Growth stocks are great—until the market turns. However, if you can find a company with such a powerful marketplace opportunity, that it can buck the larger “style box” trends (e.g. growth vs value) and continue to grow under just about any conditions, it’s worth considering. Here is one stock that looks to have found a special market opportunity, and we believe it is worth considering. And if you’re going to buy, starting with a small bite might be prudent.

RealPage (RP), Yield: 0.0%

Summary:

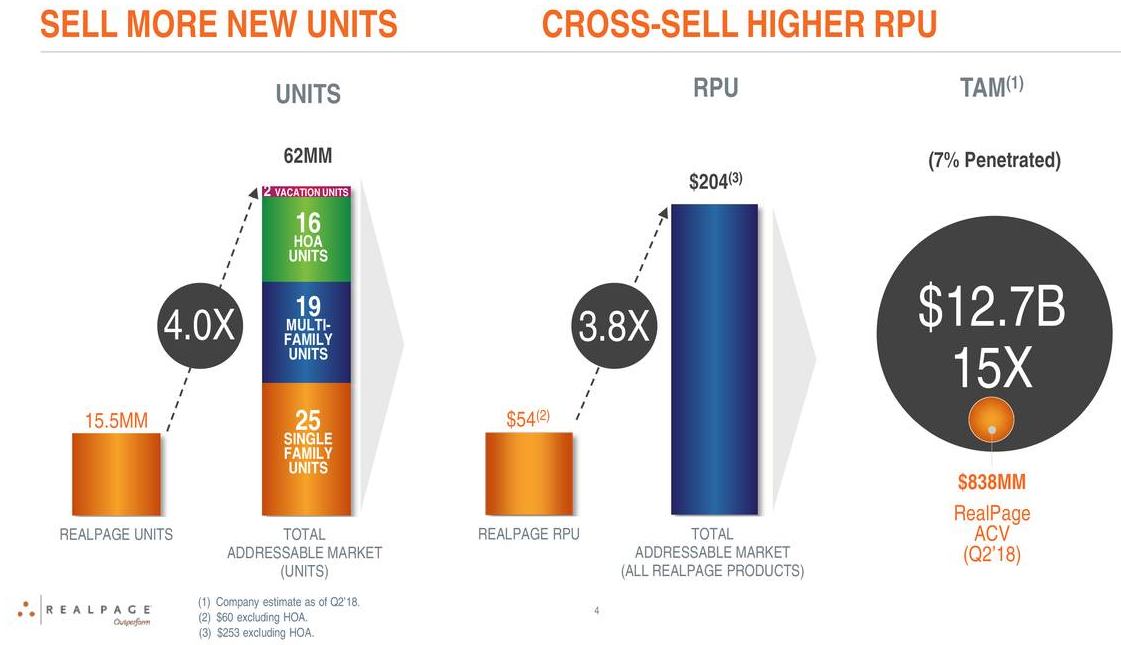

RealPage is a software company that helps landlords manage their properties, and the company continues to grow revenues rapidly, both organically and inorganically. The total addressable market is large, estimated at $12.7 billion (RealPage has penetrated only 7%).

The industry is highly fragmented, and is being disrupted, as many small players are being acquired by larger players with better solutions and more economies of scale.

The biggest risk appears to be a lack of clear differentiation from other large players in the space, and the potential for price pressure from the competition. There is also room for larger players to become acquired or acquirers.

A Summary of the business and the industry:

RealPage is a software company that helps landlords manage their properties (ranging from acquisition, collecting rent, marketing rentals, and more). There is a large TAM (estimated at $12.7 billion, RealPage has penetrated 7%), and the industry is being disrupted. There are many small software solutions, and a few big players (RealPage, Apfolio, CoStar Group). There have been lots of acquisitions because the big players have better solutions and lower prices. The company was founded by Stephen T. Winn in November 1998, it’s headquartered in Richardson, TX, and Winn owns 18.16% of the shares outstanding (market cap is $5.8 billion). Forward P/S is 6.6x.

Business Getting Better:

Real Page continues to grow organically and inorganically, and is ahead of schedule on growth, now expecting to achieve $1 billion in sales in 2019 instead of the planned 2020.

RealPage’s business is getting better across all segments:

Risks and Bear Case:

RealPage faces risks from a few larger competitors as well as pricing pressure. More specifically, the biggest risk appears to be a lack of clear differentiation from other large players in the space, and the potential for price pressure from the competition.

Brief History of the Company and its founding:

The company was founded by Stephen T. Winn in November 1998 and is headquartered in Richardson, TX. Winn owns 18.16% of the shares outstanding.

Valuation:

Wall Street likes the shares, and has an aggregate “buy” rating.

Competition:

RealPage competitors vary depending on product and service. Certain competitors compete within a number of areas, including Yardi, Inc., Entrata, Inc., MRI Software LLC, AppFolio, Inc., and CoStar Group, Inc. Other competitors compete with respect to a single product or category of products.

Since July 2002, RealPage has completed over 40 acquisitions that have enabled it to expand its platform, enter into new rental property markets, and expand its client base. Recent acquisitions included QucikPay and LeaseLabs.

Google is making life more difficult for aggregators. They have now positioned themselves on the front page of apartment searches, typically in front of the Internet listing service. Within their search window, Google is providing ways to search more directly for different types of apartments, different price ranges and different amenities. The apartments that meet their search criteria appear on a map right next to the search window.

The following table demonstrates the deep and wide variety of competitors.

Total Addressable Market:

RealPage has an estimated total addressable market of $12.7 billion, of which they’ve currently penetrated 7%, as shown in the following graphic.

Per the most recent investor presentation, RealPay is ahead of schedule on its goal to achieve its 2020 goal of $1 billion in revenue and $300 million in adjusted EBITDA.

Management- (Capital Allocation):

Since July 2002, RealPage has completed over 40 acquisitions that have enabled the company to expand its platform, enter into new rental property markets, and expand its client base. The company has recently increased its debt and shares outstanding, as shown in the following chart.

Catalyst:

The catalyst is continued industry growth and adaptation as there are value add opportunities for property owners and landlords to improve their businesses. The TAM is large, and there appears to be room for multiple large players to grow rapidly before competing on price may eventually become an issue (after all the small players have been acquired or put out of business).

Recent Price action:

Special/Unique:

RealPage is one of several market leaders in the space, considering its size and sophistication.

Quality:

Real page helps users generate high quality “leads,” which is why the business has been growing. Additionally, RealPage solutions help simplify and streamline operations for property owners, which is another indication of quality.

Insider Activity:

Founder, Stephen Winn, owns 18% of the shares outstanding (the company’s total market capitalization is $5.8 billion). Stephen’s position has fallen from 26% in 2013 to 18% now (perhaps due to the company’s issuing of new shares).

Capital Structure:

Convertible bonds...

The Convertible Notes will pay interest semiannually in arrears at a rate of 1.50% and will be convertible into cash, shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election, based on the applicable conversion rate at such time. The Convertible Notes have an initial conversion rate of 23.8393 shares of the Company’s common stock per $1,000 principal amount of the Convertible Notes (which is equal to an initial conversion price of approximately $41.95 per share of the Company’s common stock), representing an initial conversion premium of approximately 27.5% over the closing price of $32.90 per share of the Company’s common stock on May 17, 2017. The Convertible Notes will mature on November 15, 2022, unless repurchased or converted in accordance with their terms prior to such date. Prior to May 15, 2022, the Convertible Notes will be convertible only upon the occurrence of certain events and during certain periods, and thereafter, at any time until the close of business on the second scheduled trading day immediately preceding the maturity date.

Conclusion:

If you are an income-focused value investor, Real Page is NOT for you. And even if you like to diversify with a few growth stocks, it can be difficult to purchase a stock with as much momentum as Real Page (the shares have climbed significantly in recent months). However, if you consider the sheer size of the market opportunity with the success that the company has already been having, Real Page is worth considering. If you are going to invest, this one can be volatile, and starting with a small nibble could be prudent.