The market has been strong, particularly technology stocks, and in this report we review a very attractive CPaaS (Communication Platform as a Service) technology stock. In particular, we share an attractive options trade, that generates high upfront premium income (that you get to put in your pocket and keep no matter what), and the trade also gives you a shot of picking up shares of this very attractive CPaaS stock (if the price falls below your strike price prior to the option contract expiration in 1-month). We believe this is a very attractive trade to place today, and potentially over the next few trading sessions, as long as the price doesn’t move too dramatically before then.

(Bandwidth Share Price)

Overview: Bandwidth (BAND)

Bandwidth Inc. (BAND) is a cloud-based communications platform as a service (CPaaS) provider that offers a suite of software application programming interfaces (APIs) for voice and text functionalities, as well as 911 response capabilities primarily to enterprise-grade customers. It has a diverse and impressive set of customers that includes Google, Microsoft, Zoom, Arlo, RingCentral, and many more that have leveraged Bandwidth’s API infrastructure for several years. Being the only CPaaS player to own an all-IP network in the US, we believe the company is well-positioned to take advantage of the many secular growth opportunities, going forward. You can read our previous full report on Bandwidth here.

The Trade: “Bullish Vertical Put Spread” on Bandwidth (BAND)

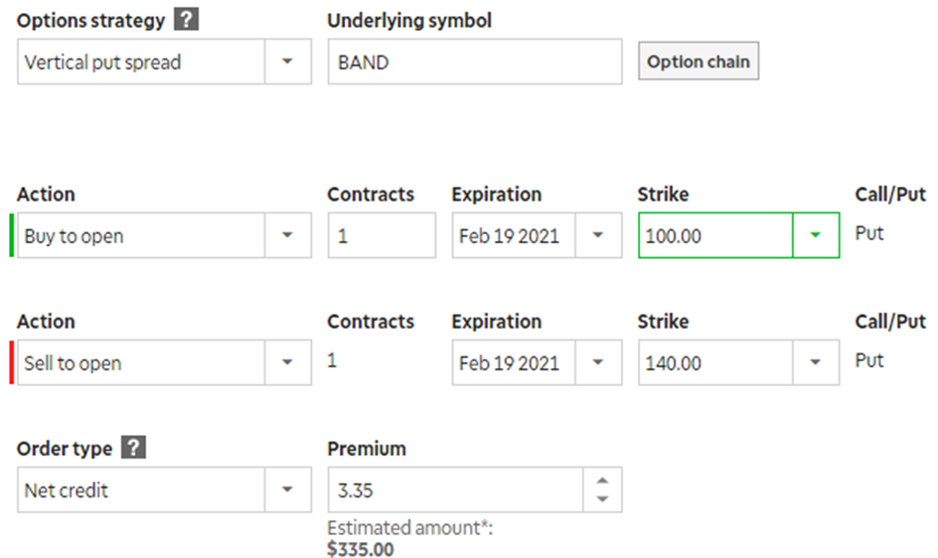

Sell AND Buy Put Options on Bandwidth (BAND) with a strike price of $140.00 (sell) and $100.00 (buy), and an expiration date of February 19, 2021 (just under 1-month from today), and for a net premium (upfront cash in your pocket) of at least $3.35 (or $335 because options contracts trade in lots of 100). You’re broker will make you keep $4,000 cash on hand (($140 - $100) x 100. The trade generates ~8.4% of extra income in less than 1-month ($335/$4,000) and that is a lot for such a short period of time (on an annualized basis that would be over a 100% rate of return (8.4% x 12). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive CPaaS leader Bandwidth at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own BAND, especially if it falls to a purchase price of below $140 but above $100 (if it falls below $100 we’d take the cash difference between our $100 strike put and the market price at expiration—this is basically insurance). The trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic below.

Note: The prices in the graphic above are constantly moving based on market conditions, so you should feel free to adjust the put strike prices to levels where you are comfortable with the trade and the premium income it generates.

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of BAND doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) that you feel adequately compensates your for the risks (currently ~8.4% in less than 1-month).

Our Thesis: Bandwidth (BAND)

Our main thesis is basically that Bandwidth is a very attractive business, trading at an attractive price. We believe the shares have significant upside price appreciation potential per our full Bandwidth report (included here within), and Wall Street analysts agree (per the price target and rating chart below). However, some investors are focused on generating high income and are nervous about market price volatility. This trade addresses those concerns by generating high income and by giving you a chance to pick up shares of this attractive business at an even lower price.

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the share price and thereby impact your trade. In this particular case, dividend payments are not an issue because BAND doesn’t pay a dividend. However earnings is an important consideration because the company will likely announce quarterly earnings numbers near the end of this month (before our options contract expires) and depending on the results—that could add significant volatility to the share price and our trade. However, given the very high upfront premium income this trade generates, we are comfortable with this trade (i.e. we believe the high premium income more than compensates us for the volatility risk).

Conclusion:

Bandwidth is an attractive business, and this trade generates attractive income. We believe the company is well-positioned to take advantage of the many secular growth opportunities, going forward, and we believe an investment in Bandwidth’s shares could pay off handsomely for in the near to mid-term, while the longer-term wealth creation potential is immense.

And if you’d like to own shares, but are waiting for a slightly better price—you may consider implementing a bullish vertical put spread on BAND (as described in this article). It gets you attractive upfront premium income, a chance to own the shares at a lower price, and a little insurance on the extreme downside. Overall, we believe Bandwidth is an attractive business, and this is an attractive trade to place today and potentially over the next few trading sessions (as long as the price doesn’t move too dramatically from here).