A lot has changed since the onset of the pandemic, obviously. And healthcare is one sector that has felt the impacts. This article not only reviews an innovative healthcare leader, but we also share an attractive option trade that utilizes a lessor known (but not complicated) strategy, sometimes referred to as a bullish vertical put spread (not as scary as it sounds). The trade lets you generate attractive upfront income, while limiting your downside risk, limiting the amount of cash you need to set aside to secure the trade, and it also gives you the chance of owning a very attractive stock at a lower price. Given the stock’s recent price move, we believe this is an attractive trade to place today, and potentially over the next few trading sessions.

Livongo (LVGO)

The stock we are referring to is Livongo (LVGO)—one of the fastest-growing health tech companies and among the select few that have seen their value propositions become more evident as a result of the COVID-19 outbreak. The company provides digital chronic disease management solutions using applied health sciences for diabetes as well as Hypertension, Prediabetes, Weight Management, and Behavioral Health related solutions.

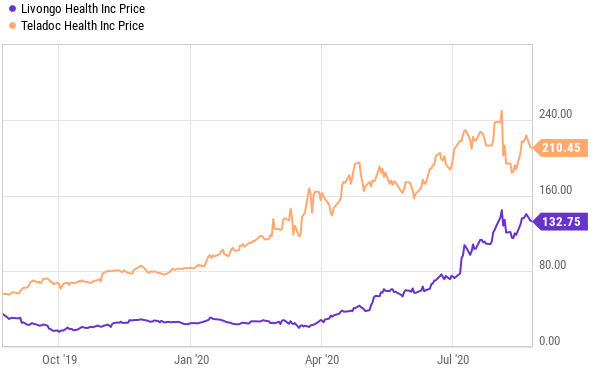

To the chagrin of many LVGO shareholders, the company recently announced a merger with another health tech company—Teladoc (TDOC). Both are rapidly growing companies in the right place at the right time, but many LVGO shareholders were disappointed by the news because LVGO was growing faster and was smaller (more room to run than TDOC, arguably, in some ways). The shares of both companies pulled back after the merger announcement at the beginning of this month. However, we believe both companies remain attractive, particularly LVGO (both pre and post the likely merger), and you can read our recent full report on Livongo here:

(Purple Line: LVGO, Orange Line: TDOC)

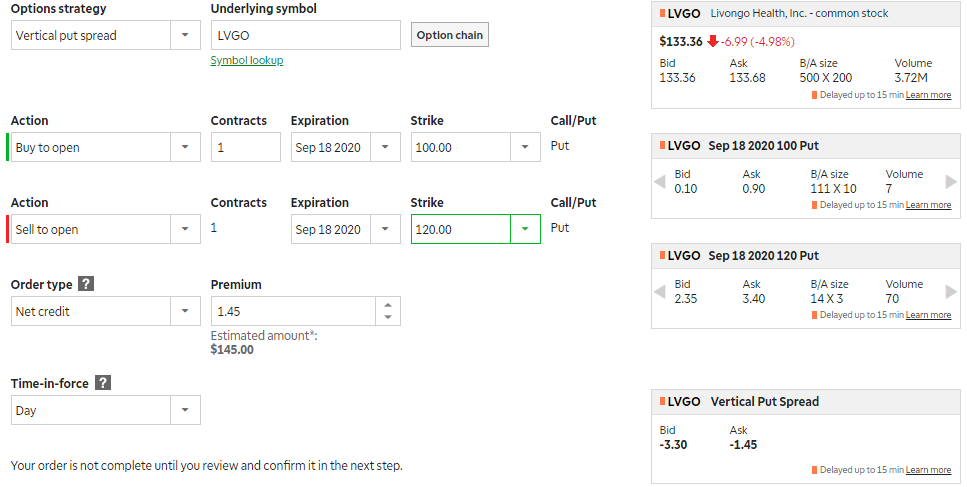

The Trade: “Bullish Vertical Put Spread” on LVGO

Sell AND Buy Put Options on Livongo (LVGO) with a strike price of $120.00 (sell) and $100.00 (buy), and an expiration date of September 18, 2020, and for a net premium (upfront cash in your pocket) of at least $1.40 (or $140 because options contracts trade in lots of 100). You’re broker will make you keep $2,000 cash on hand (($120 - $100) x 100. The trade generates ~84% of extra income on an annualized basis ($140/$2,000 x (12 months, annualized). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive fast-grower LVGO at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own LVGO, especially if it falls to a purchase price of below $120 but above $100 (if it fall below $100 we’d take the cash difference between our $100 strike put and the market price at expiration—this is basically insurance). The trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic below.

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of LVGO doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) that you feel adequately compensates your for the risks (currently 84%, annualized).

Our Thesis: Livongo (LVGO)

Our main thesis is basically that we like Livongo and Teladoc as a long-term investment, but we also like high income and we know the shares are volatile. Rather than buying the shares outright—and rather than selling naked puts (which requires a much higher amount of cash on hand to secure the trade), this bullish vertical spread lets us generate attractive upfront income, it gives us the chance of owning the shares at a lower price, and it gives us a little insurance against a dramatic stock price decline. Your worst loss on the trade is limited to ~$1,854 (i.e. ($120 - $100) x 100 - $140 (upfront cash premium). This may sound like a large loss but it is unlikely to occur, and relative to the income you can earn by executing this strategy over and over again, month after month—the trade is quite attractive. Furthermore, you can adjust the amount of capital you are risking by changing the strike prices (or even selecting a different expiration date for the trade). Again, the most likely situation is you get to simply keep the upfront cash premium if the share don’t fall below the strike—and if they do fall to somewhere between $120 and $100 you’ll end up owning a very attractive long-term stock (as we wrote about in our previous article—linked above).

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the share price and thereby impact your trade. In this particular case, dividend payments are not an issue because LVGO doesn’t pay one, and earnings is not an issue because the company is not expected to announce again until November—well after this contract expires. New news on the merger could cause the price to move significantly—but given the attractive upfront premium income—we’re okay with that. We view this trade as quite attractive.

Conclusion:

Both Livongo and Teladoc are benefiting from the pandemic lockdowns because it highlights the long-term attractiveness of their businesses, and continues to accelerate the future (i.e. people are waking up to the benefits of these types of companies). We understand this trade may seem more complicated than our typical “naked put,” but there are also distinct advantages—such as less cash to secure the trade and a little insurance on the downside. Overall, we like the telahealth business (and Livongo, in particular), and we like the upfront premium income this trade generates.