Fiverr (FVRR) is a global marketplace connecting freelancers and businesses for their digital service needs. The business was already growing rapidly, and the pandemic accelerated it. The trade in this report generates very high upfront premium income (that you get to keep no matter what) and it gives you a chance to pick up shares of this attractive business at a significantly lower price. The premium income available on this trade is very high because the share price has been volatile, but the business remains attractive in the long-term. We believe this is an attractive trade to place today and potentially over the next few trading sessions as long as the share price doesn’t move too dramatically before then.

The Trade: “Bullish Vertical Put Spread” on Fiverr (FVRR)

Sell AND Buy Put Options on Fiverr (FVRR) with a strike price of $170.00 (sell) and $130.00 (buy), and an expiration date of February 19, 2021 (less than 1-month from today), and for a net premium (upfront cash in your pocket) of at least $2.90 (or $290 because options contracts trade in lots of 100). You’re broker will make you keep $4,000 cash on hand (($170 - $130) x 100. The trade generates ~7.25% of extra income in less than 1-month ($290/$4,000) and that is a lot for such a short period of time (on an annualized basis that would be over an 87% rate of return (7.25% x 12). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of this attractive company (Fiverr) at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own FVRR, especially if it falls to a purchase price of below $170 but above $130 (if it falls below $130 we’d take the cash difference between our $130 strike put and the market price at expiration—this is basically insurance). The trade may sound complicated, but it’s not, and your broker likely makes all the calculations and execution easy as you can see in the graphic below.

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of FVRR doesn't move too dramatically before then, and as long as you’re able to generate premium income that you feel adequately compensates your for the risks (currently 7.25% premium income in less than 1-month).

Our Thesis: Fiverr (FVRR)

Our main thesis is basically that Fiverr is a very attractive business, trading at an attractive price. We believe the shares have continuing long-term price appreciation potential based on the large market opportunity (large total addressable market) and the high growth rate. For a little more perspective, here is a look at the average Fiverr recommendation and price target per the 9 Wall Street analysts covering the stock and reporting to Factset.

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the share price and thereby impact your trade. In this particular case, dividend payments are not an issue because FVRR doesn’t pay a dividend. However earnings is an important consideration because the company is expected to announce quarterly earnings numbers neon February 18th (the day before this contract expires), and depending on the results—that could add significant volatility to the share price and our trade. However, given the very high upfront premium income this trade generates, we are comfortable with the earnings risk (i.e. we believe the high premium income more than compensates us for the volatility risk).

The Bottom Line on The Trade:

Fiverr is an attractive growing business. It trades at a high price-to-sales valuation metric (as you can see in the table presented later in this report), but it has a very high sales growth rate to back it up. The business was accelerated by the pandemic, but it was already growing fast before the pandemic and we expect it to continue growing fast long after the pandemic. This trade generates very high upfront premium income for us, and it gives us a shot to own the shares at an even lower price. You can read more about the business in our earlier report, which is provided below…

Fiverr: About the Business

image source: Fiverr.com

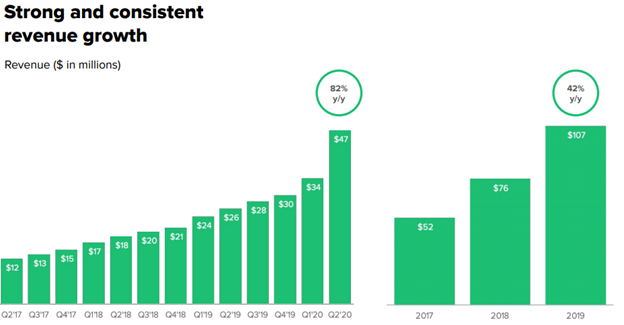

As mentioned, Fiverr connects freelancers and buyers via an online platform. The company offers over 400 categories ranging from digital marketing, to writing and translation, to programming and technology, to name a few. Fiverr is still only a $7.5 billion market cap company, but it has been growing revenues very rapidly. For a little perspective, Fiverr’s revenue growth rate is very high, as shown in the following table.

For a little more perspective on the business, this graphic from the company’s investor presentation shows how the traditional workplace is changing.

And Fiverr’s unique e-commerce approach to freelancing helps solve the challenges of traditional “offline” freelancing, such as finding the right talent to facilitating payments.

source: investor presentation

In particular, Fiverr’s “Service-as-a-Product” model also helps solve these challenges for both freelancers and buyers of their work.

source: investor presentation

A quick glance at Fiverr’s website makes the business and process fairly clear and easy. And the value added to both buyers and freelancer’s is further explained in the graphic below.

source: investor presentation

To be clear, the majority of Fiverr’s revenue comes from its core freelancer-buyer marketplace, but the company is also innovating and expanding through additional products such as learn, And.Co and ClearVoice, as shown in the graphic below.

source: investor presentation

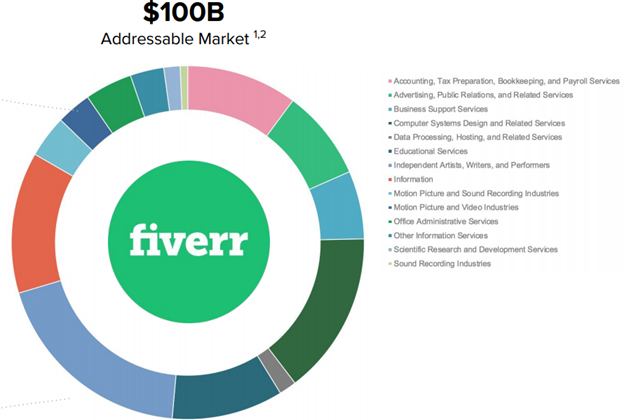

Large Market Opportunity:

One of the things that makes Fiverr’s business particularly attractive is its very large total addressable market (i.e. the business still has a lot of “room to run”). For starters, the majority of freelancing still happens offline, as shown in the graphic below.

source: investor presentation

Next, Fiverr estimates its own total addressable market at $100 billion, as shown in the next graphic (for perspective, Fiverr’s 2019 total revenue was only $107 million).

source: investor presentation

Furthermore, Fiverr has multiple levers for long-term grown, such as bringing new buyers on to the platform, expanding products, expanding categories, and expanding geographies, to name a few.

source: investor presentation

Overall, despite Fiverr’s rapid growth, the business still has a lot more room to run (a good thing for investors).

Valuation:

From a valuation standpoint, Fiverr is attractive. For starters, not only is revenue growing, but it is growing for multiple positive reasons. Specifically, not only does the business continue to attract new buyers at an impressive rate, but relationships with existing buyers continue for multiple years.

source: investor presentation

In aggregate, the company’s total revenue grew by 42% year-over-year in 2019 (as shown in the chart below), and that growth rate has been accelerated in 2020 by the COVID-19 pandemic (thanks to a combination of factors, including unemployment, work-from-home, and social distancing).

source: investor presentation

Importantly, we believe the higher revenue brought about by the pandemic is permanent and will continue to grow from here. Fiverr management agrees as they recently raised full-2020 revenue guidance (“revenue is now expected to grow 66-68% for FY20 with expected FY20 Adjusted EBITDA profitability.”)

source: investor presentation

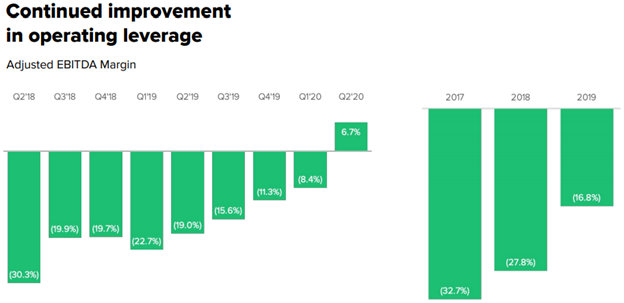

Many investors have been turned off by Fiverr’s lack of profitability, but this is normal (and actually preferred) for a high growth company that is currently focused on building long-term growth instead of maximizing short-term profits.

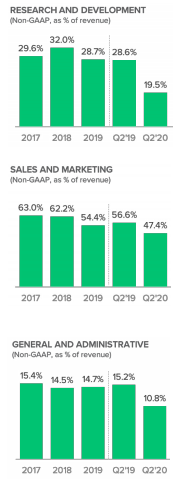

A closer look at the business shows that gross margins are very high and improving (a good thing). And Research & Development and Sales & Marketing costs continue to decline (as a percent of total revenue) as revenue continues to grow rapidly (i.e. the company increasingly benefits from economies of scale).

source: investor presentation

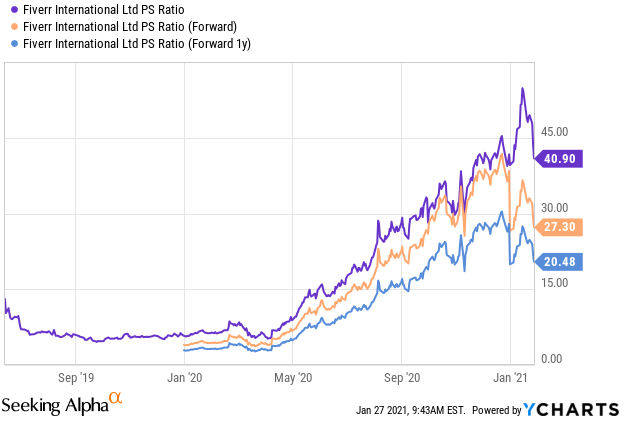

From a price-to-sales (and an enterprise value to sales) standpoint, Fiverr’s high multiples continue to frighten short-sighted investors.

Recall from our earlier table, Fiverr’s growth rates and valuation metrics are near the top of the list among other top growth stocks.

In our view, if you extrapolate Fiverr’s high growth rate for just a few years into the future (which we believe is very reasonable considering the opportunity) then the high valuation metrics quickly drop down to more palatable levels. In a nutshell, despite the recent rapid price appreciation, the market is still to short-sighted and undervaluing the business.

Risks

Volatility: For starters, as we head into an election in the United States, volatility is expected to continue to rise, and this can put significant pressure on high-growth companies (such as Fiverr) as they tend to be more sensitive to market ups and downs. However, for a little perspective, we personally prefer a lumpy 20% return versus a smooth 6% every time. Furthermore, this heightened volatility creates opportunity in the options market, as we will discuss later in this report.

COVID-19 Bump: Another risk for Fiverr is simply that stay-at-home work declines (as the pandemic recedes). Some investors may fear that the revenue acceleration from the pandemic is temporary, however we believe it has simply accelerated the growth of the business and established a new base from which to add further growth.

Competition is another risk. Fiverr competitors include companies such as UpWork (UPWK), 99designs, toptal, and outsourcely, to name a few. However, Fiverr and UpWork tend to be the two leaders, and there is plenty of room for both to grow at this time (the total addressable market is huge). In its most recent shareholder letter, Fiverr acknowledged the competition by explaining:

“Our expansive and ever-growing service catalog continues to be our key competitive advantage. During Q2’20, we launched nearly 30 new categories and added depth in certain popular areas including e-commerce management, social media marketing and music and music videos. We now have over 400 categories on our marketplace.”

Conclusion

Fiverr is an attractive business. It is in the right place at the right time (as the nature of work changes), and it is growing its leadership position (with differentiation and a long runway for continued growth).

Some investors are worried about the very strong price performance in recent months and the potential for high volatility. One way to play this short-term uncertainty is by setting up a “bullish vertical put spread,” as described in this report. The premium income available is very high (because the expected volatility is high), and the trade gives you a chance to own the shares at a significantly lower price (plus it provides you a little insurance on the downside).

Further, if you are a long-term investor, and you can handle the volatility, Fiverr shares are worth considering for a spot in your portfolio. The long-term pathway for growth remains highly compelling as the nature of work is evolving in Fiverr’s direction at an accelerated pace.