Shares of this LNG shipping company have gotten crushed in recent weeks due to cyclicality of the business, uncertainty about new International Maritime Organization (“IMO”) Environmental Regulations, and an analyst warning about the risk of a distribution reduction. However, there are reasons to believe the market has dramatically overreacted and the distribution will still be very large and attractive (even after any speculated reduction). Rather than buying the shares outright, the premium income available in the options market is enormous and attractive.

GasLog Partners (GLOP):

The Trade:

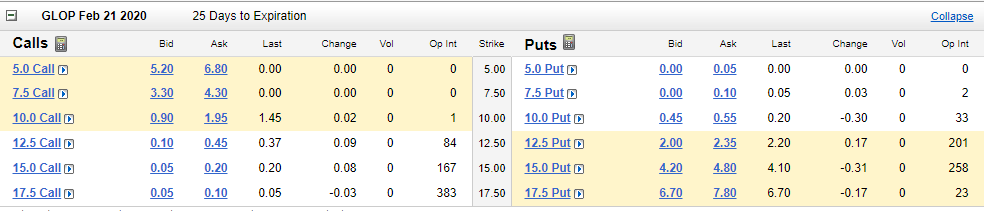

Sell Put Options on GasLog (GLOP) with a strike price of $7.50 (this is a very wide 32.7% out of the money), and an expiration date of February 21, 2020, and for a premium of $0.10 (this comes out to +16% of extra income on an annualized basis, ($0.10/$7.50 x (12 months). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of GLOP at a dramatically lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be excited to own GLOP, especially if it falls to a purchase price of $7.50 per share).

Note: depending on how much upfront premium income you want to generate, and how much likelihood you’re comfortable with that the shares may get put to you before expiration, you might consider the $10 strike price, or even simply buying the PREFERRED shares outright (more about the preferred shares in our full report linked below).

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of GLOP doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 15% or greater.

Our Thesis:

Our thesis is basically that the market is dramatically overreacting to the risks that GLOP currently faces, such as IMO environmental regulations and the cyclicality of its business as we described in our recent full GLOP report:

Additionally, a recent analyst note about a potential distribution reduction has sent the shares into a free fall. The market is overreacting (as we described in our full report), and when there is “blood in the streets” (as it currently is with GLOP) it’s usually a good idea to be on the other side of that trade. We love the huge premium income this trade generates, the shares have to fall very far before they get put to us, and even if they do get put to us at the strike of $7.50 we’d be happy to own them considering the business prospects and the fact that distribution yield will likely still be very large.

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. In this particular case, both are very important considerations. First, GLOP is scheduled to announce earnings on February 6th (before this options contract expires), and it is expected to go ex-dividend on around the same time (also before these put options expire). Both of these items (especially the earnings announcement could have a dramatic impact on the share price). However, we are comfortable with these factors considering the the large premium income and considering the $7.50 strike is so far out of the money. Further, we’d be happy to own the shares for the “long-term” if we get to buy them at $7.50 and considering they’ll likely keep paying a very big distribution for a very long time.

Conclusion:

There is currently panic in the streets with regards to GasLog. In our view, it’s due to a misunderstanding of the cyclicality of the business, combined with IMO regulatory fears, plus fear caused by the recent Evercore ISI report. However, as we concluded our full report a couple weeks ago:

Given the healthy business and outlook, (contract coverage stands at 81% with demand expected to increase) and considering the well-covered distributions (coverage stands at 1.2x) and significantly low valuation, we believe GasLog is worth considering for investment, especially if you are a value-oriented income-focused investor. Obviously, there are risks to investing in GasLog, as described in this article, and especially considering that anything with a yield this high is going to have some warts on it. And if you prefer high income with lower volatility, the preferred shares are also interesting considering they also trade at a discount, and the company continues to be able to access the capital markets.

This trade allows you to generate attractive upfront income that you get to keep no matter what. And this options trade also gives you a chance of picking up shares of this attractive long-term business at an even lower price, if the shares fall even further than they already have, and they get put to you at $7.50. And at a price of $7.50, GLOP is an extremely attractive long-term cash flow generator.