If you are looking for a healthy, growing dividend, you may be considering Brookfield Property Partners LP (BPY) (and/or Brookfield Property REIT (BPR)—if you prefer to invest in the REIT vehicle). Not only does the dividend appear attractive, but the shares seem to be trading at a significant discount to NAV. However, concerns over its relatively high debt continue to remain an overhang on the stock. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about whether BPY (and/or BPR) is worth considering for a spot in your long-term income-focused portfolio.

(Note: access a PDF version of this report here).

Overview:

Brookfield Property Partners LP is a leading commercial real estate company with ~$85 billion in total assets. It primarily focuses on premier retail properties, high-end malls and office buildings in some of world’s renowned cities such as New York, London, Berlin. Some of its properties include Hudson Yards and Brookfield Place (formerly the World Financial Center) in Manhattan, Canary Wharf in London, and the Fashion Show mall in Las Vegas. Its portfolio is well diversified with 42% of its assets in malls and other retail properties, 41% in office buildings, and 17% in private real estate funds run by BAM.

Brookfield Property was spun off by Brookfield Asset Management in 2013. Subsequent to the spin-off, BAM remains the major shareholder with ~53% interest which is a big advantage given its pedigree and history of creating shareholder wealth.

If you prefer to invest in the REIT vehicle, BPR may be more appealing. According to the company’s website:

“Brookfield Property REIT (NASDAQ: BPR) (“BPR”) is a subsidiary of BPY, intended to offer investors economic equivalence to BPY units but in the form of a U.S. REIT security. Dividends on BPR shares are identical in amount and timing to distributions paid out for BPY units, and BPR shares are exchangeable on a 1:1 basis for BPY units or their cash equivalence.”

However, keep in mind that BPY is structured as a limited partnership, meaning it generates a K-1 at tax time, and this means the dividends are actually distributions, and they’re not taxed right away but rather act to reduce your cost basis thereby potentially increasing your capital gains when you sell. Some investors prefer the simplicity of the BPR structure, particularly within their retirement accounts, especially considering they are treated as non-qualified dividends, not distributions.

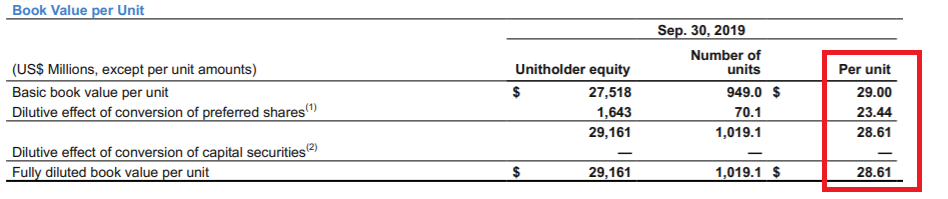

Trading at discount to NAV despite strong performance

In November, Brookfield Property announced an impressive third-quarter 2019 results. Net income shot up by 20% year over year to $870 million, while funds from operations (FFO) grew by a notable 7% to $324 million. Despite strong asset performance, it continues to trade at discount to its net asset value (NAV). Management also noted the same in their recent quarterly earnings conference call and are even repurchasing shares which further validates our view. The Q319 shareholder letter estimates the NAV at ~$29 per share, ~34% discount to the current market price of $19.17. As per the CEO:

“BPY shares currently trade at a discount. We therefore continue on the path of repurchasing shares this quarter since we believe it represents an attractive investment opportunity for us.”

(source: Company Data)

The valuation gap is primarily attributable to concerns around debt and the use of external managers. The debt is indeed sizeable and much higher compared to other similar REITs. At the end of Q319, the debt obligations were ~$52 billion and the debt to equity ratio stood at ~1.8x. The high level of debt reflects the private-equity mindset of BPY which it has inherited from its parent and manager BAM. While it increases returns, the risks in the eyes of investors also rises making them cautious. But the important thing to note is that nearly all the debt is non-recourse i.e. backed by individual properties which limits the risk to the company. If a project goes bad, the lender will recover money by selling the property thereby not impacting operations of the company.

Additionally, BPY is focused on reducing leverage via non-core asset sales. Year to date it has generated $1.2 billion from asset sales and more are planned for Q4 of this year. Another issue marring the shares has been the use of external managers which are typically expensive compared to traditional internal managers. Brookfield Property is managed by BAM, which takes annual management fees that result in higher overall expenses than other large US REITs. For nine months ended September 30, 2019, the management fee was ~$142 million, compared to ~$6.1 billion in revenue and $3.3 billion net operating income (NOI), which is not an insignificant amount.

Although investors should keep an eye on the above dynamics, given the current scenario we do not believe they warrant a discount to NAV.

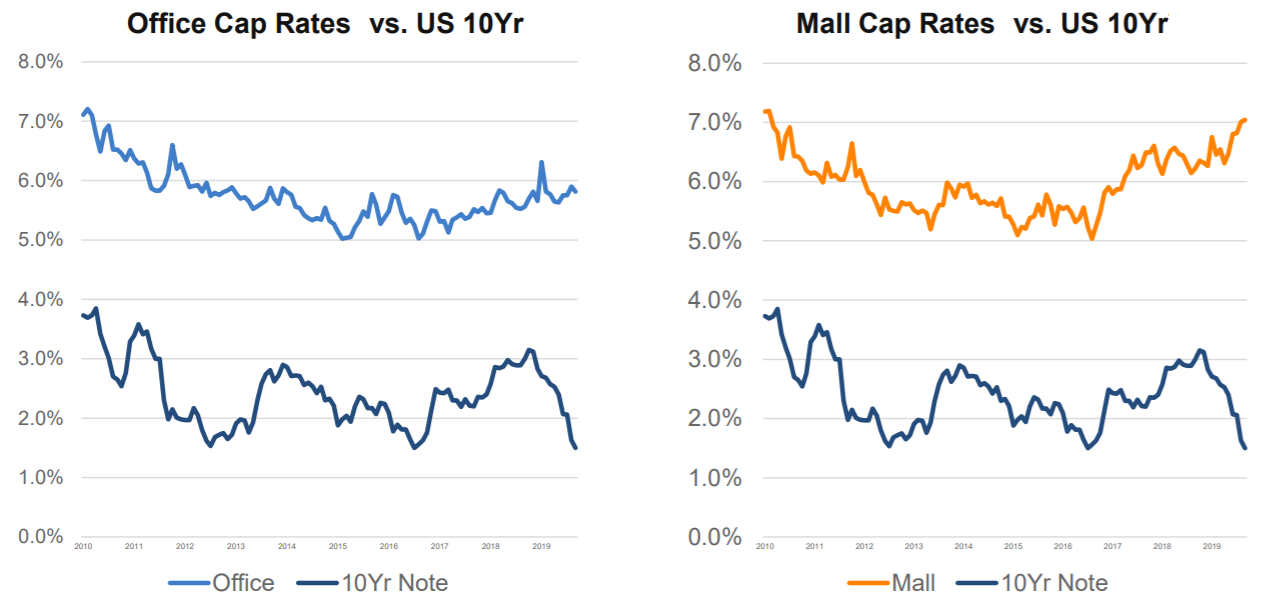

Low interest rate environment globally positive for BPY

Over the last 12 months, there has been a dramatic decline in interest rates in both the US and in Europe. The Federal Reserve has cut interest rates three times this year, reducing it to between 1.5% and 1.75%. This unprecedented period of low interest rates not only benefits real estate as an asset class but also makes REITs attractive among investors seeking yield. The accommodative central bank policy allows REITs to borrow or refinance at lower rates, thereby reducing interest expenses and boosting profitability. But this is yet to be reflected in the valuation of BPY’s assets as the cap rates have not yet moved in line with the interest rates. Management noted that there is a slight lag effect and the cap rates will soon be in sync with lower interest rates. To put this into perspective, CEO Brian Kingston said:

“100 basis point reduction in cap rates, adds almost $20 to our net asset value per unit. The continued low interest rate environment should translate into higher demand for real assets, which will increase the value of our portfolio of properties. It also assists us in continuing to monetize mature, derisked assets at great prices and reallocating that capital to development and other higher returning investment opportunities.”

The divergence in the cap rate (as shown in chart below) is temporary and should correct soon which should boost BPY’s valuation.

(source: Company Presentation)

Portfolio Diversification Adds to Cash Flow Stability

With a portfolio of assets in office, retail, industrial, multi-family, and hospitality, BPY generates diversified cash flows, which enhance cash flow stability and reduce cost of capital. Besides this, BPY is well diversified geographically (as seen in the chart below) as well with presence in North America, Europe, Australia, Brazil, China and India. Due to the cyclical nature of the real estate industry, we believe that a real estate portfolio diversified by property type and geography will perform more consistently over time. Furthermore, since property valuations fluctuate considerably based on market sentiment and other factors, we believe that the flexibility to shift capital to sectors and geographies that are out of favor enables BPY to earn premium returns on the capital. As a result of this diversity, combined with Brookfield’s sponsorship and its strong institutional relationships, BOY has access to capital across market cycles which positions it to take advantage of attractive opportunities as they arise.

(source: Company Presentation

Demand Remains Strong for Core Assets

The core business, which includes office and retail properties, accounts for 85% of the balance sheet and continues to see strong demand. The third quarter of 2019 marked the opening of two marquee buildings for Brookfield in New York and London, delivering over three million square feet of modern office space that was approximately 85% leased upon opening. The core office business completed over 1.9 million square feet of leasing in the third quarter, at rents that were over 30% higher than leases that expired during the period. The project pipeline remains robust with more office assets to be rolled out in the market in Q419. Per the quarterly call:

“In October, we completed three of our largest office development projects to date – two office towers in London and one in New York – totaling nearly four million square feet. These projects cost $3.6 billion to build and will be worth approximately $5.5 billion at stabilization. More importantly, they will add approximately $150 million of proportionate annual net operating income to our operations.”

The quality and demand of BPY’s portfolio can further be validated by the fact that it has already signed an anchor lease for its office project (Two Manhattan West in New York) which is likely to be completed in 2023. In total, BPY has ~8 million square feet of active office development pipeline.

The remaining 15% of balance sheet (LP Investments) is focused on taking more speculative bets that, while being risky, provide an opportunity to generate outsized returns. This is done via investments in various private funds that have a strong track record, with 20%-plus annual historical net returns.

Valuation:

From a valuation standpoint, here is some perspective. Specifically, on a Price to Funds from Operations basis (“FFO”) and Adjusted FFO, BPY is inexpensive relative to its peer group average.

(source: Thomson Reuters)

Yet analysts expect FFO to keep growing significantly (a good thing), as shown in the following table.

(source: Thomson Reuters)

Of the four analysts covering the firm, one has a Strong Buy rating and the other three have a Buy rating on the stock. This suggests a consensus among all analysts regarding the stock’s undervaluation. For more perspective, these analysts, on average, believe the shares are undervalued by 14.4%. Including dividend, the return is bound to be much higher.

(source: Thomson Reuters)

Brookfield Property aims to generate annual growth of 7% to 9% in FFO over the next five years and increase the distribution at a 5% to 7% rate. It also aims to realize ~$2.6 billion (or $500 million per year) in gains from its investments in BAM-run real estate funds over the next five years.

Dividend Safety:

Annual growth in distribution from 2014 to now has been very steady. BPY has raised the annual distribution every year since 2014 at a CAGR of ~6%. Year to date 2019, the dividend has grown by ~4% year on year.

(source: Company Data)

Risks:

Interest rate risk: Even though we expect interest rates to remain relatively tame, dramatically rising rates could create challenges. As REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price.

Tenant bankruptcies: BPY earnings continue to be impacted by bankruptcies that have taken place since the beginning of 2018. According to Q319 earnings call: “These bankruptcies which aggregate 3 million square feet have put pressure on our same-property NOI results, which were flat on a period-over-period basis.” Though the company expects the impact to abate going forward, but given the rising retail bankruptcies in the US, more tenant challenges and bankruptcies cannot be ruled out.

Conclusion:

Brookfield Property Partners is a high-quality real estate company that is likely to generate compelling returns over the coming years, through a combination of an attractive dividend yield and substantial share price gains. Brookfield Property Partners units are trading at ~34% discount to net asset value and almost a 7% yield. Despite strong performance by the stock year-to-date (up 19%), we see more upside. If you are a long-term income focused investor, BPY offers an attractive investment opportunity at current levels.