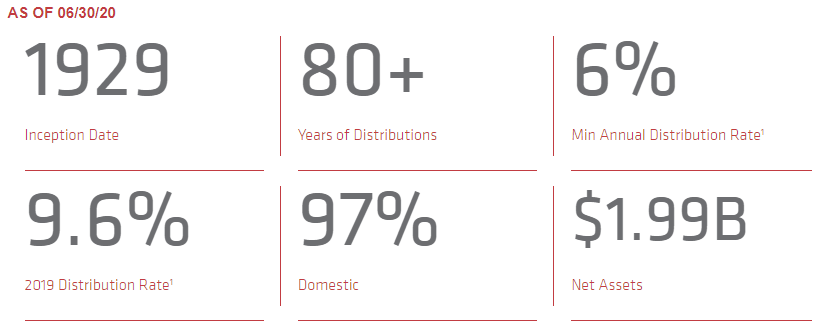

Income-focused stock-market investors often make the unfortunate mistake of concentrating all of their investments in the same few big-dividend sectors of the market. However, this particular closed-end fund diversifies across important sectors, thereby reducing investor risks, increasing total return opportunities, and still offering a big yield for investors. It is also trading at a very attractively discounted price, has an experienced-leadership team, and pays investors at least a 6% annual yield—and usually more (in 2019 it paid 9.6%, and 2020 is on pace to be another very strong year). What’s more, because it pays three smaller dividends in Q1, Q2 and Q3, investment websites consistently under-report the size of the big yield, and there is still time for investors to get in now to capture the big upcoming Q4 payment. And by the way, it’s been paying healthy dividends for over 80 years straight!

Adams Diversified Equity Fund (ADX), Yield: 9.1%

We are referring to the Adams Diversified Equity Fund (ADX), and we like it for a variety or reasons. For starters, the fund has been around since 1929, and offers a minimum annual distribution rate of 6% (in 2019 in was 9.6%, and this year is on pace to be very strong too).

According to the fund’s website:

ADX seeks to deliver superior returns over time by investing in a broadly-diversified equity portfolio. The Fund invests in a blend of high-quality, large-cap companies. The fund seeks to generate returns that exceed its benchmark and consistently distribute dividend income and capital gains to shareholders.

Diversification and Discipline:

Traditional income-focused market sectors/industries include REITs, utilities, consumer staples, financials and energy. And these can be fine sectors, however they ignore other attractive sectors such as consumer discretionary and technology. ADX is well diversified across market sectors as shown in the following graphic.

And here is a look at the fund’s top holdings.

Disciplined Distributions Paid to Investors

You may be wondering how a fund investing in the types of securities described above can offer a 9.6% annual payout to investors, and the answer is a disciplined combination of dividends and price appreciation, as shown in the following table.

As the table shows, ADX generates its big distribution payments through a very disciplined combination of “income” (dividends) and gains (price appreciation). We like this approach because (a) it gives investors steady spending cash if they need it (they can choose to simply reinvest it in the fund if they don’t need it), and (b) it forces disciplined selling (the management team watches the positions closely to determine where/when it is prudent to place sell orders—we like this discipline).

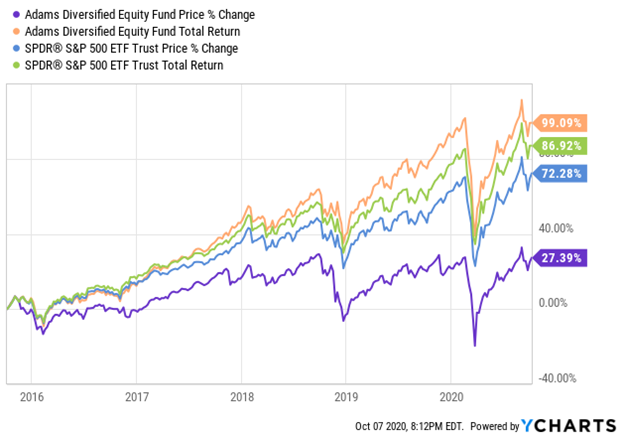

For perspective, here is a look at the performance of the fund (versus the S&P 500) both with and without distributions (“dividends”) reinvested.

As you can see, if you spent all the distributions, the fund’s value has still been on the rise, and if you reinvested them, the fund has recently been outperforming the S&P 500.

And as mentioned, ADX pays three smaller dividends in Q1, Q2 and Q3 (consisting of dividend income generated by the underlying holdings), and it pays a big distribution in Q4 (generated through a combination of dividends plus selling some of its winners).

Attractively Discounted Price

Another thing we really like about this fund is that it trades at an attractively discounted price versus its net asset value (“NAV”). This is a unique (and advantageous) characteristic of closed-end funds (“CEFs”). Specifically, unlike mutual funds and ETFs (which trade very much in lock step with their NAVs), CEFs trade based on supply and demand only (buys and sells) and thereby frequently have market prices trading at significant discounts or premiums to NAV. And in this case, ADX trades at an attractive discount, as shown in the following chart.

Because ADX trades at a discount, it means you basically get to own all the underlying holdings (such as the top 10 stocks we listed earlier) at a discounted price (you are buying on sale!). This not only gives you access to all the dividends of the underlying holdings at an attractively discounted price, but when the fund sells some of its winners (from its underlying holdings) to generate gains to fund distributions, it gets to recognize some of that discounted mismatch between NAV and market price—and pay it out to you.

There is no guarantee that the discounted price will ever go away. In fact it could get larger, and it has existed for a very long time. However, given the fact that we get access to the distribution income stream at a discounted price, we don’t mind. It’s a very attractive quality for investors. Further, the discount is attractively wide right now, as you can see in the chart above.

Quality Management Team

ADX is actively managed, whereby the portfolio managers select the underlying holdings (it recently held 104 positions).

Furthermore, the management fee, recently only 0.61%, is very low for this type of fund. It is very important for investors to closely monitor investment management fees because they detract from your performance, and that detraction compounds over time. We are comfortable with the management fee of this fund. For perspective, it is not uncommon for similar stock CEFs to charge 3 and 4 times as much in management fees.

Important Takeaways

If you are a disciplined, long-term, income-focused investor, the Adams Diversified Equity Fund is attractive. Not only does it offer a big distribution yield, but it trades at an attractively discounted price and it is well managed. We like the portfolio management team’s decision to diversify into non-traditional high-income sectors of the market because it reduces risks and improves the total return opportunities for investors. Furthermore, the big upcoming annual Q4 distribution adds discipline to the portfolio management process—something we really like. If you are an income-focused investor, this one is worth considering for a spot in your portfolio. We currently own shares, and we are looking forward to the big Q4 distribution based on the strong performance of the underlying holdings so far this year.

For a little more perspective on the fund, you might want to consider this recent note from its management team on the real cost of trying to “time the market.” We really like what the Adams Team had to say:

The truth is, investors can rarely predict the best time to exit stocks, as the recent market sell-off shows. In fact, we believe you are far better off remaining disciplined and staying invested in the markets through good times and bad.