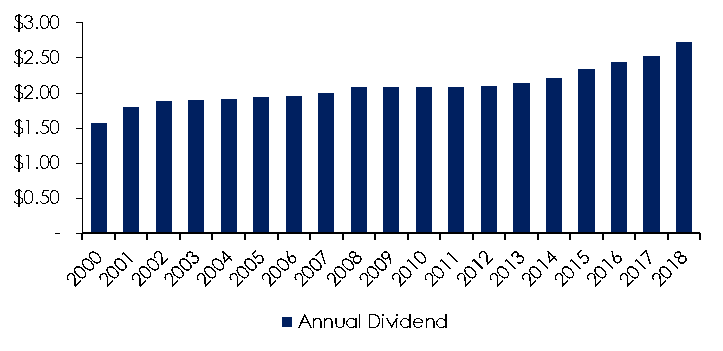

EastGroup Properties (EGP) has been one of the best performers in the industrial REIT sector over the last five years in terms of maximizing shareholder value. The company’s differentiated operating strategy and risk-adjusted targeted development program is expected to pave the way for future growth. This article analyzes the various strengths of EGP, looks at the dividend yield and valuation (the dividend has been consistently increasing, but the yield is still only 2.5% because the price keeps increasing too, as it should) and concludes with our opinion on whether EGP is worth considering if you’re a long-term dividend growth investor.