If you are an income-focused contrarian investor, you may be looking for opportunities among real estate securities, considering this has been one of the worst performing sectors of 2020 and it is know for its attractive dividend yields (and especially considering the potentially positive impacts of the recent coronavirus vaccines). In this report, we review an attractively priced real estate Closed-End Fund (“CEF”) that is able to offer investors a compelling 6.8% yield (paid monthly—MOPAY) thanks to its share price discount versus its net asset value (NAV) and its prudent use of leverage (~23.98%), among other important characteristics.

As the chart above shows, real estate (XLRE) has delivered a negative total return this year, as compared to significantly positive returns for the overall S&P 500 (SPY) and the technology sector (XLK) in particular. However, if you like to “buy low,” and you suspect the recent coronavirus vaccines could help contribute to a reversal (between underperforming brick-and-mortar real estate versus naturally “socially distanced” technology stocks), you might want to consider the following REIT CEF as one attractive high-income way to play it.

Cohen & Steers REIT & Preferred Income Fund (RNP)

According to the Cohen & Steers website, the “primary investment objective of RNP is high current income through investment in real estate and diversified preferred securities. The secondary investment objective is capital appreciation. Real estate securities include securities of any market capitalization issued by real estate companies (including REITs) and preferred securities are issued by U.S. and non-U.S. companies.”

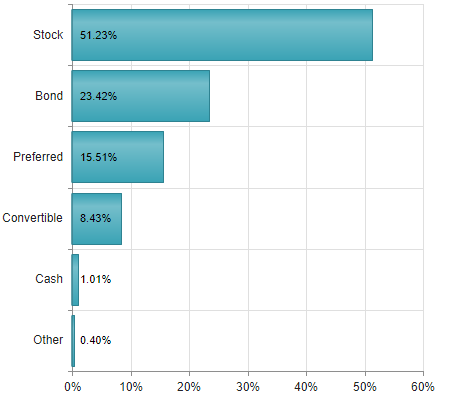

For a little more perspective, here is a look at the recent asset allocation of the fund.

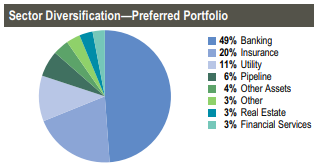

RNP is mostly stocks, but also has a fair amount of bonds (23.42%) and preferred securities (15.51%). And here are the sub-sector breakdowns of the portfolio’s REIT and preferred share portfolios (note the fund is well diversified with 256 individual security holdings).

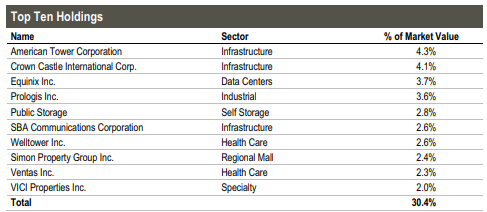

And lastly, for just a little more perspective, here are the top 10 holdings as of the end of last quarter.

For more data on this fund, CEF Connect and the Cohen & Steers RNP page are good (well organized) sources.

Market Price vs Net Asset Value

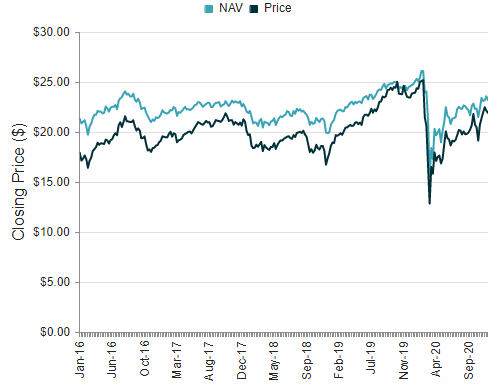

One of the most interesting and important things to consider when investing in a closed-end fund is the current market price versus the fund’s net asset value (NAV is the aggregate value of all the individual underlying holdings). Unlike a mutual fund or an exchange-traded fund, the market price of a closed-end fund can vary significantly from its NAV (because the market price is based on supply and demand, and there is no immediate mechanism to bring the two into alignment as there is with mutual funds and ETFs). Here is a look at the current and historical market prices RNP:

RNP NAV vs Price:

We generally prefer to buy and own CEFs that are currently trading at a discount to NAV (as is currently the case for RNP, it’s currently at a 5.7% discount to NAV) because it means we are getting a chance to buy the assets “on sale,” and because it means we get to buy the income stream they produce (in this case quite high) at a discounted price.

However, there is more to it than simply premium versus discount. For starters, there is no guarantee that discounted price CEFs will ever rise back up to their NAV price (the discount could get bigger), and there is no guarantee that premiums will ever revert either. In the case of RNP, it trades at an relatively attractive discount as compared to its own history.

Distribution History: RNP Pays Monthly

If it is steady income payments you seek, you might be happy to know this particular CEF (RNP) pays income to investors monthly. And as you can see in the following charts, this income has been steady.

RNP Monthly Distribution History:

Important to note, this fund aims to pay income based on the income produced by the underlying holdings. But in rare cases RNP can generate some of its big steady income payments with capital gains and/or a return of your own capital. While many investor prefer to see distributions come from 100% income of the underlying holdings, it is acceptable in our view for some distribution payments to be generated from other sources as described above so long as it is minimal and the overall distribution strategy is sustainable. In the case of RNP, the income has recently been generated entirely from “Income” or “Long-Term Gains,” —a good thing.

Note that there are slight tax differences in income payments (ordinary income rate) versus long-term short-term capital gains and return of capital (return of capital reduces your cost basis, which can result in more capital gains taxes when you do eventually sell). We are comfortable with the distribution composition of RNP.

Leverage (Borrowed Money):

Many CEFs use borrowed money as part of their normal operations. While this can increase risk and volatility, we approve of the leverage in RNP because the fund uses it prudently, it adheres to regulatory limits, and it does so at a lower cost (and with more discipline) that you or I could do, and the leverage helps increase the monthly income payments and total long-term returns (i.e. it magnifies/increases your monthly income payments). Leverage is concerning to some, but it’s not unlike the leverage corporations use on their balance sheets, homeowners use when they get a mortgage, or the borrowing Warren Buffett does at Berkshire Hathaway. Furthermore, the types of securities this fund invest in tend to have somewhat lower volatility in the first place (REITs, preferreds, bonds), so the leverage is less concerning (and totally normal). RNP’s recent leverage ratio was 23.98%, an acceptable and attractive level.

Fees and Expenses:

Fees and fund expenses are another important consideration when investing in closed-end-funds. And in the case of funds that use leverage (such as RNP), the cost of borrowing money is important to be aware of so you don’t misjudge the fee. For example, RNP charges an “all in” expense ratio of 1.93%. This includes the funds management fee as well as the cost of leverage. Overall, we believe the fee on this fund is significant but acceptable if you are looking for strong management to deliver steady monthly income payments.

Conclusion:

The Cohen & Steers REIT and Preferred Income Fund (RNP) is attractive for its high monthly income payments, discounted price (versus NAV) and attractive allocation to real estate securities (a sector that has been underperforming, but may be attractive to contrarian investors, especially as we head into 2021 with the ongoing rollout of coronavirus vaccines). Not only are the steady monthly income payments attractive, but so too is the price and sector allocation. We especially like that the leverage and discounted price both combine to increase the size of the steady monthly income payments this fund makes to its investors. If you are looking for high income and a chance for healthy contrarian price gains, this particular CEF (RNP) is worth considering for a spot in your long-term income-focused investment portfolio.