Buying great businesses when they’re out of favor can work well over the long-term. This report reviews a compelling income-generating options trade on a very attractive semiconductor business that is currently/temporarily out of favor. Specifically, the share price is down as supply chain uncertainties add to sector momentum challenges. These factors have combined to create an attractive options trade opportunity that puts compelling upfront premium income in your pocket, and gives you a chance to pick up these attractive shares at an even lower price. We believe the trade is attractive to place today, and potentially over the next few trading sessions, as long as the share price doesn’t move too dramatically before then.

Advanced Micro Devices (AMD)

Share Price (AMD):

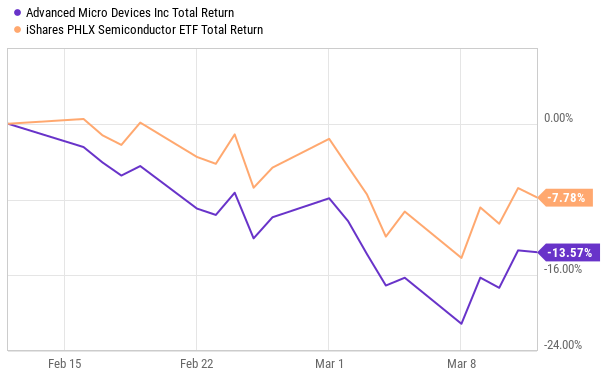

AMD has successfully reinvested itself and turned itself around in recent years, and it has continuing powerful long-term price appreciation potential ahead, despite the price pullback in recent weeks (see chart above). We recently completed a detail full report on AMD (explaining why the business is so increasingly attractive), and you can access that report here.

The Trade:

Sell Put Options on AMD with a strike price of $72.50 (~11.3% out of the money, it currently trades at ~$81.75), and an expiration date of April 16, 2021, and for a premium of at least $1.08 (or $108 because options contracts trade in lots of 100). This comes out to approximately 1.49% of extra income in just 31 days—which may not sound like a big return—but it is a lot for such a short time frame (it’s approximately 17.9% of extra income on an annualized basis, calculated as ($1.08/$72.50) x (365/31) days). And this trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this attractive long-term company at a dramatically lower price ($72.50—the strike price) if the market price falls below $72.50 and the shares get put to us before this option contract expires in 31 days. And we get to keep the upfront premium income no matter what.

Also important to note, you can adjust the strike price of this trade (for example to $75) or the expiration date (for example to March 19th) depending on how badly (and at what price) you want the shares put to you, and to generate a different amount upfront income as shown in the table above).

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next few trading days, as long as the price of AMD doesn't move too dramatically before then and you’re able to generate enough premium income to your liking.

Our Thesis:

Our thesis on this trade is simply that AMD is an attractive long-term investment (thanks to its impressive turnaround in recent years and the incredibly large market opportunities ahead). Further, current market volatility has driven the upfront premium income available—higher (when volatility is higher, premium income available goes up). This is an attractive trade because it generates high income (that you get to keep no matter what), and it gives you a shot of picking up shares of this attractive business at an even lower price (if they get put to you before the options contract expires in about one month.

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and earnings announcements because they can both impact your trade. In AMD’s case, neither is a concern. AMD doesn’t pay a dividend, and it is not expected to announce earnings again until a few days after this contract expires. (earnings announcements add uncertainty, volatility and risk to an options trade because that’s when new information often comes out that can significantly move the share price).

Conclusion:

Simply put, AMD is an attractive business at an attractive price. In fact, we are not totally opposed to simply buying some shares outright on this recent share price pullback. However, if you are sensitive to price moves, you may instead want to consider this options trade which is particularly compelling based on current market conditions. Not only does it put significant upfront income in your pocket (that you get to keep no matter what), but it also gives you a chance to pick up these attractive shares at an even lower price.