This data analytics software company recently began trading publicly, and it is known for its highly secretive work with the US government. It has also recently experienced strong revenue growth, and it has a large (and growing) total addressable market (although a fiercely competitive one). In this report, we analyze the company’s business model, growth prospects, valuation, risks, and finally conclude with our opinion on whether this stock offers an attractive risk-versus-reward investment opportunity.

Overview: Palantir Technologies (PLTR)

Headquartered in Denver, Colorado, Palantir Technologies (PLTR) is a software company that helps government agencies as well as enterprises manage their data efficiently and facilitate informed decision-making. The name “Palantir” comes from Lord of the rings’ seeing-stone, “Palantíri”. The company was co-founded in 2003 by Peter Thiel, Alexander Karp, Nathan Gettings, Joe Lonsdale, and Stephen Cohen with the objective of using software to help governments in countering terrorism.

The company launched its first platform, Gotham in 2008 for limited use in defense and intelligence sectors. Over time, it further expanded its focus to address the security needs of various governmental organizations as well as large corporates across industry verticals including energy, transportation, financial services, and healthcare. It derives nearly 55% of its revenue from government agencies and the remaining 45% comes from commercial customers.

The company does not provide data or mine data for its customers, however it acts as a data processor by helping its customers integrate and manage their existing data to derive meaningful insights while maintaining data security and privacy.

The key platforms offered by the company include:

Gotham: It is a big data analytics software designed for government agencies primarily in defense and intelligence sectors. It integrates various types of structured and unstructured data including spreadsheets, tables, emails, images and videos, etc. that are stored in multiple disconnected systems. This data is then put to use to identify patterns, respond to threats (e.g. protecting soldiers from improvised explosive devices). The company recently entered into a contract to provide AI and machine learning capabilities for military planning and defense operations to the U.S. Army Research Laboratory. Users of the Gotham platform include the CIA, FBI, and Department of Defense, among others.

Foundry: The platform is used by both government and commercial customers. Foundry was launched in 2016 to penetrate the commercial client segment. The company creates a central operating system for the organization where users can integrate and analyze data in one place. For instance, Palantir’s Foundry platform has helped Airbus improve operational efficiency and productivity, including cutting down the time required to fix production mistakes, thereby saving costs. Other customers include BP plc, Credit Suisse AG, and FCA US, to name a few.

Palantir generally enters into long-term contracts with its customers extending from one to five years, however, several contracts can be terminated with a prior notice of three to six months. Although the company has a global presence, the US remains the largest market generating more than half of the company’s revenue.

Operating in an industry with a large and growing total addressable market

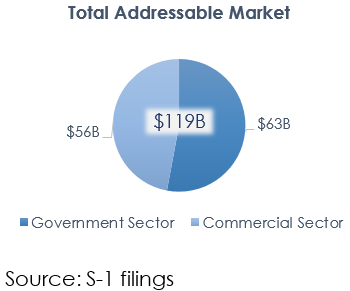

As per the company’s S-1 filings, Palantir has a large and expanding total addressable market (“TAM”) valued at $119B, implying Palantir’s market penetration is currently at less than 1%. The TAM includes an estimated commercial sector TAM of $56B and government sector TAM of $63B (U.S. government sector TAM: $26B). Since the company’s software is expensive and targeted at large enterprises, the Commercial sector TAM is based on 6,000 companies that have annual revenue of more than $500M.

The government sector TAM is calculated based on 5% of the total federal and state expenditureacross various government functions in the US and its allies. Palantir does not do business with countries that are considered to be adversarial to the U.S. and its allies.

Rising data management and analysis needs of both government and commercial organizations will drive growth in the addressable market over the next five years. As per MarketsandMarkets.com report, the global big data market is expected to expand from $138.9B in 2020 to $229.4B in 2025, growing at a CAGR of 10.6%.

Despite large market, broader application of Palantir’s solutions could be constrained

The company has positioned itself uniquely in its niche market with strong ties to the U.S. government and its allies. It has been able to win large government contracts and at the same time has landed a few large marquee commercial clients. Having said that, we are not completely sold on the company’s scalability.

We believe that Palantir’s ability to scale may currently be constrained by two factors:

High touch and bespoke solutions: The company’s sales cycles are lengthy and costly. Unlike a plug and play solution, the company’s sales process involves understanding its customer’s business and customizing its solutions almost like a consulting firm rather than a product firm. The customization of solutions to address specific client needs restricts the scalability of the platform. As per company’s S-1 filing, Palantir has significantly reduced the required time to install its software at the customer end, however, the onboarding process can still be significantly longer for complex implementations.

Costly product offerings: Unsurprisingly, highly customized solutions make Palantir’s offerings costlier than its competitors. It generated $5.8M per customer during first nine months of 2020. The higher ticket value means the company can only target large enterprises. Additionally, even large enterprises have less patience when dealing with Palantir given the cost involved. In fact, as per a CNBC article in 2017, Home Depot ended a 2-3 year relationship with Palantir citing reasons that solutions weren’t worth the price and it could do much of the same thing on its own.

In the recent quarter, the company cited examples of many customers being onboarded in a short span of time despite COVID-19-driven challenges. While these signs are encouraging, we will need to see a sustained trend before we form a positive view on the scalability of the business.

Sticky customer base, albeit concentrated

Palantir’s top 20 customers have been with the company for around 6.6 years on average as of 2019 year end. Moreover, since the customers are mainly large enterprises and government agencies, the company’s business is less susceptible to economic dislocation as compared to a company catering to “small and mid-sized” commercial clients. The average contract duration on a dollar-weighted basis is 3.6 years.

While we like the company’s solid relationships with its existing clients, we are concerned about the company’s high customer concentration. It generated nearly 61% of YTD 2020 revenue from its top 20 customers and 27% of revenue came from its top 3 customers. Additionally, some of the customers are related parties. For example, an issue with one branch of the government can potentially impact its business with other branches as well. We believe the customer concentration risk is worth keeping in mind.

Recent topline momentum strong

The company recently reported Q3 revenue of $289.4M which was up 52% on a YoY basis. YTD 2020 revenue at $770.6M was up 50% on a YoY basis, primarily fueled by increased revenue from existing customers which grew by 38%. The government segment YTD revenue grew at 73% while commercial business revenue grew at 30% on a YoY basis. The company increased its full-year 2020 revenue guidance to $1.07B representing a YoY growth of 44%. Finally, revenue growth in 2021 is also expected to be greater than 30% as per the company. While we are encouraged by these positive trends, we would like to wait and see sustainability of growth trends before jumping in. The reason for our cautious stance is a result of moderate historical growth relative to its current trajectory as well as relative to SaaS based data analytics peers.

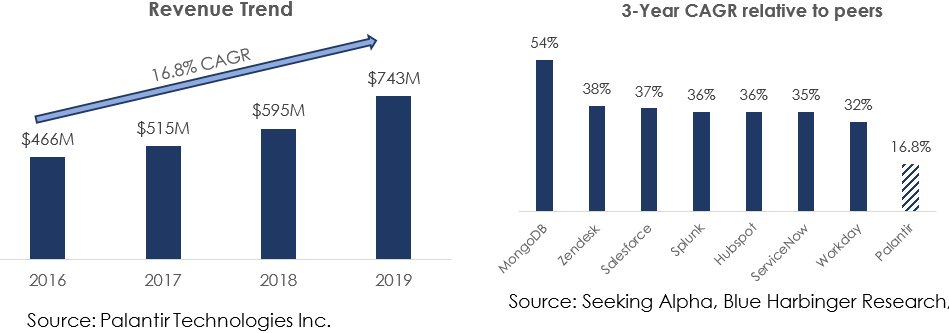

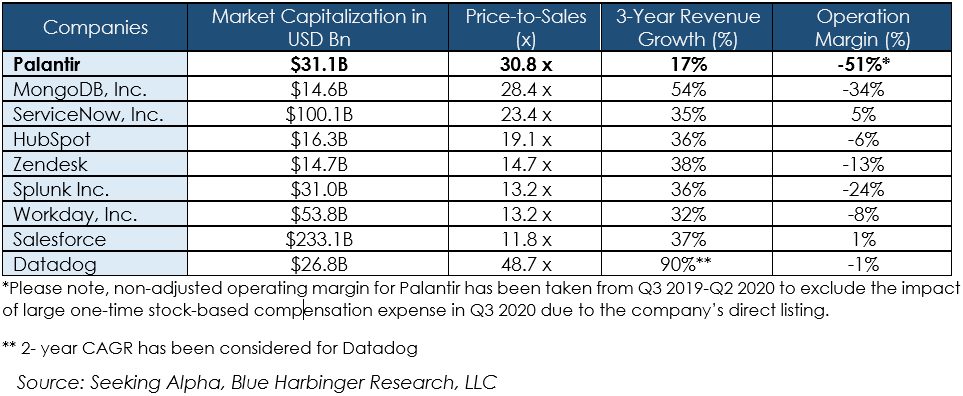

As evident in the chart below, Palantir’s revenue grew at a CAGR of just 16.8% between 2016-2019. Furthermore, Palantir’s historical growth has been subpar relative to other high growth software companies. This low relative growth historically despite significantly large and expanding addressable market is concerning.

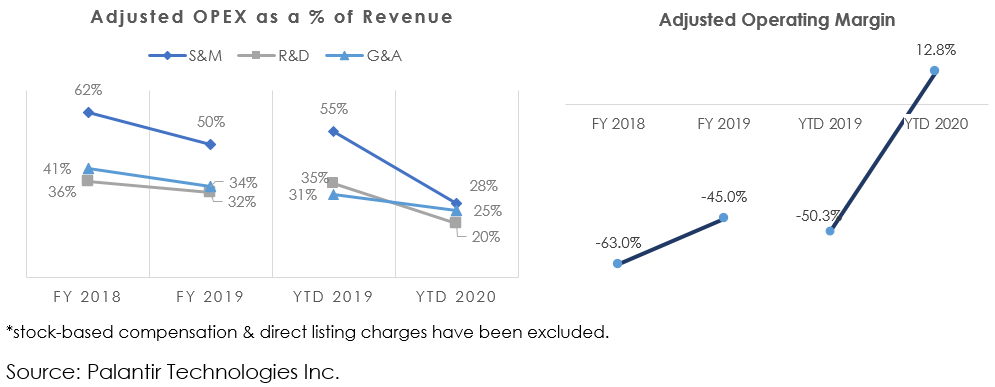

Operating leverage improved, but likely lumpy

Despite being in business since 2003, Palantir has been unable to achieve profitability until recently. In 2019, the company’s adjusted operating margin was -45%, primarily as a result of high levels of investment in the business and lengthy sales cycles. This year, it has seen a significant improvement in operating margins as evident in the chart below. However, we believe the key reasons for this recent margin improvement have been: a) majority of the growth coming from existing customers requiring less incremental investment b) lower operating expenditures due to COVID-19 restrictions. Both these aspects are short lived as the company will have to ramp up spending again for landing new customers and spending on associated business expenses. We believe operating margins may be lumpy over the next few years and cannot make a confident case for significant operating leverage at this time.

Rich Valuation

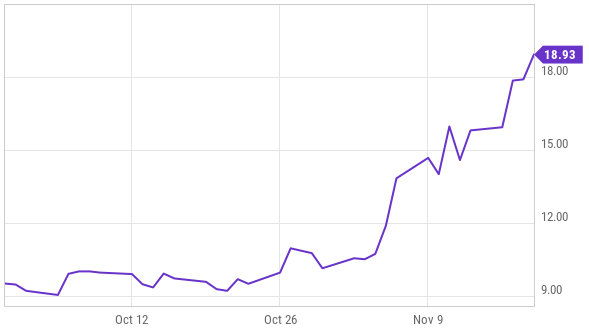

Palantir’s stock price has risen by more than 80% within 2 months of its listing. Strong price action has led to the company’s price-to-sales ratio expanding to nearly 30.8 times. The current valuation multiples are higher than most other high growth software peers despite a less than stellar track record in terms of revenue growth and operating leverage. We think the valuation currently leaves little room for error.

Additional Risks

Risk of data breach: The data Palantir helps analyze is generally highly confidential. A data breach can lead to tarnishing of its reputation, thus resulting in loss of existing as well as potential clients.

Customer concentration: The company has only 132 customers and large portion of revenue comes from a small number of customers. A loss of one key customer can cause considerable negative impact on company’s financials.

Highly competitive industry: The company operates in a fiercely competitive industry with constant threat of new entrants.

Conclusion

The company has a strong established position in its niche market, it has seen healthy improvement in profitability recently, and there is a large and expanding total addressable market. However, high customer concentration, constrained platform scalability (due to a high touch business model) and a premium valuation all lead us to maintain a cautious stance at this time. This could turnout to be an incredible long-term growth opportunity, but rather than purchasing shares—we’re waiting for more information (it just went public on September 30th), and we’re keeping Palantir high on our watchlist—for now.

note: pdf version of this report.