Shares of this Chinese, small-cap, “brand-focused,” e-commerce company trade in the US (on the Nasdaq) as an ADR (American Depositary Receipt), and they are currently priced attractively after the recent sell-off, especially considering the continuing powerful growth expectations for online commerce and for the company in particular. In this article, we review the solutions offered by the company, its growth prospects, valuation, risks and conclude with our view on why the shares are worth considering if you are a long-term investor.

Overview: Baozun (BZUN)

Baozun Inc. (BZUN) is a leading, brand-focused, e-commerce solutions company in China. Specifically, Baozun helps brands execute their e-commerce strategies by selling their goods and by providing services such as digital marketing, warehousing, fulfillment, customer service, information technology and store operations. Baozun generates all of its revenue from China.

Baozun provides e-commerce solutions to ~250 brand partners across a range of industries including apparel and accessories; appliances; electronics; home and furnishings; food and health, among others. It helps brand partners establish market presence and launch products quickly on official brand stores and major online marketplaces in China, such as Tmall and JD.com, and on some emerging e-commerce channels, such as WeChat Mini Programs. Baozun has been consistently recognized by Tmall as a “six-star”, or top-rated e-commerce service partner since 2016.

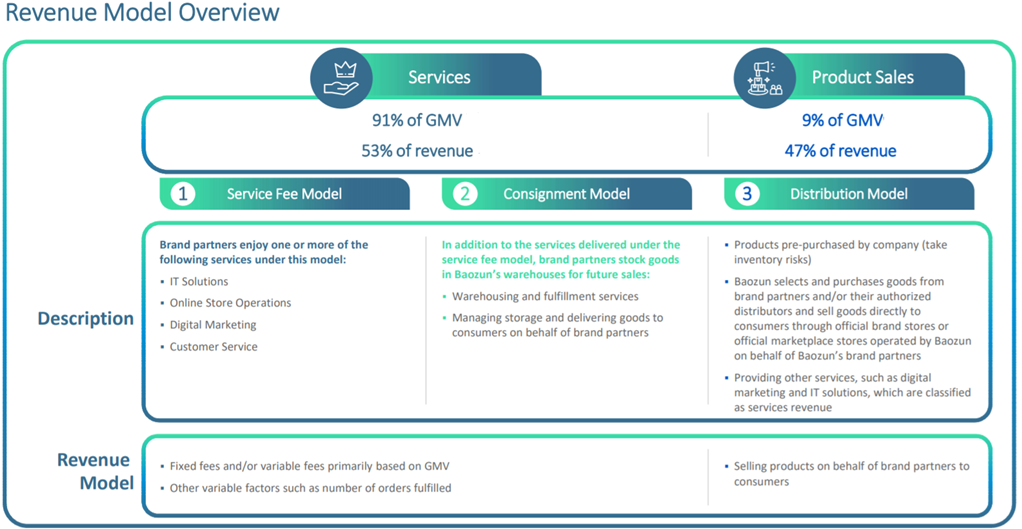

Baozun offers its services under three business models:

Distribution model: BZUN purchases goods from brand partners and sells the goods directly to consumers through official brand stores or official marketplace stores;

Service fee model: BZUN provides a variety of e-commerce services, such as IT solutions, online store operation, digital marketing, and customer services to brand partners;

Consignment model: In addition to services under the service fee model, Baozun also offers warehousing and fulfillment services.

As you can see in the following graphic, product sales accounted for ~47% of total sales in FY19, while services accounted for the remaining 53%.

source: Company Presentation

Established Leader in a High Growth Sector

Baozun is the leader in China’s brand ecommerce services industry, currently garnering a 7.9% market share, thereby making it the #1 player in the space. As mentioned, Baozun has ~250 brand partners (including 15 of the top 50 most valuable global brands, and it was able to add 19 new brands to its portfolio during a challenging first half to 2020—a healthy sign in our view.

The branded e-commerce space overall has dramatic growth prospects. For example, it has has been growing at a healthy annual clip in recent years (as shown below), and it has an expected compound annual growth rate of 23.9% through 2025.

source: Company Presentation

One-Stop Shop for Brand Partners

Unlike many of its more narrowly-focused competitors, Baozun is well equipped to meet a variety of demands for brands of different scale, different origin and at different stages of development. Specifically, Baozun provides end-to-end solutions that encompass every aspect of the e-commerce value chain, including IT infrastructure setup and integration, online store design and setup, store operations, visual merchandizing and marketing campaigns, customer services, warehousing, and order fulfillment. Baozun also offers omni-channel solutions helping brands integrate their online and offline operations.

In contrast (see graphic below), other brand ecommerce providers generally offer a narrower scope of services, such as a single e-commerce channel and a limited set of verticals.

source: Company Presentation

Management recently acknowledged Baozun as the preferred, one-stop choice for brands looking to establish online presence, noting during the Q2 earnings call:

We are seeing growing needs from our brand partners for creative go-to-market strategies, tactical IT, data analysis and marketing solutions, sophisticated and integrated omni-channel initiatives and logistic services.”

Luxury and FMCG Brands to Drive Growth

Luxury and FMCG brands (fast-moving consumer goods) have become a key growth driver for Baozun. Specifically, the company expects both of these categories to deliver growth rates in excess of 100% for 2020 and into 2021. In particular, Baozun is aiming to deepen its cooperation with domestic FMCG brands by: (1) helping more brands build an online channel (especially emerging brands, inexperienced in online operation), and (2) working with existing brands to incubate new brands by leveraging their supply chain. Additionally, Baozun continues to expect more luxury brands to come online by the end of the year.

Per management, during the Q2 earnings call:

“We continue to make meaningful progress in engaging with new brands and optimizing our category mix with a net addition of 11 new brands. These new brands included several luxury brands, as well as a few FMCG brands, especially in the food and health categories.

Consequently, the financial benefits (of new brands) are expected to kick in next year (2021), thereby supporting revenue growth of +30%.

Furthermore, continued portfolio optimization and deeper cooperation with new brands should raise the non-distribution take rate and margins—a good thing for the Baozun’s business and its investors.

Temporary Slowdown Concerns

There are some concerns about a slowdown in revenue growth in Q3. Specifically, the company expects revenue growth for Q3 to be in the range of 16-20%, which is a touch lighter. However, the slowdown in Q3 is primarily due to the company’s strategic decision to focus away from lower profitability brands. And while revenue growth is likely to be weak, the Q3 profitability outlook is promising—with Baozun expecting 40% year-over-year growth in non-GAAP operating profits.

Furthermore, the most recently announced Q2 earnings were better-than-expected, with solid top-line growth and meaningful margin expansion. Revenue grew 26% year-over-year, on the back of 31% GMV growth (i.e. gross merchandise value). Revenue was helped by sportswear, luxury and FMCG. Non-GAAP operating margin expanded by 260 bps to 8.7% with operating leverage. And moving forward, Baozun expects GMV and revenue to see a strong reacceleration in Q4. In our view, the recent dip in share price provides an attractive opportunity for long-term investors.

Baozun share price:

Recent Public Offering/Dilution: Worth mentioning, Baozun conducted a public offering of nearly 40 million new shares at the end of September (this consisted of 4 million shares in a Hong Kong public offering, and 36 million new shares for the international offering). This amounted to nearly 13.3 million new American Depository Receipts (ADRs) or ~21% dilution. While this type of offering is not uncommon for high growth stocks (as they seek more capital for growth), this particular offering was significant. Shareholders took a near-term dilution hit in exchange for stronger long-term growth opportunity.

Valuation:

From a price-to-sale valuation standpoint (see chart below), Baozun is inexpensive relative to its high growth potential. The shares have recently taken a hit from investor concerns over near-term earnings. However, the hit was due to structural changes that will benefit the company (such as Baozun’s initiative to improve operating efficiency by eliminating low-return brands). Furthermore, the company has a strong pipeline in the FMCG and luxury categories, and expects to deliver revenue growth of +30% year-over-year for fiscal FY 2021. In our view, the valuation is very appealing, and the share price decline offers a more attractive entry point for long-term investors with the patience to ride out short-term volatility.

For additional perspective, here is a look at the average share price target for Baozun, as per the 16 Wall Street analysts covering it an reporting to Factset.

In aggregate, the analysts rate the shares a “Buy,” and with a price target of $45.76, suggesting the shares have at least 22% upside in the relatively near-future, and we believe the shares have significantly more upside in the long-term based on Baozun’s leadership position and the large market opportunity.

Risks:

Lower growth in brand partners: BZUN growth depends on its ability to add new brand partners as well renewing contracts with existing partners. Slower-than-expected growth in new brand partner additions could impact revenue growth. Also, if the company is unable to retain existing brand partners, results of operations could be materially and adversely affected.

Slowdown in China’s e-commerce: If consumer utilization of e-commerce channels in China does not grow (or grows more slowly than expected), demand for BZUN’s services and solutions would be adversely affected, revenues would be negatively impacted and the growth trajectory would be compromised.

Intensifying competition: BZUN faces intense competition in the market for brand e-commerce solutions and services, and we expect competition to continue to intensify in the future. Increased competition may result in reduced pricing or service scope for its services and solutions or a decrease in its market share. This could negatively affect its ability to retain existing brand partners and attract new brand partner.

Conclusion:

Baozun is a play on growth in online sales (as consumer purchasing behaviors continue to shift). The company (with its end-to-end offerings) is very well positioned to benefit from this shift (especially considering the opportunity is so large). In our view, the recent share price decline and low valuation provide an attractive opportunity for long-term investors. If you can handle some short-term volatility, Baozun is worth considering for a spot in your long-term portfolio. We currently own shares.