undrawn credit facilities. Furthermore, SRC has announced a forward sale agreement of 8 million shares of common stock which would bring in an additional $300 million of liquidity on the balance sheet in the future. SRC has sufficient cushion to ride through the near-term market challenges as well as make opportunistic acquisitions at favorable terms. The next major debt repayment of $345 million is due in May 2021. Keeping in mind the current liquidity position and 93% unencumbered real estate portfolio, the company will not face any material difficulty in servicing the debt.

Attractive income potential despite risk of some dividend cuts

While most retail REITs have temporarily cut or suspended dividend payments owing to significant business uncertainties, SRC has not cut its dividend yet. In May 2020, the company declared its quarterly dividend of $0.625 per share which is in line with the previous dividend. The stock is now trading at a dividend yield of ~7% which is slightly below its 4-year average.

We stress-tested the company’s income through a worst-case, base-case and best-case scenario to analyze the sustainability of current level of dividends and found that the payout ratio in the worst-case scenario of a 30% decline in AFFO, will breach the 100% level and in that case the company may have to cut dividends by 15-20% in near-term to preserve capital.

“Obviously, the dividends are going to be a board discussion. But I'm more encouraged now than I was a couple weeks ago, just by kind of what's happening with these stimulus program and how operators, they're not only just trying to open they're trying to open the right way. And these examples that give you are kind of across the portfolio.” – Jackson Hsieh, CEO on Q1 2020 earnings call

Additionally, even after a 20% cut in dividends, the common stock of SRC would still generate a yield of ~5.5% which the investors might find attractive given the record low-interest rates.

Please note that the stock provides an above average dividend yield in its peer group.

Preferred Shares (SRC.PA)

While we like the common stock, the preferred shares may offer a more compelling risk-reward, depending oh your views and needs. For starters, the preferreds are currently trading just below par with a yield of 6% and have been rated BB+ by S&P. With a yield difference of just 100 bp between common and preferreds, coupled with significantly higher dividend coverage ratio of over 30x and cumulative nature of preferreds, we believe the risk-reward is highly compelling in the case of preferreds.

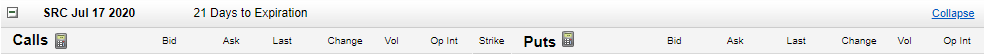

Options Trade: High Upfront Premium Income for Selling Put Options

Another investment strategy that investors may want to consider is selling out-of-the-money put options on SRC because this generates high upfront premium income (that you get to keep no matter what), and it gives you the chance to own the shares at an even lower price (if they get put to you before the options contract expires). And because fear of a second wave of coronavirus outbreaks (and the possibility of extended “stay-at-home” orders) is high, so too is the the premium income available in the options market (as volatility rises, so too does upfront premium income available). In particular, selling the July 17, 2020 puts with a $29 strike price is compelling because is it’s relatively far out of the money, it offers significant upfront income (again because fear is high right now), and it gives you the chance of owning the shares at $29.

(image source: TD Ameritrade)

We write often about selling income-generating put options, and this opportunity is on our radar. There are a few important things to keep in mind for this type of trade. First of all, we don’t recommend even considering the strategy unless you’d be comfortable owning the shares for the long-term if they get put to you (at the lower price, depending on which strike price you select). Secondly, pay attention to ex-dividend dates and earnings announcement dates because they can both dramatically impact the market price and your trade. In this particular case, SRC isn’t expected to announce earnings until around August 6th (after this contract expires) so it is largely a non-issue. However, SRC does go ex-dividend on Monday June 29th, so you need to be comfortable with the price impact (or in some cases investors may wait until after the ex-dividend date to execute the trade).

Conclusion

While we are cognizant of the disruption in the retail sector due to the Covid-19 pandemic, we believe that retail REITs with long term leases and ample liquidity (such as SRC) still provide attractive income earning potential to investors. And depending on your situation and views, you may want to consider the common, the preferred and/or generating upfront premium income by selling put options. We understand that some investors are avoiding the dangers of this space altogether, however we have our eye on selling out-of-the money puts in the coming days. In our view, despite the risks and the high fears, we believe Spirit Realty offers a compelling risk-reward opportunity that income-focused investors may want to consider.