This global oncology company with patented “Tumor Treating Fields” (“TTF”) technology. It has multiple programs in phase 2 and phase 3 of clinical trials which can potentially result in exponential revenue growth and Total Addressable Market (“TAM”) expansion. The shares are volatile (for example yesterday they declined more than 14% as the market reacted to the company’s final results from a liver cancer study), and this volatility has given rise to an attractive high-income-generating options trade. The trade strategy sounds complex (i.e. “bullish vertical put spread”), but it’s not. It puts attractive upfront premium in your pocket today, it gives you a chance to pick up shares of this attractive stock at a lower price, and it gives you a little insurance on the downside (i.e. your max loss is limited). We believe this is an attractive trade to place today—and potentially over the next few trading sessions (including post the holiday)—as long as the underlying share price doesn’t move too dramatically before then.

NovoCure: Quick Overview

As mentioned, NovoCure is a global cancer treatment company possessing patented Tumor Treating Fields (“TTF”) technology for treating some of the most aggressive forms of cancer. The company’s TTF technology uses electric fields tuned at a certain frequency to restrict tumor spread through disarranging the tumor’s natural orientation. It is engaged in manufacturing, and commercializing TTF delivery systems, namely, Optune and Optune Lua (previously NovoTTF-100L). Optune is used for treating glioblastoma multiform (GBM, brain cancer) and Optune Lua is used for treating malignant pleural mesothelioma (MPM, a rare form of lung cancer). Besides these two products, the company has ongoing or completed clinical trials for utilizing TTF in brain metastases, pancreatic cancer, ovarian cancer, liver cancer, and non-small cell lung cancer.

We wrote about the attractiveness of NovoCure’s revenue growth and market opportunity earlier this year, and you can read that report here.

Purple Line is NovoCure share price. Source: YCharts

The Trade: “Bullish Vertical Put Spread” on NovoCure

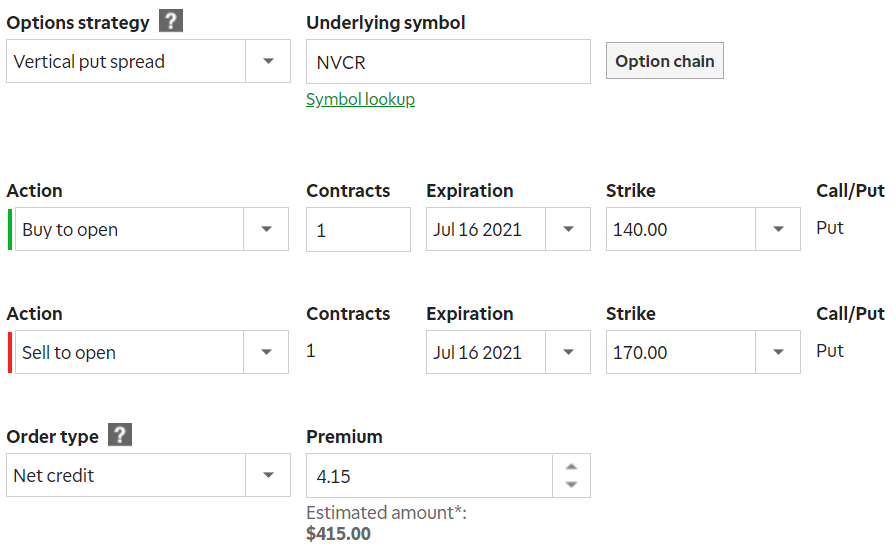

Sell AND Buy Put Options on NovoCure (NVCR) with a strike price of $170 (sell) and 140 (buy), and an expiration date of July 16, 2021 (roughly 2 weeks away), and for a net premium (upfront cash in your pocket) of at least $4.15 (or $415 because options contracts trade in lots of 100). Your broker will make you keep $3,000 of cash on hand (($170 - $140) x 100 (assuming you don’t want to use margin)). The trade generates ~13.8% of extra income over the next 2 weeks ($415/$3,000). And this trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive NovoCure at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own NovoCure, especially if it falls to a purchase price of below $170 (it currently trades around $190) but above $140 (if it falls below $140 we’d take the cash difference between our $140 strike put and the market price at expiration—this is basically insurance)). The trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic from TD Ameritrade below.

Note: Depending on you risk tolerance and premium income preferences, you can adjust both strike prices for this trade.

Your Opportunity:

We believe this is an attractive trade to place today, and potentially into next week (post the holiday), as long as the price of NovoCure doesn't move too dramatically before then, and as long as you’re able to generate premium (income for selling, divided by the cash required to secure the trade) that you feel adequately compensates your for the risks (currently ~13.8% over the next 2 weeks).

Our Thesis:

Our thesis is simply that we believe NovoCure is a highly attractive (albeit very volatile) long-term business, and we’d be happy to pick up shares at the lower price of $170—and then hold them for the long-term (you can read our detailed explanation of why, here). Further, the premium income on this trade is unusually high, for a combination or reasons, including NVCR’s high volatility, the added volatility of yesterday’s news, and the uncertainty of the upcoming earnings announcement shortly after this trade expires. When uncertainty and volatility are higher, so too is the premium income available.

Important Trade Considerations:

Two important considerations when dealing with options contracts are earnings announcement dates and dividends because they can both impact the price of the shares and thereby your trade. However, neither occurs during this trade because NovoCure does not pay a dividend and it is not scheduled to announce earnings again until around July 27th—which is more than one week after this options contract expires.

Conclusion:

When shares are weak in the short-term (as NovoCure was yesterday) volatility and fear are higher, and this causes the upfront premium income available in the options market to increase. And this has created an attractive trading opportunity, especially considering NovoCure remains a very attractive business in the long-term (despite the recent share price weakness). In our estimation, these shares will eventually go much higher in the long-term considering its impressive growth trajectory and massive market opportunity (as we have explained in our earlier report link).

Regarding the trade in this report, if the shares do get put to us at $170—that’s great—and we look forward to hanging on for the long-term. And if they don’t get put to us, we’re happy to keep the upfront premium income that this trade generates for us (we get to keep that income, no matter what). Furthermore, not only do we have a little insurance on this trade (we put/sell the shares at $140 if they fall below that level before the options contract expires), but the insurance piece also lets us enter this trade with a lower amount of cash set aside than if we just sold naked puts (for example, we’d have to keep $17,000 of cash in our account—to avoid using margin—if we sold naked puts with a strike price of $170). The big risk is that the shares fall all the way below $140 and we sell at that level (after purchasing at $170). However, there are lots of ways to win. We like this trade and we like NovoCure as a long-term investment—especially if we get the shares at a lower price.