Navios Maritime Partners (NMM) generated enough operating cash flow to cover its distribution more than four times over, over the last quarter. And with a DCF yield of 36%, and shares trading at 1/3 estimated NAV (shares 97¢, NAV $2.91), is there any reason to believe this isn’t a prince of an investment? But of course there is more to this story… What follows is a guest article by Darren McCammon of Cash Flow Kingdom…

Per Darren’s write-up…

I only wish I could stop the story there; it would be a fairytale investment. Unfortunately, such things don't exist in real life. Instead we need to ask ourselves just what kisses from Mrs. Frangou (CEO of Navios family), are necessary to turn this into a prince of an investment?

The Warts:

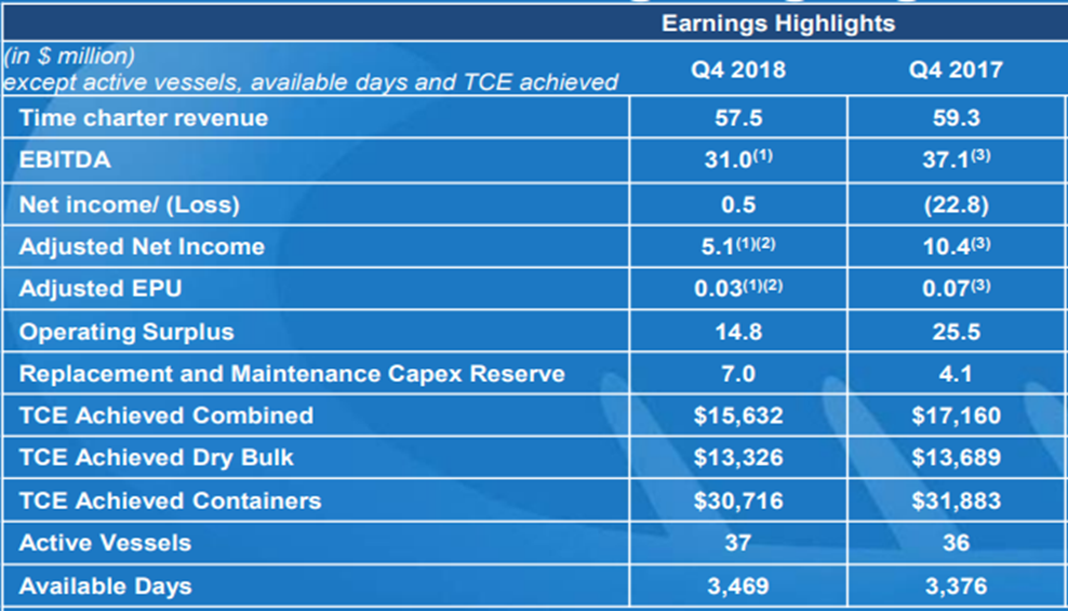

Navios Maritime Partners (NMM) had a weak quarter with TCE and EBITDA down about 27% in Q4.

Source: NMM Presentation

Next quarter is likely to be even weaker.

Vale (VALE), an iron ore producer in Brazil had a dam break which killed at least 179 people and caused it to shut down production at mines with similar dams. This in turn has caused a significant reduction in iron ore being shipped from Brazil to places like China (estimated at 10% of total production). Since the Brazil to China route is a long haul that reduces ton-mile demand for Capesize dry bulk even more significantly and trickles down to the smaller sizes Panamax dry bulk ships as Capesize ships get repurposed elsewhere. As a result, Capesize and Panamax Dry Bulk shipping rates are down about 55% from this time last year with frankly no one really knowing when they might recover. The decrease in iron ore shipments from Brazil will likely be measured in years, rather than months. Legal ramifications and regulatory rule changes need make their way through the system. Tailing dams need to get reinforced in an acceptable manner. (I don't mean to be callous to the loss of life here, it is a tragedy. My job however is to mainly focus on the financial ramifications to Navios Maritime Partners.)

Adding to this, the Navios family and its CEO, Angeliki Frangou, are currently not well thought of by individual investors. The parent company Navios Maritime (NM) has made some improvements, but continues to have negative equity value and remains in serious danger of bankruptcy. NM stopped paying its preferred shares distributions several years ago (NM.PH, NM.PG), underwent a 1:10 reverse split in order to remain listed (stock price above $1), and has seen debt on its Navios Maritime Acquisition (NNA) child downgraded by Moody's. The fear is a relatively strong cash position at NMM will be used to support the parent.

There is some precedence for this fear. At one-point Mrs. Frangou did try to orchestrate a loan from one of its children to NM. This loan however was canceled after significant shareholders protest). NMM also prepaid a higher level of dry dock expenses to its parent in the past couple years, breaking from previous precedence of NMM reimbursing NM for the expenses shortly thereafter. Although the overall amount wasn’t massive, this move gave the equivalent of an interest-free credit facility to NM.

An obvious question is, why would anyone want to invest in such a troubled firm?

The answer is shipping is notoriously cyclical. Shipping costs are typically relatively minor compared to the value of the end product being produced (steel for instance). Thus, ship lease rates can double (or halve) without there being a significant feedback loop changing actual shipping demand. Additionally, there are fairly long lead times for a ship being built, and once a ship is built it usually keeps operating for 20 years or more, almost regardless of lease prices, until it is eventually scrapped. Thus, shipping is a relatively inelastic good. When there is more demand than supply, rates quickly go up, doubling or even tripling. This in turn causes there to be more ships ordered and when they hit the water a couple years later, supply exceeds demand and prices plummet. 90% declines in shipping stock prices are not uncommon. The trick with these kinds of cyclical companies is you want to buy when things are looking the worst, but about to get better. In our fairytale its always darkest before the dawn. The question being how long until dawn appears?

Well, it is clear midnight has passed, it’s pretty dark out there. As indicated, Capesize and Panamax dry bulk rates are down over 50% and NMM stock itself has dropped 95% in the last 5 years.

Source: Navios Maritime Partners Website Data

The Hidden Charm:

However, NMM is still generating a fair amount of cash thanks in large part to 5 container ships that it was supposed to transfer to sibling Navios Maritime Container (NMCI). These ships are on lease to HMM through the end of this year for $24.4k per day ($11 million per quarter in aggregate). They then step up to $30.5k per day for another four years until their lease expires at the end of 2023 ($13.7 million per quarter). This represents a pretty decent amount of ongoing cash flow even if dry bulk continues to be the ugly stepsister of the shipping world for a bit longer.

Navios Maritime Containers has the right to purchase these ships for $36 million each but has yet to do so, instead choosing to use available cash to buy other containerships from third parties. Thus, the longer NMCI takes to exercise its right to purchase NMM containerships, the more cash these containerships generate for NMM. Furthermore, even assuming one day NMCI does buy the ships, NMM won't be hurting for cash. Instead it will suddenly be flush with an estimated $80 million additional cash on hand (= $144 million from sale - $64 million mortgage payoff) on top of the $61 million it already had at the end of the year. To put some perspective on that, in combination it would represent over 81¢ per share in cash for a firm that itself is only trading for 97¢ per share ($3.65 EV, $2.91 NAV). Anyway, you look at it, it’s a lot of cash. Furthermore, it is likely NMCI completing the purchase of these ships would concur with them also declaring a dividend, 1/3rd of which gets returned back to NMM thereby generating further cash flow (NMM also owns 33.5% of NMCI). Which brings up our next topic.

Could NMCI trade Shares for Ships?

NMM already owns 33.5% of NMCI. While it would probably want to stay under the 49% ownership level in order to keep NMCI results separate from NMM, it otherwise has been very willing to take ownership in NMCI. Furthermore, I don't see the 49% level as a limiting factor, because NMM can just choose to distribute NMCI units to NMM shareholders as it has done previously in order to stay under this level. There is even additional attraction to distributing NMCI shares to NMM shareholders as it allows NMCI to achieve greater liquidity on US markets.

What is a bigger problem is NMCI shares themselves are currently too cheap to fund accretive ship deals (NMCI trades at less than 50% of NAV). Don't get me wrong, a ship for share deal at current prices would be a great deal for NMM shareholders, exchanging fairly priced ships for cheap NMCI shares just doesn’t work for NMCI. Thus, I don't think a share for ship sale happens until after a US - China trade deal occurs, NMCI declares a meaningful distribution, and its share price rises. Only then does a ship for share deal become feasible. In the meantime, NMM has lots of lasting power.

NMM Debt:

As stated previously, NMM's main dry bulk business is in the dumps, as is its stock, but if you look below the surface NMM's cash situation is pretty decent. As is its debt profile. In fact Moody's upgraded NMM's debt rating to B2 last November.

As a result, NMM was able to obtain loans at an attractive LIBOR + 2.7% rate which will refinance 43% of the debt it has coming due in Q3 2020. The previous rate for this debt was LIBOR + 5.0%, so this is quite an improvement which recognizes NMM's improved cash position. This refinance also both adds about 2.4¢ per share in cash flow to the bottom line thanks to the lower interest rate, and de-risks the debt schedule. Additionally, NMM did a sale leaseback transaction at roughly the same rate as current debt, but with a longer fixed term. This leaseback deal represented another 7% of total debt bringing the total refinanced amount to about 50% of total debt.

Source: NMM Presentation

The combination of the above moves reduce risk and allow for greater surety in utilizing cash for other purposes. While trading at less than $1.00, and in a sector that is in the dumps (dry bulk), NMM is nowhere near going bankrupt. In fact, the better question to ask is not if NMM has enough cash top survive, but rather, "what will our rich prince in hiding do with its excess treasure?"

Capital Allocation: What will NMM do with excess cash flow?

In my opinion NMM is unlikely to up its distribution any time soon beyond a token amount. Rather, I think it is likely to take a large portion of the excess cash from any containerships sales to NMCI and reinvest them in more dry bulk ships. Part of the reason for this is because Mrs. Frangou benefits from increased management fees the bigger the fleet gets, but it also just makes sense to buy ships while the sector is in trouble and they are likely cheap. Additionally, however, NMM has announced up to a $50 million dollar share buyback program. NMM shares, trading at only 1/3rd of fair market NAV, are an even better deal than buying ships. In theory NMM could potentially reduce share count by more than 30% while simultaneously purchasing dry bulk ships at attractive prices, and still maintain a good debt to capitalization ratio.

Source: NMM Presentation

The reality of the situation however is not quite that simple. There are daily SEC share buyback limitations (20-25% of average trading volume) and the use of a $50 million buyback program on such a cheap stock in a relatively short period of time would drive up the price. This makes buying back 30% of one's float in a quarter or two nearly impossible. Buying back 1% - 3% of outstanding shares per month however is feasible, and would go a long way towards restoring shareholder confidence. In fact, some surmise that a $7 million-dollar transaction which occurred after hours on Friday, February 28th may be NMM buying back 4% of its own shares from NM or some other large shareholder at very attractive sub-$1 prices.

To Be Continued:

While the US-China Trade War has produced significant negative sentiment and lower multiples across the shipping sector, I would remind readers this can change rather quickly. Such a change might also enable the NMCI - NMM ship sale deal, leaving NMM flush with cash. Even without it, and despite ongoing challenges in the sector, NMM is doing OK. Certainly, better than a sub-$1.00 price would imply.

That being said, the price of NMM shares is clearly high volatility. Thus, there's no way you can consider the stock as anything but speculative. Speculative however isn’t a euphemism for un-investable. It just means you need to size your position appropriately to control your overall portfolio risk. NMM tripling in price over the next couple years is quite possible. In fact, it would only bring the stock up to the firm's current estimated NAV.