GasLog Partners has a history of paying and raising distributions consistently despite being part of the highly cyclical LNG shipping industry. The 14.1% distribution yield on the common shares is interesting (and so are the preferred shares), especially considering the likelihood of price appreciation. In this article, we review the health of the business, cash flow position, balance sheet flexibility, valuation, risks, dividend safety, and conclude with our opinion about investing in GasLog.

Overview:

GasLog Partners LP (GLOP) is a master limited partnership (MLP) that owns, operates and acquires LNG carriers. It was created by GasLog Limited (GLOG) in 2014, which currently owns ~35% of limited partnership (LP) units and a 2.0% general partner (GP) interest. The MLP structure often comprises two entities: a limited partnership (LP) that owns the underlying assets and a general partner (GP) that is responsible for managing the day-to-day operations of the business.

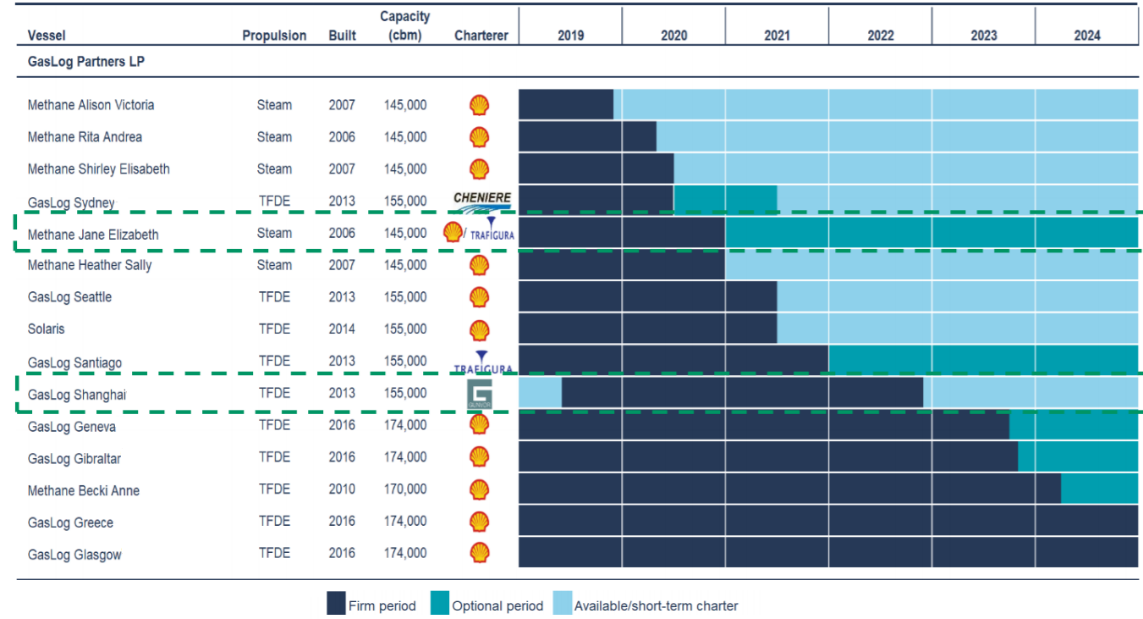

As of Q319, GLOP’s fleet consisted of 15 LNG carriers, including 10 vessels with tri-fuel diesel electric (TFDE) propulsion and five modern steam turbine propulsion (steam) vessels. GLOP has options and rights under which it may acquire additional LNG carriers from its parent GasLog Limited. We believe that such options and rights provide it with significant built-in growth opportunities.

GasLog Partners Fleet

(source: Company Presentation)

Currently, all 15 vessels are chartered under long-term contracts which provides cash flow visibility. The nearest upcoming charter expiry is for the Methane Alison Victoria, which may occur in early January 2020. Looking forward through 2020, GLOP has a revenue backlog of over $1 billion and already enjoys locked-in charter cover of 81% with over 75% of its open days falling in 2H20 wherein we anticipate a very strong LNG shipping market. GLOP recently delivered its highest-ever partnership performance results with revenues up 18% YOY, EBITDA up 22% YOY and distributable cash flow up 26% YOY.

No K-1

GasLog Partners LP has elected to be treated as a C-Corporation for U.S. federal income tax purposes. This means investors receive a Form 1099 and not a Schedule K-1. This is important because it makes life easier for investors around tax time.

The Elimination of IDRs

The elimination of the general partner’s incentive distribution rights (IDR) during Q219 also positions GLOP for growth. IDRs give a general partner an increasing share of a limited partnership's incremental distributable cash flow. Management noted that IDR elimination is immediately accretive to distributable cash flow per unit, reduces expected cost of capital and increases potential accretion from future acquisitions.

High Coverage Ratio Adds to Distribution Safety

GLOG’s cash distributions to shareholders have grown at an average annual rate of ~8% since its IPO in Q214. The current yield of ~14.5% is one of the highest in its operating history. And for some reassurance, GasLog Partners has signed multi-year charters with high-quality customers, including a subsidiary of Royal Dutch Shell plc, Cheniere Energy, Inc. and Guvnor. The leases provide predictable cash flows and allows GasLog Partners to return cash to investors on a regular basis. In fact, because the company is structured as a master limited partnership (MLP), it is required to distribute most of its available cash to unitholders.

(source: Company data)

It is important to note that the distribution coverage ratio for Q319 stood at 1.3x, meaning it generated 30% more cash than what was needed to meet its distribution obligations. The ratio highlights the company’s ability to pay cash distributions to its shareholders (a ratio of greater than 1 indicates that the company generates more cash than is required for distributions and shows strength in the business). And as shown in the chart below, GLOG has maintained a ratio of >1 every quarter since its IPO in 2014. We are encouraged by the high distribution coverage ratio as it helps validate our view that the distribution is relatively safe, and GLOP will not only be able to maintain its payout but also increase it going forward. For fiscal 2019, GLOP is guiding for 2% to 4% distribution growth.

For perspective, following the acquisition of GasLog Glasgow in Q219, the partnership expects to meet its distribution growth guidance for 2019 without the need for additional dropdowns. However, it expects to continue to acquire assets from its parent at the historical pace of some two vessels per year. While we expect distributions to continue serving as primary means of returning capital to unitholders, repurchasing units is another option used by the management team to generate additional shareholder returns. Through Q3 2019, GasLog Partners had repurchased common units worth ~$20 million, which equates to $0.44 per unit of cash returned to shareholders.

(source: Company data)

Dropdown Pipeline Provides Visibility for Future Growth Opportunities

A dropdown refers to the transaction wherein the parent sells its asset (vessel) to the master limited partnership (MLP). This helps parent to monetize its asset and at the same time provides the MLP with a new source of cash flow which is essential for growing its distribution payout. GLOG has a drop-down pipeline of 14 vessels currently owned by its parent GasLog Limited. Each vessel has a firm charter period ranging from 2025 to 2032 and represents approximately $3 billion in contracted backlog and ~$300 million in total annual EBITDA. These vessels provide visible future growth opportunities for GasLog Partners and would contribute positively to the average charter length of its fleet, as well as to enhance distributable cash flows. This coupled with its strong balance sheet and access to diverse sources of debt and equity capital, we believe GasLog Partners is poised for continued growth.

Dropdown Pipeline of 14 Vessels

(source: Company Presentation)

Strong Financials

GLOG’s balance sheet strength can be attributed to its debt amortization schedule which frees up capacity and maintains flexibility to raise capital if needed. GLOG’s debt amortizes at roughly twice the rate its ships depreciate building equity value and balance sheet capacity for future growth (debt amortization is the process of paying off debt over time in regular installments of interest and principal). The company expects to amortize approximately $220 million of debt over 2019 and 2020, equivalent to almost 1x annual EBITDA and 9% of total capital. Further, its net debt to total capital and net debt to EBITDA remains healthy at 55% and 5x respectively. The total available liquidity including revolver capacity and short-term investments is ~$133 million as of the end of Q319.

Further, GLOP has access to cost competitive debt and equity capital markets which helps ensure enough availability of capital to fund its acquisitions. The company has raised money via common units, preference units as well as unsecured debt instruments. The weighted average cost of preference equity is 8.4%, while the weighted average cost of debt is 4.6% as of Q319. The cost of funding is very reasonable in our view.

LNG Industry Fundamentals Favorable

LNG demand globally is expected to grow significantly which should be positive for GLOP. In total, Wood Mackenzie expects net LNG demand to grow by 150 million tons between 2018 and 2025. Although China's imports have been significant in recent years, it's important to note that other countries in Southeast Asia, together with Europe account for nearly two-thirds of the projected LNG demand growth 2025.

(source: Company Presentation)

As can be seen in chart below, the market is expected to be structurally tighter through at least the end of 2020 based on the latest quarterly LNG supply growth estimates and based on the water shipping fleet plus scheduled vessel deliveries. GLOP’s fleet is 98% contracted through the end of 2019 and its nearest exposure to the spot market is not expected until January 2020. In 2020, GLOP's fleet is 81% contracted and 75% of its open days are weighted toward the second half of the year when shipping demand is expected to be robust.

(source: Company Presentation)

Moreover, the rate trends in the LNG shipping market tend to be more robust during the second half of the year. As shown in the chart below, spot rates generally bottom out in early spring and peak in the fourth quarter. GLOP is well positioned to benefit from this seasonality given that the majority of its charter expiry for 2020 is weighted towards second half, wherein the spot market rates are expected to be high.

(source: Company Presentation)

Preferred Shares; Should you Prefer them Over Common Units?

GLOP has issued three classes of Preferred shares so far – 8.625% Series A, 8.20% Series B and 8.50% Series C. All three classes were issued with liquidation preference of $25.00 per unit, at a price to the public of $25.00 per preference unit. These units are senior to the common units and as such receive priority over the common units in distributions and liquidation.

The Preference Units are listed on the New York Stock Exchange under the symbol “GLOP PA”, “GLOP PB”, and “GLOP PC”. GLOP-PA is currently trading at a slight premium (1.72%) to its liquidation preference and is callable in June 2027. GLOP-PB is currently trading at a slight discount (0.48%) to its liquidation preference and is callable in March 2023. GLOP-PC is also currently trading at a slight discount (~3.12%) to its liquidation preference and is callable in March 2024 (when the preferred stock is callable, it means that the issuer (in this case GLOP) has the right to call in or redeem the stock at a pre-set price (liquidation preference) after a defined period (callable date)). The dividend yields (as shown in table below) are decent, but significantly lower as compared to common units. The advantage is that the preferred units show much lower price volatility when compared to the common units. Thus, the preferred shares may be particularly attractive for investors seeking steady income with low volatility.

(source: Yahoo finance)

Valuation:

From a peer valuation standpoint, GLOP looks undervalued compared to other LNG shipping MLPs. On most measures, such as EV to EBITDA, Price to Distributable Cash Flow and Dividend Yield, we believe GLOP is under appreciated by the market despite its strong balance sheet, high growth trajectory and solid payout coverage. GLOP’s dividend yield historically has been in the range of 8%-12%, compared to ~14.5% currently. There is scope for yield to move down which will mean capital appreciation for investors.

(source: Thomson Reuters)

Risks:

International Maritime Organization (IMO) Environmental Regulations: New IMO regulation are a risk, and likely a contributor to the recent price decline for shares of GasLog. According to Reuters:

“From January 2020, United Nations shipping agency the International Maritime Organization (IMO) will ban ships from using fuels with a sulphur content above 0.5%, compared with 3.5% now.”

According to GasLog’s annual report:

“These and other laws or regulations may require additional capital expenditures or operating expenses (such as increased costs for low-sulfur fuel or pollution controls) in order for us to maintain our ships’ compliance with international and/or national regulations.

There remains a significant amount of uncertainty about the full impact of the regulations, as well as GasLog’s ability to pass costs through to customers.

Parent Relationship: GLOP’s future growth is largely dependent on a continuing relationship with GasLog Limited. Specifically, uncertainty in winning new charters for existing and newbuild vessels may limit the drop-down pipeline for GLOP thereby impacting growth and payouts.

Industry risk: The LNG sector is cyclical and volatile. Volatile commodity prices, global GDP growth, natural gas demand, weather and environmental regulations pose risks to the industry and to GLOP.

Conclusion:

Given the healthy business and outlook, (contract coverage stands at 81% with demand expected to increase) and considering the well-covered distributions (coverage stands at 1.2x) and significantly low valuation, we believe GasLog is worth considering for investment, especially if you are a value-oriented income-focused investor. Obviously, there are risks to investing in GasLog, as described in this article, and especially considering that anything with a yield this high is going to have some warts on it. And if you prefer high income with lower volatility, the preferred shares are also interesting considering they also trade at a discount, and the company continues to be able to access the capital markets. Obviously, we’re not suggesting anyone dump their life savings into GasLog, but it’s worth considering for a spot in your prudently-diversified, goal-focused investment portfolio.